Malaysian Trader Loses Over RM1.6 Million in Investment Scam via WeChat

Abstract:A 56-year-old trader from Gombak, Malaysia, recently lost more than RM1.6 million in a sophisticated online investment scam orchestrated through the popular messaging application, WeChat.

A 56-year-old trader from Gombak, Malaysia, recently lost more than RM1.6 million in a sophisticated online investment scam orchestrated through the popular messaging application, WeChat. Selangor police chief Datuk Hussein Omar Khan confirmed the case, which involved a fraudulent investment app that exploited the victim's trust and led to substantial financial losses.

The investigation revealed that the trader was first approached by the suspect via WeChat, where they convinced him to download an investment app linked to a supposed online trading platform. The trader was then encouraged to deposit funds into this platform. Shortly after transferring the funds, the app showed that his investment was generating profits. This initial success appeared promising, strengthening the victim's trust in the platform and motivating further engagement.

However, complications began when the trader attempted to withdraw his alleged profits. The app cited various administrative fees and taxes as obstacles to the withdrawal. Among the reasons provided were so-called “cross-border transfer fees” and additional tax requirements, which the suspect claimed were necessary for the withdrawal process. According to the police report, these excuses compelled the victim to make further payments in an attempt to retrieve his funds.

Over time, the trader made a total of 44 transactions, transferring RM1,688,725 across four separate accounts associated with the fraudulent platform. Only after his continued efforts to withdraw funds remained unsuccessful did he realise that the promised profits were a sham. The trader then filed a report with the Selangor Police on November 9, prompting an official investigation into the case.

In response to the incident, Selangor's Commercial Crime Investigation Department opened an investigation under Section 420 of the Penal Code, which addresses cheating and dishonestly inducing the delivery of property. This case has sparked concerns among the authorities, leading them to urge the public to exercise caution when engaging in online investment schemes.

The police chief highlighted the importance of verifying the legitimacy of investment platforms before transferring funds, advising individuals to consult Malaysias central bank, Bank Negara Malaysia, and the Securities Commission Malaysia to authenticate the credentials of stock investments. He emphasised that scams exploiting digital platforms have become increasingly sophisticated, making it essential for investors to conduct thorough checks before committing to any investment apps.

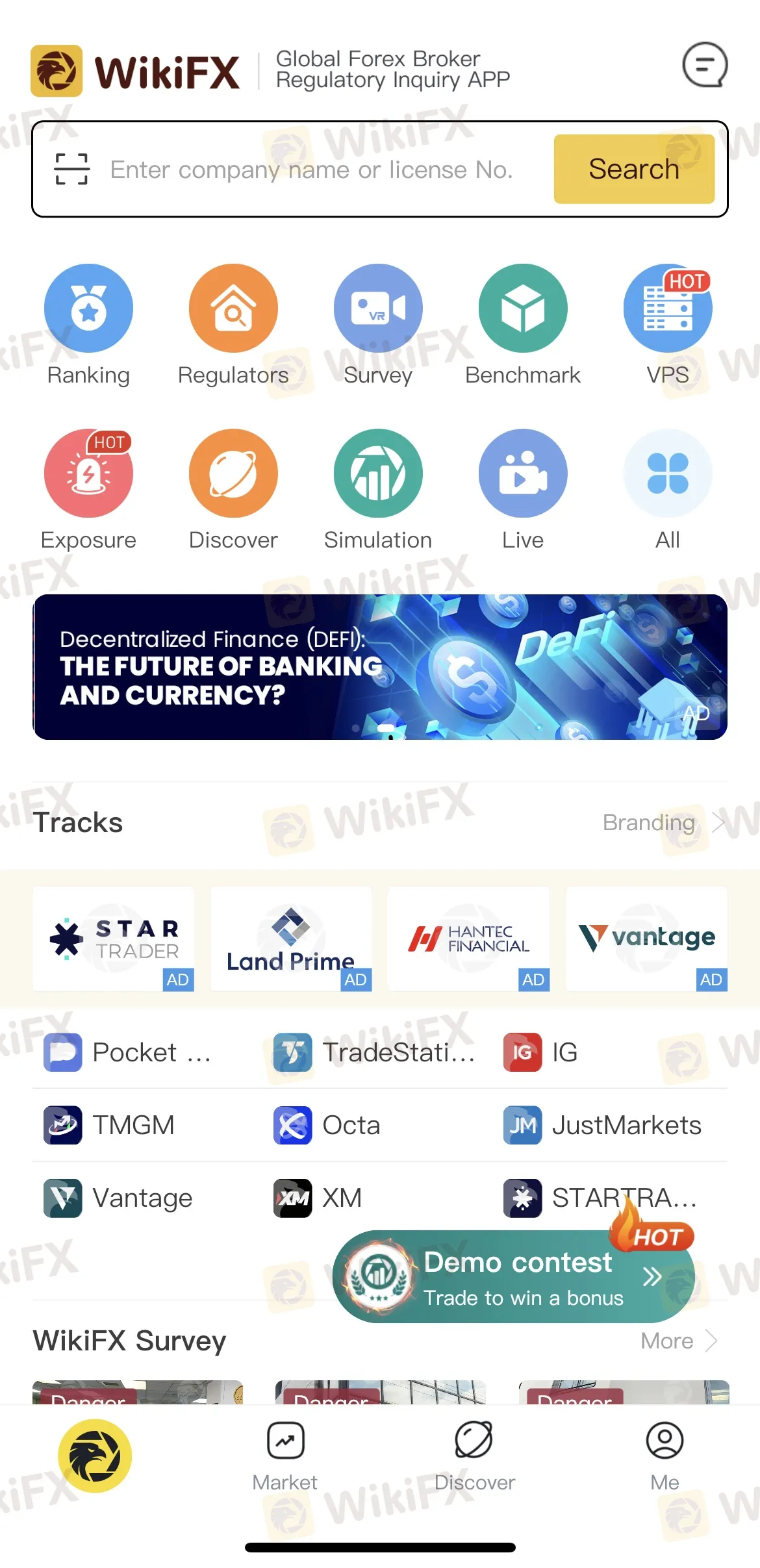

To prevent falling victim to fraudulent schemes like this one, using tools like WikiFX can be a game-changer. WikiFX provides detailed information on brokers, including regulatory status, customer reviews, and safety ratings, allowing users to verify the legitimacy of any investment platform before committing their money. With access to in-depth insights and risk alerts, WikiFX equips potential investors with the resources to make informed decisions and avoid unauthorised or unlicensed entities. By checking with WikiFX, users can confidently protect their savings and avoid the costly traps set by unscrupulous investment syndicates.

Read more

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Is your trading experience with MYFX markets full of fund withdrawal denials despite repeated communications with its customer support team? Has the broker deleted all your profits? Did the broker accuse you of false trading strategy implementation while deleting your profits? There have been many such instances reported by traders against these activities online. In this MYFX Markets review article, we have shared some complaints. Take a look!

Exfor Exposure: Investigating Alleged Withdrawal Denials, Illegitimate Account Closure & More

Exfor, a Malaysia-based forex broker, has allegedly been the centre of attention for all the wrong reasons. These include long-pending withdrawal denials, no communication or assistance from the broker’s customer support team, manipulated pricing upon a withdrawal request by the trader, and account blowups due to bonus-related issues. It’s the traders who allegedly bear the brunt of all these suspicious trading activities. A lot of them have criticized it on broker review platforms. We have highlighted some of their complaints in this Exfor review article. Take a look!

Understanding Xlibre's Regulation: What You Need to Know About Its License and Risk Level

When choosing a broker, the most important question is: "Is my broker properly regulated and is my capital safe?" For Xlibre, the answer is straightforward but worrying. Based on detailed research from independent global regulatory checking platforms, Xlibre is not regulated by any major financial authority. This article looks at the main issues around Xlibre Regulation status, or more correctly, the lack of it. We will examine the truth behind the claimed Xlibre License and explain why its business setup has high-risk warning signs such as a "Suspicious Regulatory License" and very low trust scores from auditors. The goal of this research is to give a clear, fact-based analysis of Xlibre's company registration, its claims, and the real risks these create for traders' capital. While this article provides a detailed analysis, regulations can change. Traders should always check the most current information before working with any broker. You can find the detailed verification report for

Is Xlibre Legit? A Complete Investigation into Scam Claims and Warning Signs

Let's answer the main question right away: Is Xlibre a safe and trustworthy broker for traders? After carefully reviewing how it operates and checking its legal status, our answer is a clear no. We strongly advise against using Xlibre for trading. Our research shows that this company operates without proper financial oversight, has multiple serious warning signs, and faces complaints from users who claim the company has acted dishonestly with their funds. This decision isn't based on personal opinions but on facts we can verify. We used information from global broker research platforms such as WikiFX. These services help protect traders by collecting information about regulations, user experiences, and expert reviews in an easy-to-understand format. Before you invest in any broker, you should always check its status on one of these platforms. You can see all the information about Xlibre yourself on the Xlibre WikiFX page.

WikiFX Broker

Latest News

Oil War Shock: Diesel Futures Surge 34% as White House Pledges Military Escort for Tankers

Energy Crisis Deepens: Hormuz Blockade Risks Physical Supply Shock

Middle East conflict poses fresh test to central banks as oil shock fuels inflation

Nigeria: Tinubu Overhauls Fiscal Team Amid Fuel Price Hike and Inflationary Pressures

WikiFX Invitation Rewards Program

Mentari Mulia Review : Is This BAPPEBTI-Regulated Indonesian Forex Broker Right for You?

OANDA to Transfer Prop Trading Business to FTMO Platform

Global Divergence: Eurozone Inflation Fears vs. China's "Value" Play

ECB Watch: Energy Shock Won't Derail Policy Path, Says Nomura

Geopolitical Shock: Reports of Iranian Drone Strike on U.S. Embassy in Riyadh

Rate Calc