【MACRO Insight】Will the Fed's delicate balance be broken? The tug of war between interest rate adjus

Abstract:On the global financial stage, the U.S. monetary policy and financing market dynamics are a barometer of the global economy and play a vital role in the stability and predictability of global financia

On the global financial stage, the U.S. monetary policy and financing market dynamics are a barometer of the global economy and play a vital role in the stability and predictability of global financial markets. As 2024 draws to a close and 2025 approaches, market participants are nervously watching key interest rate changes in the U.S. overnight financing market and how the Federal Reserve can maintain the consistency and independence of its policies amid the uncertainty of the new administration's policies. These changes not only foreshadow the short-term direction of the U.S. economy, but may also have a profound impact on the global economy.

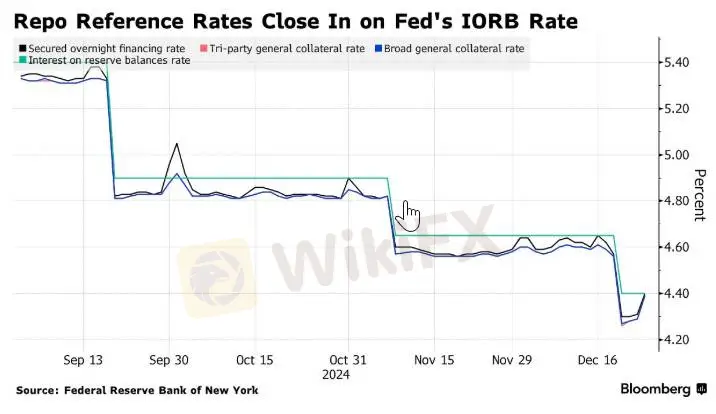

After the Federal Reserve adjusted the reverse repurchase rate last week to keep the US funding market running smoothly, the rise in key interest rates has attracted widespread attention from the market. Data released by the New York Federal Reserve on Thursday showed that the secured overnight financing rate (SOFR) jumped from 4.31% to 4.40%, in line with the reserve requirement ratio, reflecting that banks' end-of-year constraints on their balance sheets began to push up overnight funding costs. As an important indicator of the US short-term lending market, SOFR's changes not only affect the pricing of financial products, but also have a profound impact on global monetary policy and capital flows.

Meanwhile, the Tri-Party General Collateral Repo Rate (TGCR) and the Broad General Collateral Rate (BGCR) also jumped from 4.29% to 4.39%. The rise in these rates comes at a critical time at the end of the year, when Wall Street is closely watching for signs of market volatility, especially outside of the end of the month and quarter. Banks support their balance sheets by curbing repo activity during these periods, and Fed officials last week cut the rate on the overnight reverse repurchase agreement facility (RRP) by 5 basis points. The new RRP rate is 4.25%, in line with the lower limit of the federal funds rate target range, designed to help keep funding markets functioning smoothly.

In this context, the Fed's policy moves are particularly important. Nick Timiraos, a reporter for the Wall Street Journal who is known as the "Fed's mouthpiece," pointed out that the Fed is trying to balance avoiding confrontation with President-elect Trump while dealing with potential inflationary pressures from his policies. Fed Chairman Powell made it clear in early November that the Fed would not set interest rates based on assumptions or speculation about the incoming administration's policies, including potential changes in trade and immigration policies.

However, the Fed's interest rate policy needs to be "forward-looking," taking into account forecasts of future price pressures and employment conditions. Last week, the Fed cut interest rates by 25 basis points, bringing the policy rate down a full 100 basis points since September. The new forecasts show officials expect fewer rate cuts next year, in part because they expect price pressures to be more stubborn than previously expected. The forecast echoes the inflationary pressures that could come from Trump's policies, including threats to raise or impose new tariffs and tighten immigration rules, which could boost prices and wages in the short term.

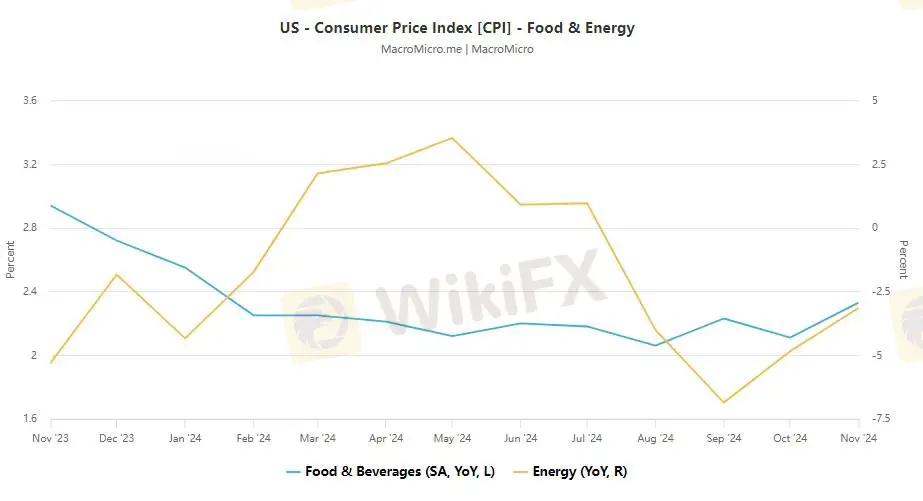

Fed officials expect inflation excluding food and energy items to fall to 2.5% next year, from a previous forecast of 2.2%. The forecast shows that the Fed's concerns about inflation are rising. Trump's advisers have argued that deregulation and measures to promote energy production can offset the impact of rising commodity prices, allowing inflation to continue to fall. But Fed officials' forecasts and the market's reaction show that they are cautious about this possibility.

Against this backdrop, the Fed‘s policy challenge is to balance current interest rate policy with possible future policy changes. Powell stressed that the Fed’s inflation forecast for this year is “a bit broken,” which may be the biggest factor affecting policy decisions. Fed officials need to be careful in their public comments not to directly link possible policy changes from the White House to the Fed‘s response in order to maintain the Fed’s image as apolitical and calmly analytical.

In summary, the rise in key interest rates in the US funding market is closely tied to the Fed's policy outlook. The Fed is walking a tightrope between maintaining market stability and responding to potential inflationary pressures while avoiding confrontation with the new administration. The market remains alert to further signs of volatility, considering how long the central bank can continue to shrink its balance sheet. The Fed's policy decisions will have a profound impact on the US and global economies, and investors need to pay close attention to the Fed's policy trends to grasp market dynamics and make wise investment decisions.

WikiFX Broker

Latest News

ZarVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

The Warsh Dilemma: Why the New Fed Nominee Puts Fiscal Plans at Risk

Eurozone Economy Stalls as Demand Evaporates

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Nigeria Outlook: FX Stability Critical to Growth as Fiscal Revenue Surges

AUD/JPY Divergence: Aussie Service Boom Contrasts with Japan's Fiscal "Truss Moment"

ZarVista Regulatory Status: A Deep Look into Licenses and High-Risk Warnings

KODDPA Review: Safety, Regulation & Forex Trading Details

Rate Calc