FPG XAUUSD Market Report October 2, 2025

Abstract:Gold reached a fresh all-time high at 3895, reinforcing its strong bullish bias and confirming investors ongoing appetite for safe-haven assets. However, after testing this peak, the market quickly en

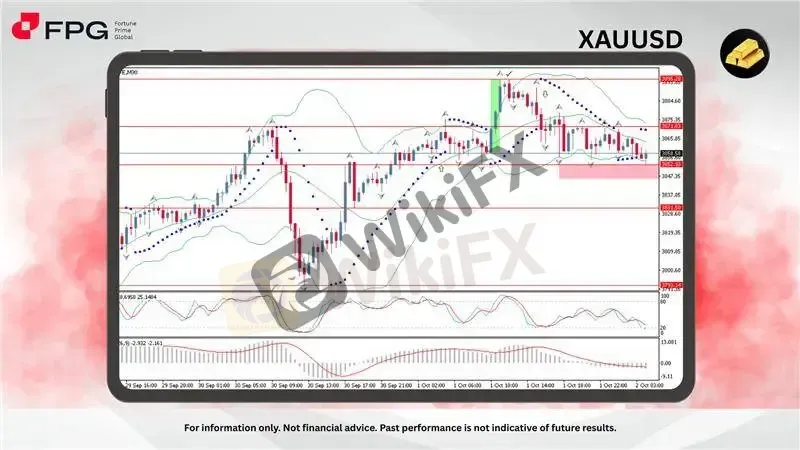

Gold reached a fresh all-time high at 3895, reinforcing its strong bullish bias and confirming investors' ongoing appetite for safe-haven assets. However, after testing this peak, the market quickly entered a phase of heightened volatility, with sharp intraday swings reflecting both profit-taking and cautious positioning. The current price is fluctuating around 3858, indicating that while the bullish trend remains intact, sellers are also actively defending higher levels, creating a tug-of-war between buyers aiming for new highs and sellers attempting to push the price lower. This volatility highlights the markets sensitivity to both technical levels and external macroeconomic drivers.

From a technical perspective, price action shows consolidation after testing the resistance zone near 3895–3871. The Bollinger Bands are narrowing, suggesting a potential breakout setup, while the Parabolic SAR is positioned above price candles, signaling short-term bearish pressure. The Stochastic Oscillator is moving in the oversold region, indicating potential buying interest if momentum strengthens. Meanwhile, the MACD is showing bearish crossover signs, pointing to weakening momentum and possible continuation of the correction if support fails to hold. Key support levels are seen at 3852 and 3831, while resistance remains firm at 3895.

Gold's movement continues to be heavily influenced by broader macroeconomic and geopolitical factors. Uncertainty surrounding global economic fundamentals, ongoing geopolitical tensions, and policy directions from major central banks, particularly the US Federal Reserve, remain key drivers of volatility. These elements will likely keep Gold in a sensitive position, with traders closely monitoring both technical signals and fundamental developments for the next directional move.

Market Observation & Strategy Advice

1. Current Position: Gold is trading around 3858 after reaching a new all-time high at 3895. Price action is currently consolidating in a volatile range, with buyers and sellers both testing short-term momentum.

2. Resistance Zone: Immediate resistance lies at 3871, with the key barrier at the all-time high of 3895. A clear breakout above this zone could trigger further upside momentum toward the psychological 3900–3920 range.

3. Support Zone: The first support level is seen at 3852, with stronger support resting at 3831. A breakdown below 3831 may open the path toward deeper retracement near 3793.

4. Indicators: The Bollinger Bands are narrowing, signaling a potential breakout setup ahead, while the Parabolic SAR remains positioned above price candles, reflecting short-term bearish pressure. The Stochastic Oscillator is moving closer to the oversold region, suggesting that buying interest could emerge if momentum shifts. Meanwhile, the MACD shows a recent bearish crossover, indicating weakening momentum and raising the risk of extended correction should key support levels fail to hold.

5. Trading Strategy Suggestions:

Bullish Continuation: A breakout above 3871–3895 could extend upside momentum toward 3900–3920.

Buy on Dips: Pullbacks into the 3852–3831 support zone may offer re-entry opportunities in line with the broader uptrend.

Risk Management: Place stop-losses below 3831 to manage downside risks if bearish pressure intensifies.

Market Performance:

Precious Metals Last Price % Change

XPTUSD 1,561.08 −0.64%

XAGUSD 47.1800 −0.29%

Today's Key Economic Calendar:

AU: Balance of Trade

JP: Consumer Confidence

Risk Disclaimer This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

WikiFX Broker

Latest News

Behind the Licences: Is Pepperstone Really Safe for Malaysians?

Promised Recession... So Where Is It?

Hirose Halts UK Retail Trading Amid Market Shift

FINRA Fines United Capital Markets $25,000

CONSOB Blocks EurotradeCFD’s Solve Smart, 4X News

Oanda: A Closer Look at Its Licenses

FCA Urges Firms To Report Online Financial Crime

IBKR Jumps on September DARTs, Equity Growth

Service Sector Surveys Show Slowdown In September Despite Rebound In Employment

Rate Calc