In-Depth Review of Uniglobe Markets Trading Conditions and Account Types – An Analysis for Traders

Abstract:For experienced traders, selecting a broker is a meticulous process that extends far beyond headline spreads and bonus offers. It involves a deep dive into the fundamental structure of a broker's offering: its regulatory standing, the integrity of its trading conditions, and the flexibility of its account types. Uniglobe Markets, a broker with an operational history spanning over five years, presents a complex case study. It offers seemingly attractive conditions, including high leverage and a diverse account structure, yet operates within a regulatory framework that demands intense scrutiny. This in-depth analysis will dissect the Uniglobe Markets trading conditions and account types, using data primarily sourced from the global broker inquiry platform, WikiFX. We will explore the Uniglobe Markets minimum deposit, leverage, and account types to provide a clear, data-driven perspective for traders evaluating this broker as a potential long-term partner.

For experienced traders, selecting a broker is a meticulous process that extends far beyond headline spreads and bonus offers. It involves a deep dive into the fundamental structure of a broker's offering: its regulatory standing, the integrity of its trading conditions, and the flexibility of its account types. Uniglobe Markets, a broker with an operational history spanning over five years, presents a complex case study. It offers seemingly attractive conditions, including high leverage and a diverse account structure, yet operates within a regulatory framework that demands intense scrutiny.

This in-depth analysis will dissect the Uniglobe Markets trading conditions and account types, using data primarily sourced from the global broker inquiry platform, WikiFX. We will explore the Uniglobe Markets minimum deposit, leverage, and account types to provide a clear, data-driven perspective for traders evaluating this broker as a potential long-term partner.

Broker Profile and Critical Regulatory Scrutiny

Uniglobe Markets has been operating for between 5 to 10 years, with its domain registered in late 2014. This longevity might suggest a degree of operational stability. However, the broker's regulatory status is the most critical factor for any discerning trader, and it is here that significant red flags emerge.

According to WikiFX data, Uniglobe Markets holds “No valid regulatory information.” The platform assigns the broker a very low score of 2.25 out of 10 and issues a stark warning: “Low score, please stay away!” This lack of regulation is the single most important consideration. It means the broker is not accountable to any stringent financial authority that would typically enforce rules on client fund segregation, capital adequacy, and fair dealing. In the event of a dispute or insolvency, traders have no access to a compensation scheme or a formal, independent body for recourse.

The corporate structure further complicates the picture. While WikiFX notes a registered region of the United Kingdom, the physical address provided is in Saint Lucia, a well-known offshore jurisdiction. Furthermore, a related entity, UNI SMART SOLUTIONS LTD, is listed as “Deregistered” in the United Kingdom. This combination of an offshore operational base and a defunct related UK company is a classic characteristic of high-risk, unregulated brokers. For experienced traders, this setup immediately signals a lack of transparency and a high counterparty risk.

A Deep Dive into Uniglobe Markets Account Types

A broker's account structure is a clear indicator of its target audience. Uniglobe Markets offers a surprisingly wide array of account types, suggesting an attempt to cater to everyone from complete novices to high-volume institutional traders. Based on information from WikiFX and other public sources, the account lineup is one of the broker's main selling points.

Micro Account

Designed as the entry-level option, the Micro account likely targets new traders or those wishing to test the broker's environment with minimal capital.

• Minimum Deposit: The entry point is an accessible $100, which is in line with industry standards for such accounts.

• Pricing: This account type is almost certainly a spread-only model. The general spread of 1.5 pips is relatively wide for an entry-level account, as many competitors offer spreads closer to 1.0 pips for their standard offerings.

• Suitability: Best for small-volume traders and those testing strategies or the broker's execution without committing significant funds.

ECN Classic & ECN Elite Accounts

These accounts are the core offerings for serious and experienced traders who demand better pricing and direct market access. The “ECN” designation implies a pricing model based on raw spreads plus a fixed commission.

• Spreads: Third-party sources suggest spreads on these accounts can start from 0.0 pips on major pairs like EUR/USD. This is highly competitive, but traders should be aware that “from 0 pips” does not guarantee zero spreads, especially during volatile periods.

• Commissions: The cost of trading is a commission, which some review sites state starts from $2 per side per lot. The primary difference between the Classic and Elite tiers would logically be the commission rate and the required minimum deposit. The ECN Elite account would presumably offer lower commissions in exchange for a higher initial deposit.

• Suitability: These accounts are built for active day traders, scalpers, and algorithmic traders who prioritize tight spreads and fast execution. The viability of this model, however, depends entirely on the broker's integrity and the quality of its liquidity providers, which is impossible to verify in an unregulated environment.

Uniglobe Premium & Uniglobe VIP Accounts

Positioned at the top of the hierarchy, these accounts are for high-net-worth individuals and institutional clients.

• Minimum Deposit: While not explicitly stated in the provided data, these accounts would require substantial minimum deposits, likely in the tens of thousands of dollars.

• Benefits: Traders on these tiers would expect premium benefits, such as a dedicated account manager, priority customer support (some sources mention 24/7 support for professional accounts versus 24/5 for standard ones), the lowest possible commissions, and potentially bespoke trading solutions.

• Suitability: Reserved for professional, high-volume traders who can meet the high deposit requirements and demand a premium service level.

Specialty Accounts

WikiFX also lists “Islamic” and “Fixed Spread” accounts, offering further flexibility.

• Islamic Account: This is a swap-free account that adheres to Sharia law by replacing overnight interest (swap fees) with a fixed administration fee. This is a standard feature offered by most global brokers.

• Fixed Spread Account: This account type offers predictable trading costs by fixing the spread for certain instruments. While this eliminates uncertainty, fixed spreads are typically much wider than the variable spreads found on ECN or standard accounts, making them less cost-effective for active traders.

This tiered structure appears comprehensive on paper. However, the appeal of each account is fundamentally undermined by the broker's regulatory status and the operational risks that come with it.

Core Trading Conditions: An Analysis of Leverage, Costs, and Execution

Beyond the account types, the specific trading parameters define the day-to-day trading experience. Here, Uniglobe Markets offers conditions typical of an offshore broker, blending high-risk opportunities with potential cost advantages.

Leverage

Uniglobe Markets offers maximum leverage of up to 1:500. This is a significant draw for traders seeking to maximize their market exposure with limited capital. However, experienced traders understand that such high leverage is a double-edged sword. It is a level prohibited by top-tier regulators such as the FCA (UK), ASIC (Australia), and ESMA (EU) for retail clients precisely because it dramatically amplifies the risk of catastrophic losses. The availability of 1:500 leverage is a direct result of the broker's offshore status and should be approached with extreme caution.

Spreads and Commissions

The cost structure is bifurcated. The Micro and Fixed Spread accounts operate on a spread-only basis, with WikiFX indicating a minimum spread of 1.5 pips. This is not particularly competitive. The real allure lies with the ECN accounts, which promise raw spreads (from 0.0 pips) paired with a commission. If the commissions are indeed as low as some sources suggest (e.g., from $2 per side), this could represent a very low-cost environment for high-frequency trading. The critical unknown, however, is the consistency and authenticity of these “raw” spreads without regulatory oversight.

Minimum Deposit

The $100 minimum deposit for the entry-level account makes Uniglobe Markets highly accessible. This low barrier allows traders to test the waters, but it also serves as a tool for unregulated brokers to attract a large volume of small, often inexperienced, clients.

Execution and Platform Technology

Uniglobe Markets provides the industry-standard MetaTrader 5 (MT5) platform. WikiFX confirms that the broker holds a Full License for MT5, which is a positive indicator. A full license suggests a more direct relationship with MetaQuotes and implies better technical support, server stability, and risk control capabilities compared to a cheaper white-label solution.

The WikiFX data also provides some insight into server performance, listing ping times of 158 ms and 190 ms for its MT5 servers located in Germany and the UK. While not lightning-fast, these speeds are generally acceptable for most trading styles outside of ultra-low-latency scalping. The platform also supports the use of Expert Advisors (EAs), a crucial feature for traders who rely on automated strategies.

Fund Safety, User Feedback, and Severe Operational Risks

This is where the theoretical appeal of Uniglobe Markets' trading conditions collides with the harsh reality of its operational track record. The absence of regulation is not just a theoretical risk; it manifests in tangible problems reported by users.

The operational risks are further highlighted by numerous user complaints. For instance, a quick review on a platform like WikiFX reveals multiple 'Exposure' reports detailing severe issues such as unprocessed withdrawals and arbitrarily blocked accounts, painting a concerning picture of the broker's post-deposit conduct.

Key complaints logged against Uniglobe Markets include:

• Withdrawal Failures: A user from Taiwan reported in April 2023 that after depositing a total of $500 and attempting to withdraw $534, the withdrawal was never processed, and customer service became unresponsive.

• Blocked IB Accounts: A user from Pakistan, claiming to be an Introducing Broker (IB) with over 1300 clients, reported in 2020 that Uniglobe Markets blocked their IB account without reason, labeling the broker a “scam.”

• General Unresponsiveness: A report from Bangladesh in 2021 noted that multiple clients complained about the broker preventing withdrawals and not responding to emails.

While there is a single positive review from an IB in India from early 2020, it is vastly outnumbered by recent and severe negative feedback. These reports of withdrawal issues are the most serious indictment against any broker, as they strike at the core of the trust relationship between a trader and their financial intermediary. For an experienced trader, the risk of being unable to access profits or even initial capital is unacceptable.

Conclusion: Are Uniglobe Markets' Conditions Worth the Risk?

Uniglobe Markets presents a paradox. On one hand, it offers a sophisticated menu of trading options: a multi-tiered account structure catering to all levels, the powerful MT5 platform with a full license, very high leverage, and the potential for low-cost ECN trading. These are features that, in a regulated context, would be highly attractive.

On the other hand, these offerings are built on a foundation of immense risk. The broker is unregulated, operates from an offshore jurisdiction, and has a related UK entity that is now deregistered. Most damningly, it has a documented history of serious user complaints regarding the most fundamental of all broker obligations: processing withdrawals.

For the experienced trader evaluating a broker for long-term partnership, trust and reliability are paramount. The attractive Uniglobe Markets trading conditions and account types are severely undermined by the lack of regulatory oversight and the alarming user feedback. The potential savings on a few pips in spread or commission are insignificant when weighed against the risk of losing your entire trading capital to operational malpractice.

While the low minimum deposit might tempt some to “try it out,” the evidence suggests that this is a high-risk proposition. The broker appears to be targeting traders in regions with less stringent local regulations, leveraging attractive conditions to mask fundamental weaknesses in its safety and reliability. Ultimately, traders must weigh the allure of high leverage and varied account types against the stark reality of an unregulated environment. Before committing any capital, it is imperative to conduct thorough due diligence, and consulting a comprehensive resource like WikiFX can provide further structured data, user reviews, and up-to-date regulatory status checks.

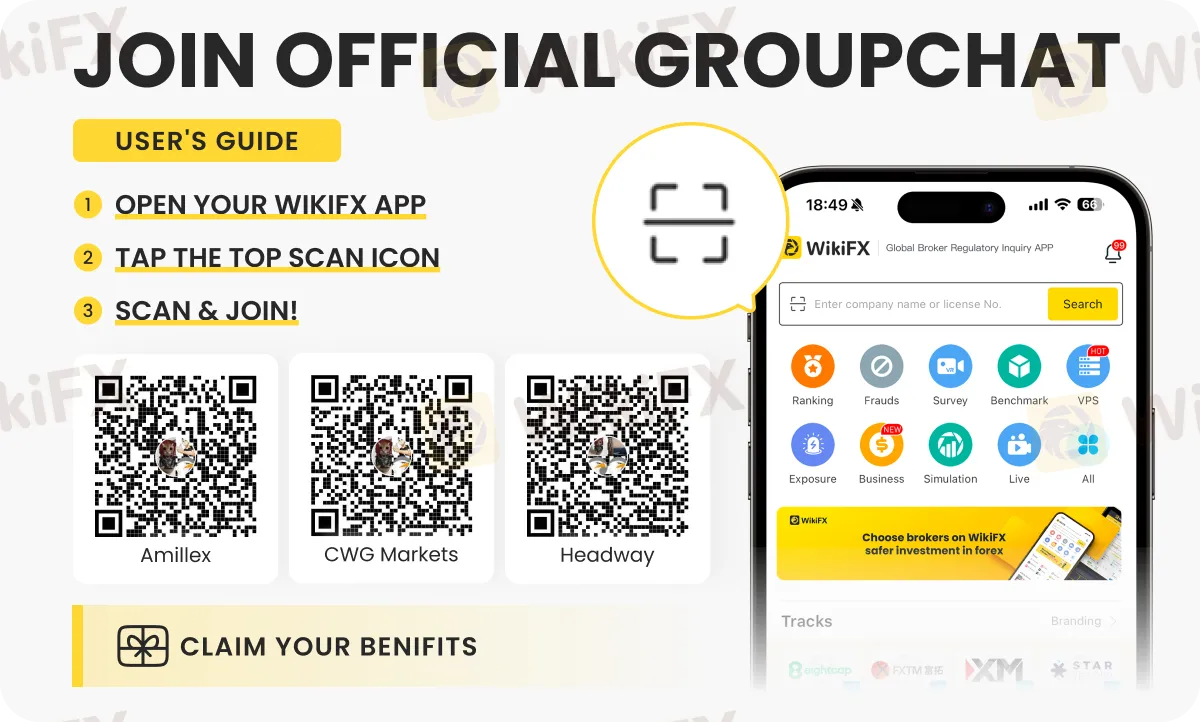

Want to know the latest about the forex market? Be part of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the instructions shown below.

Read more

KUBERA MARKETS Payout & Withdrawal Issues — What Traders Are Saying

Did you fail to receive payouts from KUBERA MARKETS despite successfully passing the trading challenge? Failed to log in to the trading account despite passing both the evaluation and funded phase? Were you surprised by the sudden nominal fee norm to receive a funded account? Did you have to go through a long withdrawal process? We have investigated these user claims while preparing this KUBERA MARKETS review article. Keep reading!

BelleoFX Review: Allegations of Controversial Profit Cancellations & Account Closure

Have your past good experiences been marred by recent cases of profit cancellations by BelleoFX, a Mauritius-based forex broker? Has your trading account been blown away by the broker’s official upon your refusal to deposit more? Did the broker’s official tell you to deposit more, even if the earlier attempt turned unsuccessful? Did the high-return promise fall flat on the ground? In this BelleoFX review article, we have investigated these allegations. Take a look!

Is Dbinvesting Real or Fake: A Simple Check to See if This Trading Company Can be Trusted

When a trading company like Dbinvesting shows up and says it's an experienced partner with great deals like high leverage up to 1:1000 and different account types, it gets people's attention. But this appeal gets clouded by more and more serious complaints from users. This creates a big problem for people thinking about investing. The main question that needs a clear answer based on facts is: Is Dbinvesting legit, or is it a clever scam that could cause you to lose a lot of capital? This investigation wants to give you that answer. We will look past the company's marketing claims to study facts we can check. Our study will carefully look at the main worries: Is Dbinvesting watched over by a trustworthy authority? What are the real, honest experiences of people who used it? Are the many reports about withdrawal problems and Dbinvesting scam claims believable? To do this, we will use solid data from third-party checking services, such as WikiFX, including their complete regulatory check

Dbinvesting Complete Review (2026): A Detailed Look at Safety, Costs, and Customer Experiences

An Honest First Look When checking out a forex broker, the main question is always about trust: "Is Dbinvesting a safe place for my investments?" This review answers that question directly. Dbinvesting says it's an experienced broker that offers the popular MT5 platform, different account options, and access to worldwide markets. But as we look closer, we find a very different story. Our research found serious warning signs, especially its weak overseas regulation and a very low trust score from independent reviewers. This review gives you a short summary of what we found, comparing what the broker promises with the serious problems shown by real data and lots of user feedback. We want to give you a clear, fact-based answer to help you understand the major risks before investing. The difference between what it promises and what users actually report is the main focus of our investigation.

WikiFX Broker

Latest News

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Middle East Escalation Rocks Markets: Oil Surges while Brokers Tighten Leverage

Eightcap Review: Understanding Fees, Features, and Important User Warnings

Exnova Review 2026: Is this Forex Broker Legit or a Scam?

Moneycorp Problems Exposed: Fund Transfer Failures & Customer Support Complaints

Rate Calc