【MACRO Alert】U.S. November CPI data in line with expectations, paving the way for the Fed to cut int

Abstract:The latest US Consumer Price Index (CPI) report for November showed that inflation did not exceed market expectations, which provided support for the Federal Reserve to cut interest rates by 25 basis

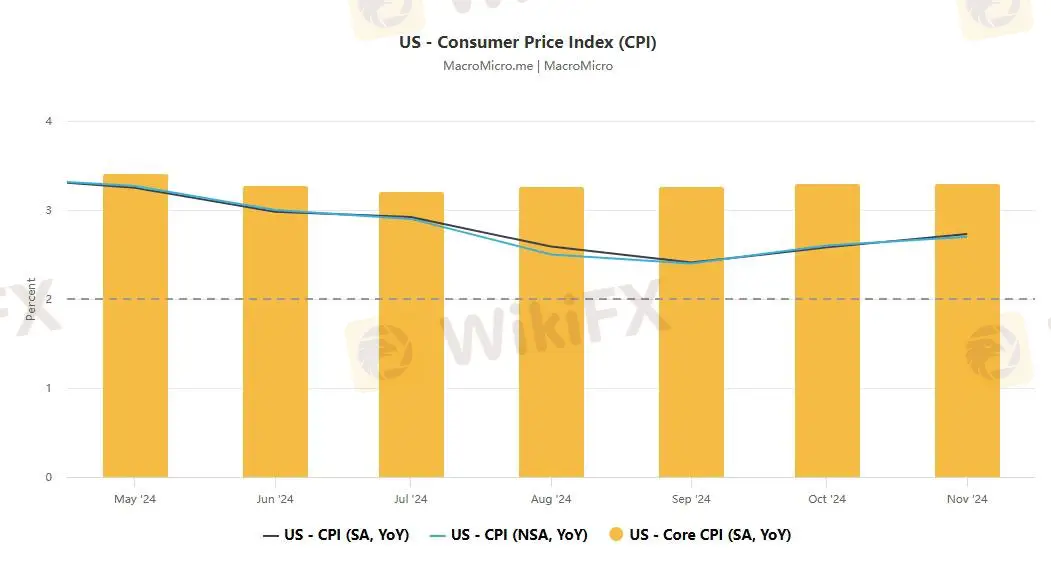

The latest US Consumer Price Index (CPI) report for November showed that inflation did not exceed market expectations, which provided support for the Federal Reserve to cut interest rates by 25 basis points at the upcoming meeting. The November CPI data showed that the core CPI annual rate remained stable at 3.3% for the third consecutive month, with a monthly increase of 0.3%, in line with market expectations. The overall CPI annual rate rose to 2.7%, with a monthly increase of 0.3%, both in line with expectations, showing the continuity of the inflation trend.

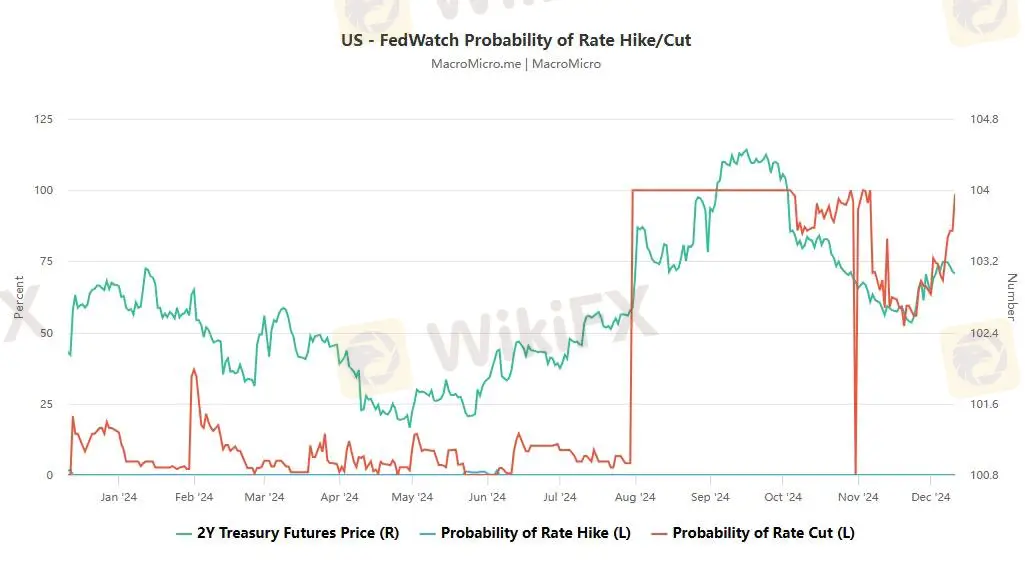

After the release of the CPI data, market participants' expectations for the Fed's December rate cut further strengthened. Both the US dollar index and spot gold prices experienced short-term fluctuations, with the US dollar index fluctuating by 20 points in the short term. Spot gold rose by $5 in the short term. This reflects the market's sensitivity to expectations of rate cuts. Swap traders expect the Fed to cut interest rates by a total of 87 basis points by the end of 2025, including the expected 25 basis point rate cut next week and two possible rate cuts in 2025.

In the details of the CPI data, housing inflation slowed to 0.3% month-on-month, and owner equivalent rent (OER) rose 0.2% month-on-month, which may indicate that the anti-inflation trend in the housing sector is coming. However, this also means that inflationary pressure in the super core service industry still exists. Analysts pointed out that the current CPI data is unlikely to change the market's view on the economic outlook, but the mild performance of inflation data provides support for the Fed's decision to cut interest rates next week.

The consensus is that the Fed will cut interest rates by 25 basis points next week, its third this year. However, there is uncertainty in the market about the path of rate cuts through 2025 due to the stickiness of inflation. The Fed is trying to balance maintaining inflation close to 2% and a healthy labor market. With interest rates approaching a "neutral" level, officials have discussed the possibility of slowing the pace of rate cuts to avoid cutting rates too quickly and causing inflation to exceed the target or a sharp rise in unemployment.

Although U.S. inflation has retreated from its peak in mid-2022, it remains above the Fed's 2% target. Policymakers have expressed frustration with the stickiness of inflation and hinted that the pace of rate cuts may need to be adjusted if progress is slow. Goldman Sachs analyst Whitney Watson believes that the CPI data paves the way for a rate cut next week and expects the Fed to continue to gradually ease monetary policy in the new year.

Pepperstone analyst Michael Brown also believes that the CPI data will not prevent the Federal Reserve from cutting interest rates by 25 basis points next Wednesday, but he expressed concerns about inflation risks next year, especially considering the upside risks of inflation that may arise from the tariff plans of incoming President Trump.

Investors generally expect the Fed to cut interest rates by 25 basis points next week, but are cautious about the number of rate cuts in 2025. Former Cleveland Fed President Loretta Mester said the Fed can safely make a December rate cut, but needs to reconsider the pace of rate cuts next year because inflation progress seems to have stalled. The Fed started its rate cut cycle three months ago, and next week's rate cut will be the third this year, lowering the federal funds rate to a range of 4.25% to 4.5%.

Conrad DeQuadros, senior economic adviser at Brean Capital LLC, said the Fed's path to future rate cuts will be more gradual. According to the pricing of federal funds futures, investors expect the Fed to cut interest rates in December and two or three more times next year. Julia Coronado, founder of MacroPolicy Perspectives and a former Fed economist, also believes that the Fed's easing pace may be slower.

Data released by the Bureau of Labor Statistics in November showed that core CPI inflation rose 0.3% month-on-month for the fourth consecutive month and rose 3.3% year-on-year. Housing costs cooled, but commodity prices excluding food and energy rose 0.3%, the largest increase since May 2023. Traders have raised the probability of a Fed rate cut next week to about 90%.

James Athey, portfolio manager at Marlborough Investment Management, said the December rate cut decision seemed certain and the Fed did not like to surprise the market. Short-term U.S. Treasuries initially rose sharply after the data was released, but then gave up some of their gains. Stronger inflation data may also raise questions about whether the neutral interest rate is higher, which will affect the Fed's rate cut decision.

WikiFX Broker

Latest News

ECB Minutes: Service Inflation and Wage Spikes Kill Rate Cut Speculation

Trade War Averted: Euro Rallies as US Withdraws Tariff Threats

Yen Volatility Spikes: PM Takaichi Calls Snap Election Amid BoJ 'Hawkish Pause'

Sticky US Inflation Data Dashes Near-Term Fed Rate Cut Hopes

Yen Fragility Persists: Inflation Miss Cements BoJ 'Hold' Expectation

BoJ "Politically Paralyzed" at 0.75% as Takaichi Calls Snap Election

'Bond Vigilantes' Return: JGB Rout Sparks Contagion Fears for US Treasuries

ZarVista User Reputation: Looking at Real User Reviews to Check Is ZarVista Safe or Scam?

Gold Fun Corporation Ltd Review 2025: Is This Forex Broker Safe?

MONAXA Review: Safety, Regulation & Forex Trading Details

Rate Calc