6 Red Flags to Notice Before Investing in Neuron Markets

Abstract:Investment scams have been rising over the last 5–6 years. Therefore, you need to be alert in the forex market, as many scam brokers are active and waiting to exploit inexperienced investors and traders. Neuron Markets is one such broker that appears genuine and makes big promises but ends up swindling investors’ money. Checkout red Flags and stay Safe

Investment scams have been rising over the last 5–6 years. Therefore, you need to be alert in the forex market, as many scam brokers are active and waiting to exploit inexperienced investors and traders. Neuron Markets is one such broker that appears genuine and makes big promises but ends up swindling investors money. Look out for red flags and stay safe.

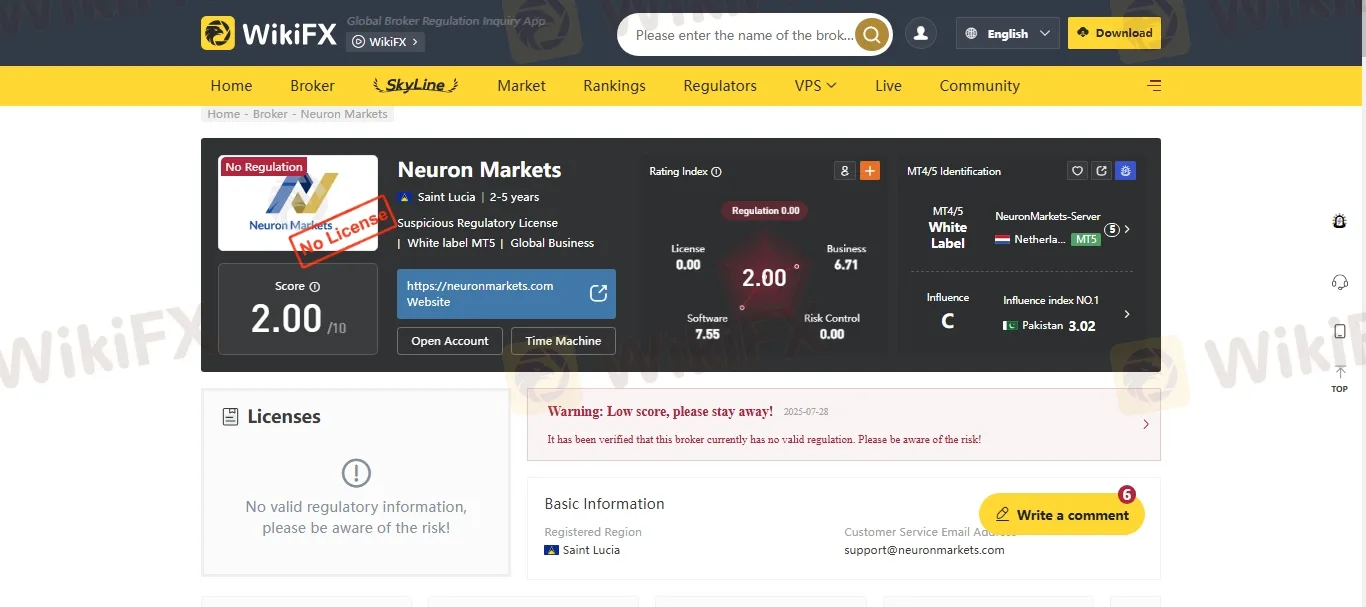

1. No Regulation

When picking a forex broker, regulation should be your top concern. A regulated broker means there‘s legal oversight and rules to protect your money. Neuron Markets is unregulated—it does not hold licenses from well-known authorities like the UK’s FCA, Australia‘s ASIC. This absence of regulation means there’s no legal supervision over how they operate, which puts your funds at serious risk of fraud, unfair practices, or loss.

2. Very Low Score

WikiFX gives Neuron Markets a rating of only 2.00 out of 10—a very low score that indicates major risks. Low scores like this usually signal potential scams or shady operations. This makes Neuron Markets untrustworthy and raises serious doubts about its safety.

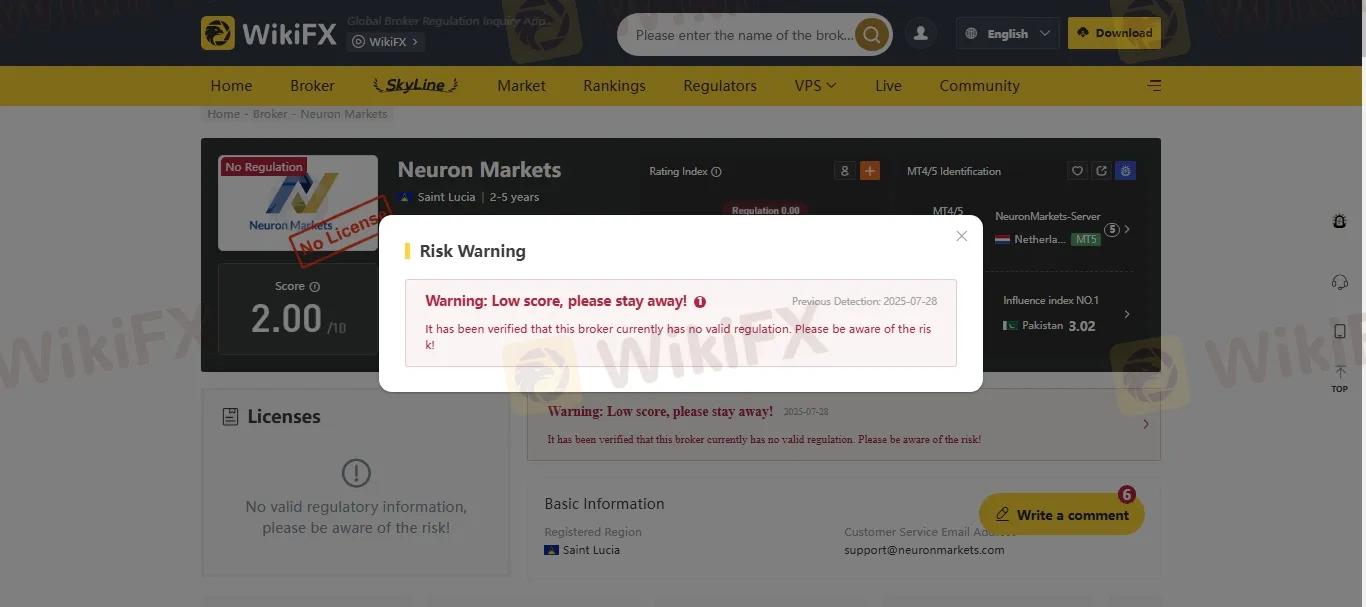

3. Official WikiFX Warning

WikiFX has issued a clear and direct alert urging users to avoid Neuron Markets. They highlight the brokers low rating and confirm it lacks valid regulatory approval—stating simply: “Warning: Low score, please stay away!... no valid regulation… be aware of the risk.”

4. Suspicious Promises

Neuron Markets promotes itself with bold claims—guaranteeing high returns and superior trading conditions—but offers very little concrete detail about its team, licensing, or safeguarding of customer funds. This vagueness is a classic tactic of scam platforms. If they can't give accurate information upfront, what else might they be hiding?

5. Withdrawal Issue

Multiple independent reviews reveal widespread issues with Neuron Markets customers being unable to withdraw funds. Depositors frequently report delays, blocked access to accounts, unresponsive support, or requests for extra charges just to release their own money. These are strong indicators of fraudulent behavior.

6. Aggressive Marketing

Neuron Markets appears to rely heavily on aggressive marketing and pushy sales techniques to recruit investors. Independent reviews describe how third party affiliates lure prospects using flashy promises and celebrity endorsements, then pass the leads on to the brokers sales team for hard-selling tactics.

How to Protect your Money?

1. Choose a Regulated Broker

2. Avoid Unrealistic Promises

3. Educate Yourself Continuously

4. Secure Your Trading Accounts

5. Never Risk More Than You Can Afford to Lose

Join WikiFX Community

Investment scams have become a reality in the Forex market. While trading forex, you can avoid these scams by staying informed and alert. Therefore, be attentive and stay updated with fraud alerts. With WikiFX, you can get all the information you need about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR Code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Read more

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Switched to Galileo FX from other brokers, thinking that you would earn profits, but things went the other way round? Did you continue to face losses despite executing constant optimizations on the trading software? Like did you experience issues concerning executing stop-loss orders? Failed to cash in on the positive market wave because of the broker’s trading bot? You are not alone! Many complaints concerning losses due to trading bot deficiencies have been doing the rounds. In this Galileo FX review article, we have demonstrated these complaints. Take a look!

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

EGM Securities has been reported as a scam by many forex traders, as they encountered several problems concerning fund withdrawals. The broker is alleged to have defrauded traders by applying unnecessary restrictions on withdrawals. Also known as FXPesa, the broker seems to have caught traders’ attention, mostly for negative reasons, though. In this EGM Securities review article, we have discussed withdrawal-related complaints made against the broker online. Keep reading!

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Vebson is listed as high risk on WikiFX, with exposure to unpaid withdrawal cases and misleading claims. Read this forex scam alert before you deposit a cent.

Amaraa Capital Scam Alert: Forex Fraud Exposure

Exposed: Amaraa Capital is a forex scam. Protect your funds—read this detailed scam alert now and avoid risky forex investments.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

South Africa's Reform Agenda Gains Traction, Business Sentiment Improves

4T Review 2026: Is this Forex Broker Legit or a Scam?

evest Review 2025: Is This Forex Broker Safe?

Rate Calc