Vantage Promotes Its CPA Affiliate Program

Abstract:Online forex broker Vantage, founded in 2009 and headquartered in Sydney, recently launched its new Cost-Per-Acquisition (CPA) affiliate program. Vantage recently celebrated its 15th anniversary and forms part of a broader suite of marketing initiatives aimed at expanding its referral network.

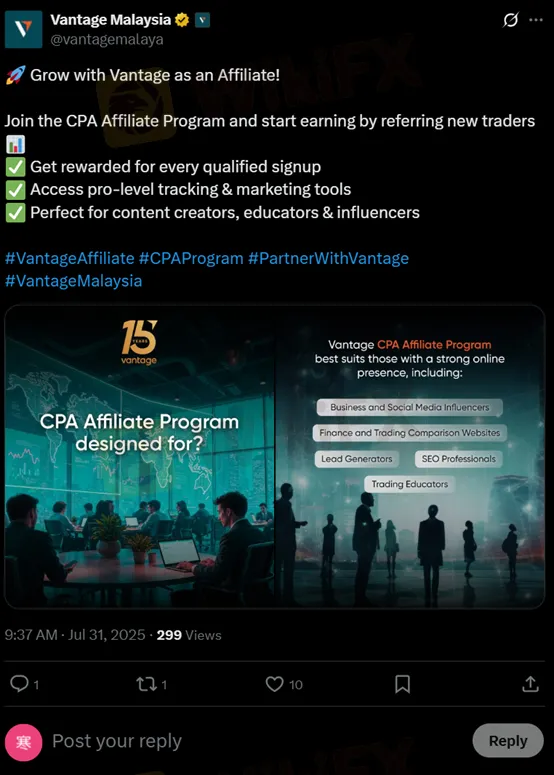

Online forex broker Vantage, founded in 2009 and headquartered in Sydney, recently launched its new Cost-Per-Acquisition (CPA) affiliate program. Vantage recently celebrated its 15th anniversary and forms part of a broader suite of marketing initiatives aimed at expanding its referral network.

Key Features of the Affiliate Program

- Reward for Every Qualified Signup

Affiliates will earn a fixed commission for each trader they refer who meets predefined “qualified” criteria.

- Pro-level Tracking & Marketing Tools

Vantage provides a dashboard with real-time tracking and link-management tools to help partners monitor performance and optimize campaigns.

- Designed for Content Creators, Educators & Influencers

According to Vantage, the program is especially well-suited to Business and Social Media Influencers and other B-terminal third parties.

These partners are expected to leverage their audiences and content channels to drive qualified traffic.

Marking its 15th year of operation, Vantage has rolled out a string of celebratory activities, from social-media countdowns to anniversary webinars featuring guest speakers. Historically, brokers often tie such milestones to limited-time offers (reduced spreads, deposit bonuses, VIP seminars) to boost client acquisition and retention.

About Vantage

Vantage was founded in2009 in Sydney, Australia. It has set up branches in various regions, such as the UK, Cayman Islands, and China. Vantage is a regulated broker; it is regulated by the Australian Securities & Investments Commission (ASIC) and the UKs Financial Conduct Authority (FCA).

- Trading Instruments:

- Forex majors, minors, and exotics

- Indices (e.g., S&P 500, FTSE 100)

- Precious metals (gold, silver)

- Soft commodities (coffee, sugar)

- Energies (oil, gas)

- ETFs, share CFDs, and bonds

- Platforms: MetaTrader 4, MetaTrader 5, Vantage WebTrader

- Education: Daily market analysis, webinars, e-books, and tutorial videos

WikiFX currently assigns Vantage a solid rating based on its regulatory standing, trading conditions, and user feedback.

Conclusion

While affiliate programs and anniversary campaigns can offer attractive incentives, WikiFX underscores that they are fundamentally marketing strategies.

After all, an affiliate program‘s shine should not blind participants to the underlying trading environment. Whether evaluating brokers for one’s trading or considering affiliate partnerships, deep due diligence remains essential.

Read more

EPFX Exposure: Examining Complaints Concerning Withdrawal Denials & Account Blocks

Lured into trading on the EPFX platform with an attractive bonus that did not come to your account? Was your profile disabled by the broker upon raising a technical query concerning a profit withdrawal request? Did the South Africa-based forex broker deny you access to withdraw your hard-earned capital from the platform? Have you faced account closure by the EPFX broker without any reason? These alleged scams have become the centre of discussion on broker review platforms. We have shared these complaints in this EPFX review article. Keep reading!

Arena Capitals Complete Review: Finding High Risks and Major Warning Signs

Is Arena Capitals a safe and trustworthy broker? The evidence gives us a clear answer: no. Our research into Arena Capitals shows a high-risk business that doesn't have the basic protections needed to keep investor capital safe. The main reason for this conclusion is that no respected financial authority regulates them at all. This main problem gets worse when you add extremely low trust scores on checking websites, official warnings telling traders to stay away, and a troubling pattern of user complaints, especially about not being able to withdraw funds. Based on our study of public information, we strongly recommend against opening an account or investing in Arena Capitals. This Arena Capitals review will explain the evidence behind this warning, helping you make a smart and safe choice.

Monaxa Scam Exposed: Withdrawal Delays and Fraud

Monaxa scam exposed: denied payouts, downtime, profit manipulation, weak offshore license. Protect your money—read full broker review now!

ProMarkets Review: Total Forex Scam Alert

ProMarkets, an unregulated St. Vincent broker, faces WikiFX warnings, frozen withdrawals, and fake profits. Avoid deposits—check reviews and protect your funds.

WikiFX Broker

Latest News

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

FX SmartBull Regulation: Understanding Their Licenses and Company Information

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

Neptune Securities Exposure: Real Forex Scam Warnings

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

The micro-documentary "Let Trust Be Seen" is officially launched today!

Rate Calc