SogoTrade Review 2025: Discover its Red Flags Now!

Abstract:Forex trading is a risky space where scams happen every day. The best way to stay protected is by staying informed. This is another important article you shouldn't skip; it reveals the key warning signs of SogoTrade.

Forex trading is a risky space where scams happen every day. The best way to stay protected is by staying informed. This is another important article you shouldn't skip; it reveals the key warning signs of SogoTrade.

Red Flags & Issues

1. Absence of MT4 & MT5 Trading Platform

One of the major drawbacks of SogoTrade is the lack of support for MetaTrader 4 (MT4) and MetaTrader 5 (MT5) , the most widely used trading platforms in the forex industry. These platforms are popular for their user-friendly interfaces, advanced charting tools, and support for automated trading through Expert Advisors (EAs). Without MT4 or MT5, traders miss out on robust tools and functionalities that are considered industry standards. Instead, SogoTrade relies on its own trading platforms, which are available on web, desktop, and mobile devices.

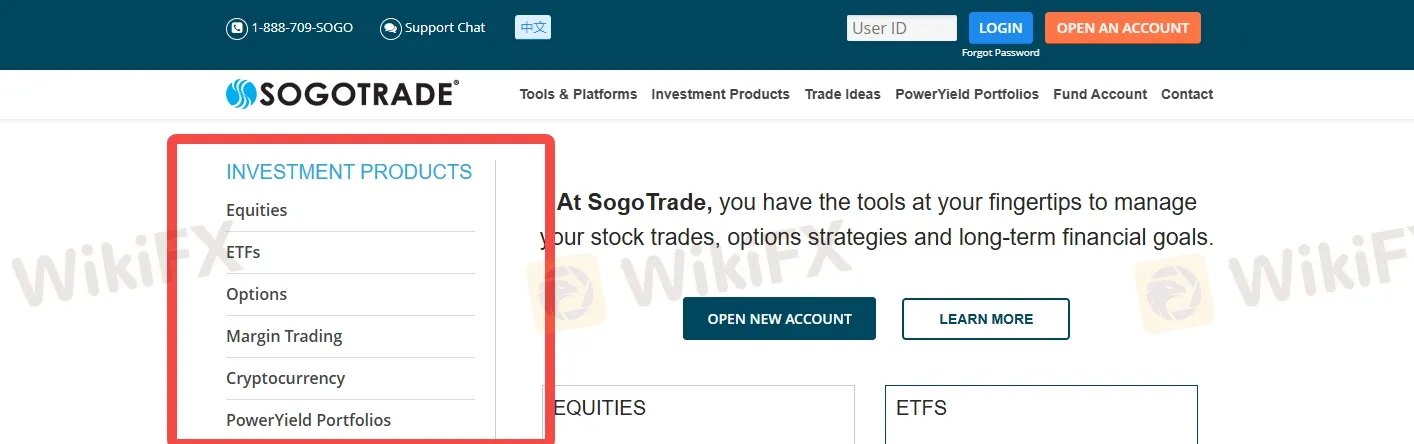

2. Limited Investment Options

SogoTrade offers a narrow range of tradable instruments, which can significantly restrict a traders ability to diversify. The platform does not provide access to bonds, fixed-income products, futures, commodities, or even major currency pairs. This limited selection means that clients are confined to a small set of assets, reducing flexibility and potentially increasing risk due to lack of diversification.

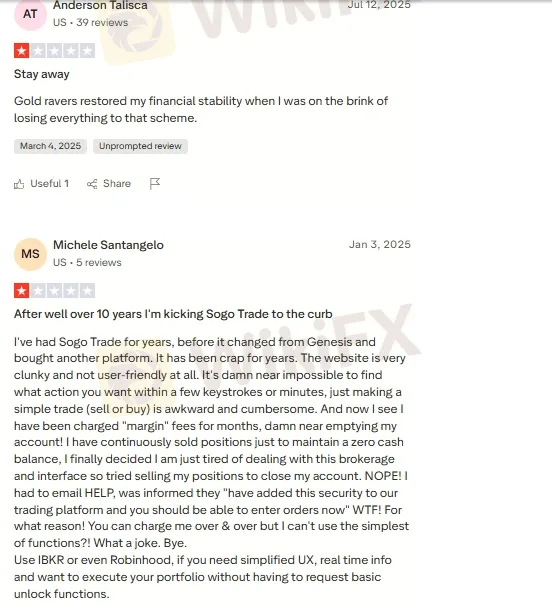

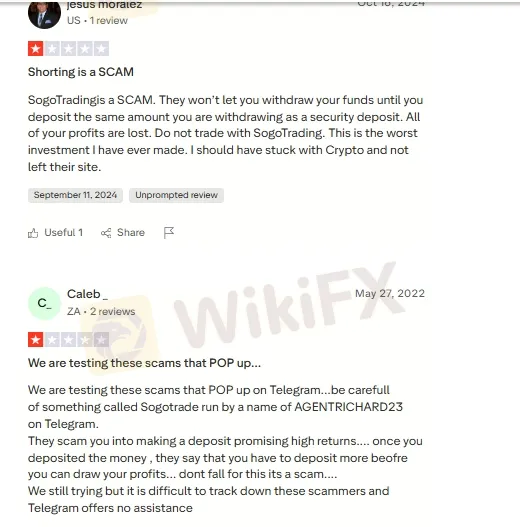

3. SogoTrade is being called a SCAM

SogoTrade is being called a scam by an increasing number of users, raising serious concerns about its credibility and trustworthiness. Online forums and review platforms have highlighted various complaints, including delayed withdrawals, poor customer service, lack of transparency in trading conditions, and questionable account practices. It's important for traders to conduct thorough research and be cautious before investing.

4. Withdrawal Issue

Many users have raised concerns over SogoTrade slow withdrawal process. In some cases, withdrawal requests take several days or even weeks to be processed, far beyond the standard industry timeframe of 24–72 hours. This delay raises transparency concerns and can disrupt trading plan. The lack of prompt fund withdrawals can be a major red flag for any financial service provider.

5. Weak Research & Education Offering

SogoTrade provides limited resources when it comes to market research and trader education. Unlike reputable brokers that offer daily analysis, webinars, economic calendars, and educational content tailored for beginners and advanced users, Sho Trade offers very little in this area. This lack of educational material and market insight makes it harder for traders specially for newcomers—to make informed decisions and improve their skills over time.

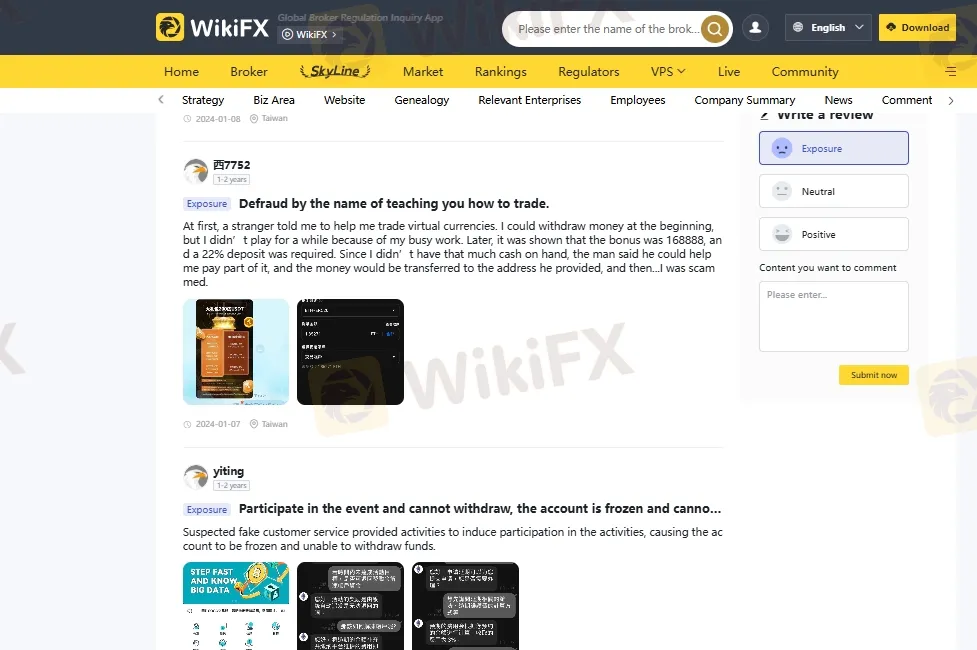

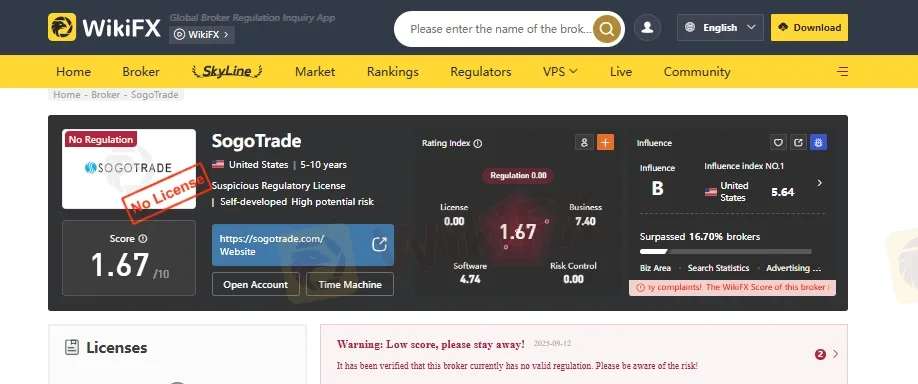

WikiFX Findings on SogoTrade

According to WikiFX, SogoTrade has received a very low credibility score of just 1.89 out of 10, raising serious concerns about its reliability as a broker. WikiFX has also issued a public warning about Soho Trade to alert traders to the potential risks involved in using the platform. It states:

Warning: Low score, please stay away!

It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Join WikiFX Community

Stay alert and informed with WikiFX- your one-stop destination for everything related to the Forex market. Whether you're looking for the latest market updates, scam alerts, or reliable information about brokers. Join the WikiFX Community today by scanning the QR code at the bottom and stay one step ahead in the world of Forex trading.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Read more

AssetsFX Review – What Traders Are Saying & Red Flags to Watch

Has AssetsFX stolen your deposits when seeking withdrawals from the trading platform? Did the broker fail to give any reason for initiating this? Did you notice fake trades in your forex trading account? Does the Mauritius-based forex broker deny you withdrawals by claiming trading abuse on your part? Did you also receive assistance from the AssetsFX customer support team? Firstly, these are not unusual here. Many traders have shared negative AssetsFX reviews online. In this article, we have highlighted such reviews so that you can make the right investment call. Take a look!

ROCK-WEST Complete Review: A Simple Guide to Its Trading Platforms, Costs, and Dangers

Traders looking for unbiased information about ROCK-WEST often find mixed messages. The broker offers some appealing features: you can start with just $50, use the popular MetaTrader 5 trading platform, and get very high leverage. These features are meant to attract both new and experienced traders who want easy access to potentially profitable trading. However, as you look deeper, there are serious problems. The good features are overshadowed by the broker's weak regulation and many serious complaints from users, especially about not being able to withdraw their capital. This complete 2025 ROCK-WEST Review will examine every important aspect of how it works—from regulation and trading rules to real user experiences—to give traders clear, fact-based information for making smart decisions.

LTI Review 2026: Safe Broker or a High-Risk Scam? User Complaints Analyzed

When you search for terms like "Is LTI Safe or Scam," you are asking the most important question any investor can ask. Picking a broker is not just about fees or trading platforms; it is about trust. You are giving the broker your hard-earned capital, expecting it to handle it honestly and professionally. The internet is full of mixed user reviews, promotional content, and confusing claims, making it hard to find a clear answer. This article is designed to cut through that confusion.

LTI Regulatory Status: Understanding Its Licenses and Company Registration Details

When choosing a forex broker, the most important question is always about regulation. For traders looking into the London Trading Index (LTI), the issue of LTI Regulation is not simple. In fact, there are conflicting claims, official warnings, and major red flags. According to data from global regulatory tracking platforms, LTI operates without proper regulation from any top-level financial authority. The main problem comes from the difference between what the broker claims and what can actually be verified. While LTI presents itself as a professional company based on London's financial standards, independent research shows a different story. This article will examine the claims about the LTI License, look closely at the broker's company structure, and analyze the warnings issued by financial watchdogs. Read on!

WikiFX Broker

Latest News

Is ICM Brokers Legit? Checking Its Legitimacy and Scam Risks

Trade Nation Rebrands TD365 in Global Integration Move

NaFa Markets Review: An Important Warning & Analysis of Fraud Claims

TenTrade Review: Safety, Regulation & Forex Trading Details

USD Crisis: Capital Flight Accelerates as Europe Pivots Away from 'Political Risk'

Gold Breaches $5,110: 'Fear Trade' Dominates as Dollar Wavers

Italian Regulator Moves to Block Multiple Unauthorised Investment Platforms

Yen Awakening: Intervention Risks and Real Rates Signal Structural Turn

HERO Review: Massive Withdrawal Crisis and Platform Blackouts Exposed

PRCBroker Review: Where Profitable Accounts Go to Die

Rate Calc