Is FXCC Regulated? Full FXCC Regulation Overview

Abstract:FXCC is licensed and regulated by CySEC. Understand its regulatory compliance, authorized jurisdictions, and investor protections.

FXCC Review: Regulation, Trading Conditions & Broker Transparency

FXCC has operated in the retail forex market for nearly two decades—long enough to attract both loyal users and stringent regulatory scrutiny. With its headquarters in Cyprus and a regulatory license under CySEC, the broker positions itself as a transparent ECN/STP provider offering competitive spreads, zero-commission trading, and a minimum deposit accessible to newer traders.

This review examines FXCCs regulatory integrity, trading environment, fees, account structures, safety controls, and overall credibility.

FXCC Regulation & Licensing

FXCC CySEC License Explained

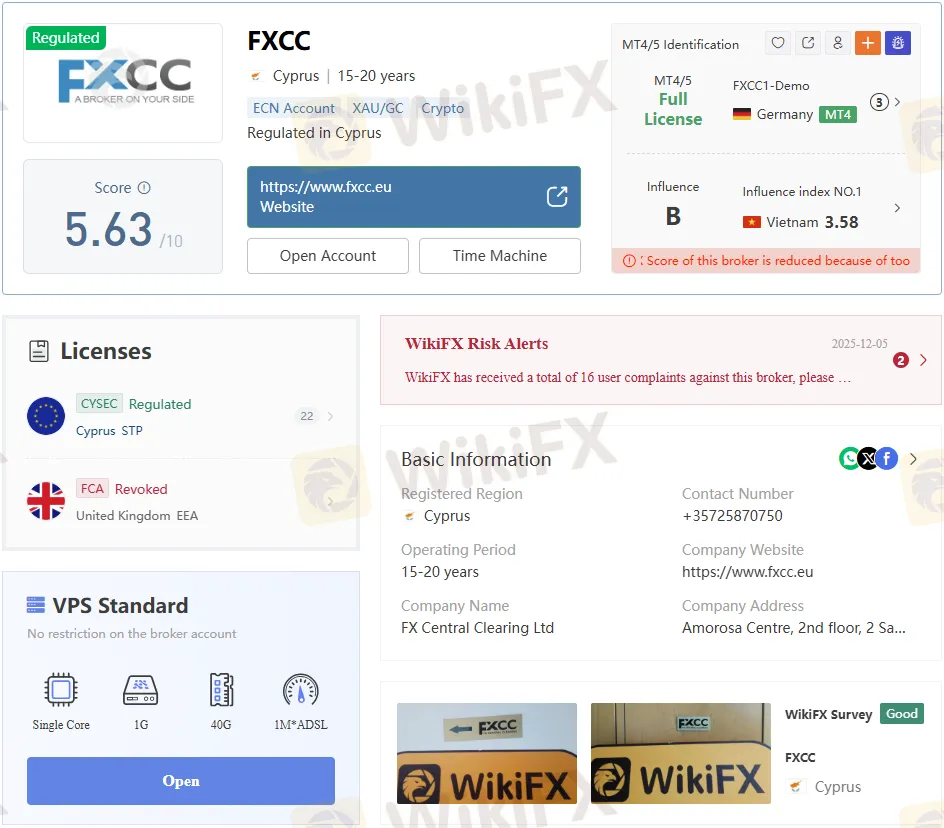

FXCC (FX Central Clearing Ltd) holds an active CySEC license No. 121/10, operating under a Straight Through Processing (STP) model. Its regulatory status is explicitly shown as Regulated.

Key Regulatory Details

- Regulator: Cyprus Securities and Exchange Commission (CySEC)

- License Type: STP (Straight Through Processing)

- Authorized Jurisdictions: 20+ EU countries, including Austria, Belgium, Croatia, Denmark, Estonia, Finland, and others).

- Entity: FX Central Clearing Ltd

- Effective Date: 2010-09-03

- Operational Address: 2 Samou Street, Amorosa Centre, 2nd Floor, Limassol, Cyprus

This regulatory framework ensures client-fund segregation, periodic reporting, and investor protection under CySEC oversight.

Former FCA Authorization

The broker also has a historical FCA authorization (License No. 549790), now marked Revoked as of 2020-12-31, previously authorizing EEA representatives.

While no longer active, this indicates past compliance within UK jurisdiction before Brexit-related changes.

FXCC Domain Transparency & Corporate Footprint

The list of several verified domains:

- fxcc.eu

- fxcc.com

- fxcc.net

All show US-based IP hosting domain panel.

A physical office is confirmed in Limassol, Cyprus—supported by an on-site verification.

FXCC Company Overview

A summary table provides the backbone of FXCCs corporate profile. Key facts include:

- Founded: 2004

- Registered Region: Cyprus

- Regulation: CySEC

- Primary Instruments: Forex, gold, silver

- Trading Platform: MetaTrader 4

- Minimum Deposit: $100 (ECN XL account)

- Leverage: Up to 1:200 depending on account type

- Customer Support: 24/5 phone and email support from Cyprus

These attributes position FXCC as a long-standing European ECN broker with a straightforward product lineup.

FXCC Trading Instruments

A detailed instrument table shows what FXCC supports:

| Instruments | Supported |

| Forex | ✔️ |

| Gold | ✔️ |

| Silver | ✔️ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Takeaway:

FXCC is highly specialized in forex and metals, unlike competitors such as Exness or Pepperstone, which offer far broader multi-asset choices.

FXCC Account Types & Minimum Deposits

FXCC provides three ECN accounts:

| Account Type | Minimum Deposit |

| ECN Standard | $10,000 |

| ECN XL | $100 |

| ECN Advanced | $100,000+ |

The ECN XL account is highlighted as the most popular, offering zero deposit fees and competitive spreads.

Key Account Features Across All Types

- Zero commission fees

- STP execution

- Micro lot trading

- Free economic calendar & analysis tools

- MT4 desktop/mobile/web access

Leverage at FXCC

Leverage ranges by account type:

| Account | Maximum Leverage |

| ECN Standard | 1:30 AM |

| ECN XL | 1:30 AM |

| ECN Advanced | 1:200 |

EU regulatory rules typically cap retail leverage at 1:30; therefore, the 1:200 figure may apply to specific jurisdictions or professional clients.

FXCC Fees & Spreads

Trading Fees

FXCC charges no commission fees on its ECN accounts. This is explicitly noted, stating: “No commission fees are charged.”

Spreads

While live spreads aren't disclosed, FXCC promotes “tight spreads” prominently on platform.

Deposit & Withdrawal Fees

A detailed payment processor fee table. Highlights:

- Bank Wire:

- Deposit fee: 2–5 USD

- Withdrawal fee: 18 USD

- Visa:

- Deposit fee: 3.2% + 0.29

- Withdrawal fee: 2%

- Skrill:

- Withdrawal fee: 0.49%

- Neteller:

- Withdrawal fee: 2%

- Paysafe:

- Bank wire fee applied

These fees place FXCC in the mid-range category—lower than some EU brokers but not fee-free like IC Markets or XM.

FXCC Trading Platform

FXCC supports MT4 only, with no MT5 access available.

- MT4: ✔️ Desktop, mobile, web

- MT5: ❌ Not supported

MT4 remains fully functional but may be limiting for traders needing more advanced backtesting or modern interface features.

FXCC Pros and Cons

A pros and cons table which aligns with real-world broker analysis.

Pros

- Demo accounts available

- Regulated by CySEC

- Long operational history

- Zero deposit fees on ECN XL

- STP execution model

Cons

- Limited range of tradable products

- MT4-only platform offering

- Deposit and withdrawal fees on many payment methods

FXCC Safety & Legitimacy Assessment

Based on the regulatory documents and verified company data, FXCC meets key trust indicators:

- Valid CySEC regulation (license 121/10)

- Verified Cyprus office and corporate presence

- Two-decade operational history

- Segregated client funds under EU regulations

- Transparency of domain and contact information

These components collectively support FXCCs legitimacy and reliability.

Competitor Comparison Snapshot

| Broker | Asset Variety | Regulation | Platforms | Minimum Deposit |

| FXCC | Limited (FX, metals) | CySEC | MT4 | $100 |

| Exness | Very broad | CySEC, FCA, FSCA | MT4/MT5 | $10 |

| Pepperstone | Broad | FCA, ASIC, DFSA | MT4/MT5/cTrader | $0 |

| IC Markets | Broad | ASIC, CySEC | MT4/MT5/cTrader | $200 |

FXCC is most competitive for traders who prefer:

- MT4

- Pure ECN/STP execution

- Tight spreads with no commissions

But less optimal for multi-asset or MT5 traders.

Bottom Line: Is FXCC a Good Broker?

FXCC stands as a fully regulated CySEC broker with a long operational history and a transparent STP trading model. Its trading environment is optimized for forex and metals, with the ECN XL account offering the best value through tight spreads and no commission. However, its limited asset range and withdrawal fees may be drawbacks for traders seeking broader exposure or lower transaction costs.

For traders who prefer MT4, ECN execution, and EU-regulated oversight, FXCC remains a credible and structurally sound choice backed by verifiable licensing data.

Read more

MYFX Markets Review (2025): Is it Safe or a Scam?

If you are considering depositing funds with MYFX Markets, you need to pause and read this safety review immediately. While many brokers operate with high standards of transparency, our analysis of the data suggests MYFX Markets poses significant risks to retail investors.

9Cents Review 2025: Institutional Audit & Risk Assessment

9Cents (established 2024) presents the risk profile of a newly formed, unsupervised financial entity. Despite utilizing the reputable MT5 trading infrastructure, the broker operates without effective regulatory oversight and has already accrued serious allegations regarding fund safety. 9Cents is classified as a High-Risk Platform, primarily due to the discord between its high minimum deposit requirements for competitive accounts and its lack of legal accountability or capital protection schemes.

Bridge Markets Review: Is It Safe to Trade Here?

Bridge Markets Review uncovers scam alerts, blocked withdrawals, and unregulated trading risks.

ZForex Review: Is It Safe for Traders?

ZForex Review highlights the lack of regulation, risky leverage, and withdrawal issues reported by traders worldwide.

WikiFX Broker

Latest News

Stop Chasing Headlines: The Truth About "News Trading" for Beginners

Why Markets Pump When the News Dumps: The "Bad Is Good" Trap

Common Questions About GLOBAL GOLD & CURRENCY CORPORATION: Safety, Fees, and Risks (2025)

Yen in Peril: Wall Street Eyes 160 as Structural Outflows Persist

Is CMC Markets Legit or a Scam? Key Questions Answered (2025)

Biggest Scams In Malaysia In 2025

Rate Calc