FPG XAUUSD Market Report November 18, 2025

Abstract:Gold continues to extend its bearish correction after failing to hold above the major resistance zone near 4245, where a strong rejection candle triggered a sharp downside reversal. The current price

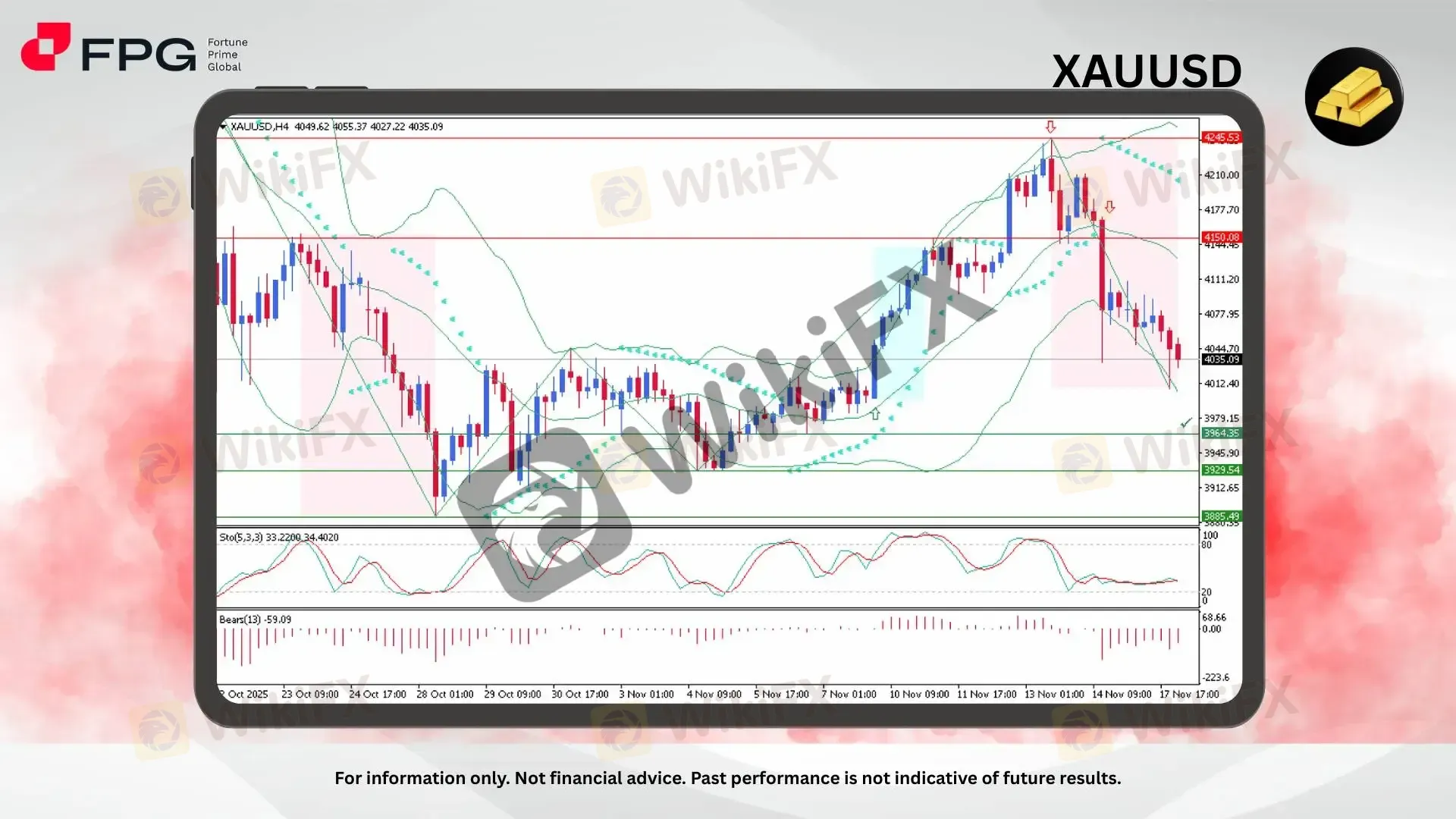

Gold continues to extend its bearish correction after failing to hold above the major resistance zone near 4245, where a strong rejection candle triggered a sharp downside reversal. The current price is trading around 4035, sliding beneath the short-term trendline and losing bullish momentum that dominated the early November rally. The shift in structure now tilts sentiment toward a deeper corrective move while volatility remains elevated.

The break below 4150 marked a decisive shift, sending price sharply through mid-range support levels and signaling the end of the prior bullish wave. Candles are now consistently closing below the mid-Bollinger band, indicating that downside pressure is in control. The Parabolic SAR dots have flipped above the candles since the rejection at the highs, further reinforcing bearish momentum.

Stochastic Oscillator (5,3,3) is currently drifting near 33/34, sitting in lower territory without yet entering extreme oversold conditions — leaving room for continued price weakness. Bears Power has dropped deeply into negative territory at -59.09, confirming that sellers are dominating the current cycle. The zone between 3964–3929 now plays a critical role as a reaction area where previous rebounds have formed.

Market Observation & Strategy Advice

1. Current Position: Gold is trading around 4035, continuing its decline from the peak near 4245. The break below the ascending trendline confirms that bearish momentum is now dominating, and price continues to follow the downward slope with little sign of stabilizing.

2. Resistance Zone: Immediate resistance is located at 4100–4150, a key area where the previous breakdown occurred. A push back above this zone is needed to challenge higher levels again, with 4245–4250 remaining the major resistance ceiling.

3. Support Zone: Strong support sits at 3964, followed by a deeper zone at 3929. Holding above these levels will be critical to prevent further downward continuation; a clean break below could expose 3885 and trigger broader bearish continuation.

4. Indicators: Bollinger Bands are widening with price riding the lower band, signaling strong bearish volatility. The Parabolic SAR has firmly flipped above candles since the reversal, confirming sustained downside bias. Stochastic Oscillator is in lower levels, suggesting momentum still favors sellers, while Bears Power deeply negative indicates strong selling pressure.

5. Trading Strategy Suggestions:

Sell on Pullbacks: Consider short positions around 4080–4100, targeting 3964 and 3929, with tight stops above 4115.

Breakdown Continuation: A clean break below 3964 opens room for further bearish expansion toward 3929–3885.

Risk Management: Trailing stops recommended due to elevated volatility and extended candle ranges during the decline.

Market Performance:

Precious Metals Last Price % Change

XPTUSD 1,527.55 −0.37%

XAGUSD 49.9034 −0.62%

Today's Key Economic Calendar:

US: Fed Kashkari & Waller Speech

AU: RBA Meeting Minutes

US: Fed Logan Speech

CN: FDI (YTD) YoY

US: ADP Employment Change Weekly

CA: Housing Starts

US: Export & Import Prices MoM

US: Factory Orders MoM

US: Fed Barr Speech

Risk Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

WikiFX Broker

Latest News

ZarVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

The Warsh Dilemma: Why the New Fed Nominee Puts Fiscal Plans at Risk

Eurozone Economy Stalls as Demand Evaporates

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Nigeria Outlook: FX Stability Critical to Growth as Fiscal Revenue Surges

AUD/JPY Divergence: Aussie Service Boom Contrasts with Japan's Fiscal "Truss Moment"

ZarVista Regulatory Status: A Deep Look into Licenses and High-Risk Warnings

KODDPA Review: Safety, Regulation & Forex Trading Details

Rate Calc