Multiple Forces at Play: Decoding Gold Market Volatility

Abstract:Fed Independence in QuestionBloomberg‘s report on former President Trump potentially firing Fed Chair Jerome Powell—followed by Trump’s vague denial—reveals a deeper concern: the Federal Reserves inde

Fed Independence in Question

Bloomberg‘s report on former President Trump potentially firing Fed Chair Jerome Powell—followed by Trump’s vague denial—reveals a deeper concern: the Federal Reserves independence may not be immune to political influence.

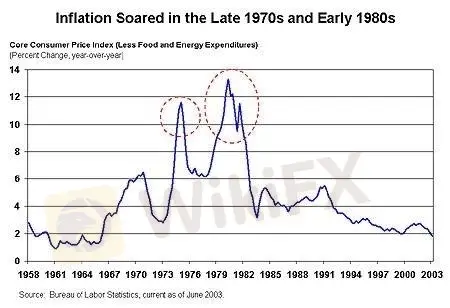

Persistent political pressure could subtly steer the Feds future monetary policy decisions. When it comes to critical choices such as rate hikes or cuts, can a repeatedly challenged central bank truly remain apolitical? The market has reason to be wary. (Remember the 1970s, when political pressure led to aggressive rate cuts? That policy misstep sparked a decade-long stagflation crisis.)

[Chart: U.S. Inflation in the 1970s | Source: BLS]

Trump has also taken aim at the alleged “overspending” on the Fed's headquarters renovation. But beneath this narrative may lie a strategic effort to erode the Fed's credibility further by weaponizing fiscal scrutiny. These developments deserve close attention—not only for their potential impact on gold prices, but for their implications on global market confidence.

The “Tame” PPI Data: A False Sense of Relief?

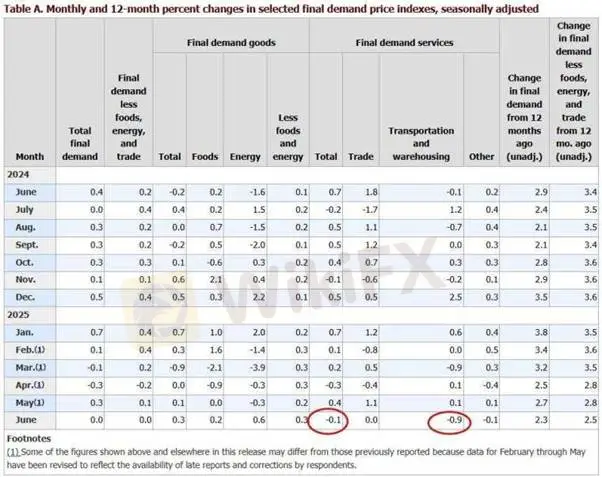

While June‘s U.S. PPI data appeared subdued, offering short-term support to gold by easing immediate Fed tightening concerns, the broader inflation picture is far from benign. Annual PPI still rose 2.3%, signaling that price pressures persist. More tellingly, the Fed’s Beige Book highlighted that tariffs are already pushing up costs, prompting businesses to preemptively adjust prices. This could be the calm before the inflation storm.

Whether soft services inflation can offset rising goods prices due to tariffs remains uncertain. Should services prices rebound while tariffs filter through supply chains, a second wave of inflation could hit harder and faster than expected. Against this backdrop, gold—an established inflation hedge—may be significantly undervalued. Once inflation pressures fully materialize, gold could rally well beyond current levels.

[Chart: U.S. PPI for June | Source: BLS]Currency and Bond Market Turbulence: A Sign of Fragile Confidence

Wednesday saw sharp moves in the dollar and bond yields: USD/JPY dropped, EUR/USD rose, and Treasury yields reversed dramatically. These swings reflect a critical truth—investor confidence in the U.S. economy and policy outlook remains fragile.

Despite Trump‘s denial of firing Powell, the market’s knee-jerk reaction underscored its sensitivity. As the world‘s reserve currency, the dollar’s credibility magnifies any volatility. That very volatility, in turn, fuels safe-haven demand.

Of particular note: the 30-year Treasury yield briefly hit an eight-week high, highlighting long-term inflation and deficit concerns. Meanwhile, the widening 2-year/10-year yield spread—a classic recession signal—suggests a deteriorating economic outlook. Under these conditions, golds appeal as a safe-haven asset will likely remain strong.

Geopolitical Risk: A Strong Foundation for Golds Hedge Appeal

While Israels airstrike on Syria may seem like just another chapter in Middle East tensions, it underscores a broader theme: geopolitical risk isnt isolated, and sparks in the region can ignite wider conflict.

Given the complexity of the Middle East, any flare-up could escalate swiftly. Should tensions intensify, the impact on global markets would be severe, and gold demand as a hedge could surge dramatically.

Conclusion: Long-Term Support for Gold Is Intact

Despite short-term fluctuations, key macro forces—including political pressure on the Fed, lingering inflation risks, market fragility, and rising geopolitical tensions—form a robust foundation for long-term gold strength. As such, gold will likely continue playing a critical role in diversified investment portfolios.

Technical Outlook:

Golds upward trend remains intact, though currently consolidating near $3,340. The RSI suggests a slight retreat but remains in neutral territory. To resume bullish momentum, XAU/USD must break above $3,375, opening a path toward $3,400. Conversely, a drop below $3,320 could trigger a correction toward the $3,282–$3,285 range.

Resistance: $3,375 / $3,400

Support: $3,320–$3,325 / $3,282–$3,285

Risk Disclaimer: The views, analysis, research, prices, or other information mentioned above are intended solely as general market commentary and do not constitute investment advice. Readers are solely responsible for any decisions they make. Please trade cautiously.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Grand Capital Review 2026: Is this Broker Safe?

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Rate Calc