2025 FXTM Comprehensive Review

Abstract:Description: This article provides a thorough review of FXTM from multiple perspectives, including its basic introduction, fees, safety, account opening, and trading platforms.

Basic Introduction

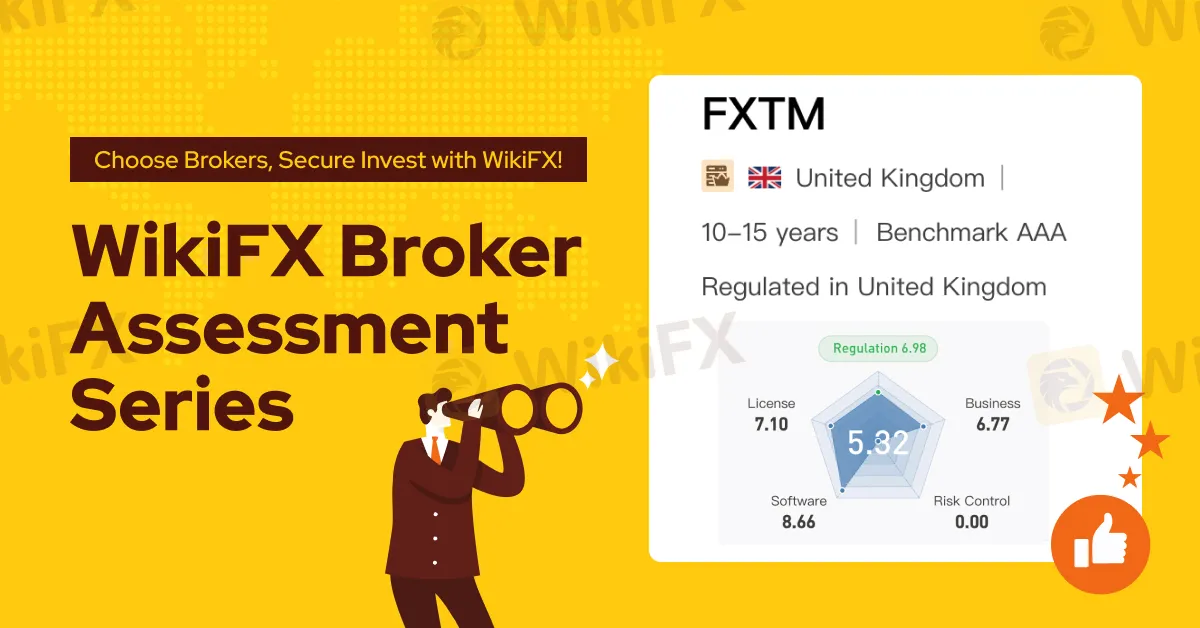

FXTM is a globally recognized CFD and forex broker, regulated by the UK's Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Mauritius Financial Services Commission (FSC). It's important to note that since March 2021, FXTM, under CySEC regulation, continues to offer services to professional clients in the region.

FXTM offers competitive forex trading fees, a seamless and fully digital account opening process, and provides fast, effective customer support.

Features

FXTM has become a popular choice among forex traders, attracting a large number of investors due to its low fees, digitalized account opening process, and excellent customer service. The account opening process is entirely online and fast, allowing users to complete registration in a short amount of time, eliminating the cumbersome steps typically involved in traditional account setups. Additionally, FXTM excels in customer service, offering efficient and professional support to ensure that clients receive timely assistance and solutions to any issues they may encounter. Whether you're a beginner or an experienced investor, FXTM provides a convenient and transparent trading experience to help you navigate the forex market effectively.

Fees

FXTM offers low-cost forex trading services. For forex transactions, FXTM charges a commission of $3.50 per lot, in addition to the spread costs (for example, the EUR/USD spread is 0.2). For CFDs on indices, FXTM charges a commission of $35 per million nominal value, along with spread costs (for instance, the S&P 500 CFD spread is 1.0). Withdrawal fees vary depending on the client's country of residence, the withdrawal method used, and the currency involved, with specific fees differing based on individual circumstances.

Trading Platforms

FXTM provides the MetaTrader 4 (MT4) mobile trading platform, which is available for both iOS and Android devices, offering a convenient mobile trading experience. Particularly notable is its design and user-friendliness, with all features easily accessible. The login process is simple and quick, requiring only one step, and the two-factor authentication (2FA) feature offers enhanced security, which should be a priority for any company to implement in order to bolster account safety.

In terms of features and design, FXTMs MetaTrader 4 mobile platform is almost identical to the desktop version, with the main difference being that the desktop platform allows users to set price alerts. This consistency across platforms ensures a seamless trading experience, whether on desktop or mobile.

Product Selection

FXTM offers a range of products including forex and CFDs, with non-EU clients also able to trade real stocks. These products sufficiently cover the primary investment needs of most individual investors, providing flexible investment choices suited to various types of traders. If you wish to explore the reliability of a specific broker, you can visit our website (https://www.WikiFX.com/en) for more information, or download the WikiFX app to find a broker you can trust, ensuring your trading experience remains safe and reliable.

Read more

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

Before trusting any forex broker, checking if it's legitimate isn't just a good idea – it's the most important step to protect yourself. The excitement of financial markets can make people forget about safety, but a broker's regulatory status is the foundation that keeps traders safe. This article gives you a thorough, fact-based investigation into the UPFOREX Regulation status for 2026. Our research uses publicly available information, mainly from WikiFX (a global broker checking platform), to give you an objective and honest view.

Is UPFOREX a Real Company? Checking If This Trading Platform Can be Trusted

The question "Is UPFOREX legit?" isn't just something people ask casually - it's about finding safety and security. For anyone who trades online, the biggest fear is exposing capital to a fake company. You've probably heard about UPFOREX, looked at what it offers, and felt unsure about it. This feeling makes sense and shows you're smart. In this detailed investigation, we'll look past fancy marketing and personal opinions. We'll do a careful, fact-based study using public information about regulations to give you a clear answer. Our goal is to give you the facts you need to make a safe choice. To save your time and answer your main question right away, our conclusion is clear from the start: Our research shows that UPFOREX works without any proper financial rules for forex trading and shows many warning signs that are typical of risky, untrustworthy brokers. The evidence shows an unacceptably high level of risk for any trader thinking about using this platform.

WikiFX Officially Launches the “Every Review Counts” Broker Review Initiative!

In forex trading, what truly determines risk is often not market volatility itself, but whether information is authentic, transparent, and fully visible.

Zenstox Scam Alert: Offshore Forex Fraud Exposed

Zenstox scam alert: offshore regulation, blocked withdrawals, fake profits, high fees, and weak oversight by the Seychelles FSA. Protect funds—read the exposure review now.

WikiFX Broker

Latest News

$128M Crypto Scam: Chinese Suspect Nabbed in Thailand

Is AssetsFX Safe or Scam: Looking at Real User Feedback and Complaints

FIBOGroup Critical Withdrawal Scam Exposed

Institutional Players Pivot to Physical Gold: CMC Markets Eyes Singapore Expansion Amid Macro Uncertainty

Prop Trading Industry Pivots to Futures to Secure US Market Access

GODO Legitimacy Check: Addressing Fears - Is This a Fake Broker or a Legitimate Trading Partner?

Fintech Partnership Targets "False Positive" Crisis in Market Surveillance

The Trading Pit Launches Regulated Brokerage Unit 'TTP Markets' in Strategic Pivot

CME Group Moves to 24/7 Trading for Digital Asset Derivatives

Trump Defies Supreme Court with 15% Global Tariff; Record Retail Flows Buffer Market Impact

Rate Calc