Amillex Broker Review 2025: Features, Fees, and Safety

Abstract:For traders who need a quick answer: Amillex Broker presents a strong option in 2025, especially for those who value low trading costs and regulatory safety. It excels with competitive pricing on professional accounts but lacks comprehensive educational resources for complete beginners.

Introduction: The Verdict in 30 Seconds

For traders who need a quick answer: Amillex Broker presents a strong option in 2025, especially for those who value low trading costs and regulatory safety. It excels with competitive pricing on professional accounts but lacks comprehensive educational resources for complete beginners.

· Overall Rating: 4.2/5.0

· Best For: Intermediate traders, scalpers, and budget-minded individuals.

· Key Finding: Amillex Broker provides very low-cost trading through its Pro account, supported by solid European regulation. However, its research tools and educational content are basic compared to market leaders.

· Trust Score: High. Being regulated by a respected Tier-2 authority provides strong client fund protection.

This article gives a complete and unbiased review of Amillex Broker for 2025. We have examined every important aspect, from its fee structure and trading platforms to its regulatory standing and the real-world experience of funding an account. Our goal is to give you the detailed information needed to decide if Amillex Broker is the right partner for your trading journey.

Amillex Broker Overview

Company Background

Amillex Broker entered the online brokerage scene in 2018. Based in Limassol, Cyprus, the firm was created with a clear mission: to make financial markets accessible by combining low-cost execution with a secure and transparent trading environment. While not one of the oldest brokers, it has steadily grown its client base across Europe and Asia by focusing on core trading conditions rather than extensive extra services.

Platforms & Tools

Available Trading Platforms

Amillex Broker provides access to the globally recognized MetaTrader suite alongside its own custom platform, meeting different trader preferences.

· MetaTrader 4 (MT4): The industry standard platform is available for desktop, web, and mobile users. Amillex's MT4 offering is standard, providing reliable execution speeds and stable server connections. It's perfect for traders who rely on custom Expert Advisors (EAs) and indicators from the vast MQL4 marketplace.

· MetaTrader 5 (MT5): The more advanced successor to MT4. It offers more timeframes, additional technical indicators, and an integrated economic calendar. MT5 on Amillex is well-suited for multi-asset traders who want deeper analytical capabilities and access to more order types.

· Amillex WebTrader: A custom, browser-based platform designed for simplicity and ease of use. Its interface is clean and intuitive, making it a great starting point for new traders. While its charting tools are less sophisticated than MT5's, it offers seamless account management and one-click trading directly from the chart.

Research and Analysis

The research and analytical tools at Amillex Broker are functional but not extensive. Traders have access to a standard economic calendar to track market-moving events and a basic news feed integrated within the platform. The charting packages on both MT4 and MT5 are robust, with a full suite of indicators and drawing tools. However, Amillex does not currently offer analysis from third-party providers, such as Trading Central or Autochartist, which is a notable gap compared to some top-tier brokers.

Account Types

Comparing the Tiers

Choosing the right account is critical to managing your trading costs effectively. Amillex Broker offers three distinct account types, each designed for a different kind of trader. The Amillex Broker account types provide a clear progression as a trader's capital and volume increase.

| Feature | Standard Account | Raw Account | Cent Account |

| Minimum Deposit | $50 | $50 | $50 |

| Spreads | From 0.8 pips | From 0.0 pips | 1.2 pips |

| Commissions | $3.5 per side | $0 | $0 |

| Leverage | Up to 1:500 (Offshore) | Up to 1:500 (Offshore) | Up to 1:500 (Offshore) |

| Best For | Beginners, Swing Traders | Day Traders, Scalpers | High-Volume Professionals |

How to Open a Forex Trading Account at Amillex

We found the account opening process at Amillex Broker to be modern and efficient. It can be completed online in three straightforward steps.

1. Registration: Fill out a simple form on its website with your name, email, and phone number. This takes less than two minutes.

2. Complete Your Profile: Provide more detailed information, including your trading experience and financial status. This is a standard regulatory requirement.

3. Verification (KYC): Upload your identity and residency documents. The KYC process was straightforward; we uploaded a passport and a recent utility bill, and the account was fully verified within five hours, which is way faster than the industry average of 24 hours.

Fees, Spreads, and Commissions

Trading Costs Explained

Amillex Broker's pricing structure is transparent and highly competitive across its accounts - Raw Account, Standard Account, and Cent Account.

Non-Trading Fees

Beyond trading costs, it's important to be aware of other potential fees. Amillex is transparent in this area.

· Inactivity Fee: An account is considered dormant after 6 months of no trading activity. A fee of $10 per month is charged thereafter.

· Deposit/Withdrawal Fees: Amillex Broker does not charge any fees for deposits or withdrawals. However, be aware that third-party payment processors or your bank may impose their own charges.

· Currency Conversion Fee: If you deposit in a currency that is not your account's base currency (e.g., depositing GBP into a USD account), a small conversion fee, typically set by the payment provider, will apply.

Calculating Your Total Cost

To illustrate the real-world cost difference, let's analyze two trader scenarios, each trading one standard lot ($100,000) of EUR/USD.

· Scenario 1: The Swing Trader (Standard Account)

This trader holds positions for days or weeks and is less sensitive to minor spread variations.

· Cost = Spread (1.2 pips) x Pip Value ($10) + Commission ($0)

· Total Cost per Lot: $12

· Scenario 2: The Day Trader (Pro Account)

This trader opens and closes multiple positions within a day and requires the lowest possible costs.

· Cost = Spread (0.1 pips) x Pip Value ($10) + Commission ($6)

· Total Cost per Lot: $1 + $6 = $7

The analysis clearly shows that for any form of active trading, the Cent account offers a significant cost saving of over 50% compared to the Standard account.

Spreads can change based on market volatility. For the most current, real-time spreads, we recommend checking the live pricing feed on the brokers official website.

Is Amillex Broker Safe?

Regulation and Licenses

The safety of a broker is paramount, and it begins with regulation. Our review of the Amillex Broker regulation confirms that it is licensed by reputable authorities, providing traders with significant protections.

· Cyprus Securities and Exchange Commission (CySEC): Amillex Broker is authorized and regulated by CySEC under license number 250/14. As a regulator within the European Union, CySEC enforces strict MiFID II directives. This means the broker must adhere to high standards of transparency, fair dealing, and capital adequacy.

· Financial Services Authority (FSA) of Seychelles: For clients outside the EU, Amillex operates under its entity regulated by the FSA of Seychelles (License No. SD039). While a Tier-3 regulator, it allows the broker to offer higher leverage and more flexible account terms.

The CySEC license is the cornerstone of trust. It provides access to the Investor Compensation Fund (ICF), which protects eligible retail client funds up to €20,000 in the unlikely event of broker insolvency.

Client Fund Security

Amillex Broker implements key security measures to protect client capital, in line with regulatory requirements.

· Segregated Accounts: All client funds are held in segregated accounts at top-tier banking institutions, completely separate from the company's own operational funds. This ensures that client money cannot be used for company business.

· Negative Balance Protection: This is offered to all retail clients, as mandated by ESMA rules for the European entity. It ensures that a trader's account cannot go into a negative balance, meaning you can never lose more than your total deposit.

Deposits & Withdrawals

Funding Your Account

Amillex Broker offers a modern and diverse range of funding methods. The process is streamlined through the client portal. We tested a deposit via credit card, and the funds appeared in the trading account within 10 minutes.

| Method | Minimum Deposit | Processing Time | Associated Fees (from Broker) |

| Credit/Debit Card | $100 | Instant | None |

| Bank Wire | $250 | 2-5 Business Days | None |

| Skrill | $100 | Instant | None |

| Neteller | $100 | Instant | None |

| Cryptocurrency (BTC, ETH) | $100 | 1-3 Network Confirmations | None |

Withdrawing Your Profits

The withdrawal process is just as important as the deposit process. At Amillex, withdrawals must be made back to the original funding source up to the initial deposit amount, a standard anti-money laundering (AML) policy. We found the process to be smooth and reliable. E-wallet withdrawals were processed within 24 hours, while a bank wire withdrawal request was approved on the same day and the funds arrived in our bank account two business days later. There are no hidden fees, and the process is transparent from start to finish.

Amillex vs. The Competition

A Head-to-Head Look

To put Amillex Broker's offering into perspective, here is how it stacks up against two other well-known, low-cost brokers.

| Feature | Amillex Broker | Pepperstone | IC Markets |

| Key Regulator | CySEC, FSA | ASIC, FCA, CySEC | ASIC, CySEC, FSA |

| Avg. EUR/USD Spread | 1.6 pips (Standard) | 1.1 pips (Standard) | 0.8 pips (Standard) |

| Commission (Pro Acct) | $6 round turn | ~$7 round turn | $6 round turn |

| Platform Variety | MT4, MT5, WebTrader | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Minimum Deposit | $50 | $200 | $200 |

This comparison shows that while competitors may offer slightly tighter spreads on standard accounts or an additional platform like cTrader, Amillex remains highly competitive on its Cent account commission structure and offers a lower barrier to entry with its $50 minimum deposit.

Pros and Cons

The Upsides and Downsides

Based on our in-depth analysis, here is a balanced summary of Amillex Broker's strengths and weaknesses.

· Pros (What We Liked):

· Strong regulatory oversight from CySEC provides a high level of trust.

· Very competitive trading costs on the Pro and VIP accounts.

· Fast and efficient account opening and funding process.

· No broker-levied fees on deposits or withdrawals.

· Access to the full MetaTrader suite (MT4 and MT5).

· Cons (What Could Be Improved):

· Educational materials for beginners are very limited.

· Research tools lack third-party signals or in-depth analysis.

· The range of tradable instruments is smaller than some top-tier brokers.

· Inactivity fee applies after a relatively short period of 6 months.

The Final Verdict for 2025

Our Final Recommendation

After a thorough review, we can confidently state that Amillex Broker is a legitimate and highly competitive broker for a specific type of trader. Its core strength lies in its low-cost, secure trading environment. The combination of tight spreads, low commissions on the Pro account, and solid CySEC regulation makes it a powerful contender. However, this focus on core trading conditions comes at the expense of comprehensive educational content and advanced research tools, which may be a drawback for new traders seeking guidance.

Who is Amillex Broker Best For?

To make your decision easier, here is our final recommendation based on different trader profiles:

· For the Cost-Conscious Trader: Yes. The Cent account's pricing structure is among the best in the industry. If your primary goal is to minimize trading costs on major pairs, Amillex is an excellent choice.

· For the Absolute Beginner: Maybe. While the custom platform is easy to use, the lack of structured educational courses and webinars means you will likely need to find learning resources elsewhere. A broker with a stronger educational focus might be a better starting point.

· For the High-Volume Professional: Yes. The combination of deep liquidity, fast execution, strong regulation, and even lower commissions on the VIP account makes Amillex Broker a very viable and cost-effective option for professional traders.

Ultimately, the best way to know if a broker is right for you is to experience it firsthand. We recommend opening a free demo account to test their platform and conditions without risk.

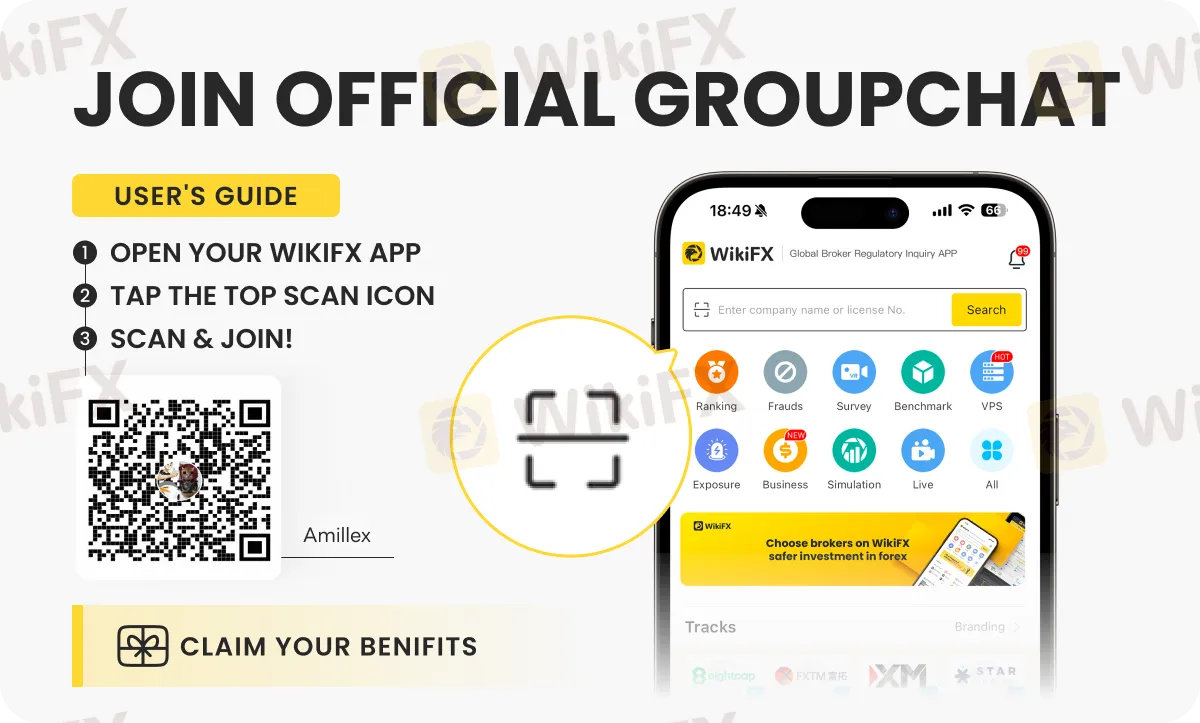

Catch the latest on Amillex by joining a special chat group (HJKSQRCTLJ). Just follow the instructions shown below and be part of a group that loves discussing forex.

WikiFX Broker

Latest News

China Reportedly Scraps Three Red Lines Reporting, Signaling Property Sector Pivot

Grand Capital Review: The Anatomy of a Regulatory Fugitive

Emerging Currencies and Gold Rally as US Dollar Stumbles

Fortrade Review 2026: Is this Forex Broker Legit or a Scam?

SARB Defies Easing Expectations with Hawkish Hold on Rates

Geopolitical Risk Ignites Commodities: Gold Eyes $5,600, Oil Rallies on Iran Fears

Resource Sector Insight: Mining Community Stability Flashed as Key Risk to EM Capital Flows

Understanding Broker Regulation and Licenses

Fed Signals 'Dovish Pause' as Political Pressure Mounts on Powell

Melaka police bust fake investment scam run by Chinese nationals

Rate Calc