"Lost Control" - Surprise UK Budget Deficit Blowout Batters Sterling & Gilts

Abstract:The fiscal farce in the UK went from bad to worse this morning as government borrowing came in signi

The fiscal farce in the UK went from bad to worse this morning as government borrowing came in significantly higher than forecast in August.

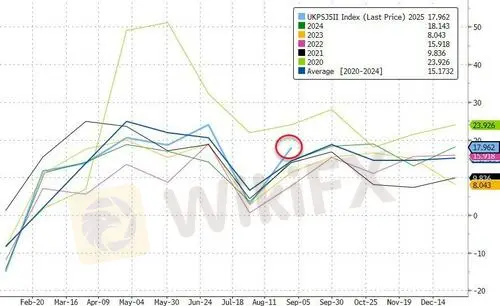

In yet another blow to Chancellor of the Exchequer Rachel Reeves - ahead of a challenging budget in the fall (autumn) - the deficit stood at £18 billion($24.4 billion), the Office for National Statistics said Friday, well above the £12.5 billion the Office for Budget Responsibility had forecastand the highest borrowing for the month in five years...

Source: Bloomberg

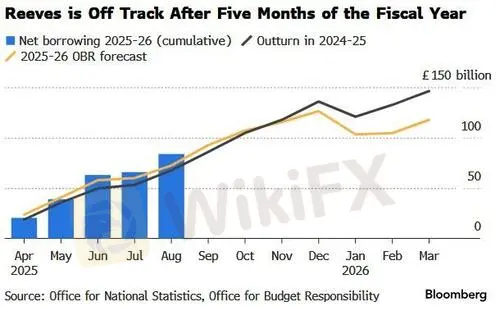

As Bloomberg reports, this left the deficit after five months of the fiscal year at £83.8 billion - £11.4 billion above the OBR forecast andthe second-highest since records began in 1993 after the pandemic in 2020. The deficit was £67.6 billion a year earlier.

Source: Bloomberg

The disappointing August figures were compounded by a series of revisions to the previous four monthsthat added £5.9 billion to the deficit, much of it due to lower-than-previously-estimated VAT receipts and higher local-government spending and borrowing.

Reeves had looked on track this yearwith stronger tax receipts offsetting higher spending but the latest figures are a significant setback, underscoring the perilous state of the public finances and potentially further eroding the slim £9.9 billion headroom set aside against her main fiscal rule.

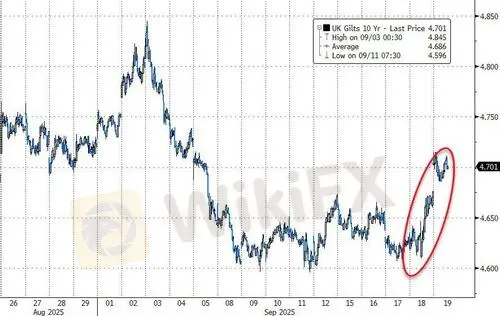

The pound and gilts fell.

The yield on 10-year bonds rose two basis points to 4.70%, while the 30-year rate rose three basis points to 5.54%.

Source: Bloomberg

Sterling dropped as much as 0.5% to $1.3483, the lowest since Sept. 8.

Source: Bloomberg

Mel Stride, the opposition Conservative shadow chancellor, said.

Reeves already faced a difficult budget on Nov. 26, when she is expected to announce billions of pounds of growth-sapping tax rises to offset higher borrowing costs, policy u-turns and an anticipated growth downgrade by the OBR.

WikiFX Broker

Latest News

Arena Capitals User Reputation: Looking at Real User Reviews and Common Problems

Stop Letting Your Trading Rewards Gather Dust: A Limited-Time 30% Opportunity

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Middle East Escalation Rocks Markets: Oil Surges while Brokers Tighten Leverage

Eightcap Review: Understanding Fees, Features, and Important User Warnings

Exnova Review 2026: Is this Forex Broker Legit or a Scam?

Moneycorp Problems Exposed: Fund Transfer Failures & Customer Support Complaints

Rate Calc