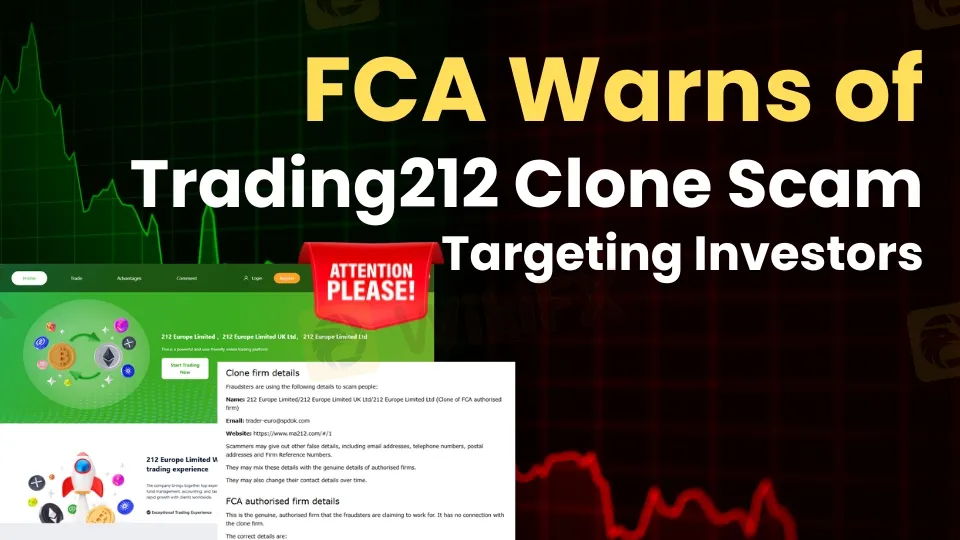

FCA Warns of Trading212 Clone Scam Targeting Investors

Abstract:FCA alerts investors about a Trading212 clone scam using fake details. Learn how to spot clones and protect your funds with the WikiFX app.

The UK Financial Conduct Authority (FCA) has issued a warning against a fraudulent clone firm impersonating Trading212 to scam unsuspecting investors. Fraudsters often create fake companies using the details of regulated firms, including their name, address, website, and branding, to appear legitimate and deceive victims into depositing funds.

Clone Firm Details

The FCA has identified the fraudulent company using the following details:

- Name: 212 Europe Limited/212 Europe Limited UK Ltd/212 Europe Limited Ltd

- Email: trader-euro@spdok.com

- Website: https://www.ma212.com/#/1

Official Trading 212 UK Details

The genuine Trading212 UK Limited is fully authorized and has no connection with the fraudulent clone. Below are the verified details:

- Firm Name: Trading212 UK Limited

- FCA Reference Number: 609146

- Address: Aldermary House, 10-15 Queen Street, London, EC4N 1TX, UNITED KINGDOM

- Telephone: +44 020 3857 1320

- Email: info@trading212.com

- Website: www.trading212.com

Why This Matters

If you unknowingly engage with a clone firm, you wont be eligible for financial protections such as the Financial Ombudsman Service or the Financial Services Compensation Scheme (FSCS). If the fraudulent firm collapses, your money is likely unrecoverable.

WikiFX database has found several clones of Trading212 that need your attention:

How to Stay Safe

To avoid scams like this, always:

✔ Verify broker details on the FCAs official register.

✔ Be cautious of unsolicited emails or investment offers.

✔ Use the WikiFX app, a trusted platform to verify broker legitimacy and detect fraudulent firms before investing.

About the FCA

The Financial Conduct Authority (FCA) is the UKs regulatory body overseeing financial markets. It ensures firms operate fairly and transparently, protecting investors from fraud and misconduct.

Stay informed, verify brokers, and secure your investments.

Read more

TradingPRO: A Closer Look at Its Licences

In an industry where safety and transparency are essential, the regulatory status of online brokers has never been more important. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about TradingPRO and its licenses.

New SEBI Regulations on Intraday Trading

The Securities and Exchange Board of India (SEBI) has implemented revised regulations on Intraday trading, with effect from November 20, 2024. These regulations are meant to lessen risks and prevent speculative trading practices.

Top Forex Trading Strategies Every Trader Must Implement

Successfully navigating the fluctuating forex market landscape requires more than having a high-risk appetite. It requires effective strategies that assure you gains even during the market fall. Let’s go through the strategies many traders implement to gain.

Errante Launches Deposit Bonus Offers with Rewards Up to $2,000

Errante has introduced a new deposit bonus promotion for first-time clients. Under this offer, eligible traders can receive a bonus of up to 30% on their initial deposit, with a maximum bonus amount capped at USD 2,000.

WikiFX Broker

Latest News

eToro Review 2025: Top Trading Opportunities or Hidden Risks?

How much money will you earn by investing in Vantage Broker?

IronFX vs Exness Review 2025: Comprehensive Broker Comparison

Fraudsters Are Targeting Interactive Brokers' Users with Lookalike Emails

Interactive Brokers: Global Office Visits and Licensing Details

Top Tips to Choose the Best Forex Broker in 2025

SEBI Notifies New F&O Rules for Investors - New Derivative Trading Limits & More Amendments

ASIC Urges Financial Licensees to Fix Register Errors Before 2026 Deadline

U.S. Jobs Data Released: A Potential Boost for Gold Prices

SkyLine Guide 2025 Malaysia: 100 Esteemed Judges Successfully Assembled

Rate Calc