Equiti: A Closer Look at Its Licenses

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Equiti and its licenses.

Equiti is a multi-jurisdictional broker offering financial services under several regulatory frameworks. With licenses issued by both established and offshore regulators, Equiti demonstrates a broad geographic presence. WikiFX assigns Equiti a WikiScore of 6.25 out of 10, reflecting a moderate performance in areas such as compliance, trading conditions, and operational transparency.

Equiti holds a license from the Cyprus Securities and Exchange Commission (CySEC) under license number 415/22. CySEC is a well-recognized regulatory authority within the European Economic Area, responsible for overseeing investment firms, financial transactions, and collective investment schemes in Cyprus. The license held by Equiti falls under the Straight Through Processing (STP) model, which typically indicates that the broker routes client orders directly to the market without internal dealing desk intervention. This regulatory approval enhances the brokers credibility within the European market.

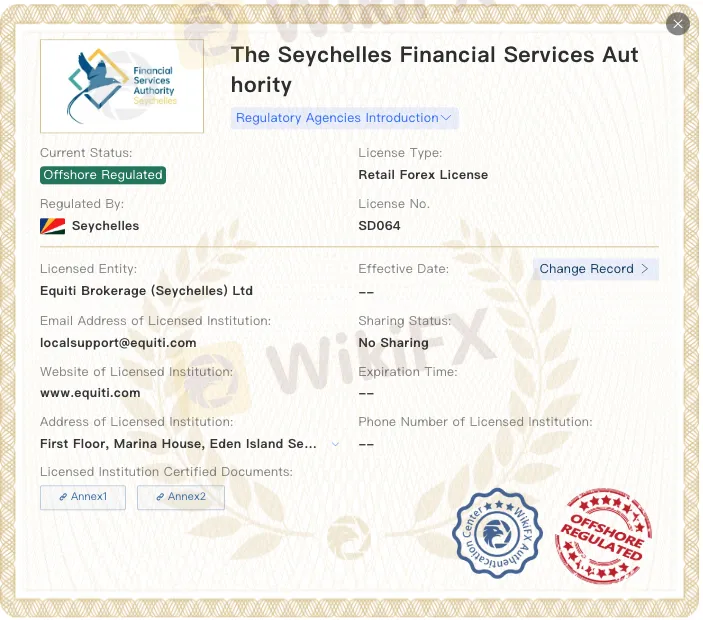

The broker is also licensed by the Seychelles Financial Services Authority (FSA) under license number SD064. The FSA governs non-bank financial services in Seychelles, including retail forex brokers. This offshore license allows the broker to operate with fewer regulatory constraints, but may also offer a lower degree of investor protection compared to more strictly regulated jurisdictions.

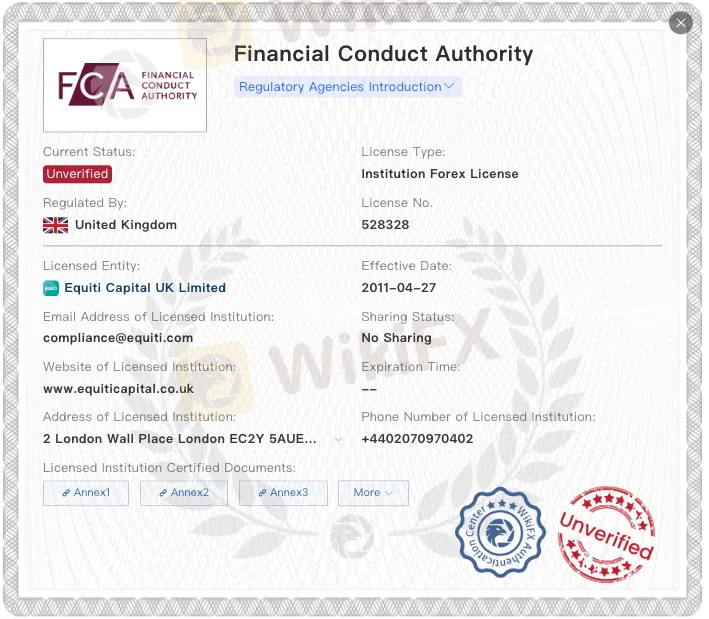

In addition, Equiti is listed under the United Kingdom‘s Financial Conduct Authority (FCA) with license number 528328. The FCA is a highly regarded financial watchdog known for its rigorous compliance standards. However, it is important to note that this license is currently marked as unverified, suggesting the need for caution and additional research to confirm the broker’s regulatory status under the FCA framework.

With a WikiScore of 6.25/10, Equiti is placed in the mid-range among global brokers listed on WikiFX. This score takes into account various factors, including licensing integrity, business operations, trading environment, risk management, and user feedback. The combination of onshore and offshore licenses reflects a diverse operating strategy, although the presence of an unverified FCA listing may require further clarification for clients focused on regulatory security.

Equiti operates under a mix of regulatory licenses, including those from CySEC in Cyprus and the FSA in Seychelles, offering a balance between regulatory oversight and operational flexibility. While the verified CySEC license adds credibility, the offshore license and unverified status under the FCA raise questions that should not be overlooked by potential traders. As with any financial service provider, individuals are advised to carry out thorough due diligence and understand the scope and limitations of the regulatory coverage before engaging with the broker.

Read more

Effective Stop Loss Trading Strategies

In a forex market where fundamental and technical factors impact the currency pair prices, volatility is expected. If the price volatility acts against the speculation made by traders, it can result in significant losses for them. This is where a stop-loss order comes to their rescue. It is one of the vital investment risk management tools that traders can use to limit potential downside as markets get volatile. Read on as we share its definition and several strategies you should consider to remain calm even as markets go crazy.

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

WikiFX Broker

Latest News

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Promised 30% Returns, Lost RM630,000 Instead

MultiBank Group Analysis Report

Pepperstone Analysis Report

TradingPro: Regulation, Licences and WikiScore Analysis

NEWTON GLOBAL Legitimacy Check (Addressing fears: Is This a Fake or a Legitimate Trading Partner?)

Weltrade Review: Safety, Regulation & Forex Trading Details

SPREADEX Review: Reliable Broker Check

U.S. trade deficit totaled $901 billion in 2025, barely budging despite Trump's tariffs

Rate Calc