RM1.3Mil Gone in Days: JB Kinder Boss Falls for Online “Investment”

Abstract:A Johor Baru kindergarten owner lost her life savings of RM1.3 million to a non-existent online investment scheme after responding to a social media ad promising returns of up to 41%. Between Nov 6–21, she made multiple transfers to several accounts and was later pressured to “add funds” to release profits that never materialised. She lodged a police report on Nov 28; the case is being probed under Section 420 (cheating).

A Johor Baru kindergarten owner has lost her life savings of RM1.3 million after falling for an online “investment” that never existed. The 42-year-old was lured by a social media advert in September touting unusually high returns, and later engaged with individuals claiming to be share-investment agents.

Johor police chief Comm Datuk Ab Rahaman Arsad said the victim was promised profits of up to 41% on her total capital. Between 6 and 21 November, she made a series of transfers totalling RM1.3 million into several bank accounts. When the supposed profits failed to materialise, the scammers pressured her to deposit even more funds, claiming extra money was needed to “release” her returns.

Realising something was wrong, the victim lodged a police report on Friday (28 Nov). The case is being investigated under Section 420 of the Penal Code for cheating. Police have cautioned the public not to be swayed by online schemes that dangle guaranteed or outsized returns—especially those encountered via social media.

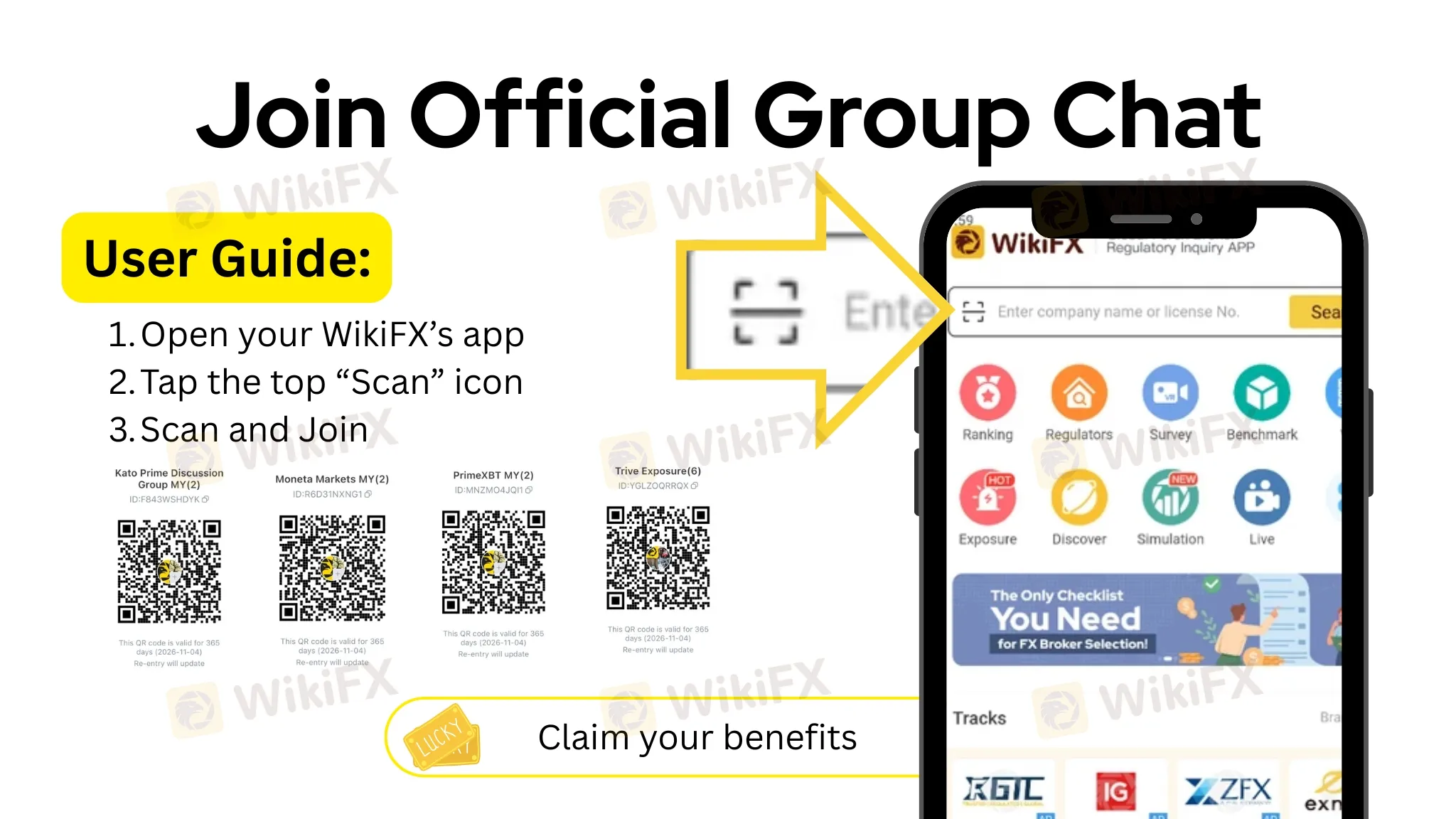

Members of the public are urged to verify any investment opportunity through official channels such as the Royal Malaysia Police (PDRM), Bank Negara Malaysia (BNM) and the Securities Commission Malaysia (SC). As an added step, users can also check a brokers regulatory status and community feedback via tools like the WikiFX app before committing funds.

For this victim, the warning signs came too late. What began as a search for better financial security ended in a devastating loss—reminding all of us that “too easy” and “too profitable” are red flags in the online investment world.

Read more

BlackBull Markets User Reputation: Looking at Real User Reviews and Common Problems to Judge Trust

When traders ask, "Is BlackBull Markets safe or a scam?", they want a simple answer to a hard question. The facts show two different sides. The broker began operating in 2014 and has a strong license from New Zealand's Financial Markets Authority (FMA). It also has an "Excellent" rating on review sites such as Trustpilot. But when searching for "BlackBull Markets complaints," you find many negative user stories, including withdrawal issues and poor trading conditions. This article goes beyond simple "safe" or "scam" labels. We want to carefully look at both the good reviews and common problems, comparing them with how the broker actually works and its licenses. This fact-based approach will give you the full picture of its user reputation, helping you make your own smart decision.

Is BlackBull Markets Legit? An Unbiased 2026 Review for Traders

Is BlackBull Markets legit? Are the "BlackBull Markets scam" rumors you see online actually true? These are the important questions every smart trader should ask before exposing capital to markets. The quick answer isn't just yes or no. Instead, we need to look at the facts carefully. Our goal in this review is to go beyond fancy marketing promises and do a complete legitimacy check. We will examine the broker's rules and regulations, look at its business history, break down common user complaints, and check out its trading technology. This step-by-step analysis will give you the facts you need to make your own smart decision about whether BlackBull Markets is a good and safe trading partner for you.

A Clear BlackBull Markets Review: Trading Conditions, Fees & Platforms Explained

This article gives you a detailed, fair look at BlackBull Markets for 2026. It's written for traders who have some experience and are looking for their next broker. Our goal is to break down what this broker offers and give you facts without taking sides. We'll look at the important things that serious traders care about: how well they're regulated, what trading actually costs, what types of accounts you can get, and how good their technology is. We're not here to tell you to use this broker - we want to give you the facts so that you can decide if it fits your trading style and how much risk you're comfortable with. Making a smart choice means checking things yourself. Before you pick any broker, you need to do your own research. We suggest using websites, such as WikiFX, to check if a broker is properly regulated and see what other users say about it.

SGFX User Reputation: Is it Safe or a Scam? A Detailed Look at User Complaints

The most important question any trader can ask is whether a broker is legitimate. Recently, SGFX, also called Spectra Global, has been mentioned more often, leading to many questions: Is SGFX Safe or Scam? Is it a safe platform for your capital, or is it another clever online scam? This article will give you a clear, fact-based answer to that question. Read on!

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc