Lirunex Introduces Sharia-Compliant Islamic Trading Accounts

Abstract:Lirunex Limited, an international brokerage firm, has launched its new Islamic Account. The account is designed for Muslim investors seeking a trading option that follows Sharia principles.

Lirunex Limited, an international brokerage firm, has launched its new Islamic Account. The account is designed for Muslim investors seeking a trading option that follows Sharia principles. The move reflects the companys aim to make global markets more inclusive and accessible to clients of different faiths.

A Fully Sharia-Compliant Option

The Lirunex Islamic Account, also known as a swap-free account, removes overnight interest charges. Under Islamic finance, both earning and paying interest are prohibited. By removing these charges, the account allows Muslim traders to take part in Forex and CFD markets while staying compliant with their faith.

Two Account Types Available

Lirunex offers two Islamic account types: Islamic Standard and Islamic Prime.

- The Islamic Standard account requires a minimum deposit of USD 25. It offers leverage up to 1:2000, zero commission, and spreads from 1.5 pips.

- The Islamic Prime account starts with a minimum deposit of USD 200. It includes an USD 8 commission and spreads starting at 0.0 pips.

Both accounts allow trade sizes from 0.01 to 20 lots. Traders can access a wide range of instruments, including major and minor currency pairs, commodities, and precious metals. The leverage ratio is set at 1:2000 for currencies and metals, and 1:100 for commodities. These options give traders flexibility to choose strategies that match their trading goals.

Trading Platforms and Regulation

Founded in 2017, Lirunex has built a presence as a global broker offering various trading services. With the new Islamic Account, the company is addressing growing interest in ethical and interest-free trading. Demand for such products has been rising in regions like the Middle East, North Africa, and Southeast Asia, where many traders seek Sharia-compliant options. This development also reflects a broader trend in the financial industry. More brokers are now creating accounts that align with Islamic values, allowing faith-based investors to trade without compromising their beliefs.

Lirunex supports trading on MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are known for fast execution, advanced tools, and compatibility with desktop and mobile devices.

The broker operates under the regulation of the Labuan Financial Services Authority (LFSA). This provides oversight of the companys operations and adds a level of security for client funds.

Due Diligence Made Easy with WikiFX

Despite the availability of new trading products, traders should always perform careful research before choosing a broker. Attractive offers or account features do not always guarantee safety or reliability. Investors should verify a brokers licence, regulation, and background before making any deposit.

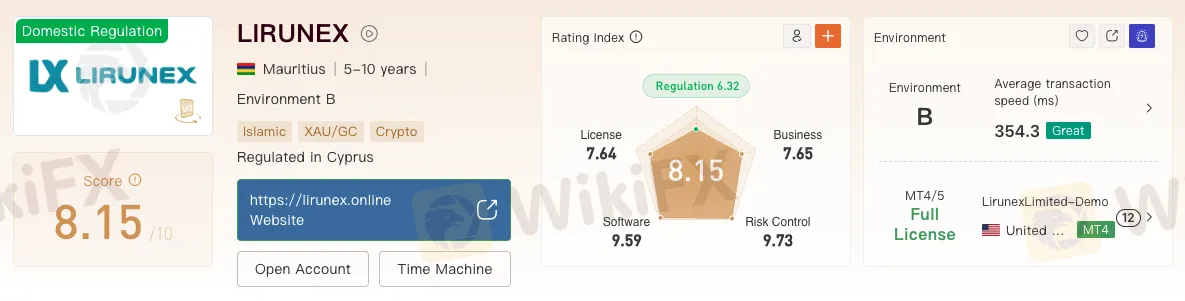

This is where WikiFX can help. WikiFX is a global forex broker regulatory query platform that allows users to check a brokers regulatory status and credibility. It provides access to verified data on hundreds of financial institutions worldwide. The platform helps traders identify potential risks and make informed choices.

WikiFX Exposure Service: Share and Protect

Transparency is central to investor protection. The WikiFX Exposure Service allows traders to report suspected scams and share critical risk information with the wider community. Every report is carefully investigated, and, where appropriate, WikiFX updates broker ratings and reliability scores to reflect the latest findings.

By contributing to this collective knowledge, you are not only protecting yourself but also helping to safeguard other investors. Importantly, WikiFX ensures that all personal data is kept strictly confidential, employing advanced security measures to prevent leaks and unauthorised access.

The WikiFX mobile app is available for free on Google Play and the App Store, offering users quick access to broker information anytime and anywhere.

Read more

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

NEWTON GLOBAL Deposit and Withdrawal Methods: A Complete 2026 Review

When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker. One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from "How can I withdraw?" to "Is it safe to invest here?" This background information is essential for protecting your capital.

WikiFX Broker

Latest News

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Promised 30% Returns, Lost RM630,000 Instead

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Effective Stop Loss Trading Strategies

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Hits Q4 Growth

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Slams Growth

Pepperstone Review: Regulation, Licences and WikiScore Analysis

Rate Calc