Is Seaprimecapitals Safe or a Scam? A Simple 2025 Safety Review

Abstract:When you're thinking about choosing any trading company, the most important question is always about safety. For Seaprimecapitals, the answer is complicated and you should be very careful. The most important thing you need to know is that Seaprimecapitals works without any proper financial rules watching over them. This review will explain exactly what that means for you as a trader. We will look at the company background, trading platform, account options, and fees based on the information we have, to give you a complete answer about whether it's safe. This detailed 2025 analysis is made to help potential investors understand what they need to know before investing. We will examine the features they advertise and compare them against the serious risks their business setup creates.

When you're thinking about choosing any trading company, the most important question is always about safety. For Seaprimecapitals, the answer is complicated and you should be very careful. The most important thing you need to know is that Seaprimecapitals works without any proper financial rules watching over them. This review will explain exactly what that means for you as a trader. We will look at the company background, trading platform, account options, and fees based on the information we have, to give you a complete answer about whether it's safe. This detailed 2025 analysis is made to help potential investors understand what they need to know before investing. We will examine the features they advertise and compare them against the serious risks their business setup creates.

Rules and Oversight: A Major Warning Sign

The most important factor in evaluating if any trading company is safe is looking at what rules it follows. When it comes to this, Seaprimecapitals shows a big and immediate problem. We have confirmed that this trading company currently has no valid financial license from any trusted authority.

The company, Seaprimecapitals LLC, is registered in Saint Vincent and the Grenadines. While this registration is real, it's a common trick used by high-risk, offshore trading companies. The Financial Services Authority (FSA) of Saint Vincent and the Grenadines has publicly said that it does not give any licenses to forex or CFD brokers, and it does not regulate, watch, supervise, or license international business companies that carry out these activities. This means Seaprimecapitals operates with no rules watching over them at all.

Official warnings connected to this broker include “Suspicious Regulatory License,” “High potential risk,” and a clear warning to “Please stay away.” Trading with an unregulated broker puts a trader at serious risks that don't exist with properly licensed companies. These risks include:

· No Protection for Your Money: Regulated brokers must keep client capital in separate accounts, away from the company's operating funds. Without this oversight, your money could be at risk if the company has financial problems.

· No Access to Protection Programs: Places like the UK (FSCS) or Cyprus (ICF) have investor protection funds that protect traders up to a certain amount if their broker goes out of business. Unregulated brokers offer no such safety net.

· No Fair Practice Watching: Regulatory bodies make sure companies follow rules on fair pricing, trade execution, and honest business practices. An unregulated company has no one to answer to, increasing the risk of price manipulation or unfair terms.

· No Legal Help: If you have a problem with an unregulated broker, such as not being able to withdraw your capital, there is no official governing body to ask for help. Your legal options are very limited and often not practical.

Trading Conditions and What They Offer

Despite the serious regulatory problems, it's important to look at the services Seaprimecapitals claims to offer. This helps a potential user understand what they're being promised and compare those features against the risks involved.

Trading Platform: MetaTrader 5

Seaprimecapitals gives its clients the MetaTrader 5 (MT5) platform. MT5 is a globally known and powerful trading program, respected for its advanced charting tools, technical analysis features, and support for automated trading through Expert Advisors (EAs). The broker uses a “Full License” version of MT5, which suggests a more complete setup than a basic white-label solution. Server data shows its MT5 server, “Seaprimecapitals-Live,” is located in the United States.

However, some user feedback, while generally positive about the platform's functionality, has noted that MT5 can experience delays during periods of high market activity. This is a practical consideration for traders who need split-second execution.

Available Trading Instruments

The broker offers trading only through Contracts for Difference (CFDs). The range of available instruments is moderately diverse but notably incomplete compared to many larger, regulated competitors.

| Instrument Category | Availability | Details |

| Forex | ✔ | 50+ currency pairs |

| Cryptocurrencies | ✔ | A selection of popular crypto pairs |

| Commodities | ✔ | Major commodities including gold, silver, and crude oil |

| Indices | ✖ | Not available |

| Stocks | ✖ | Not available |

| Bonds | ✖ | Not available |

| Options | ✖ | Not available |

| ETFs | ✖ | Not available |

The focus is clearly on the most popular CFD markets, which may be enough for some traders. However, the complete absence of stock, index, and ETF CFDs limits opportunities for diversification and access to broader market trends.

Account Types and Leverage

Seaprimecapitals structures its offerings across three different account levels, plus a demo account for practice. An important point is the provision of up to 1:200 leverage across all account types. While high leverage can increase potential profits, it equally increases losses and is an extremely high-risk tool, especially for new traders. The lack of regulatory oversight on leverage limits is another warning sign.

A confusing difference appears in their deposit requirements. While the general minimum deposit is listed as a very low $10, the “Micro” account, designed for beginners, requires a minimum deposit of $100. This inconsistency can be confusing for new clients.

Here is a breakdown of the account types:

| Account Type | Minimum Deposit | Maximum Leverage | Spread (EUR/USD) | Suitable For |

| Micro | $100 | 1:200 | 1.0 – 1.5 pips | Beginners, small-scale traders |

| Standard | $500 | 1:200 | 2.0 – 2.5 pips | Regular traders |

| Premium | Not Specified | 1:200 | 2.5 – 3.5 pips | Traders seeking premium services |

The broker does not mention the availability of swap-free (Islamic) accounts, which is a key feature for traders of Islamic faith.

Fees, Spreads, and Costs

A deep look into the cost structure shows that trading with Seaprimecapitals is much more expensive than the current industry average. These costs mainly show up through wide spreads, which are the difference between the buy and sell price of an asset.

Analysis of Spreads

The broker operates on a zero-commission model, meaning its profit is built directly into the spread. While this seems simple, the spreads themselves are not competitive.

· Micro Account: 1.0 - 1.5 pips

· Standard Account: 2.0 - 2.5 pips

· Premium Account: 2.5 - 3.5 pips

To put this in context, a spread of 2.0 - 2.5 pips on a Standard account for a major pair like EUR/USD is very high. Many well-regulated brokers today offer spreads well below 1.5 pips, and often below 1.0 pip, for the same account type. For a trader to be profitable, the market must move significantly in their favor just to cover the initial cost of the trade. The even wider spreads on the Premium account are particularly concerning, as premium levels should typically offer better, not worse, trading conditions.

Deposit and Withdrawal Policies

Seaprimecapitals offers a low barrier to entry with a minimum deposit of just $10 via methods such as Visa, Mastercard, and Skrill. However, withdrawal policies introduce further costs. While deposits are generally free, withdrawals can have fees. For example, bank transfers have a stated fee of 2.5%. Processing times also vary widely. For a full, detailed list of all associated fees and payment method details, traders should check a comprehensive broker review platform before making any financial commitments.

Here is a summary of their payment policies. Please note that available information may be incomplete, and these details should be verified.

| Payment Method | Min. Deposit | Deposit Fee | Withdrawal Fee | Withdrawal Time |

| Bank Transfer | $10 | Free | 2.5% | 1-7 working days |

| Neteller | $10 | Free | 0% | Instant |

| Skrill | $10 | Free | Not specified | Instant |

| Visa | $10 | Free | Not specified | 6-12 working hours |

| Mastercard | $10 | Free | 0% | Instant |

The combination of instant withdrawals on some e-wallets is a positive feature, but the 2.5% fee on bank transfers can be substantial, especially on larger withdrawal amounts.

Looking at User Reviews

When examining an unregulated broker, user reviews can provide examples of its operations. In the case of Seaprimecapitals, there are a number of positive reviews available. However, a careful analysis of these reviews is essential.

Users have praised the broker for several aspects:

> “Fast trades execution Fast withdrawals Fast client service 📈”

>

> “I have been in copy trade with this broker for more than 2.5 years. My Account and my colleagues and friends are more profitable... It has made us financially sound.”

These reviews mention fast withdrawals, good client service, and profitable copy trading facilities. On the surface, this seems reassuring. However, there are several important warnings:

1. All Reviews are Unverified: Every single positive review found is marked as “Unverified.” This means there is no system in place to confirm that the reviewer is a real, funded client of the broker. Unverified reviews can be easily manipulated and should be treated with extreme doubt.

2. Heavy Geographic Concentration: The vast majority of the positive reviews come from a single country: India. While this shows a regional focus for the broker, a lack of diverse, global feedback is often a warning sign. A legitimate, well-regarded global broker typically has verified reviews from traders globally.

3. Stories vs Facts: While these positive experiences are noted, traders must weigh these unverified, story-based reports against the concrete, verifiable fact of operating with an unregulated entity. A few positive stories about withdrawals do not cancel out the fundamental risk that there is no legal framework to protect your funds if the broker decides to stop processing them.

Conclusion: The Final Answer

So, is Seaprimecapitals safe or a scam? Based on a comprehensive review of the available evidence, we can draw a clear conclusion.

While the broker offers some attractive features on the surface, such as the popular MT5 platform and a low minimum deposit, these are overshadowed by one overwhelming and non-negotiable factor: a complete lack of valid financial regulation. This is the single most important measure for trader safety, and Seaprimecapitals fails this test entirely.

| Pros | Cons |

| MetaTrader 5 (MT5) Platform | NO REGULATION (Major Red Flag) |

| Low Minimum Deposit ($10) | High, Uncompetitive Spreads |

| Wide Range of CFD Instruments | Unverified and Geographically Concentrated User Reviews |

| Instant Withdrawal Options (e-wallets) | Withdrawal Fees on Some Methods |

The term “scam” means a deliberate intent to steal funds. While it is impossible to definitively prove intent from the outside, the operational characteristics of Seaprimecapitals place it firmly in the highest-risk category of brokers. Operating without regulation, from an offshore location known for not overseeing forex activities, and charging high spreads are all classic warning signs.

The verdict is that Seaprimecapitals cannot be considered a safe broker for any trader. The risk of encountering issues with trade execution, pricing, and, most importantly, the withdrawal of funds is unacceptably high. The potential for total capital loss due to factors outside of trading is significant.

Ultimately, the decision rests with the individual trader, but the evidence points to significant risks. For a safer trading journey, it is always recommended to choose brokers with top-tier financial regulation from authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). As you continue to evaluate brokers, you can use comprehensive tools and verified regulatory information on dedicated verification platforms to ensure you are making the safest investment choice.

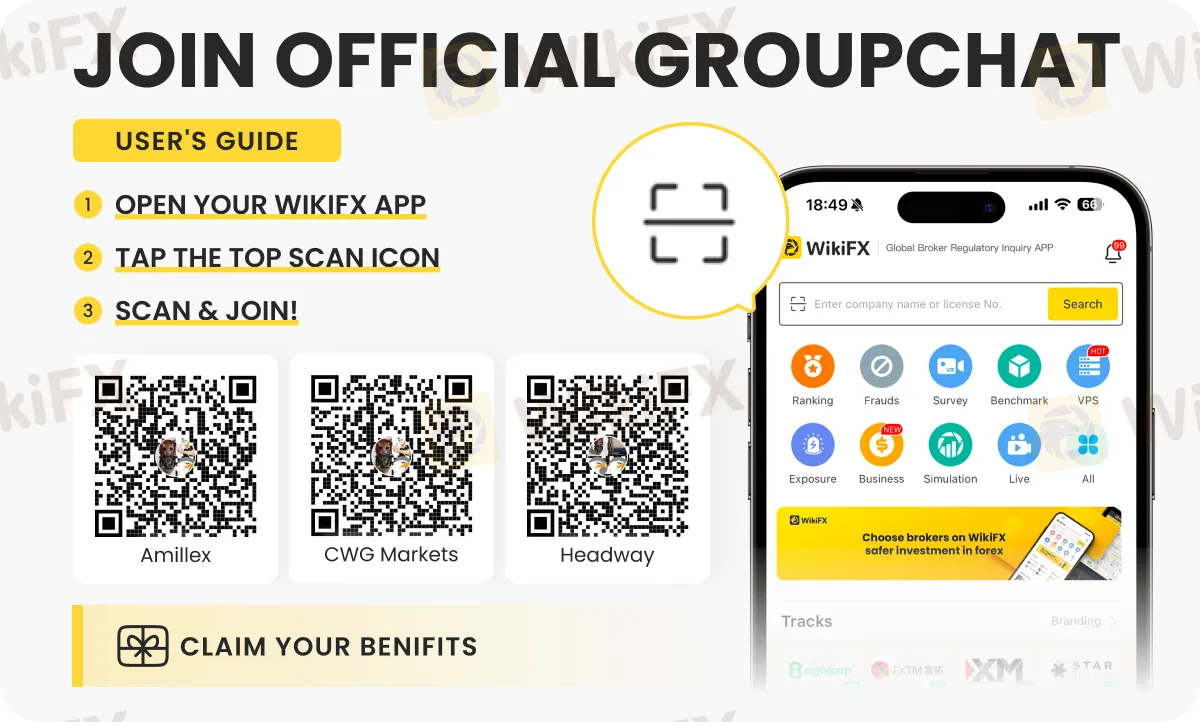

Get the latest forex updates, news, insights & tips by joining any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Follow the instructions shown below for joining the group/s.

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc