Is Oron Limited Trustworthy? A 2025 Expert Review

Abstract:When trading in global financial markets, choosing a broker is the most important decision a trader will make. The question of whether a company can be trusted affects every action that follows, from putting money into an account to making trades. This review looks at Oron Limited, a broker that has gotten attention for its easy entry requirements and modern platform. But is it a reliable partner for your trading money?

When trading in global financial markets, choosing a broker is the most important decision a trader will make. The question of whether a company can be trusted affects every action that follows, from putting money into an account to making trades. This review looks at Oron Limited, a broker that has gotten attention for its easy entry requirements and modern platform. But is it a reliable partner for your trading money?

This detailed analysis for 2025 looks at Oron Limited from every important angle. We will examine its company structure, regulatory status, trading conditions, and platform technology. Most importantly, we will compare these factors with real user experiences to give a clear, fact-based answer to the main question: can traders trust Oron Limited?

Core Company Profile

Oron Limited is registered in Saint Lucia, an offshore location that is popular with forex brokers. The company's operating history is presented with some confusion; while some records show an operating period of 2-5 years, other information suggests it was founded in 2023. As of 2025, either timeline makes it a relatively new company in the competitive brokerage industry.

The broker provides several contact points, including a phone number based in the UAE (+971 42956005) and multiple email addresses (info@orontrade.com, support@orontrade.com). It lists a physical address in Saint Lucia at Ground Floor, TheSotheby Building, Rodney Village, Rodney Bay, Gros-Islet. An additional office address is listed in India, suggesting significant business focus in that region.

Importantly, as of our latest check, the official website for Oron Limited (orontrade.com) was reportedly not accessible. A non-working website is a major warning sign for any online service provider, especially a financial one, as it cuts off the main line of communication and information for clients and raises serious questions about the company's operational status and reliability.

The Question of Regulation

The single most important factor in determining if a broker is trustworthy is its regulatory status. In this case, the information is clear: Oron Limited operates without a valid license from any recognized financial regulatory authority.

This lack of oversight is a serious risk. Regulated brokers must follow strict standards that include keeping client funds separate from company money, maintaining enough operating cash, and providing access to investor compensation programs in case of bankruptcy. Unregulated brokers have none of these requirements. This means that if Oron Limited were to face financial trouble or engage in unethical practices, traders would have no formal way to get help through a governing body and could face a total loss of their deposited funds.

The broker is flagged with warnings such as “High potential risk” and “Suspicious Regulatory License,” reinforcing the significant dangers involved. For any trader, the absence of regulation should be a deal-breaker, as it removes the basic layer of security that protects money.

Trading Instruments Offered

Oron Limited provides access to a reasonably diverse range of markets, which can be appealing for traders looking to diversify their strategies. The available asset classes include:

• Forex

• Cryptocurrencies

• Indices

• Stocks

• Energy

• Commodities

This selection covers the most popular financial markets. However, the variety of instruments is a secondary concern when viewed through the lens of the broker's unregulated status. While the opportunity to trade various assets is present, the basic risk to money remains, regardless of the instrument being traded. The broker does not appear to offer other instruments like Bonds, Options, or ETFs.

Account Structure Analysis

Oron Limited offers a tiered account system designed to serve different levels of traders, from beginners to those with significant money. The three primary account types are Micro, Standard, and Swap Free.

| Account Type | Minimum Deposit | Minimum Spread | Commission |

| Micro | $20 | From 1.5 pips | None |

| Standard | $1,000 | From 1.0 pips | None |

| Swap Free | $2,000 | From 1.5 pips | None |

The Micro account's $20 minimum deposit is a key selling point, making it extremely accessible for new traders who want to test live market conditions with minimal financial exposure. However, the jump to a $1,000 minimum for a Standard account is substantial, and the $2,000 requirement for the Swap free account places it in a premium category.

A significant drawback is the lack of a demo account. Demo accounts are an essential tool for traders to practice strategies and become familiar with a broker's platform and execution speeds without risking real money. The absence of this feature forces traders to deposit real funds to test the environment, which is a particularly risky proposition with an unregulated entity.

Leverage, Spreads, and Commissions

The trading costs and leverage offered by a broker directly impact profitability and risk. Oron Limited's offerings present a mixed picture. The maximum leverage of 1:500 is extremely high. While high leverage can increase potential gains from small market movements, it equally increases losses. A small negative price move can lead to a margin call or a complete loss of the trading account. For an unregulated broker to offer such high leverage is particularly concerning, as it encourages high-risk trading without the safety measures provided by regulators in places like the EU, UK, or Australia, where leverage is strictly limited for retail clients.

Spreads on the commission-free Micro and Standard accounts, starting at 1.5 pips and 1.0 pips respectively, are not highly competitive. Many regulated brokers offer tighter spreads on their standard account types.

The ECN account offers raw spreads from 0.0 pips, which is typical for this model. However, it comes with a commission of $7 per lot per side. This equals a $14 round-turn commission per standard lot, which is on the higher end of the industry standard. Some ECN brokers charge between $5 and $7 round-turn. This high commission can significantly reduce the profits of active or high-volume traders.

Platform and Technology

Oron Limited provides its services on the MetaTrader 5 (MT5) platform. MT5 is a globally recognized, advanced trading platform known for its sophisticated charting capabilities, extensive library of technical indicators, support for automated trading via Expert Advisors (EAs), and superior order execution features. The broker holds a “Full License” for MT5, suggesting they have invested in a legitimate and robust technological infrastructure. The platform is available for web and mobile devices.

The server, “OronLimited-Server,” is reportedly located in the United States, with an average execution speed noted around 190 ms. While this speed is adequate, it is not exceptional.However, a powerful platform cannot make up for a weak regulatory foundation. While MT5 is a trustworthy piece of software, the integrity of the broker using it is a separate and more important matter. The platform only processes orders; the broker handles the funds and ensures fair execution, which is where the risk lies.

Funding and Withdrawal Process

Flexibility in payment methods is a practical advantage. Oron Limited supports a wide array of deposit and withdrawal options, providing convenience for a global client base. These methods include traditional and modern payment options.

Please note that the following details are based on available information and should be verified, as processing times and fees can change.

Deposit Methods

| Method | Minimum Deposit | Commission | Processing Time |

| Wire Transfer | $20 | Free | 3-5 hours |

| Visa | $100 | Free | Instant |

| Mastercard | $100 | 1% | Instant |

| Neteller | $100 | Free | Instant |

| Skrill | $100 | Free | Instant |

| Paytm | $20 | Free | Instant |

| PhonePe | $20 | Free | Instant |

| UPI | $20 | Free | Instant |

| BinancePay | $20 | Free | 5-30 minutes |

Withdrawal Methods

| Method | Minimum Withdrawal | Commission | Processing Time |

| Wire Transfer | $50 | free | 3-5 hours |

| Visa | $100 | free | Instant |

| Mastercard | $100 | free | 5-30 minutes |

| BinancePay | $50 | free | 5-30 minutes |

| Neteller | $100 | 1% | Instant |

| Skrill | $100 | 1% | Instant |

| Paytm | $50 | free | Instant |

The advertised processing times are fast, particularly for electronic methods. However, these stated policies must be weighed against actual user experiences, which can sometimes differ significantly.

User Experiences and Reviews

Client feedback provides the most direct insight into a broker's trustworthiness. The reviews for Oron Limited are sharply divided and highlight critical concerns. The most alarming piece of feedback is a verified “Exposure” review from a user in India. The user, Kuldip Zapadiya, claims that the broker does not return funds and blocks client accounts upon withdrawal requests. According to the review, customer support avoids responsibility by blaming the Liquidity Provider (LP) without offering a solution. This is a very serious accusation that directly attacks the broker's core function and trustworthiness. A broker that allegedly prevents clients from accessing their money cannot be considered reliable.

In contrast, there are two unverified positive reviews. One from Portugal praises the competitive spreads and low minimum deposit, calling it “the real deal.” Another from Colombia notes a smooth experience starting with just $20 on the MT5 platform.

A neutral, unverified review from a user in New Zealand criticizes a change in the broker's copy trading system, stating that the new system requires an unreasonably high minimum fund for copiers, making it difficult to add new clients. This suggests potential issues with specific services offered by the broker.

The conflicting nature of these reviews is telling. While some users report a satisfactory experience, the presence of a verified, severe complaint regarding withdrawals is a major warning sign that overshadows the positive comments. For a comprehensive view of all user feedback and to stay updated on new reviews, traders can explore the full details on platforms like WikiFX.

Associated Business Entities

Further investigation reveals a related corporate entity: ORON LIMITED, registered in New Zealand on February 2, 2023. This company has a listed director, Louise LING. The exact relationship between the Saint Lucia-based Oron Limited and this New Zealand entity is not clearly defined in the available information.

The existence of multiple entities with the same name in different countries can sometimes be a legitimate corporate structure, but it can also be used to hide operations and accountability. Without a clear explanation from the broker about how these companies are related, it adds another layer of confusion for potential clients. Investigating a broker's corporate structure is a key part of due diligence. Traders can often find more details about such connections and corporate relationships by checking comprehensive broker review platforms like WikiFX.

Pros and Cons Summary

Pros:

• Very low minimum deposit of $20 for the Micro account.

• Access to the advanced and reliable MetaTrader 5 platform.

• A diverse range of tradable assets across multiple classes.

• Wide variety of modern and traditional payment methods.

Cons

:

• Complete lack of valid financial regulation, posing a severe risk to client funds.

• A verified user complaint claiming withdrawal denial and account blocking.

• The official website is reportedly not accessible, a sign of operational instability.

• No demo account available for risk-free practice.

• High ECN commission at $14 per lot round-turn.

• Extremely high leverage of 1:500, which can lead to rapid losses.

• Confusing corporate structure with a related entity in New Zealand.

Conclusion: Is Oron Limited Trustworthy?

After a thorough review of all available data, we cannot conclude that Oron Limited is a trustworthy broker.

While the broker presents some attractive features on the surface—namely a low entry barrier, a modern MT5 platform, and a wide range of assets—these are completely overshadowed by fundamental and non-negotiable failings.

The most critical factor is the absolute lack of regulation. Entrusting funds to an unregulated entity is an unacceptable risk for any serious trader. There are no protections, no oversight, and no guarantees. This fact alone is sufficient to advise extreme caution.

This primary concern is made worse by severe secondary warning signs. The verified user report of being unable to withdraw funds is a direct example of the potential dangers of dealing with an unregulated firm. Furthermore, an inaccessible website suggests that the company may be having serious operational issues or could even have stopped its primary business functions.

Therefore, despite the low cost of entry, the risks associated with Oron Limited are exceptionally high. The combination of no regulation, serious withdrawal complaints, and an offline website leads to the conclusion that traders should stay away to protect their money. A trustworthy broker must, at a minimum, be regulated and have a consistent track record of processing withdrawals without issue. Is Oron Limited reliable? Oron Limited fails to meet these basic criteria.

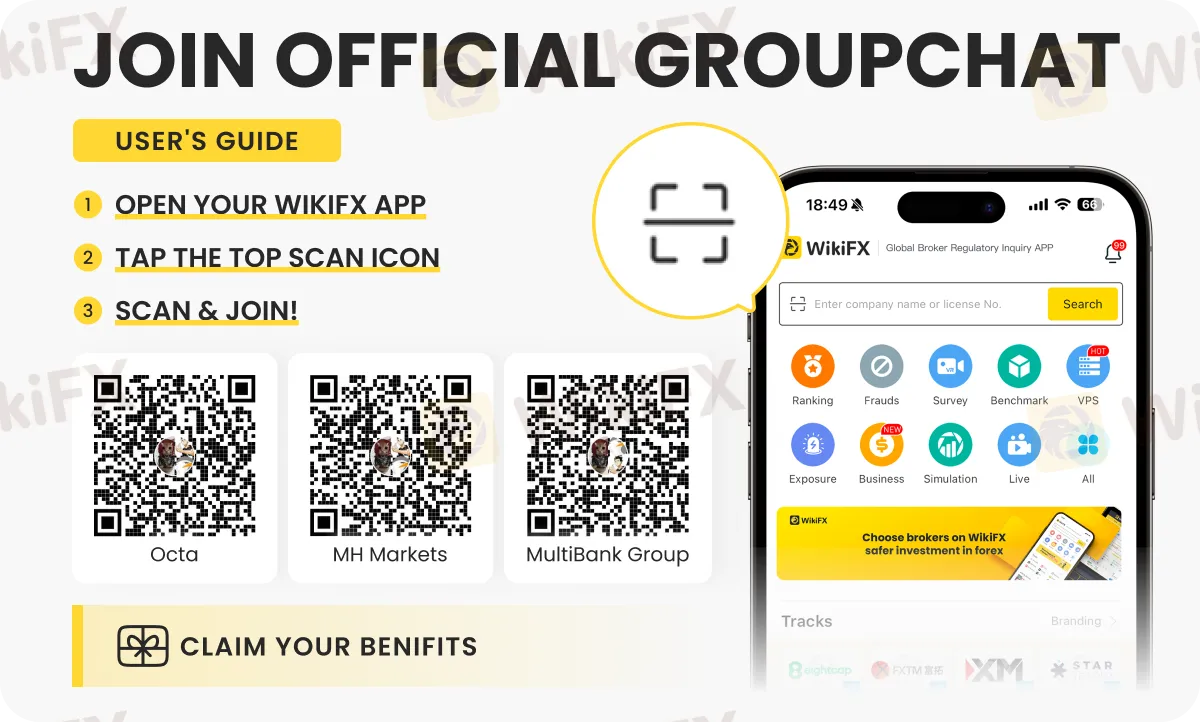

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc