【MACRO Insight】Challenges and Opportunities for Japanese Stocks and Exports - Yen Exchange Rate Fluc

Abstract:Following Federal Reserve Chairman Powell's hint at a possible rate cut in September, the yen to US dollar exchange rate briefly surged to a level of 143 yen per US dollar. However, this market enthus

Following Federal Reserve Chairman Powell's hint at a possible rate cut in September, the yen to US dollar exchange rate briefly surged to a level of 143 yen per US dollar. However, this market enthusiasm dissipated quickly, and the yen failed to maintain its appreciation trend, instead experiencing a decline. Market analysis suggests that this phenomenon is directly linked to the fluctuations of the euro.

On August 23rd, at the globally watched Jackson Hole conference, Chairman Powell essentially set the tone for the rate cut in September. This policy preview initially propelled the appreciation of the yen, but as the market sentiment stabilized, the yen to US dollar exchange rate also settled. Nonetheless, there is still potential for the yen to continue appreciating, with the euro's trajectory playing a key role in this process. Fukuya Yukitaka from Japan's Market Risk Advisory expressed doubts about the future direction of the yen exchange rate, questioning whether the current exchange rate fluctuations have reached their peak.

Against the backdrop of the monetary policies of Japan, the US, and Europe, the Federal Reserve is expected to begin cutting rates in September, while the Bank of Japan decided to raise rates at the end of July. Bank of Japan President Haruhiko Kuroda stated that if economic development aligns with the central bank's forecasts, there may be further adjustments to interest rates in the future. Meanwhile, after cutting rates in June, the European Central Bank chose to maintain rates in July, with President Christine Lagarde keeping an open stance on whether to cut rates in September, without making a clear commitment.

The market widely anticipates that the European Central Bank will cut rates in September, an expectation based on the slowdown of wage inflation in the Eurozone. At the Jackson Hole conference, ECB member Olli Rehn mentioned the risks of excessive monetary tightening. In the meantime, the Bank of Japan has not ruled out the possibility of further rate increases, while the Federal Reserve and the European Central Bank are expected to begin cutting rates, which could lead to the yen appreciating relative to other currencies. Data from the US Commodity Futures Trading Commission shows that speculative investors such as hedge funds have increased their long positions in the euro, and if the European Central Bank cuts rates in September, it might trigger a sell-off by speculators.

As the trend of narrowing US-Japan interest rate differentials becomes increasingly apparent, foreign exchange strategists are beginning to favor the yen. After the Bank of Japan raised rates in July and the Federal Reserve signaled a forthcoming rate cut, strategists reassessed the outlook for the yen. Prior to the Bank of Japan's rate cut announcement on July 31st, many strategists warned that the yen might depreciate further. However, in recent weeks, yen observers generally believe that the yen will maintain its recent appreciation trend and may continue to rise within the year.

Federal Reserve Chairman Powell indicated at the Jackson Hole conference that the timing for a rate cut is ripe, while the Bank of Japan mentioned the possibility of further rate hikes in its research reports. Christopher Wong, a foreign exchange strategist at Overseas Chinese Banking Corporation, stated that these events have given them more confidence to lower their USD/JPY expectations. Macquarie Group, one of the most bullish institutions on the yen, has lowered its year-end target for USD/JPY from 142 to 135. The yen's rapid rebound in early July has disrupted many arbitrage trades in the global market and posed risks to the profits of Japanese exporters.

The economic data of the United States and the monetary policy of the Federal Reserve are crucial to the future trend of the yen. After Powell's speech at the Jackson Hole conference, the US dollar was sold off, and the USD/JPY exchange rate fell to 143.45. The market expects the Federal Reserve to cut rates by at least 25 basis points in September, and there is also a possibility of a 50 basis point cut. Following the Jackson Hole conference, the market is devising new exchange rate strategies for the fall, which will see a concentration of monetary policy meetings in Japan, the US, and Europe.

The market widely anticipates that the Bank of Japan will further raise interest rates, but there is disagreement on the specific timing of the rate hike. Stefan Angrick, a senior economist at Moody's Analytics, predicts that the Bank of Japan may raise rates again in October and expects at least one more rate hike in 2025, possibly as early as January. He notes that Japan may continue to experience "jump-style" inflation as the government reduces energy subsidies. Although Japanese Prime Minister Fumio Kishida has promised to continue supporting household utility bills, these measures will not last forever.

Kazuo Momma, Executive Economist at Mizuho Research & Technologies, expects the Bank of Japan to maintain interest rates in October and may raise rates to 0.5% in January and further to 0.75% in July. He believes this will mark the end of the current tightening cycle of Japanese monetary policy. Tokyo's CPI rose 2.6% year-on-year in August, and the core CPI, which excludes fresh food prices, rose 2.4% year-on-year, both higher than market forecasts and the levels seen in July. Despite this, Momma says the motivation for the Bank of Japan to raise rates is not strong enough, as the central bank is monitoring global financial market risks.

With the yen exchange rate exceeding some companies' expectations, the Japanese stock market may face pressure. The recent appreciation of the yen has surpassed the levels anticipated by many companies, which could lead exporters to lower their profit forecasts and hinder the stock market recovery. Analysts predict that the yen to US dollar exchange rate may reach 135 by the end of the year, exceeding the average expectation of 144.77 shown in the latest quarterly Tankan survey of over 9,000 companies by the Bank of Japan. For every one yen increase in the yen to US dollar exchange rate, Japanese companies' profits could decrease by 0.4% to 0.6%. Kohei Onishi, Senior Investment Strategist at Mitsubishi UFJ Morgan Stanley Securities, said that once the yen to US dollar exchange rate reaches 140, some companies may lower their performance guidance.

The performance of the Japanese stock market has lagged behind that of the United States. In August, the S&P 500 index rose by 1.3%, while the Nikkei 225 index fell by 1.9%. Nobuyuki Kashihara, Executive Officer at Marusan Securities, said that concerns about the yen to US dollar exchange rate exceeding 140 are the main reason for the recent gap between US stocks and Japanese stocks. Hiroshi Namioka, Chief Strategist at T&D Asset Management, pointed out that as the yen appreciated rapidly in August, corporate profit forecasts are no longer conservative. Masahiro Ichikawa, Chief Market Strategist at Sumitomo Mitsui DS Asset Management, said that whether concerns about the yen will subside depends on the outlook for a soft landing in the US economy and economic indicators, and the actions of the Federal Reserve will also be closely watched.

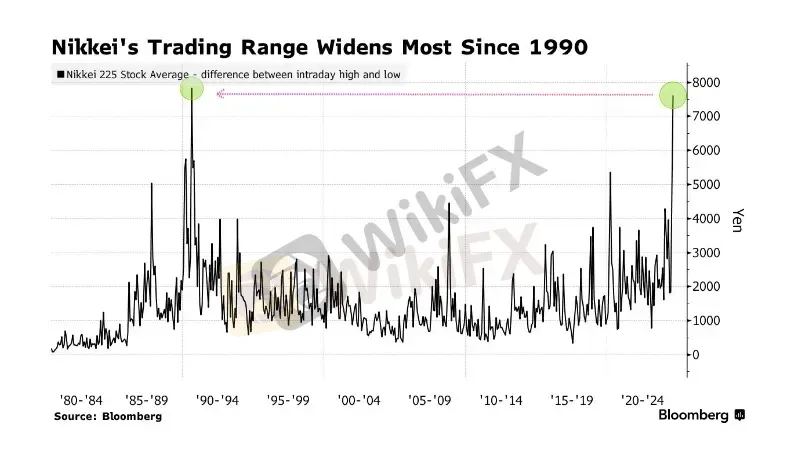

After the Japanese central bank's rate hike and signs of a slowdown in the US economy triggered market turmoil earlier this month, the Nikkei 225 index recorded its largest monthly trading range in 34 years. However, Koichi Kurose, Chief Strategist at Resona Asset Management, expects that this broad trading range may begin to stabilize from September and believes that the market may return to near record levels by the end of the year.

Amid global economic uncertainty and the ongoing evolution of monetary policies, the future trajectory of the yen remains highly uncertain. Investors and market analysts will continue to closely monitor the policy moves of the Bank of Japan and how the global economic environment affects the value of the yen. In this process, the Japanese stock market and businesses will also have to adapt to potential market fluctuations, seeking strategies to maintain competitiveness and profitability in the ever-changing global financial environment. Ultimately, the long-term performance of the yen will reflect the inherent strength of the Japanese economy and its position in the global economy.

WikiFX Broker

Latest News

Canadian Regulators Say More Than 7,500 Fraudulent Investment and Crypto Websites Were Taken Down

Retiree’s Tabung Haji Savings Gone: Elderly Retiree Loses RM277,000 After One Whatsapp Message

US NFP Preview: Markets Brace for Volatility as Employment Data Tests Fed's Patience

Crude Oil Rallies to $85 on Escalating Middle East Geopolitical Risks

Forex Brief: Dollar Dips Ahead of NFP; RBA Bets Lift AUD

HeroFx Review: Withdrawal Problems, Scam Alert & Risks

JRJR Review: Safety, Regulation & Forex Trading Details

Middle East Conflict Esculates: Cloud Infrastructure Targeted as US & Israel Strike Tehran

9X markets Review 2026: Is this Forex Broker Legit or a Scam?

Oil Surges as Qatar Warns of $150 Crude and 'Force Majeure' Across Gulf Exporters

Rate Calc