Service Sector Surveys Show Slowdown In September Despite Rebound In Employment

Abstract:With the market desperate for any visibility into the economy - due to data being cutoff during the

With the market desperate for any visibility into the economy - due to data being cutoff during the shutdown - this morning's soft survey data on the services sector could have a larger impact on stocks and bonds than normal.

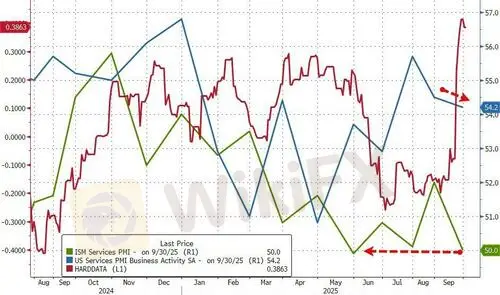

With 'hard' data surginghigher, S&P Global's US Services PMIrose from 53.9 preliminary to 54.2 final in September (but that is down from the 54.5 final print for August). The ISM Services PMI also fellMoM from 52.0 to 50.0 (worse than the 51.7 expected) - that is the weakest since May...

Source: Bloomberg

Under the hood of the ISM survey we saw prices sticky at highs, employment weak (but a small improvement) and orders slowdown...

Source: Bloomberg

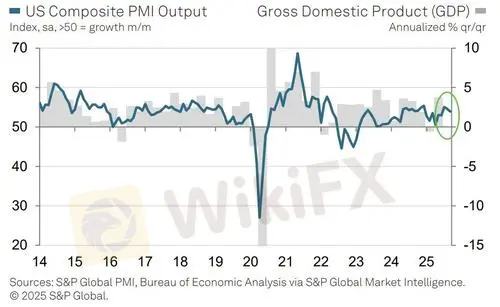

The S&P Global US Composite PMI recorded 53.9 in September. That was down from 54.6 in August and represented the slowest growth for three months.

Both sectors covered by the survey recorded weaker output expansions in line with slower gains in new business. Employment meanwhile barely rose, but confidence in the outlook strengthened noticeably. Cost pressures remained elevated, although inflation softened to a five-month low. A similar trend was seen for output charges.

according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence

The recessions shows no signs of appearing:

But jobs remain a worry:

As do (tariff-driven) price hikes...

So choose your own adventure- employment data remains in contraction but did improve modestly. The message overall appears to be that thereremains 'less' firing, but even less hiring.

WikiFX Broker

Latest News

CySEC Withdraws CIF License of OBR Investments Ltd (OBRInvest)

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Eightcap Review: Understanding Fees, Features, and Important User Warnings

Exnova Review 2026: Is this Forex Broker Legit or a Scam?

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Middle East Escalation Rocks Markets: Oil Surges while Brokers Tighten Leverage

Rate Calc