WikiFX Broker Assessment Series | GFS: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of GFS, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2013, Global Femic Services Limited (GFS) operates as an online brokerage specializing in the trading of CFDs, distinguishing itself through a commitment to offering competitive spreads. GFS is headquartered in Hong Kong, with a subsidiary, Global Femic Services Pty Ltd, registered in Adelaide, Australia.

GFS provides a diverse range of tradable assets, including currency pairs, share CFDs, commodities, global indices, and more.

Meanwhile, GFS offers an Introducing Broker (IB) program and an affiliate program, allowing individuals and businesses to earn commissions by referring new clients to the company.

It is important to note that, at present, GFS does not extend its services to the United States, Belgium, and North Korea.

Types of Accounts:

GFS does not specify the types of accounts it offers on its official website. Therefore, it can be concluded that GFS provides only one account type, with spreads as low as 0.0 pips, leverage up to 500x, and commissions of $10 per lot, with no withdrawal or deposit requirements.

Deposits and Withdrawals:

GFS accepts bank transfers, credit cards, and debit cards as payment methods. Further details are available only after the client has logged into their trading portal. While GFS states that it does not charge any commissions or fees for deposits and withdrawals, it is important to note that any fees imposed by third-party providers are the responsibility of the trading client.

The company is committed to processing all withdrawal requests within 24 hours on business days.

Trading Platforms:

GFS offers only the MetaTrader 5 (MT5) trading platform, available on PC, mobile, and web. Renowned for its technological sophistication, MT5 provides access to a depth of market and various advanced solutions. It features buy and sell flexibility with six types of pending orders, 80 technical indicators, and 21 timeframes, offering a customizable platform with numerous online tools for integration. Quick order execution, an economic calendar for tracking global macroeconomic news, one-click trading, mobile trading capabilities, and an intuitive market search and grouping functionality all contribute to the platform's comprehensive and user-friendly trading experience.

Research and Education:

No educational resources are found on GFS official website.

Customer Service:

GFS provides customer service support in multiple languages via its live chat messenger service, including English, French, Japanese, Vietnamese, and more.

Clients can reach GFS through email at support@gfs-markets.com or by submitting an inquiry via the broker's online form. Additionally, trading clients have the option to contact GFS by phone at +852 3002 2272.

Conclusion:

To summarize, here's WikiFX's final verdict:

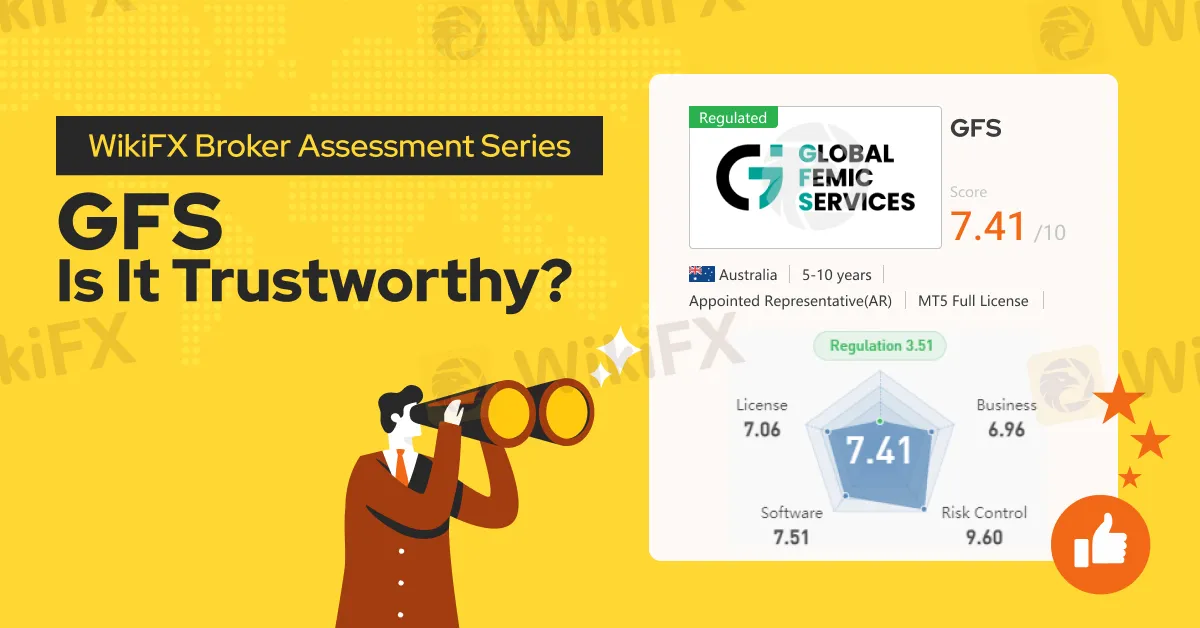

WikiFX, a global forex broker regulatory platform, has assigned GFS a WikiScore of 7.41 out of 10.

Upon examining GFS license, WikiFX found that the broker is regulated by the Australian Securities and Investment Commission (ASIC). WikiFX has also validated the legitimacy of the said license.

Read more

Warning Against Globalmarketsbull & Cryptclubmarket

Are you thinking about investing in Globalmarketsbull or Cryptoclubmarket? Think again! The Financial Conduct Authority (FCA) issued a warning about these two firms. Here are the details of these unlicensed brokers.

Why Even the Highly Educated Fall Victim to Investment Scams?

Understanding why educated individuals fall victim to scams serves as a stark reminder for all traders to remain vigilant, exercise due diligence, and keep emotions firmly in check.

WikiFX Broker Assessment Series | Lirunex: Is It Trustworthy?

In this article, we will conduct a comprehensive examination of Lirunex, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Italy’s CONSOB ordered seven unauthorized investment websites blocked, urging investors to exercise caution to avoid fraud. Learn more about their latest actions.

WikiFX Broker

Latest News

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Broker Review: Is Exnova Legit?

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Rate Calc