Seacrest Markets Exposed: Are You Facing Payout Denials and Spread Issues with This Prop Firm?

Abstract:Seacrest Markets has garnered wrath from traders owing to a variety of reasons, including payout denials for traders winning trading challenges, high slippage causing losses, the lack of response from the customer support official to address withdrawal issues, and more. Irritated by these trading inefficiencies, a lot of traders have given a negative review of Seacrest Markets prop firm. In this article, we have shared some of them. Take a look!

Seacrest Markets has garnered wrath from traders owing to a variety of reasons, including payout denials for traders winning trading challenges, high slippage causing losses, the lack of response from the customer support official to address withdrawal issues, and more. Irritated by these trading inefficiencies, a lot of traders have given a negative review of Seacrest Markets prop firm. In this article, we have shared some of them. Take a look!

Exploring the Top Complaints Against Seacrest Markets

Traders Allege Severe Payout Issues

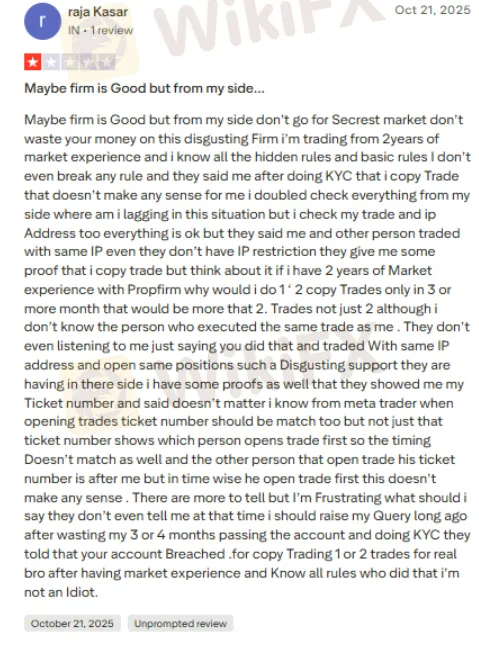

A recent complaint emerged under Seacrest Markets review where a trader claimed having won the trading challenge and received a payout by adhering to stop loss and not risking not more than 1% of the capital. However, the traders account got breached soon. A few months after, the trader purchased a new account, and the payout got denied on the stipulated day, Here is a full recount of the trading experience.

The Copytrade Tussle Between Seacrest Markets and the Trader

According to the trader, Seacrest Markets blamed him for initiating a copy trade from the same IP as the other trader. However, the trader rejected such claims by commenting on why he would copy trade when he was trading with Seacrest Markets for a couple of years. The trader claimed to have all the screenshots proving his statement. The lack of support made the trader share this Seacrest Markets review.

The Fund Loss Due to Slippage and Strange Price Spikes

It is a recurrent issue for Seacrest Markets traders if we believe their claims to be true. While one trader reported having lost funds due to slippage and strange price hikes, another lost his account while waiting for the Seacrest Markets broker to resolve the spread issue. The frustration was inevitable, and so were these Seacrest Markets reviews.

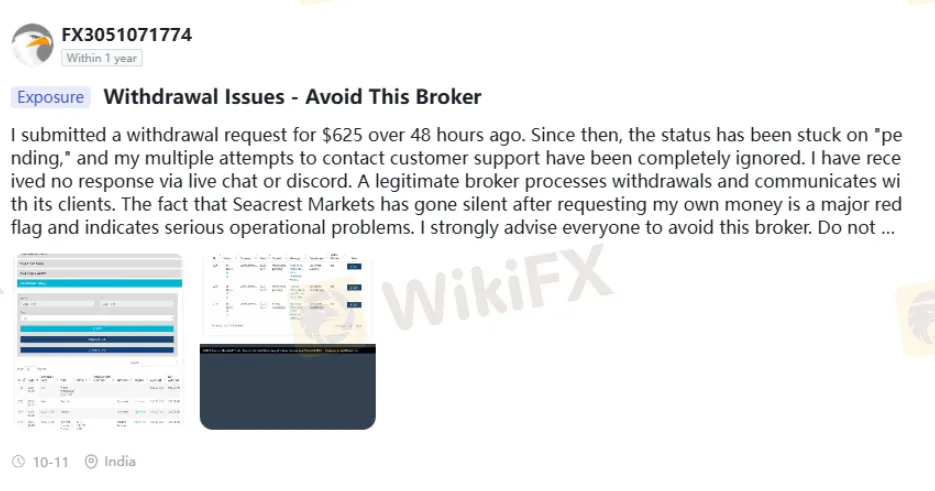

Seacrest Markets‘ Silence to Withdrawal Request

A trader reported that the Seacrest Markets broker did not commit to the withdrawal request worth $625 and chose to be silent on this matter as time went on. Whether it was live chat or Discord, the trader did not receive any response. Consequently, the trader shared this response on WikiFX, the world’s leading broker regulation inquiry app.

WikiFX Shares the Seacrest Markets Review: Score & Regulation Updates

Seacrest Markets has been receiving flak from most traders for the sheer trading issues they encounter. Looking at this, the WikiFX team conducted a detailed evaluation and found that Seacrest Markets does not possess a valid license, raising the scope for severe trading manipulation. As a result, the team gave the broker a score of 1.98 out of 10.

For forex news, trends, tips & insights, follow us on these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Just implement the steps shown below, and you can start discussing.

Read more

BlackBull Markets User Reputation: Looking at Real User Reviews and Common Problems to Judge Trust

When traders ask, "Is BlackBull Markets safe or a scam?", they want a simple answer to a hard question. The facts show two different sides. The broker began operating in 2014 and has a strong license from New Zealand's Financial Markets Authority (FMA). It also has an "Excellent" rating on review sites such as Trustpilot. But when searching for "BlackBull Markets complaints," you find many negative user stories, including withdrawal issues and poor trading conditions. This article goes beyond simple "safe" or "scam" labels. We want to carefully look at both the good reviews and common problems, comparing them with how the broker actually works and its licenses. This fact-based approach will give you the full picture of its user reputation, helping you make your own smart decision.

Is BlackBull Markets Legit? An Unbiased 2026 Review for Traders

Is BlackBull Markets legit? Are the "BlackBull Markets scam" rumors you see online actually true? These are the important questions every smart trader should ask before exposing capital to markets. The quick answer isn't just yes or no. Instead, we need to look at the facts carefully. Our goal in this review is to go beyond fancy marketing promises and do a complete legitimacy check. We will examine the broker's rules and regulations, look at its business history, break down common user complaints, and check out its trading technology. This step-by-step analysis will give you the facts you need to make your own smart decision about whether BlackBull Markets is a good and safe trading partner for you.

A Clear BlackBull Markets Review: Trading Conditions, Fees & Platforms Explained

This article gives you a detailed, fair look at BlackBull Markets for 2026. It's written for traders who have some experience and are looking for their next broker. Our goal is to break down what this broker offers and give you facts without taking sides. We'll look at the important things that serious traders care about: how well they're regulated, what trading actually costs, what types of accounts you can get, and how good their technology is. We're not here to tell you to use this broker - we want to give you the facts so that you can decide if it fits your trading style and how much risk you're comfortable with. Making a smart choice means checking things yourself. Before you pick any broker, you need to do your own research. We suggest using websites, such as WikiFX, to check if a broker is properly regulated and see what other users say about it.

SGFX User Reputation: Is it Safe or a Scam? A Detailed Look at User Complaints

The most important question any trader can ask is whether a broker is legitimate. Recently, SGFX, also called Spectra Global, has been mentioned more often, leading to many questions: Is SGFX Safe or Scam? Is it a safe platform for your capital, or is it another clever online scam? This article will give you a clear, fact-based answer to that question. Read on!

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc