Merin Regulation Review 2025: Is Merin a Safe and Legitimate Broker?

Abstract: The online trading industry is filled with both regulated brokers and high-risk offshore platforms. Among them, Merin is a forex broker that recently attracted public attention. As more traders look into Merin, a key question arises: What is the Merin regulation status, and is Merin safe or a potential scam?

The online trading industry is filled with both regulated brokers and high-risk offshore platforms. Among them, Merin is a forex broker that recently attracted public attention. As more traders look into Merin, a key question arises: What is the Merin regulation status, and is Merin safe or a potential scam?

What Is Merin?

Merin is an online trading broker that provides access to forex, CFDs, stocks, commodities, and cryptocurrency contracts. The platform has gained attention in Asia, Africa, and parts of Europe due to:

- Aggressive online marketing

- Attractive trading conditions

- Low entry requirements

- Bonuses and promotions

However, Merins popularity also raises concerns about whether it operates under proper regulation and whether client funds are fully protected.

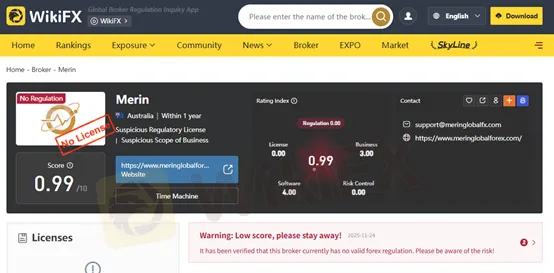

Merin Regulation: Is the Broker Regulated?

Understanding the Merin regulation is essential before depositing funds. According to publicly available information and user reports, Merin does not appear to hold a license from any top-tier regulator, such as:

- FCA (UK)

- ASIC (Australia)

- CySEC (Cyprus)

- NFA/CFTC (United States)

Instead, Merin is often associated with offshore registration, which provides minimal investor protection and lacks strict financial supervision.

What Offshore Registration Means

Offshore entities usually offer:

- No strict auditing requirements

- No mandatory segregated client accounts

- Weak oversight on withdrawals

- Limited legal recourse for clients

This does not automatically mean the broker is a scam, but it does increase risk significantly.

Is Merin Safe?

With no top-tier regulation and limited transparency regarding its corporate structure, we think that Merin cannot be considered fully safe.

The Potential risks can include:

Weak Investor Protection

Without regulation from a credible authority, traders face challenges if:

- The broker delays withdrawals

- Account manipulation occurs

- The company suddenly shuts down

Lack of Transparency

Merin provides little publicly verified information about:

- Registered physical office

- Board members or management

- Compliance standards

This is a red flag for traders seeking a trustworthy broker.

No SIPC/FSCS Protection

Merin customers do not receive compensation from investor protection schemes such as:

- FSCS (UK)

- SIPC (US)

This means your funds may not be recoverable if the broker collapses.

Is Merin a Scam?

There is no official ruling labeling Merin as a scam; however, several warning signs exist:

Frequent Complaints by Traders

According to the report, the traders accuses this broker of:

- Withdrawal delays

- Difficulty contacting support

- Aggressive account managers

- Lack of transparency over fees

No Recognized Regulatory License

Unregulated brokers can make false claims or change operations without oversight.

High-Risk Offshore Setup

This structure is commonly used by short-lived or fraudulent platforms.

Therefore, traders should approach Merin with caution and avoid depositing large amounts without verifying safety.

Merin Regulation Compared to Licensed Brokers

| Feature | Merin | Regulated Brokers |

| Regulatory License | Unclear/Offshore | FCA / ASIC / CySEC / NFA |

| Investor Protection | None | FSCS, SIPC, ICC |

| Transparency | Low | High |

| Safety Level | High-risk | Low/Medium risk |

| Fund Segregation | Not guaranteed | Mandatory |

This comparison highlights the importance of choosing a broker with reputable licensing.

How to Check Merins Regulatory Status Yourself

To verify any brokers legitimacy:

- Check the regulators database (FCA, ASIC, CySEC, NFA).

- Search for the license number provided on the brokers website.

- Verify company address and registration number.

- Read third-party reviews from credible sources.

- Evaluate whether contact channels and documents seem professional.

So far, Merin does not appear in major regulatory registries.

Should You Trade with Merin?

Traders should be cautious because Merin:

- Does not show strong regulatory oversight

- Offers limited information about its corporate structure

- Has received complaints from users regarding withdrawals

If safety is your priority, consider choosing a broker regulated by:

- FCA

- ASIC

- CySEC

- MAS

- FINRA/NFA

These authorities enforce strict rules to protect investors.

FAQ: Merin Regulation & Safety

1. Is Merin regulated?

Merin does not appear to be regulated by any top-tier or well-known financial authority.

2. Is Merin safe to trade with?

Due to weak regulatory backing, Merin is considered high risk.

3. Is Merin a scam?

Not officially, but its offshore setup and user complaints make it a potentially unsafe broker.

4. Does Merin offer investor protection?

No SIPC, FSCS, or compensation coverage is provided.

5. Should beginners choose Merin?

Beginners should avoid unregulated brokers and choose platforms with top-tier licenses.

Conclusion

Merins regulatory status is unclear and potentially problematic, with no evidence of licensing from reputable financial authorities. While the broker may offer attractive conditions, the lack of oversight exposes traders to significant risks, especially concerning withdrawals and fund security.

For safety and accountability, we recommend you choose a regulated broker.

Read more

BlackBull Markets User Reputation: Looking at Real User Reviews and Common Problems to Judge Trust

When traders ask, "Is BlackBull Markets safe or a scam?", they want a simple answer to a hard question. The facts show two different sides. The broker began operating in 2014 and has a strong license from New Zealand's Financial Markets Authority (FMA). It also has an "Excellent" rating on review sites such as Trustpilot. But when searching for "BlackBull Markets complaints," you find many negative user stories, including withdrawal issues and poor trading conditions. This article goes beyond simple "safe" or "scam" labels. We want to carefully look at both the good reviews and common problems, comparing them with how the broker actually works and its licenses. This fact-based approach will give you the full picture of its user reputation, helping you make your own smart decision.

Is BlackBull Markets Legit? An Unbiased 2026 Review for Traders

Is BlackBull Markets legit? Are the "BlackBull Markets scam" rumors you see online actually true? These are the important questions every smart trader should ask before exposing capital to markets. The quick answer isn't just yes or no. Instead, we need to look at the facts carefully. Our goal in this review is to go beyond fancy marketing promises and do a complete legitimacy check. We will examine the broker's rules and regulations, look at its business history, break down common user complaints, and check out its trading technology. This step-by-step analysis will give you the facts you need to make your own smart decision about whether BlackBull Markets is a good and safe trading partner for you.

A Clear BlackBull Markets Review: Trading Conditions, Fees & Platforms Explained

This article gives you a detailed, fair look at BlackBull Markets for 2026. It's written for traders who have some experience and are looking for their next broker. Our goal is to break down what this broker offers and give you facts without taking sides. We'll look at the important things that serious traders care about: how well they're regulated, what trading actually costs, what types of accounts you can get, and how good their technology is. We're not here to tell you to use this broker - we want to give you the facts so that you can decide if it fits your trading style and how much risk you're comfortable with. Making a smart choice means checking things yourself. Before you pick any broker, you need to do your own research. We suggest using websites, such as WikiFX, to check if a broker is properly regulated and see what other users say about it.

SGFX User Reputation: Is it Safe or a Scam? A Detailed Look at User Complaints

The most important question any trader can ask is whether a broker is legitimate. Recently, SGFX, also called Spectra Global, has been mentioned more often, leading to many questions: Is SGFX Safe or Scam? Is it a safe platform for your capital, or is it another clever online scam? This article will give you a clear, fact-based answer to that question. Read on!

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc