FPG EURGBP Market Report December 4, 2025

Abstract:EURGBP experienced a massive bearish move after the price was repeatedly rejected around 0.8801, then plunged to 0.8736. The pair is now around 0.8739 after a sharp downward extension that broke below

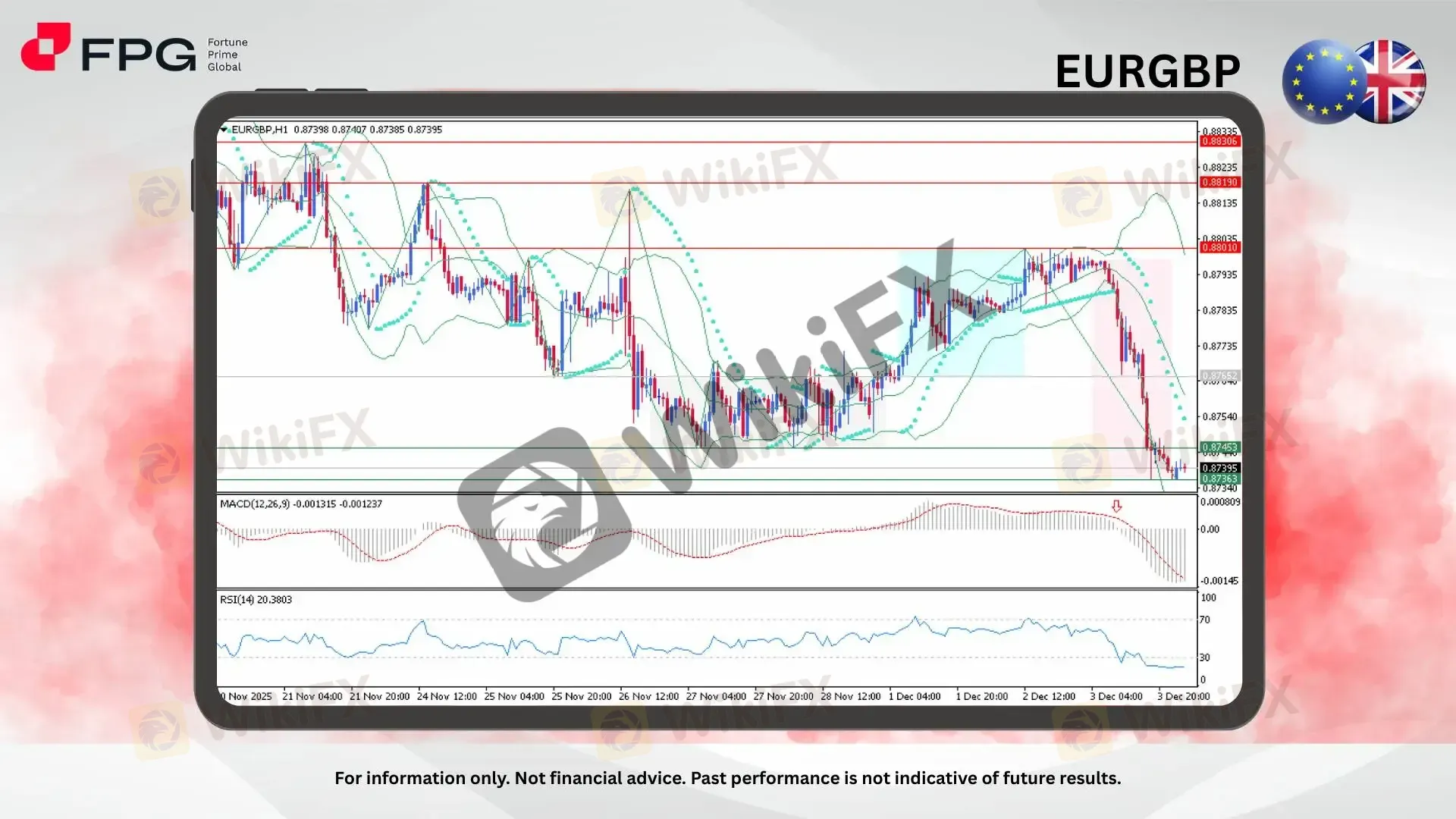

EURGBP experienced a massive bearish move after the price was repeatedly rejected around 0.8801, then plunged to 0.8736. The pair is now around 0.8739 after a sharp downward extension that broke below several intraday supports, showing a clear shift in momentum toward sellers. Despite the aggressive drop, price behavior remains highly reactive, positioning EURGBP within a crucial zone where the market must decide between extending its bearish momentum or initiating a corrective rebound.

Technical indicators show dominant bearish momentum, with heavy-bodied candles pressing along the lower Bollinger Band and Parabolic SAR dots remaining above price, confirming strong downside control. The structure continues to form lower highs and lower lows within a clear bearish channel. The MACD histogram has sharply moved into negative territory, while RSI(14) sits near extreme oversold levels around 20, indicating seller exhaustion but still lacking a confirmed reversal signal, keeping this zone highly sensitive for directional decisions.

The current area represents a critical zone between a potential bearish continuation and a rebound that may initiate a broader trend reversal. Traders are encouraged to closely observe todays price behavior, particularly given the presence of several key economic events on the schedule, which are likely to exert a direct influence on this pair and may heighten overall market volatility.

Market Observation & Strategy Advice

1. Current Position: EURGBP is currently trading around 0.8739, hovering near fresh intraday lows after a steep selloff, signaling high volatility.

2. Resistance Zone: Immediate resistance lies around 0.8765, aligning near the mid-Bollinger Band and prior structural rejection. Stronger resistance remains at 0.8801, the major supply zone that triggered the latest bearish reversal.

3. Support Zone: The nearest support is 0.8736 — the level tested during the sharp decline. A deeper support zone is found at 0.8700, a psychological round-level that historically attracts buyer interest.

4. Indicators: MACD is widening to the downside, confirming strong bearish momentum. RSI is extremely oversold around 20, suggesting potential exhaustion. Parabolic SAR continues to print above price, maintaining a bearish trend signal.

5. Trading Strategy Suggestions:

Aggressive Sell-Continuation Setup: Consider short positions if price breaks and holds below 0.8736.

Oversold Rebound Play: A corrective long can be considered only if price stabilizes above 0.8745 with bullish candlestick confirmation, targeting 0.8765.

Wait-and-React Scenario: For conservative traders, wait for clear structure confirmation (breakdown or rebound signal) as momentum is elevated and volatility may spike.

Market Performance:

Forex Last Price % Change

EUR/USD 1.1662 −0.07%

USD/JPY 155.18 −0.02%

Today's Key Economic Calendar:

AU: Balance of Trade

UK: S&P Global Construction PMI

EU: Retail Sales MoM

US: Balance of Trade

US: Exports & Imports

US: Initial Jobless Claims

CA: Ivey PMI s.a

Risk Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

WikiFX Broker

Latest News

ZarVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

The Warsh Dilemma: Why the New Fed Nominee Puts Fiscal Plans at Risk

Eurozone Economy Stalls as Demand Evaporates

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Nigeria Outlook: FX Stability Critical to Growth as Fiscal Revenue Surges

AUD/JPY Divergence: Aussie Service Boom Contrasts with Japan's Fiscal "Truss Moment"

ZarVista Regulatory Status: A Deep Look into Licenses and High-Risk Warnings

KODDPA Review: Safety, Regulation & Forex Trading Details

Rate Calc