Is Forex Zone Trading Regulated and Licensed?

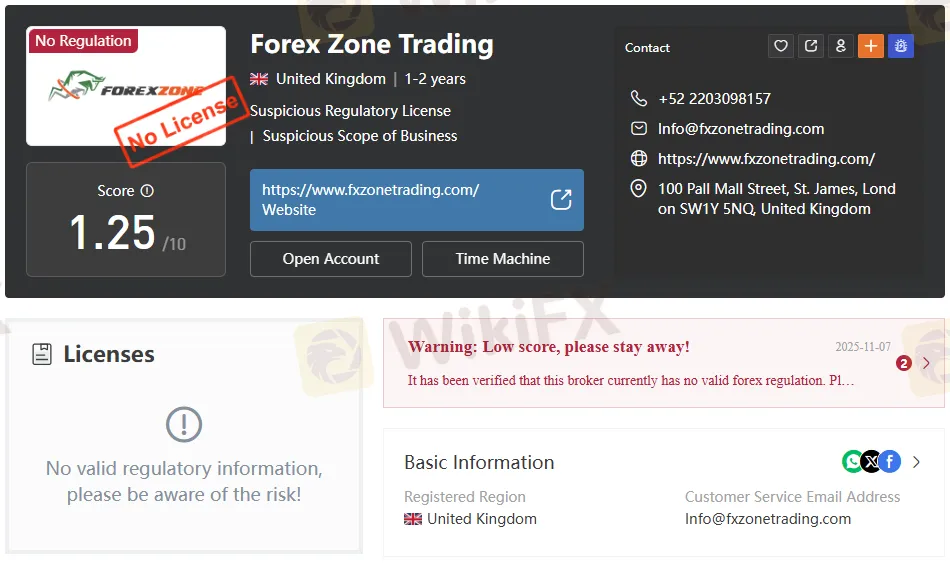

Abstract:Forex Zone Trading is an unregulated broker with no license and an FCA warning, making it a high-risk choice for traders.

Forex Zone Trading Overview

Forex Zone Trading presents itself as a promising broker, yet it operates without regulation or a valid license. This places it outside the supervision of financial watchdogs such as the FCA, CySEC, or ASIC. For traders, this is a major warning sign: without oversight, there is no assurance of fund protection, fair practices, or reliable dispute resolution.

The company promotes itself as a UK-based forex broker. Its listed address is 100 Pall Mall Street, St. James, London SW1Y 5NQ—a location often linked with reputable financial institutions. But closer review shows no verifiable office for this broker at that site.

Forex Zone Trading claims to have been active for one to two years, yet its online presence is minimal and inconsistent. Contact details include an email (info@fxzonetrading.com) and a phone number (+52 2203098157), both of which raise doubts. The phone number, notably, carries a Mexican country code instead of a UK one, which is unusual for a firm claiming London headquarters.

Other details:

- Broker name: Forex Zone Trading

- Website: fxzonetrading.com

- Trust score: 1.25/10 (very low)

- Regulatory status: Unregulated, no license

The mix of a prestigious London address with no office, mismatched contact data, and a poor trust score suggests Forex Zone Trading may be trying to appear more credible than it is.

Is Forex Zone Trading Regulated?

The most important factor in assessing any broker is regulation. Forex Zone Trading is not supervised by any recognized authority. It holds no license and has been flagged for questionable claims.

Why regulation matters:

- Investor protection: Licensed brokers must separate client funds to prevent misuse.

- Transparency: Regulators require clear disclosure of fees, risks, and trading terms.

- Accountability: Regulated firms undergo audits and compliance checks.

- Dispute resolution: Clients can appeal to regulators if conflicts arise.

Without regulation, Forex Zone Trading avoids these safeguards. Depositors have no legal recourse if the broker blocks withdrawals or vanishes.

This lack of oversight is not a minor issue—it is a fundamental red flag that should deter serious investors.

FCA Warning Against Forex Zone Trading

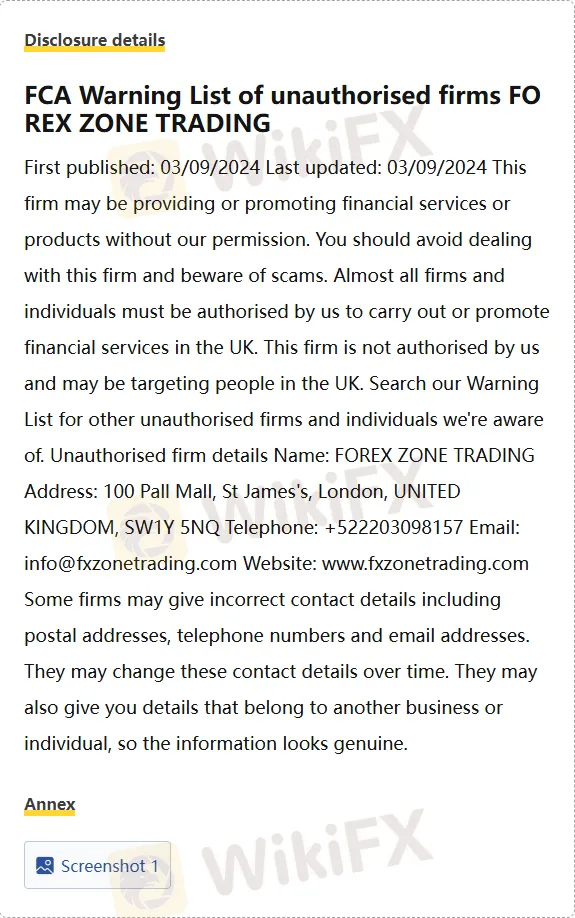

On September 3, 2024, the UKs Financial Conduct Authority (FCA) issued a public warning against Forex Zone Trading. The regulator confirmed the firm is unauthorized and may be targeting UK clients.

Key points from the FCA notice:

- Forex Zone Trading is not allowed to offer or promote financial services in the UK.

- The firm may be using false or misleading contact details, including addresses and phone numbers.

- Traders are advised to avoid this broker and remain alert to scams.

The FCA maintains a Warning List of unauthorized firms, and Forex Zone Trading is now included. This is significant: once a broker appears on this list, regulators have identified clear risks to investors.

For traders, the FCA warning should be taken as proof that Forex Zone Trading is unsafe. Such notices are rarely issued unless regulators have strong evidence of misconduct.

Account Types and Deposits

Forex Zone Trading advertises four account tiers—VIP, Pro, Premium, and Basic—but the information is inconsistent and incomplete.

Examples from its listings:

- VIP Account: Minimum deposit $100,000

- Pro Account: Minimum deposit $10,000

- Premium Account: Minimum deposit $1,000

- Basic Account: Minimum deposit $50

At first glance, these tiers suggest flexibility. Yet the documentation is riddled with gaps:

- Maximum leverage: Not disclosed

- Spreads and commissions: Not disclosed

- Withdrawal methods: Not disclosed

- Trading environment and product offerings: Not disclosed

The contradictions are striking. In one section, the “Basic” account requires $100,000, while elsewhere it is listed as $50. Such inconsistencies suggest either poor oversight or deliberate obfuscation.

For traders, this lack of clarity is dangerous. Legitimate brokers provide consistent details about account conditions. Forex Zone Tradings vague and conflicting information makes it impossible to know what clients are signing up for.

Forex Zone Trading Website

The brokers domain, fxzonetrading.com, is hosted on servers in the United States. This is unusual for a company claiming London headquarters.

Key observations:

- Domain IP: 104.21.28.121

- Most visited region: United States

- ICP registration: None

- Company details: Not disclosed

The absence of corporate ownership information is another warning sign. Legitimate brokers typically provide parent company details, registration numbers, and corporate structure. Forex Zone Trading offers none of this.

The website itself is sparse, with limited information about trading conditions, products, or company background. Combined with the FCA warning, this lack of transparency strongly suggests the broker is not acting in good faith.

Risks of Using Unlicensed Brokers

Working with an unregulated broker like Forex Zone Trading exposes traders to serious risks:

- No investor protection: Deposited funds may be lost without recourse.

- No dispute resolution: Clients cannot appeal to regulators if issues arise.

- High deposit requirements: Large sums demanded without justification.

- Suspicious contact details: Potentially false addresses and phone numbers.

- Low trust score: 1.25/10 signals extreme risk.

These risks are not theoretical. Many traders dealing with unlicensed brokers report withdrawal problems, sudden account closures, and complete loss of deposits.

Forex Zone Trading shows all the hallmarks of such high-risk firms: lack of regulation, misleading claims, and inconsistent account details. Traders should treat these red flags as clear warnings to stay away.

Final Verdict on Forex Zone Trading

After reviewing all available information, the conclusion is straightforward: Forex Zone Trading is unregulated, unlicensed, and officially flagged by the FCA.

Its contradictory account details, suspicious contact information, and lack of transparency make it a high-risk option for traders.

Recommendation:

Avoid Forex Zone Trading entirely. Instead, select brokers licensed by reputable regulators such as the FCA (UK), CySEC (Cyprus), ASIC (Australia), or NFA (United States). Regulation ensures accountability, transparency, and protection for clients.

For anyone considering Forex Zone Trading, the safest decision is to walk away. The risks far outweigh any potential rewards.

Read more

BlackBull Markets User Reputation: Looking at Real User Reviews and Common Problems to Judge Trust

When traders ask, "Is BlackBull Markets safe or a scam?", they want a simple answer to a hard question. The facts show two different sides. The broker began operating in 2014 and has a strong license from New Zealand's Financial Markets Authority (FMA). It also has an "Excellent" rating on review sites such as Trustpilot. But when searching for "BlackBull Markets complaints," you find many negative user stories, including withdrawal issues and poor trading conditions. This article goes beyond simple "safe" or "scam" labels. We want to carefully look at both the good reviews and common problems, comparing them with how the broker actually works and its licenses. This fact-based approach will give you the full picture of its user reputation, helping you make your own smart decision.

Is BlackBull Markets Legit? An Unbiased 2026 Review for Traders

Is BlackBull Markets legit? Are the "BlackBull Markets scam" rumors you see online actually true? These are the important questions every smart trader should ask before exposing capital to markets. The quick answer isn't just yes or no. Instead, we need to look at the facts carefully. Our goal in this review is to go beyond fancy marketing promises and do a complete legitimacy check. We will examine the broker's rules and regulations, look at its business history, break down common user complaints, and check out its trading technology. This step-by-step analysis will give you the facts you need to make your own smart decision about whether BlackBull Markets is a good and safe trading partner for you.

A Clear BlackBull Markets Review: Trading Conditions, Fees & Platforms Explained

This article gives you a detailed, fair look at BlackBull Markets for 2026. It's written for traders who have some experience and are looking for their next broker. Our goal is to break down what this broker offers and give you facts without taking sides. We'll look at the important things that serious traders care about: how well they're regulated, what trading actually costs, what types of accounts you can get, and how good their technology is. We're not here to tell you to use this broker - we want to give you the facts so that you can decide if it fits your trading style and how much risk you're comfortable with. Making a smart choice means checking things yourself. Before you pick any broker, you need to do your own research. We suggest using websites, such as WikiFX, to check if a broker is properly regulated and see what other users say about it.

SGFX User Reputation: Is it Safe or a Scam? A Detailed Look at User Complaints

The most important question any trader can ask is whether a broker is legitimate. Recently, SGFX, also called Spectra Global, has been mentioned more often, leading to many questions: Is SGFX Safe or Scam? Is it a safe platform for your capital, or is it another clever online scam? This article will give you a clear, fact-based answer to that question. Read on!

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc