【Macro Review 】 New dynamics in the gold market - dual drivers of central bank demand and speculati

Abstract:Central bank demand has been a key factor behind the precious metals unprecedented rally this year. However, an important question remains: who is buying all this gold? While most central bank gold pu

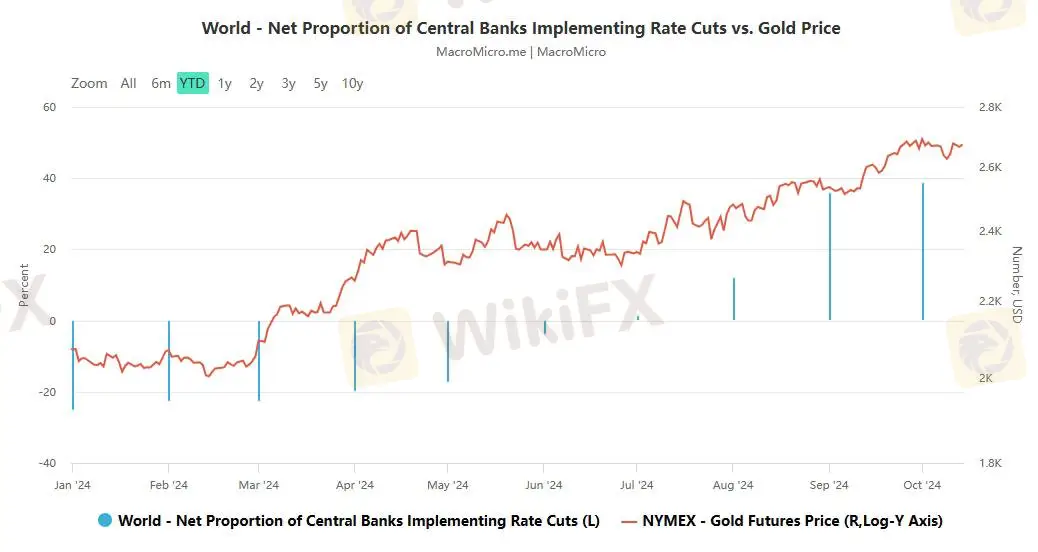

Central bank demand has been a key factor behind the precious metal's unprecedented rally this year. However, an important question remains: who is buying all this gold? While most central bank gold purchases are reported to the International Monetary Fund, a large portion remains undeclared. In the second quarter, the World Gold Council said that 67% of central banks' estimated gold purchases were unreported. In the first half of this year, central banks bought a record 483 tons of gold. Analysts speculate that Saudi Arabia has hoarded about 160 tons of gold since 2022.

Saudi Arabia's gold imports are sensitive to price increases. In the past, when gold prices rebounded, the country's gold imports would drop sharply, and even gold exports would increase. However, since 2022, Saudi Arabia's gold imports have been rising steadily. He analyzed that since the West froze Russia's dollar assets in February 2022, countries that have diplomatic differences with the West have increasingly exchanged dollars for physical gold. Following China and Thailand, Saudi Arabia's cross-border trade statistics also show that the country has transformed from a country sensitive to gold prices to a driver of gold prices.

That said, Saudi Arabia and the United States have a very long-standing diplomatic relationship. Therefore, it is difficult for it to break this relationship overnight, but it must do so gradually. Of course, Saudi Arabia still invests a lot of its surplus in US Treasuries, but it also buys a small amount of gold. And it is not unprecedented for central banks to keep their gold purchases secret. The last time the Saudi Monetary Authority updated its official gold reserves was in February 2008. At that time, its reserves increased by 180 tons to 332 tons. Obviously, the Saudi central bank is not buying 180 tons in one month.

China is another country known for its secretive gold hoarding. In April 2009, the People's Bank of China announced that it had purchased 454 tons of gold over a six-year period. In 2015, the central bank said it had purchased 604 tons of gold over a three-year period. Although China paused its gold purchases earlier this year, many analysts speculate that it has continued to quietly buy. While it is true that the U.S. dollar has faced increasing competition as the world's reserve currency in recent years, it is not surprising that Saudi Arabia has been secretive about its gold reserves, as there is a lot of uncertainty about the economy. He also noted that there has been a lot of speculation surrounding the potential development of a common currency by the BRICS countries, but that this is unlikely to happen anytime soon.

At the market level, analysts say that speculative positions in gold are only about one-third of their historical potential. Nicky Shiels, head of research and metal strategy at MKS PAMP, pointed out in the latest report that even at a record high, the gold market still faces the challenge of a triple top, because in the past 30 years, the gold market has only achieved a 30% annual increase three times: the first was in 2007, when gold prices rose 31%; the second was in 2010, when gold prices rose 30%; the third was this year. Although gold reached the 30% milestone in September, gold prices have been sluggish in recent weeks as the market quickly changed its expectations for the Federal Reserve to continue to cut interest rates sharply.

While OTC demand remains an unknown factor, there are growing signs in known markets that gold prices will consolidate further in the short term as long-term bullish support exists. She noted that the market's speculative positioning is only about one-third of its historical potential. It is reported that COT and ETFs currently own 108 million ounces of gold, which is lower than the past price peak; compared with the past price peak, the current holdings are 5 million ounces less, which is mainly due to the lack of ETF holdings rather than the lack of short-term funds/COT holdings. Year-to-date, investors have added 9.3 million ounces, which is about 11.2 million ounces on an annualized basis. These inflows are comparable to the inflows in 2020, but far less than the huge annual inflows of 38 million ounces in 2019 and 33 million ounces in 2009.

The average investor is woefully under-positioned in gold given that there is still plenty of liquidity in the system in an easing cycle. Continuing to buy the dips in this environment may be a strategy . Meanwhile, central bank demand continues to support gold prices, despite a slowdown in official purchases in the second half of this year. But overall, the slower pace of central bank purchases in 2024 isn't enough to panic the market, but it's enough to keep gold around $2,600 since August. From a broader perspective, the gold trade is far from crowded, which means that gold prices are far from peaking.

WikiFX Broker

Latest News

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

FX SmartBull Regulation: Understanding Their Licenses and Company Information

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

Neptune Securities Exposure: Real Forex Scam Warnings

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

Rate Calc