Why a Broker’s Customer Service Matters More Than You Think

Abstract:Many traders focus on regulation when choosing a broker. While this is important, it is not enough. A broker's customer service can be just as vital. If you cannot reach support when you need help, it could lead to problems.

Many traders focus on regulation when choosing a broker. While this is important, it is not enough. A broker's customer service can be just as vital. If you cannot reach support when you need help, it could lead to problems.

Responsive customer service is not just a bonus; it is a sign of reliability. A broker that answers questions quickly shows they care about their clients. They help resolve issues like login errors, deposit delays, or sudden changes in trading conditions. On the other hand, brokers that fail to respond on time can leave traders stuck. This affects not just their trading performance but also their peace of mind.

Poor customer service can also violate traders rights. When issues are ignored, traders lose time and money. For example, if a trade gets stuck due to a technical glitch, every second counts. If the broker does not act fast, the trader may face losses. Over time, this could ruin their trading account.

Many traders underestimate this risk. They think regulation is the only thing that matters. But even regulated brokers can have slow or unhelpful support. This is why traders must do more research before choosing a broker.

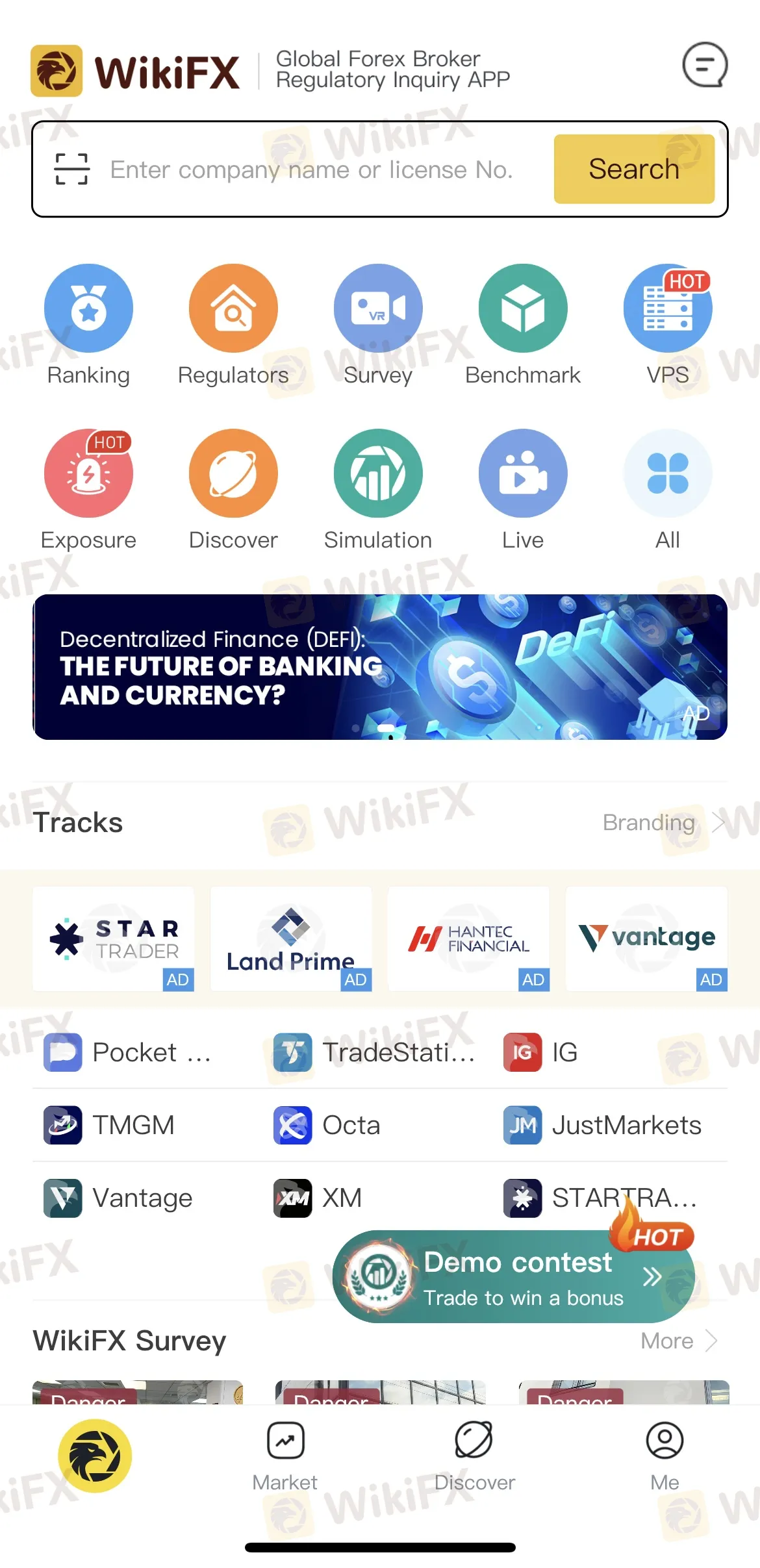

One of the easiest ways to check a brokers reliability is by using the free WikiFX mobile app. This app provides detailed reviews and ratings of brokers. It also shows whether a broker is regulated. More importantly, traders can see feedback from other users about customer service. This information helps traders make a better decision, at no cost.

Choosing a broker is a big step. Traders should not rush this process. A reliable broker with good support can make a huge difference. They can protect traders from unnecessary risks and help them perform better.

In conclusion, dont ignore customer service when picking a broker. A lack of support can lead to problems and even losses. Take the time to research brokers carefully. Use tools like WikiFX to check reviews and ratings. This simple step can save you a lot of trouble.

Read more

Why You Shouldn't Be Afraid to Trust Your Capital to Regulated Brokers

Discover why regulated brokers offer safety for your capital with oversight, security, and transparency, plus the risks of unregulated options. Invest with confidence.

PrimeXBT Expands with Stock CFDs for Major Global Companies

PrimeXBT introduces stock CFDs, allowing trading of major US stocks like Amazon, Tesla, and MicroStrategy with crypto or fiat margin options.

Prop Trading Firms vs. CFD Brokers: Who’s Winning the Retail Trading Race?

In recent years, a new breed of retailer-focused trading firms has emerged: proprietary (prop) trading outfits that recruit individual traders to trade the firm’s capital under structured rules. Boasting low entry costs, clear risk parameters, and profit-sharing incentives, these prop firms are rapidly winning over retail traders, many of whom previously traded Contracts for Difference (CFDs) with established online brokers. As prop trading revenues accelerate, a key question arises: Are CFD brokers losing business to prop firms?

Another ‘Tan Sri’ Targeted, RM347 Million in Assets Seized in MBI Scam

Malaysia’s police are stepping up their investigation into the MBI investment scam, a multi-billion ringgit fraud that has dragged on for nearly a decade. The Royal Malaysian Police (PDRM) is now planning to arrest another prominent figure with the title ‘Tan Sri’, following recent arrests and major asset seizures.

WikiFX Broker

Latest News

Germany’s April PMI Falls Below 50 as Service Sector Stumbles

PayPal Opens Regional Hub in Dubai, Expands Middle East Reach

FINRA fines SpeedRoute for alleged rule violations

RM15,000 Profit Turned into RM1.1 Million Loss for Engineer!

New to FX Trading? Stop! Read These Warnings First

Prop Trading Firms vs. CFD Brokers: Who’s Winning the Retail Trading Race?

TRADE.com UK Sold to NAGA Group Amid 2024 Revenue Drop

Why Binance Tightens Crypto Transfer Rules for South Africans?

Coinbase Eyes U.S. Federal Bank Charter for Crypto Growth

Why People Fall for Online Trading Scams

Rate Calc