Upforex Review 2025: Critical Risks and Features Examined

Abstract:Upforex calls itself an offshore forex and CFD brokerage. Based on what we know, the company has been running for about 5 to 10 years. This puts it somewhere in the middle - not brand new, but not a long-time player either in online trading. The company tries to attract traders by giving them access to different financial markets through their own trading platform. However, anyone thinking about investing needs to take a careful look at how the company operates and does business.

What is Upforex?

Upforex calls itself an offshore forex and CFD brokerage. Based on what we know, the company has been running for about 5 to 10 years. This puts it somewhere in the middle - not brand new, but not a long-time player either in online trading. The company tries to attract traders by giving them access to different financial markets through their own trading platform. However, anyone thinking about investing needs to take a careful look at how the company operates and does business.

The Main Finding

Our research into Upforex leads to one clear and important conclusion: the broker works without any proper oversight from trusted financial authorities. This is the most important fact that any potential client needs to know. This complete lack of regulation, plus an extremely low trust score from industry experts, puts Upforex firmly in the high-risk category. The chance of losing money when dealing with this company is very high, and traders should be extremely careful.

What This Review Covers

This complete Upforex review is designed to examine every important part of what the broker offers. We will look past the surface-level marketing and do a fact-based review of its regulatory status, safety measures, account types, trading costs, and platform technology. Our goal is to give you the clear information you need to make a smart and safe decision about your investment money.

Regulation and Safety Concerns

The foundation of any trustworthy broker is whether it's properly regulated. In Upforex's case, this foundation doesn't exist. Our verification confirms that the broker currently has no valid license from any recognized financial regulator. The company behind the brand, UP Global Markets Ltd – Licensed by the Financial Services Commission (FSC) Mauritius as an Investment Dealer under License No. GB25204570.. Traders need to understand that the government of Saint Lucia, like St. Vincent and the Grenadines, does not regulate forex trading activities. This means Upforex operates without any legal oversight, rules, or investor protections that are normal in regulated markets.

Also, reports show that the brokerage has made false claims about where it operates and who oversees it, suggesting it's based in the UK and regulated by the Australian Securities and Investments Commission (ASIC). These claims are completely false. A broker that lies about its regulatory status shows a clear lack of honesty and trustworthiness.

Risks of Unregulated Brokers

Choosing to trade with an unregulated broker like Upforex puts you and your money at serious risk. Without a regulatory body to enforce standards, the relationship between you and the broker is completely one-sided. The direct consequences for you as a trader include:

• No Fund Protection: Regulated brokers must keep client funds in separate accounts, away from the company's business funds. This ensures your money isn't used for the broker's business expenses and is protected if the company goes bankrupt. With Upforex, there's no such guarantee. Your funds could be mixed with theirs and at risk.

• No Dispute Resolution: If you have problems like withdrawal delays, pricing issues, or unfair trade execution, you have no official body to complain to. Regulators provide a formal process for solving disputes, but with an offshore company, your only option is the company itself, which has no obligation to rule in your favor.

• No Guarantee of Fairness: An unregulated broker can make its own rules about pricing, leverage, and how trades are executed. This creates a conflict of interest where the broker could potentially change conditions to benefit themselves, without fear of punishment from a governing authority.

Official Warning Profile

The lack of regulation isn't just something we noticed; it has led to active warnings from industry watchdogs. Upforex has been flagged with serious alerts, including “Suspicious Regulatory License” and “Suspicious Scope of Business.” These warnings aren't given lightly and serve as a direct signal of questionable practices. The consensus from risk evaluation models results in a clear warning to “please stay away,” reflecting the broker's high-risk profile and the potential danger to investors. To get a full, up-to-date view of the regulatory warnings about Upforex, traders can do their own search on a comprehensive verification platform like WikiFX.

Trading Accounts and Conditions

Account Type Overview

Upforex's website lists three main account levels: Standard, Pro-ECN, and Elite-ECN. However, a major problem is the serious lack of detailed information that explains the differences between these accounts. Most of the available information seems to refer to the Pro-ECN account, which requires a high minimum deposit of $1000. This high barrier to entry is unusual, especially for a broker that doesn't provide basic transparency.

Regulated brokers typically provide clear, comparison tables showing the specific spreads, commissions, and features of each account type. The absence of this information from Upforex is a significant red flag. As a trader, you can't make an informed decision about which account suits your strategy or budget if the basic terms aren't disclosed. This lack of transparency is a recurring theme. The table below shows the limited information available, which isn't enough for proper research.

| Account Feature | Provided Information (Mainly for Pro-ECN) |

| Account Types | Standard, Pro-ECN, Elite-ECN |

| Minimum Deposit | $1000 |

| Minimum Position | 0.01 lot |

| EA Support | Supported |

| Currency | Not Specified |

Understanding High Leverage

The broker offers maximum leverage of up to 1:300. On the surface, high leverage is often marketed as a benefit, allowing traders to control a large position with a relatively small amount of money. This can increase potential profits. However, it's a double-edged sword that equally increases potential losses. With an unregulated broker, this risk is even greater. Regulated brokers are often subject to leverage limits to protect retail clients from huge losses. Upforex, operating without such restrictions, offers a level of leverage that can quickly wipe out an entire trading account from a small negative market movement. There are no guarantees of negative balance protection or other risk management tools that are standard in regulated environments.

Spreads and Commissions

During a test on a demo account, the benchmark EURUSD pair showed a spread that moved around 1.0 pips. By itself, this spread could be considered competitive. However, it's important to add a disclaimer here: this information is for reference only, as it's unconfirmed whether demo account conditions accurately reflect the real trading environment. Unregulated brokers have been known to offer attractive conditions on demo accounts that don't translate to real-money trading.

For the Pro-ECN account, a commission of $7 per round lot is specified. This pricing structure, combining a spread with a fixed commission, is common for ECN-style accounts. When combined, a 1.0 pip spread and a $7 commission result in a total cost of about 1.7 pips, which is average, but not particularly competitive in today's market.

Tradable Instruments and Platform

Available Trading Markets

Upforex provides access to a reasonably diverse range of tradable instruments across several asset classes. This allows traders to diversify their strategies beyond a single market. The available products include:

• Forex: The offering covers over 30 currency pairs. This includes major pairs, minor pairs, and a selection of exotic currencies such as the Singapore Dollar, Danish Krone, and Mexican Peso.

• CFDs: The product list extends to Contracts for Difference (CFDs) on a variety of underlying assets, including spot metals, futures contracts, global shares, major stock indices, and commodities like oil and gas.

• Cryptocurrencies: The broker also states that it offers CFDs on popular cryptocurrencies, allowing traders to speculate on the price movements of digital assets without owning them.

While the range of instruments appears adequate, the safety and fairness of the trading environment in which these products are offered remain the primary concern.

A Below-Standard Platform

A critical failure point in this Upforex broker review is its trading platform. The broker doesn't offer the industry-standard MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platforms. Instead, clients get a proprietary web-based trading platform. While web-based platforms can offer convenience, the functionality of the Upforex platform is reportedly very limited.

It's said to lack many of the basic features that professional and even beginner traders rely on. This includes a limited set of technical indicators, poor charting tools, and an inability to use custom indicators or automated trading strategies, known as Expert Advisors (EAs). For any trader who uses technical analysis or algorithmic trading, this platform is a significant downgrade and would severely limit their ability to operate effectively. Traders who depend on sophisticated charting and automated strategies may find this platform insufficient for their needs; comparing platform technologies across brokers on a detailed review site like WikiFX can provide valuable context.

Deposits and Withdrawals

Limited Payment Methods

The process of moving money into and out of a brokerage account is a crucial part of the user experience. Upforex offers a notably limited and inconvenient selection of payment methods. The available options are:

• VISA

• MasterCard

• Bank/Wire Transfer

• Bitcoin

The most obvious omission is the absence of popular and efficient electronic wallets (e-wallets) such as Skrill and Neteller. These payment providers are standard for the vast majority of modern brokers because of their speed, low cost, and convenience. Their absence can be a significant operational problem for traders, particularly those in regions where bank transfers are slow or expensive.

A Breakdown of Fees

Perhaps more concerning than the limited methods are the fees associated with them. Unlike most reputable brokers, who absorb transaction costs as part of their service, Upforex charges fees on both deposits and withdrawals. This practice is anti-consumer and immediately puts the trader at a disadvantage by adding a direct cost to their operations. The stated fees are as follows:

• Credit Cards (VISA/MasterCard): 1.5% fee

• Bitcoin: 2.5% fee

• Bank/Wire Transfer: 1.0% fee

Charging clients to simply fund their account or access their own money is a practice typically seen among low-grade, offshore companies. These fees directly reduce your trading capital and potential profits before you even place a single trade. For example, a $1000 deposit via Bitcoin would cost a $25 fee, and a later withdrawal would cost another $25 fee, resulting in a $50 loss on a transaction that is free with most other brokers.

Upforex Company Profile

Operational Details

A closer look at the company information reveals a fragmented and concerning operational structure. The key details are:

• Company Name: Up Forex Ltd

• Registered Address: Ground Floor, Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia

• Contact Number: +971 526090312 (A United Arab Emirates country code)

• Server Location: Bulgaria

Red Flag Analysis

This scattered structure is a textbook red flag. The company is legally registered in an offshore Caribbean nation (Saint Lucia), provides a contact phone number based in the Middle East (UAE), and operates its trading servers from Eastern Europe (Bulgaria). There is no central, transparent operational headquarters in a credible location. This international shell game is a common tactic used by high-risk companies to hide their true location and make it difficult for clients to seek legal or regulatory help. It creates a picture not of a global financial firm, but of a unclear entity deliberately avoiding scrutiny.

Customer Support Channels

Contact with the broker is supposedly available through a single email address, support@upforex.com, and the UAE-based phone number. However, we must issue a disclaimer: we cannot verify the quality, responsiveness, or even the existence of meaningful customer support. With an unregulated broker, there is no guarantee of receiving adequate, fair, or timely assistance. To gauge a broker's operational credibility, reviewing its full contact details and any user-submitted experiences on a verification service like WikiFX is a smart step before committing funds.

Final Verdict and Conclusion

Summary of Key Risks

To conclude this Upforex broker review, we will consolidate the major red flags and critical risks that our analysis has uncovered. Any trader considering this broker must weigh these points carefully:

• Complete Lack of Regulation: Upforex is not authorized or overseen by any reputable financial authority, exposing clients to huge risk.

• Official High-Risk Warnings: The broker has been flagged for suspicious licenses and business practices, with a clear warning to avoid their services.

• Misleading Claims: The false suggestion of being regulated by top-tier bodies like ASIC shows a clear intent to deceive.

• High Entry Requirements and Low Transparency: A high $1000 minimum deposit is demanded without providing clear details on account differences.

• Punitive Fees: Charging fees on both deposits and withdrawals is an uncompetitive practice that hurts client profitability.

• Below-Standard Technology: The proprietary web platform is functionally inferior to industry standards, limiting traders' capabilities.

Our Final Recommendation

Given the overwhelming evidence of a lack of regulation, multiple high-risk warnings, misleading business practices, and a non-transparent operational structure, we cannot recommend Upforex as a safe or viable broker for any trader.

Engaging with an unregulated company like Upforex exposes your capital to an unacceptable level of risk. This includes not only the risk of poor trading conditions but also the very real possibility of being unable to withdraw your funds, leading to a total loss of your investment with no legal or regulatory help available. We strongly advise all traders, regardless of their experience level, to prioritize their financial security by exclusively partnering with brokers that are authorized and strictly regulated by top-tier financial authorities.

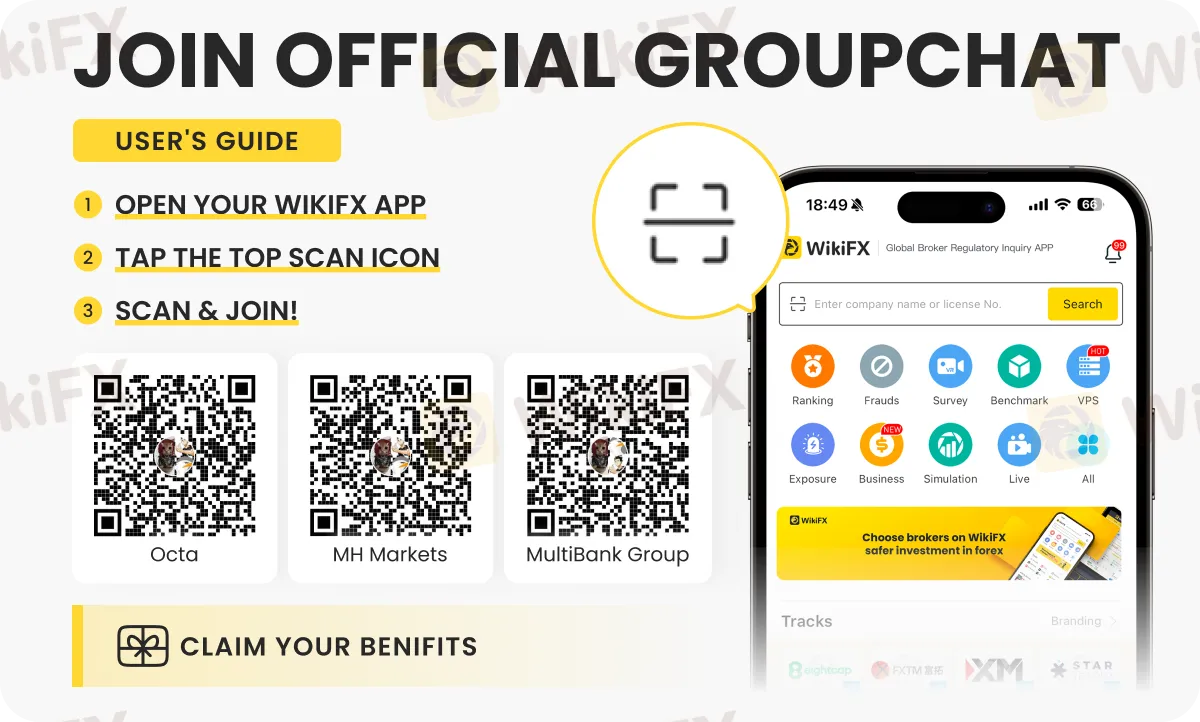

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

WikiFX Broker

Latest News

Identity Theft in FX: FCA Flags New 'Clone' Broker Mimicking Fortrade

Oron Limited Regulation: A Complete 2025 Review of Its License and Safety

The Problem With GDP

Polymarket Launches First U.S. Mobile App After Securing CFTC Approval

Thailand Seizes $318 Million in Assets, Issues 42 Arrest Warrants in Major Scams Crackdown

RM460,000 Gone: TikTok Scam Wipes Out Ex-Accountant’s Savings

The "Balance Correction" Trap: Uncovering the Disappearing Funds at Vittaverse

Adam Capitals Review 2025: A Detailed Look at an Unregulated Broker

NordFX.com Review Reveals its Hidden Negative Side- Must-Read Before You Trade

Tauro Markets Review: Tons of Withdrawal Rejections & Trading Account Terminations

Rate Calc