ADCB Faces Customer Backlash on All Fronts: Check Top Complaints

Abstract:Is your banking experience with ADCB far from ideal? Facing constant delays in credit card application approvals? Have you witnessed the stoppage of SMS from the bank for transactions? Does the customer service team fail to respond to your queries? These issues have become increasingly common for ADCB customers. A lot of them, understandably so, have criticized the bank on review platforms. Keep reading to know the top complaints against it.

Is your banking experience with ADCB far from ideal? Facing constant delays in credit card application approvals? Have you witnessed the stoppage of SMS from the bank for transactions? Does the customer service team fail to respond to your queries? These issues have become increasingly common for ADCB customers. A lot of them, understandably so, have criticized the bank on review platforms. Keep reading to know the top complaints against it.

Top Complaints Against ADCB

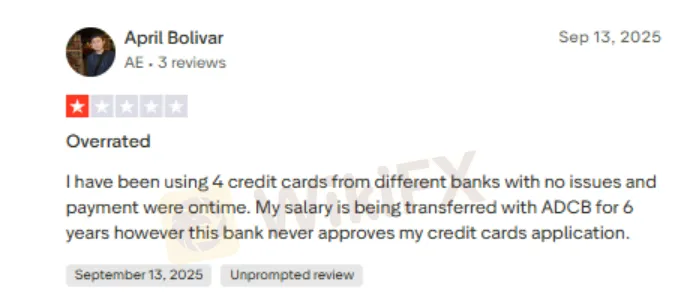

Flak from Even Old Customers

While new customers always face issues, old customers are not behind either. One customer with over six years of banking experience with ADCB has failed to get a credit card approved. Annoyed by a poor response, the customer complained about it online. We have shared the complaint below in a screenshot. Take a look!

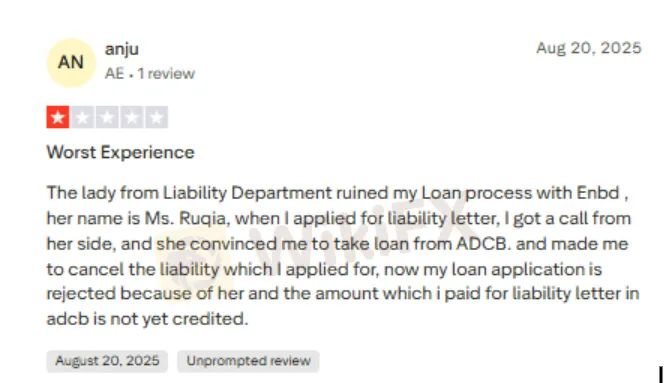

Loan Cancellation Drama

Banks are often found snatching customers from each other, given the intense competition in the banking landscape. In one such case, an ADCB executive called the customer who had initially applied for liability at another bank. Convinced over the call, the customer cancelled the liability of another bank and instead applied for a loan at ADCB. However, ADCB rejected his loan application. Whats more, the amount paid for the liability letter has not yet been credited. Check the screenshot below to know how the incident unfolded as per the ADCB customer review.

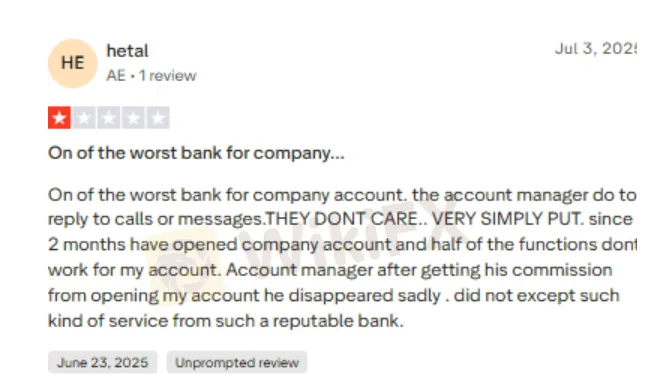

Poor Banking Services, Worst Account Managers

Poor banking services have been affecting many customers. Some of them have complained about the faulty system in place and unresponsive account managers who do not respond to customer queries. The bank appears to have forgotten the principles that help retain customers. The complaint screenshot shared below reaffirms the point made above.

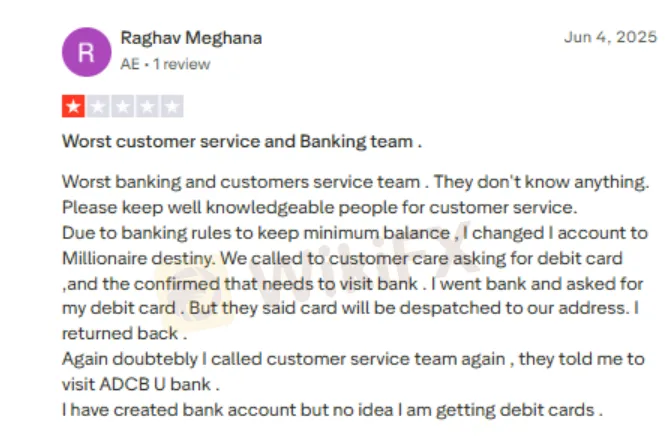

Constant Back and Forth Between the Banking and Customer Service Teams

ADCB Bank officials appear to be either unsure or are deliberately making customers frustrated. In one incident, the customer called the customer care for a debit card after changing the account type. The customer care official asked the customer to visit the bank. Upon reaching the bank, the customer asked the official there. The customer was told that the debit card would be delivered to his home. After not receiving the debit card for some days, the customer again called customer care, where officials told him to visit the bank again. The painful cycle created by the banking and customer service teams is totally uncalled for. Here are the painful words from the customer.

ADCB Review by WikiFX

WikiFX, a leading broker regulation inquiry app, is concerned about the numerous issues customers face at ADCB regarding products and services. The complaints shared above are serious and have to be looked into by the bank. The score for ADCB is merely 1.54 out of 10.

Watch WikiFX Masterminds to know more about forex scams and other financial news.

Here is how you can dive into this group -

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congratulations on joining the group.

Read more

Market10 Review: Check Out the Latest Fund Scam Allegations Against the Broker

Have you lost funds using weak signals from Market10, a South Africa-based forex broker? Has the forex broker deliberately deducted profits from your forex trading account balance? Does the broker constantly delay your fund withdrawals? Did Market10 officials continuously call you to start investing with it and remain silent on your withdrawal requests? You are not alone! Many traders have reported these trading experiences on broker review platforms. We have shared some of their experiences in this Market10 review article. Read on to know the same.

Fideuram Direct Review 2026: Is Fideuram Direct a Safe Forex Broker or High-Risk Platform?

Fideuram Direct review is gaining attention among Forex traders evaluating new brokers. However, safety and regulation are the most critical factors when choosing a broker. In this review, we examine Fideuram Direct brokers, its regulatory status, trading offerings, and risks — especially in light of its extremely low WikiFX score of 1.43/10.

DFSA Warns of Scam Impersonating DIFC Branch of Interactive Brokers

DFSA exposes scam using the name of Interactive Brokers to promote a fake crypto subscription.

CXMarkets Review 2026: Is CXMarkets a Safe Forex Broker or High-Risk Platform?

CXMarkets review has attracted increasing attention among Forex traders searching for new trading opportunities. However, when evaluating any broker, regulation, transparency, and risk indicators are far more important than marketing claims.

WikiFX Broker

Latest News

Gold Fun Corporation Ltd Review: A Deep Dive into Safety and Regulation

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Gold Tears Through $4,700 Barrier as Risk Premiums Spike

Rate Calc