Stunning Revelation: OXShare Disallows Withdrawals When Traders Make Profits

Abstract:The revelation that OXShare disallows withdrawals to traders when they make profits is stunning but true. Many traders have complained about it on forex broker review platforms, but to no avail. They may receive assurances, but company officials do not live up to their promises. What’s more, these officials manipulate trades, forge vital details, and eventually scam traders who put their hard-earned capital on it. In this article, we will expose OxShare with proof. Read on to check them.

The revelation that OXShare disallows withdrawals to traders when they make profits is stunning but true. Many traders have complained about it on forex broker review platforms, but to no avail. They may receive assurances, but company officials do not live up to their promises. Whats more, these officials manipulate trades, forge vital details, and eventually scam traders who put their hard-earned capital on it. In this article, we will expose OxShare with proof. Read on to check them.

List of Trader Complaints Against OXShare

Withdrawal Disallowed When You Make Profits

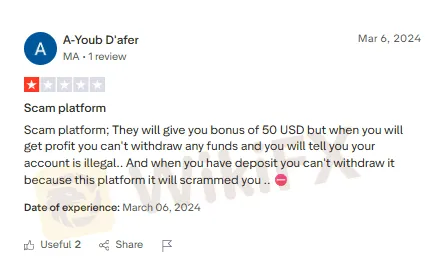

As a trader, you implement different trading strategies to ensure you earn profits amid a fluctuating forex market. When you earn profits, your morale as a trader goes up. But comes a shocker when scam forex brokers like OXShare deny you profit withdrawals. This problem has been central to almost every trader here. Sharing two screenshots where traders have expressed this issue.

Price Action Alteration Spoils Your Trading Mood

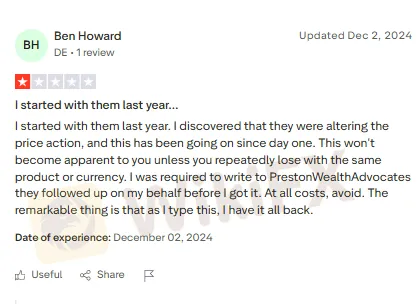

Traders also allege that OXShare manipulates price action to compound losses for them. Remember, price action is an important technical tool that showcases the price movement of different currencies over time. Here is a specific trader complaint regarding price action. Take a look!

Withdrawals Denied Even as Traders Meet No Deposit Bonus Terms

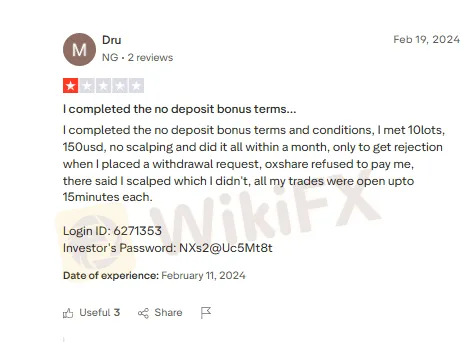

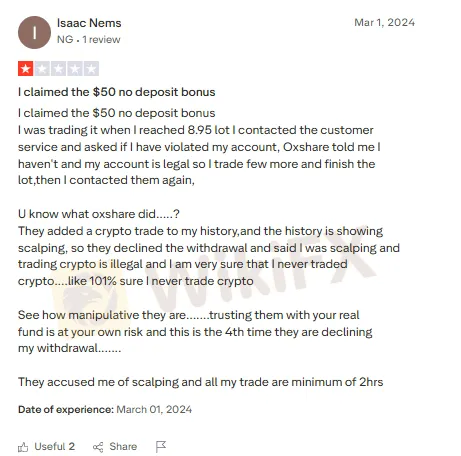

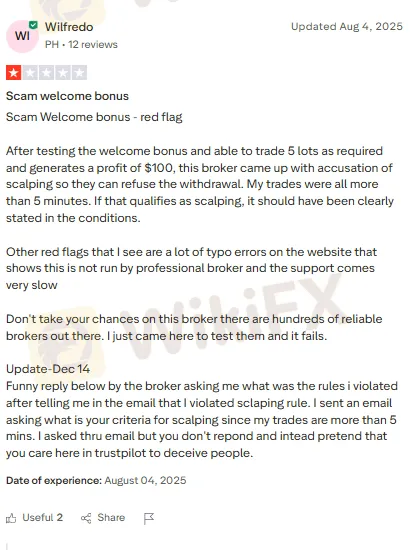

OXShare does not want to entertain withdrawal requests from traders. It finds reasons to deny withdrawals, and the case to be presented now is no different. Here is one trader claimed to have met the terms and conditions stipulated for no deposit bonus. However, the forex broker rejected accusing the trader of scalping trades. However, the trader denied it outrightly. There are multiple trader complaints on this front. Sharing some of them below for you to look at.

Why Do Complaints Rise Against OXShare?

Simple, OXShare is not a licensed forex broker. It is free from sharing details with the regulator and complying with the investor-friendly norms. The complaints shown above were bound to happen, and we at WikiFX feel empathetic for the traders at OXShare. On the score front, we can only give it 2.10 out of 10.

Moving on to an exciting update - WikiFX Masterminds - where you can track the latest forex updates.

Join the community using these simple steps -

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Great, you have become a community member.

Read more

FXORO Review: Investigating Withdrawal Denial and Fund Scam Allegations

FXORO, a Seychelles-based forex broker, has been receiving quite a few negative reviews from traders. Looking at the overall complaints, traders are not happy with the way the broker handles withdrawal issues. Even more concerning is the loss due to its alleged advice of not using risk management tools. Some traders even alleged to have been taken advantage of by the broker’s officials. In this FXORO review article, we have collected a list of complaints against the broker. Keep reading to know about them.

EPFX Exposure: Examining Complaints Concerning Withdrawal Denials & Account Blocks

Lured into trading on the EPFX platform with an attractive bonus that did not come to your account? Was your profile disabled by the broker upon raising a technical query concerning a profit withdrawal request? Did the South Africa-based forex broker deny you access to withdraw your hard-earned capital from the platform? Have you faced account closure by the EPFX broker without any reason? These alleged scams have become the centre of discussion on broker review platforms. We have shared these complaints in this EPFX review article. Keep reading!

Arena Capitals Complete Review: Finding High Risks and Major Warning Signs

Is Arena Capitals a safe and trustworthy broker? The evidence gives us a clear answer: no. Our research into Arena Capitals shows a high-risk business that doesn't have the basic protections needed to keep investor capital safe. The main reason for this conclusion is that no respected financial authority regulates them at all. This main problem gets worse when you add extremely low trust scores on checking websites, official warnings telling traders to stay away, and a troubling pattern of user complaints, especially about not being able to withdraw funds. Based on our study of public information, we strongly recommend against opening an account or investing in Arena Capitals. This Arena Capitals review will explain the evidence behind this warning, helping you make a smart and safe choice.

Monaxa Scam Exposed: Withdrawal Delays and Fraud

Monaxa scam exposed: denied payouts, downtime, profit manipulation, weak offshore license. Protect your money—read full broker review now!

WikiFX Broker

Latest News

Dukascopy Triples MetaTrader 5 Asset Suite to Surpass 400 Instruments

Scope Prime Strengthens Institutional Liquidity Infrastructure with Ultency Integration

NAGA Earnings Signal Industry Stress Amid Low FX Volatility

HFM Review 2026: Is this Forex Broker Legit or a Scam?

ESMA Tightens Derivative Rules: Crypto 'Perpetuals' Face Strict CFD Leverage Caps

INFINOX Analysis Report

Equity Volatility Signals Risk-Off Shift as Prime Broker IPO Stalls

European Retail FX Brokers Pivot to Futures Amid Regulatory Crackdown

UK Retail Sentiment: Inflation Reality Check Damps Appetite for Cash

OANDA Japan Slashes Gold Trading Limits as Volatility Drains Liquidity

Rate Calc