OneRoyal Review 2025: Is This Broker Legit or a Scam?

Abstract:OneRoyal is an Australian-based brokerage established in 2012 that offers trading services across global markets. With over a decade of operation, the broker has established a significant presence, holding licenses from top-tier regulators like ASIC and CySEC. However, despite its strong regulatory framework, recent user feedback paints a conflicting picture involving withdrawal struggles and severe slippage.

OneRoyal is an Australian-based brokerage established in 2012 that offers trading services across global markets. With over a decade of operation, the broker has established a significant presence, holding licenses from top-tier regulators like ASIC and CySEC. However, despite its strong regulatory framework, recent user feedback paints a conflicting picture involving withdrawal struggles and severe slippage.

With a WikiFX score of 6.42 and an “AA” trading environment ranking, OneRoyal appears solid on paper. However, a recent surge in complaints requires a closer look at whether this broker is truly safe for retail investors.

Is OneRoyal Safe? Regulatory Status and Licenses

The primary indicator of a broker's safety is its regulatory oversight. OneRoyal operates under a complex structure involving multiple legal entities, ranging from top-tier protection to offshore regulation.

Regulatory Licenses:

| Regulator | Country | License Type | Status |

|---|---|---|---|

| ASIC | Australia | Tier 1 (High Safety) | Regulating |

| CySEC | Cyprus | Tier 2 (Europe) | Regulating |

| AMF | France | Tier 1 (Europe) | Regulating |

| VFSC | Vanuatu | Offshore | Offshore Regulation |

Regulatory Analysis:

OneRoyal holds highly respected licenses from the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). These regulators enforce strict capital requirements and segregation of client funds.

However, many international clients are onboarded through the Vanuatu (VFSC) entity. This offshore license allows for higher leverage (up to 1:1000) but offers significantly less protection than Australian or European standards. Additionally, investors should be aware that the Securities Commission of Malaysia (SC) has issued a warning regarding OneRoyal for carrying out unauthorized capital market activities.

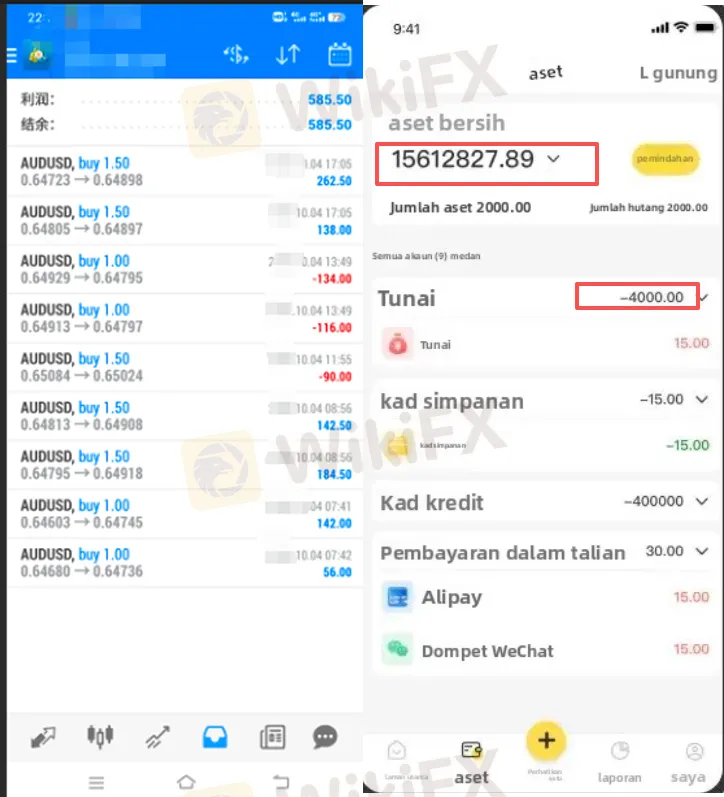

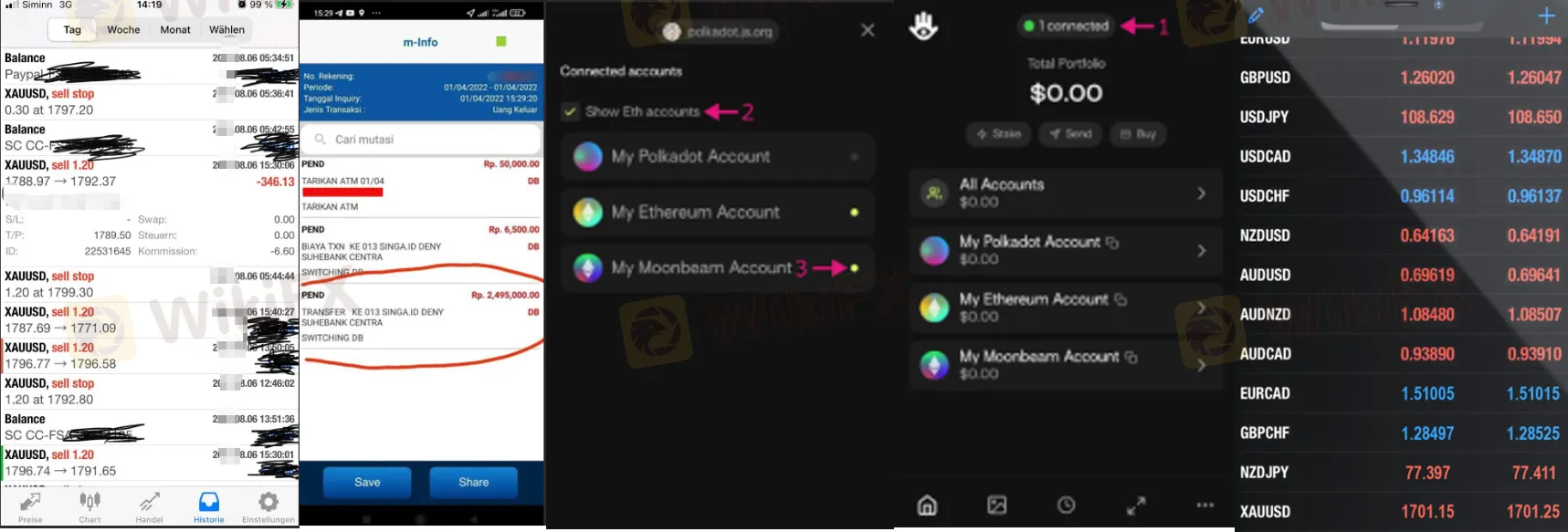

OneRoyal Scam Exposure: Withdrawal Complaints and Slippage

While the regulatory background is strong, the practical user experience has raised red flags. In the last three months alone, there have been 23 formal complaints lodged against the broker. The allegations fall into three alarming categories: withdrawal failures, platform dominance, and bonus traps.

Withdrawal Issues

A significant number of traders have reported being unable to access their funds. Reports from users in Malaysia and other regions detail instances where withdrawal requests are rejected without clear justification or remain “under review” for over 15 days.

- Documentation Delays: Users report being asked for excessive documentation, such as “tax clearance certificates”—documents not standard for standard withdrawals—essentially stalling the process.

Deducted Profits: Some traders claimed their profits were deducted under accusations of “illegal trading” or “abnormal market fluctuations,” even when they believed they traded legitimately.

Severe Slippage and Data Manipulation

Multiple case studies highlight massive slippage, where the price a trade is executed at differs vastly from the requested price.

- Stop-Loss Failures: One user reported a 160-point slippage on a GBP/USD trade, which wiped out their principal. Another user noted a gold trade was closed $30 below their stop-loss price.

Price Discrepancies: Traders have accused the platform of showing price feeds that differ from the international market rate, specifically fluctuating wildly during attempts to close positions to force losses.

“AI” Trading and Bonus Schemes

Several complaints mention an “AI Intelligent Trading System” promoted by the broker (or affiliates) guaranteeing high returns (e.g., 20% monthly). Users reported that backtest data was manipulated to look profitable, but real trading resulted in rapid losses.

Additionally, one user reported a 50% deposit bonus trap where funds were locked until a trading volume turnover of 30 times the bonus amount was achieved—a requirement often impossible to meet without losing the principal.

Trading Conditions: Fees, Spreads, and Accounts

For users who do not encounter these operational issues, OneRoyal offers a robust technical environment with flexible account options.

Trading Platforms

OneRoyal supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These are the industry standards, offering advanced charting and automated trading capabilities (EAs). The platform availability is rated “Perfect,” though it lacks proprietary mobile apps for smoother account management.

Account Types

The broker offers five distinct account types to suit different traders:

- ECN / VIP Accounts: These accounts feature raw spreads starting as low as 0.0 pips. The VIP account requires a deposit of $10,000, while the standard ECN account requires only $50.

- Classic Account: Designed for beginners with a $50 entry, but spreads are higher, starting from 1.4 pips.

- Swap-Free: Available for Islamic traders or those holding long-term positions.

Leverage

OneRoyal offers extremely high leverage up to 1:1000. While this allows for maximizing small deposits, it also increases the risk of rapid liquidation, especially given the slippage reports mentioned in user reviews.

Pros and Cons of OneRoyal

Pros:

- Regulated by top-tier authorities (ASIC, CySEC).

- Access to MT4 and MT5 trading platforms.

- Tight spreads (0.0 pips) on ECN accounts.

- Multiple account types with low entry barriers ($50 minimum deposit).

Cons:

- High volume of recent complaints regarding withdrawals.

- Regulatory Warning from the Securities Commission of Malaysia.

- Reports of severe slippage and stop-loss failures.

- Offshore entity (Vanuatu) offers lower client protection.

- Allegations of misleading bonus terms and AI trading “scams.”

Final Verdict: Is OneRoyal Safe?

The verdict on OneRoyal is complicated. Legally, it is a legitimate broker with valid licenses from top-tier regulators like ASIC and CySEC. However, the operational reality reported by recent users contradicts this safety. The accumulation of complaints regarding denied withdrawals, price manipulation, and misleading bonus schemes suggests significant risk, particularly for clients registered under the offshore (Vanuatu) entity.

While the trading conditions (spreads and platforms) are competitive, the risk of capital being locked or lost to “technical errors” currently outweighs the benefits for many retail traders. Caution is strongly advised.

To ensure you stay protected and avoid brokers with withdrawal issues, verify the specific entity you are registering with. Use the WikiFX app to check the latest regulatory warnings and real-time user reviews before making any deposit.

Read more

BlackBull Markets User Reputation: Looking at Real User Reviews and Common Problems to Judge Trust

When traders ask, "Is BlackBull Markets safe or a scam?", they want a simple answer to a hard question. The facts show two different sides. The broker began operating in 2014 and has a strong license from New Zealand's Financial Markets Authority (FMA). It also has an "Excellent" rating on review sites such as Trustpilot. But when searching for "BlackBull Markets complaints," you find many negative user stories, including withdrawal issues and poor trading conditions. This article goes beyond simple "safe" or "scam" labels. We want to carefully look at both the good reviews and common problems, comparing them with how the broker actually works and its licenses. This fact-based approach will give you the full picture of its user reputation, helping you make your own smart decision.

Is BlackBull Markets Legit? An Unbiased 2026 Review for Traders

Is BlackBull Markets legit? Are the "BlackBull Markets scam" rumors you see online actually true? These are the important questions every smart trader should ask before exposing capital to markets. The quick answer isn't just yes or no. Instead, we need to look at the facts carefully. Our goal in this review is to go beyond fancy marketing promises and do a complete legitimacy check. We will examine the broker's rules and regulations, look at its business history, break down common user complaints, and check out its trading technology. This step-by-step analysis will give you the facts you need to make your own smart decision about whether BlackBull Markets is a good and safe trading partner for you.

A Clear BlackBull Markets Review: Trading Conditions, Fees & Platforms Explained

This article gives you a detailed, fair look at BlackBull Markets for 2026. It's written for traders who have some experience and are looking for their next broker. Our goal is to break down what this broker offers and give you facts without taking sides. We'll look at the important things that serious traders care about: how well they're regulated, what trading actually costs, what types of accounts you can get, and how good their technology is. We're not here to tell you to use this broker - we want to give you the facts so that you can decide if it fits your trading style and how much risk you're comfortable with. Making a smart choice means checking things yourself. Before you pick any broker, you need to do your own research. We suggest using websites, such as WikiFX, to check if a broker is properly regulated and see what other users say about it.

SGFX User Reputation: Is it Safe or a Scam? A Detailed Look at User Complaints

The most important question any trader can ask is whether a broker is legitimate. Recently, SGFX, also called Spectra Global, has been mentioned more often, leading to many questions: Is SGFX Safe or Scam? Is it a safe platform for your capital, or is it another clever online scam? This article will give you a clear, fact-based answer to that question. Read on!

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc