LQH Markets Broker Review: Lack of Regulation Raises Red Flags

Abstract:Account wiped, funds gone—one trader shares their experience after suddenly losing access to all assets. Without effective regulatory protection, such outcomes may offer no path to recovery.

LQH Markets, operated under the name LQH Integrated Ltd., claims to be based in Anjouan, Union of Comoros. Since launching in early 2025, the broker has rapidly introduced a wide array of financial instruments, boasting over 300 available tools including forex, crypto CFDs, indices, and more. It promotes a low minimum deposit of $10.

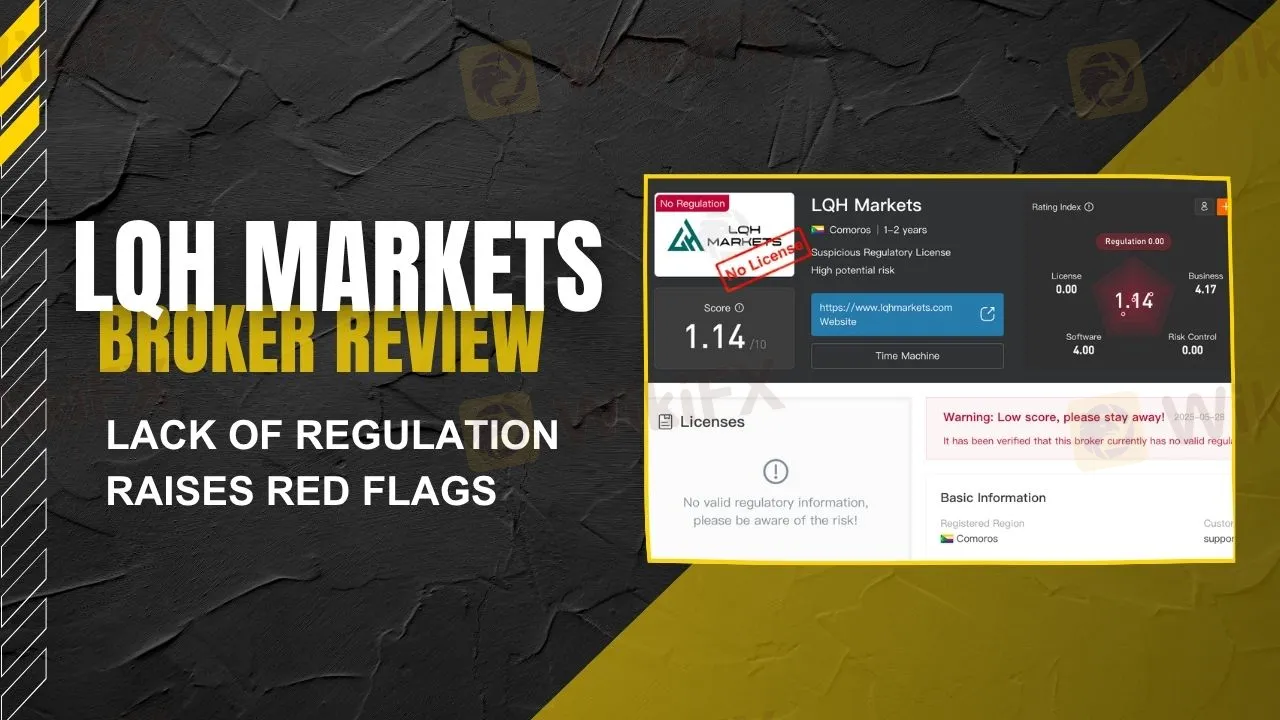

However, according to the assessment provided by WikiFX, LQH Markets currently scores only 1.14 out of 10, with a regulatory score of 0.00, clearly indicating that the broker is not regulated by any recognized financial authority:

Despite this, the brokers official website claims to hold licenses from:

- The International Brokerage and Clearing House License in Comoros (License No. L15833/LIL)

- A St. Lucia International Business Company registration (No. 2023-00570)

While these registrations may validate the companys existence as an entity in offshore jurisdictions, they do not equate to financial regulation. Unlike licenses from well-known authorities such as the FCA, ASIC, or CySEC, these offshore registrations do not provide meaningful investor protection or enforceable operational standards. As a result, any disputes regarding fund safety or trading practices could be difficult—if not impossible—to resolve legally.

User Report: Deleted Account & Withheld Funds

A recent complaint reveals a more troubling aspect of the brokers conduct. According to the trader, their entire trading account was deleted without prior notice, and all deposited funds, along with any profits made, were removed.

The trader wrote:

“My main dashboard account has been deleted completely, and they are not returning the money I deposited, along with the profit I made.”

They also shared a screenshot showing past trading activity, deposits, and a vanished balance:

Community Feedback

Online user sentiment surrounding LQH Markets has been largely negative. Several reviewers have pointed out the brokers extremely short operating history, lack of market credibility, and opaque practices. Some complaints have mentioned questionable ties to signal providers and patterns of losing trades following their guidance. While the broker has posted replies denying wrongdoing or questioning reviewer identities, they have failed to address core issues directly.

Final Recommendation

If you are considering depositing funds with LQH Markets, we strongly recommend verifying a brokers legitimacy through WikiFX or similar regulatory databases. Always choose brokers that are properly regulated by top-tier financial authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus).

When trading in volatile markets, regulation isn‘t just a formality—it’s your safety net.

Read more

EPFX Exposure: Examining Complaints Concerning Withdrawal Denials & Account Blocks

Lured into trading on the EPFX platform with an attractive bonus that did not come to your account? Was your profile disabled by the broker upon raising a technical query concerning a profit withdrawal request? Did the South Africa-based forex broker deny you access to withdraw your hard-earned capital from the platform? Have you faced account closure by the EPFX broker without any reason? These alleged scams have become the centre of discussion on broker review platforms. We have shared these complaints in this EPFX review article. Keep reading!

Arena Capitals Complete Review: Finding High Risks and Major Warning Signs

Is Arena Capitals a safe and trustworthy broker? The evidence gives us a clear answer: no. Our research into Arena Capitals shows a high-risk business that doesn't have the basic protections needed to keep investor capital safe. The main reason for this conclusion is that no respected financial authority regulates them at all. This main problem gets worse when you add extremely low trust scores on checking websites, official warnings telling traders to stay away, and a troubling pattern of user complaints, especially about not being able to withdraw funds. Based on our study of public information, we strongly recommend against opening an account or investing in Arena Capitals. This Arena Capitals review will explain the evidence behind this warning, helping you make a smart and safe choice.

Monaxa Scam Exposed: Withdrawal Delays and Fraud

Monaxa scam exposed: denied payouts, downtime, profit manipulation, weak offshore license. Protect your money—read full broker review now!

ProMarkets Review: Total Forex Scam Alert

ProMarkets, an unregulated St. Vincent broker, faces WikiFX warnings, frozen withdrawals, and fake profits. Avoid deposits—check reviews and protect your funds.

WikiFX Broker

Latest News

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

FX SmartBull Regulation: Understanding Their Licenses and Company Information

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

Neptune Securities Exposure: Real Forex Scam Warnings

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

The micro-documentary "Let Trust Be Seen" is officially launched today!

Rate Calc