WikiFX Broker Assessment Series | Decode Global: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of Decode Global, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platforms, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Registered in Vanuatu, Decode Global Limited (Decode Global) is an online brokerage specializing in the trading of exchange-based contracts for difference (CFDs). Known for its focus on delivering competitive spreads, Decode Global aims to provide traders with a cost-effective platform tailored to meet the demands of todays dynamic markets.

Decode Global provides a diverse range of over 100 tradable assets, covering currency pairs, global indices, and commodities.

It is important to note that, at present, Decode Global does not extend its services to the United States, Australia, Canada, New Zealand, and North Korea.

Types of Accounts:

Decode Global offers two account options: the STD Account and the Pro Account. Please refer to the attached image below for more detailed information on each corresponding account.

Deposits and Withdrawals:

Decode Global offers several payment options for traders, including wire transfers, cryptocurrency (USDT), and UnionPay. The minimum deposit required for Decode Global is $100.

While Decode Global states that it does not impose any commissions or fees for deposits and withdrawals, it is important to note that any fees charged by third-party providers will be the responsibility of the trading client.

The timeframe for funds to reflect in the account depends on the chosen deposit or withdrawal method.

Trading Platforms:

Decode Global provides two trading platforms:

- The MetaTrader 4 (MT4) trading platform, available on PC, mobile, and web, is widely used in the industry. MetaTrader 4 is an advanced trading platform offering a comprehensive suite of features and tools for precise trading analysis. With one-click trading, quick order execution, VPS hosting, and up to four pending order types along with trailing stops, it provides a highly customizable interface with thousands of online tools to plug in. The platform supports fully customizable and in-depth charts, in-depth trading history, and allows users to build or import Expert Advisors (EAs), enabling the automation of trading strategies.

- The MetaTrader 5 (MT5) trading platform, available on PC, mobile, and web, renowned for its technological sophistication, provides access to a depth of market and various advanced solutions. It offers features such as buy and sell flexibility with six types of pending orders, 38 technical indicators, 44 analytical objects, and 21 timeframes, providing a customizable platform with numerous online tools for integration. Quick order execution, an economic calendar for tracking global macro-economic news, one-click trading, mobile trading capabilities, and an intuitive market search and grouping functionality contribute to the platform's comprehensive and user-friendly trading experience.

Research and Education:

Decode Global provides a “Market Info” page featuring a series of educational posts in text format about the financial markets.

Customer Service:

Decode Global provides customer service support in multiple languages, including English, Chinese, Vietnamese, and Thai. Clients can reach out to Decode Global through email at support-cn@decodefx.com or by submitting an inquiry via the broker's question form. Additionally, trading clients have the option to contact the broker by phone at +678 23043.

Conclusion:

To summarize, here's WikiFX's final verdict:

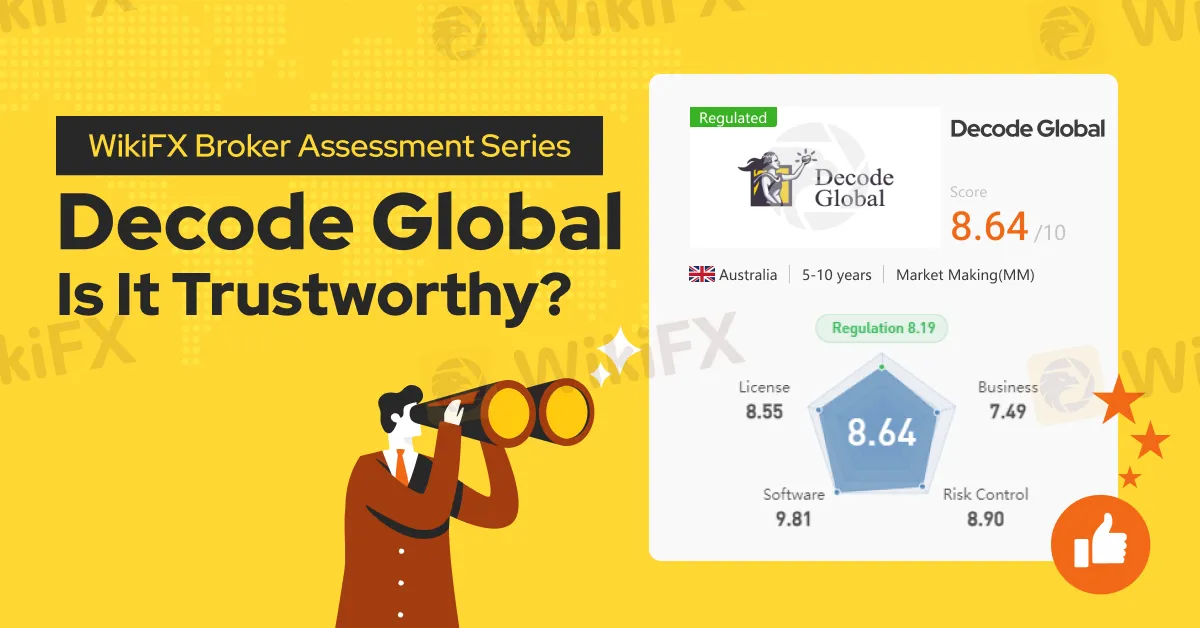

WikiFX, a global forex broker regulatory platform, has assigned Decode Global a WikiScore of 8.64 out of 10.

Upon examining Decode Global‘s licenses, WikiFX found that the broker is regulated by the Australian Securities and Investment Commission (ASIC) and the Vanuatu’s Financial Services Commission (VFSC). WikiFX has also validated the legitimacy of the said licenses.

Read more

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Is your trading experience with MYFX markets full of fund withdrawal denials despite repeated communications with its customer support team? Has the broker deleted all your profits? Did the broker accuse you of false trading strategy implementation while deleting your profits? There have been many such instances reported by traders against these activities online. In this MYFX Markets review article, we have shared some complaints. Take a look!

Exfor Exposure: Investigating Alleged Withdrawal Denials, Illegitimate Account Closure & More

Exfor, a Malaysia-based forex broker, has allegedly been the centre of attention for all the wrong reasons. These include long-pending withdrawal denials, no communication or assistance from the broker’s customer support team, manipulated pricing upon a withdrawal request by the trader, and account blowups due to bonus-related issues. It’s the traders who allegedly bear the brunt of all these suspicious trading activities. A lot of them have criticized it on broker review platforms. We have highlighted some of their complaints in this Exfor review article. Take a look!

Axiory Exposed: Low WikiFX Score & Trader Complaints!

Axiory WikiFX score 1.5: Active Belize FSC license (no FX authorization), multiple complaints. Reports show withdrawal/support issues. Traders beware.

RCG Markets Exposed: License Verification & Trader Complaints

RCG Markets holds a valid FSCA license. Reports show withdrawal rejections & stop‑loss issues. Traders urged to verify details and exercise caution.

WikiFX Broker

Latest News

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Is Tradier a trustworthy broker? A Tradier review and licensing overview based on WikiFX data.

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

Evest Broker Review: Regulated, but Complaints Persist

Rate Calc