Spread Co Regulation and FCA License Details Explained

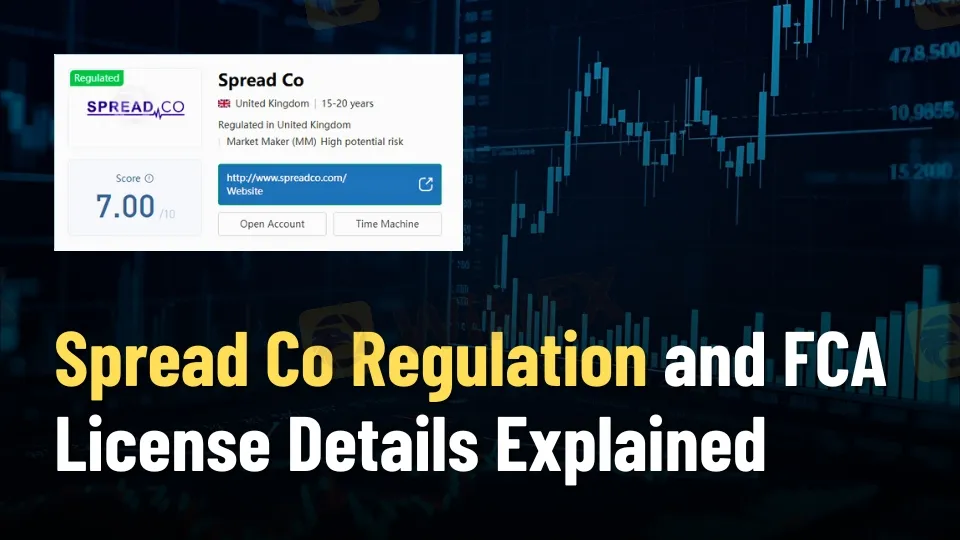

Abstract:Spread Co is FCA regulated under license 446677 as a Market Maker in the UK, offering spread betting and CFD accounts.

Spread Co Regulation Breakdown

Spread Co operates under strict oversight from the Financial Conduct Authority (FCA) in the United Kingdom. Licensed entity Spread Co Limited holds license number 446677, classified as a Market Maker (MM), active since October 6, 2006. This setup positions Spread Co Regulation as a cornerstone of its operations, with the firm's address at 1st Floor North Argyle House, Joel Street, and contact via phone (+44 01923 832600) or email (ajay.pabari@spreadco.com).

No license sharing occurs, and certified documents like Annex 1 and Annex 2 confirm compliance. Traders benefit from FCA protections, including negative balance safeguards, especially on CFD accounts. Domain records trace back to 2004-01-08, hosted in the UK by TOTAL WEB SOLUTIONS LIMITED, adding transparency to Spread Co's longevity.

Spread Co Trading Instruments Reviewed

Access over 1000 markets through Spread Co, spanning indices, FX, commodities, and equities. Key offerings include gold, equities, FTSE100, forex, commodities, and ETFs—no cryptocurrencies, bonds, options, or mutual funds noted.

Mini Markets enable stakes from 10p per point on major FX and indices, broadening appeal for smaller positions. Retail margins start at 3.33% on major FX pairs and 5% on indices, with minimum stakes from £1. These instruments allow spread betting tax-free in the UK and CFD trading without stamp duty.

| Tradable Instruments | Supported |

| Gold | Yes |

| Equities | Yes |

| Indices | Yes |

| FTSE100 | Yes |

| Forex | Yes |

| Commodities | Yes |

| ETFs | Yes |

Spread Co Trading Account Types

Two primary live accounts define Spread Co's offerings: Spread Betting and CFD, plus a demo for practice. Spread Betting delivers tax-free profits, spreads from 0.6 pips, and zero commissions across 1000+ markets. CFD accounts add negative balance protection, no stamp duty, and zero financing on short index positions.

No explicit minimum deposit details emerge, though low entry via £1 stakes suggests accessibility. Professional charting comes free, with position matching to offset spreads—partial matches allowed. Compared to rivals like IG or CMC Markets, Spread Co emphasizes UK tax perks but lacks multi-account tiers.

| Account Type | Key Features | Fees/Spreads |

| Spread Betting | Tax-free, 1000+ markets, £1 min stake | From 0.6 pips, 0 commission |

| CFD | No stamp duty, negative balance protection | 0 short index financing, low equities (0.05% FTSE100) |

Spread Co Platform Strengths Analyzed

Proprietary web, mobile, and tablet platforms power Spread Co trading—no MT4/MT5 support. Web version offers customizable screens, pop-out windows for multi-monitors, and tiled views for data consolidation. Mobile apps handle position management, stop/limits, and funding on the go.

Users toggle orders directly on charts, streamlining execution for beginners and pros alike. Against competitors, Spread Co's setup prioritizes simplicity over advanced EAs, with 24/7 support via phone (0800 078 9398), email (info@spreadco.com), and social channels. UAE traffic leads visits, per records.

Spread Co Fees and Leverage Details

Spreads start tight at 0.6 pips; no commissions apply. Financing stays competitive—zero on short indices overnight, futures baked into prices, equities from 0.05% (5 basis points) on FTSE100. Leverage ties to margins: 3.33% major FX (up to 30:1 effective), 5% indices.

Withdrawal/deposit specifics are absent, but low margins and no stamp duty cut costs versus offshore brokers. WikiFX scores Spread Co at 7.0/10, noting high potential risk from market maker model despite FCA shield—office visit flagged unconfirmed in 2025.

Spread Co Pros and Cons Balanced

Pros

- FCA-regulated with license 446677 for client safeguards.

- Tight spreads from 0.6 pips, tax-free spread betting.

- 24/7 support, demo account, 1000+ instruments.

- Low margins (3.33% FX), free pro charting.

Cons

- No MT4/MT5; proprietary platform only.

- Unclear deposit/withdrawal processes.

- Market maker model raises execution risks.

- Office verification pending per recent checks.

Bottom Line on Spread Co Value

Spread Co stands out for UK traders seeking FCA-regulated spread betting and CFDs with low costs and broad markets. License 446677 since 2006 underscores legitimacy, though market maker status warrants caution on pricing. Ideal for tax-efficient, platform-simple trading—test via demo before committing.

Read more

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Switched to Galileo FX from other brokers, thinking that you would earn profits, but things went the other way round? Did you continue to face losses despite executing constant optimizations on the trading software? Like did you experience issues concerning executing stop-loss orders? Failed to cash in on the positive market wave because of the broker’s trading bot? You are not alone! Many complaints concerning losses due to trading bot deficiencies have been doing the rounds. In this Galileo FX review article, we have demonstrated these complaints. Take a look!

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

EGM Securities has been reported as a scam by many forex traders, as they encountered several problems concerning fund withdrawals. The broker is alleged to have defrauded traders by applying unnecessary restrictions on withdrawals. Also known as FXPesa, the broker seems to have caught traders’ attention, mostly for negative reasons, though. In this EGM Securities review article, we have discussed withdrawal-related complaints made against the broker online. Keep reading!

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Vebson is listed as high risk on WikiFX, with exposure to unpaid withdrawal cases and misleading claims. Read this forex scam alert before you deposit a cent.

Amaraa Capital Scam Alert: Forex Fraud Exposure

Exposed: Amaraa Capital is a forex scam. Protect your funds—read this detailed scam alert now and avoid risky forex investments.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Renewable Grid Integration: Economics and Technology

Gold Rally Validated as Miners Forecast Doubled Earnings

US Labor Market 'Noise' vs. Reality; Trump Trade Agenda Looms Over Outlook

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Rate Calc