TriumphFX Faces Regulatory Warnings and Fraud Investigations

Abstract:TriumphFX is under scrutiny with multiple regulatory warnings and fraud investigations worldwide. Stay informed on its license status and avoid potential scams.

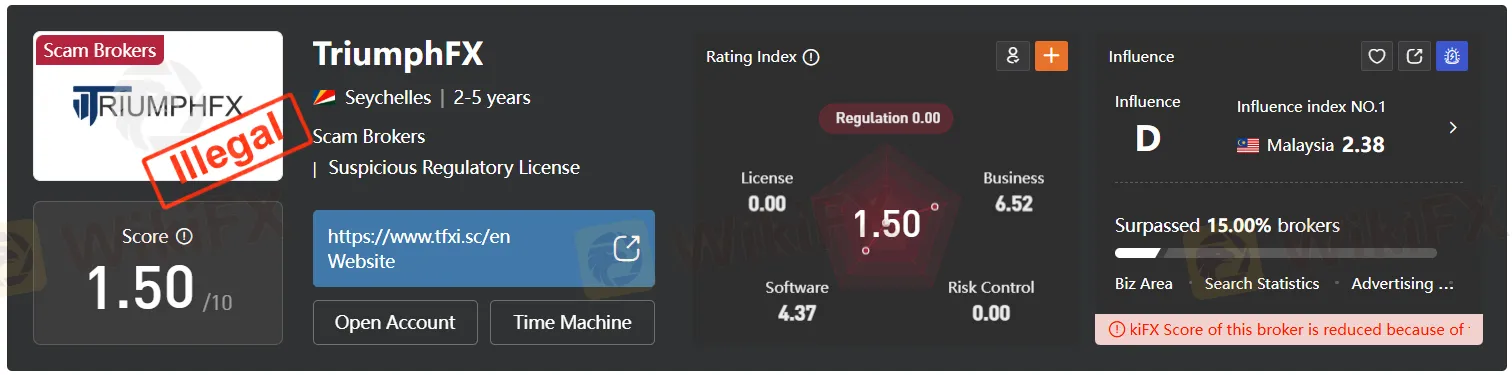

TriumphFX, known for its forex and CFD services, is operated by Triumph Int. (Cyprus) Ltd and Triumph Int. (SC) Ltd has landed in hot water with regulators around the world. Even though it held a license from the Cyprus Securities and Exchange Commission (CySEC) before the revocation, the companys activities and leadership have been repeatedly questioned, sparking a wave of cautionary warnings for potential investors.

Regulatory Trouble Spanning the Globe

The regulatory rollercoaster started rolling in December 2023 when CySEC took the extraordinary step of suspending voting rights for TriumphFX‘s sole indirect shareholder, Chong Chun Hseung. Along with this, the firm’s executive directors, Christoforos Christoforou and Joel Prakash Benedict, were handed a two-year ban on any management roles. These actions will stay in place until TriumphFX gets itself off investor alert lists in places like Singapore and Malaysia.

But the red flags didnt start or end there:

- Singapores Monetary Authority (MAS) added TriumphFX to its Investor Alert List back in August 2021, warning that the brokerage might be misleading people into thinking it was licensed locally.

- Malaysias Securities Commission joined in even earlier, blacklisting TriumphFX in 2020 for unauthorized activities tied to capital markets.

- New Zealand‘s Financial Markets Authority (FMA) and Australia’s ASIC have both issued bulletins, warning that TriumphFX is not a registered or licensed provider in their countries, and advising extreme caution for would-be investors.

This global pushback has cast doubt over TriumphFXs compliance claims, raising serious questions about its credibility as a regulated broker.

Investors Burned—and the Authorities Take Notice

Things escalated in Malaysia, where 72 police reports from frustrated investors revealed collective losses exceeding $5.3 million. Authorities didn‘t stop at the original operation—investigators also unearthed a TriumphFX clone scam, which enticed with quick profits but left victims with nothing but regret. Malaysia’s fraud investigators are now knee-deep in multiple ongoing cases, seeking accountability for the widespread financial losses.

Although TriumphFX continues to advertise itself as a licensed, regulated brokerage, a flood of negative reviews and complaints tells a different story. Customers routinely voice disappointment over management issues, poor communication, lengthy withdrawal processes, and a general lack of transparency—a pattern that raises further alarms about the firms practices.

The Companys Shaky Regulatory Foundation

TriumphFX currently holds licenses in Cyprus and the Seychelles. However, its track record is anything but reassuring. The company formerly operated under a license from the Vanuatu Financial Services Commission (VFSC) but lost that privilege after its license was revoked—a detail that adds to doubts about its reliability and intentions.

Multiple regulatory warnings from varied jurisdictions underline the importance of skepticism. Ongoing investigations in several countries only amplify concerns, signaling that authorities aren‘t yet convinced of TriumphFX’s trustworthiness or regulatory compliance.

What Savvy Investors Should Do

When it comes to choosing an online broker, doing your homework isn‘t just wise—it’s necessary. TriumphFX‘s regulatory headaches and mounting customer complaints make it a high-risk choice for anyone thinking about investing. Here’s what every investor should keep in mind:

- Scrutinize license credentials. Never take a brokers word for it—confirm licenses through official channels, and note any red flags such as negative press, lack of registration, or regulatory investigations.

- Read customer feedback. A steady stream of complaints or unresolved withdrawal issues is a major warning sign.

- Prioritize transparency and oversight. Reliable brokers are transparent about their regulations, fees, and ownership, and they communicate clearly with clients.

Choosing a broker with a spotless regulatory reputation can help you avoid headaches and financial loss. As TriumphFX faces growing international scrutiny, investors would be wise to consider safer alternatives and to stay informed by monitoring official warnings and real user experiences.

Safeguard your investments by staying diligent, skeptical, and proactive—because your financial security is too important to leave to chance.

You may also check other traders' negative experiences with TruimphFX by accessing its broker's page: https://www.wikifx.com/en/dealer/2785101112.html

Read more

datian Review: Examining Slippage and Forced Liquidation Allegations Against the Broker

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

TopstepFX Review: Investigating Fund Withdrawal Denial Claims & Other Trading Issues

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

Mazi Finance Regulatory Status: A Complete Guide to Its Licenses and High-Risk Warnings

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.

Checking if Mazi Finance is Real: Is This a Fake Broker or a Real Trading Company?

If you're wondering, "Is Mazi Finance legit?" or worried about a possible Mazi Finance scam, you are asking the right questions. These are the important first steps every trader must take to protect their capital. In a market full of chances to make money, there are just as many traps. Our goal is to give you a clear, fact-based answer. We have done a complete investigation into Mazi Finance, looking at its legal status, company structure, user experiences, and trading conditions. This is not a review based on marketing claims; it is a check for legitimacy based on facts we can prove. To be direct, our findings show that Mazi Finance operates with serious warning signs that should worry any trader. The biggest problem is its complete lack of proper regulation from any respected financial authority. This fact alone puts it in a high-risk category. This article will explain exactly what that means for you and your money.

WikiFX Broker

Latest News

Theos Markets Review 2026: Is this Forex Broker Legit or a Scam?

China’s "Deposit Migration" Myth Debunked: A Gradual Shift, Not a Flood

CBN Bolsters Forex Liquidity: Resumes BDC Sales as Reserves Hit $47 Billion

AssetsFX Review : Read This Before You Put Money In it

KK Park 2.0? New Scam Hub Shockingly Emerges in Myanmar

FX Markets: Aussie Dollar Breaks 0.7100, Yen Rallies on Political Shifts

PXBT Review: A Seychelles-Based Trap for Your Capital

Anzo Capital Detailed Analysis

Pemaxx User Reputation: Looking at Real User Reviews to Check If It's Trustworthy

CFI Detailed Analysis

Rate Calc