ARROW FORTUNE

Abstract:ARROW FORTUNE, headquartered in the United Kingdom, is a trading platform offering four account types: Basic, Intermediate, Advanced, and Expert. The company operates without regulatory oversight, providing a range of trading options to cater to different levels of experience and investment capacity.

| ARROW FORTUNE | Basic Information |

| Company Name | ARROW FORTUNE |

| Headquarters | United Kingdom |

| Regulations | Not regulated |

| Account Types | Basic,Intermediate,Advanced,Expert |

| Minimum Deposit | $250 |

| Maximum Leverage | 1:300 |

| Customer Support | Telephone number(+1 2046900625)Email (info@arrowfortune.com) |

Overview of ARROW FORTUNE

ARROW FORTUNE, headquartered in the United Kingdom, is a trading platform offering four account types: Basic, Intermediate, Advanced, and Expert. The company operates without regulatory oversight, providing a range of trading options to cater to different levels of experience and investment capacity.

Is ARROW FORTUNE Legit?

ARROW FORTUNE operates without regulatory supervision. This means the company's activities are not monitored or controlled by any financial regulatory body. Traders should be aware that this lack of regulation may impact the level of protection and oversight typically associated with regulated financial entities.

Pros and Cons

ARROW FORTUNE presents a mixed profile of advantages and potential drawbacks. The platform offers multi-user support, which can be beneficial for collaborative trading or account management. It also claims to provide openness and transparency of information. However, the lack of regulatory oversight poses potential risks to traders, as there's no external authority ensuring compliance with industry standards.

| Pros | Cons |

|

|

|

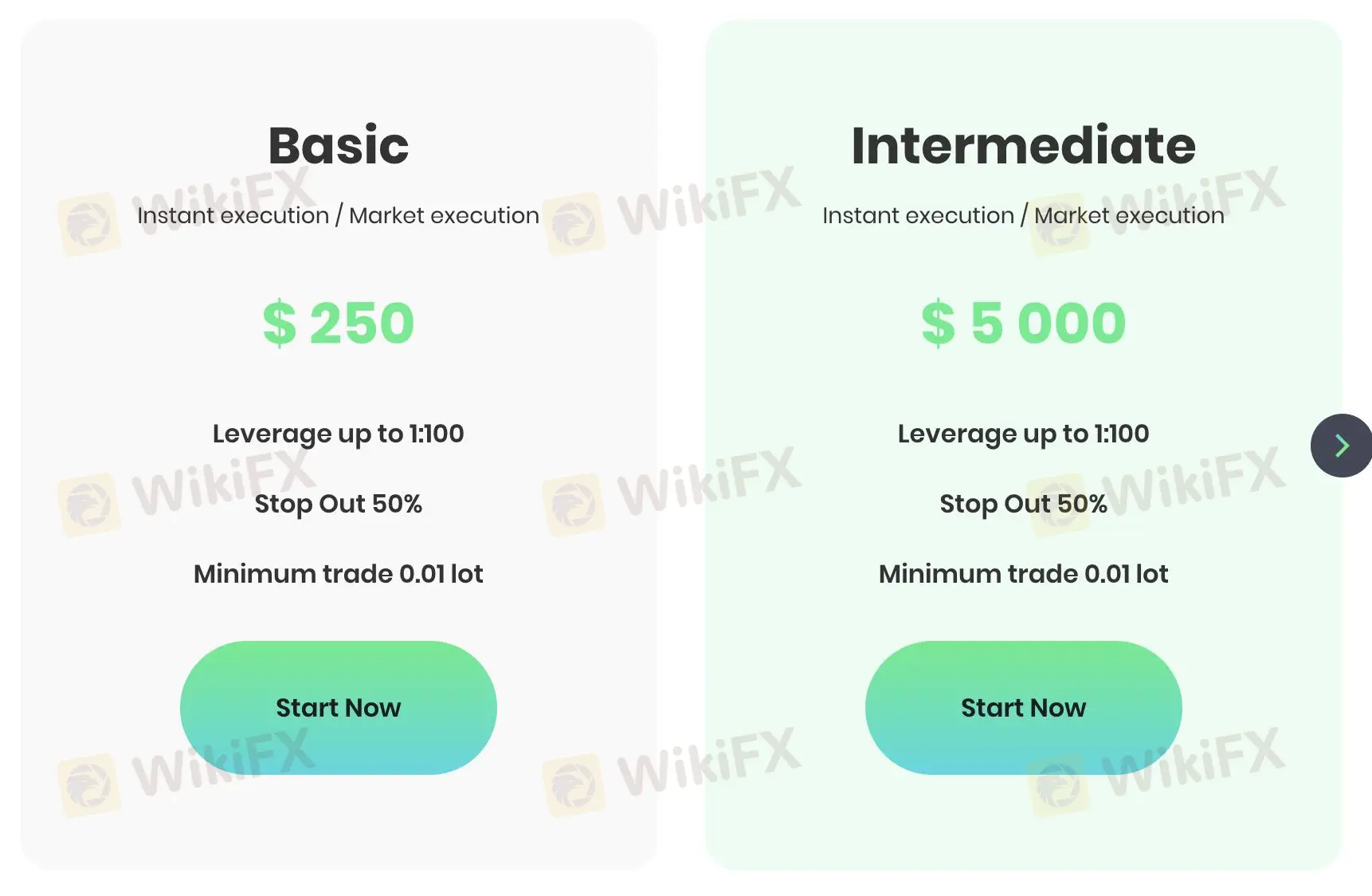

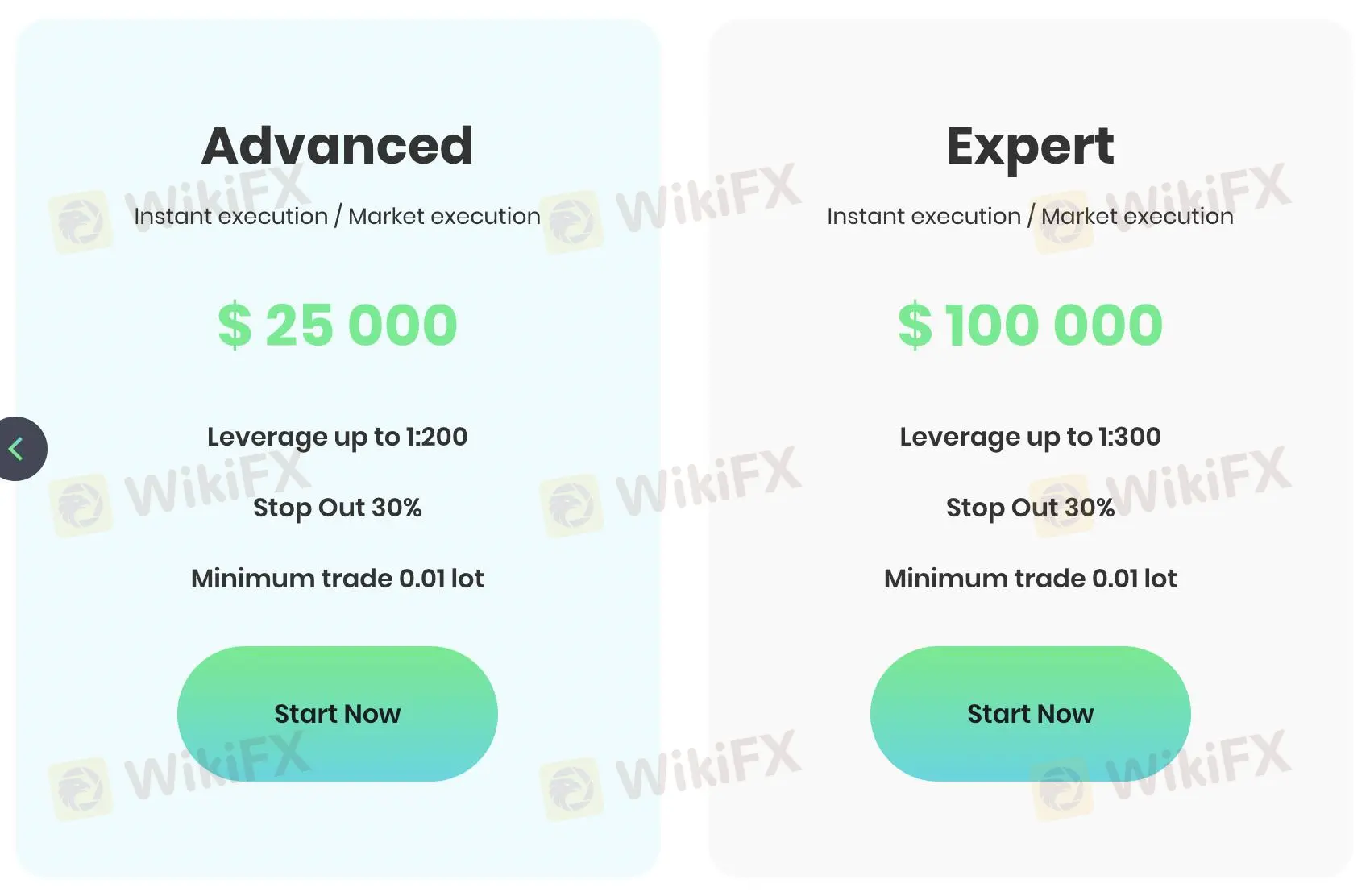

Account Types

ARROW FORTUNE offers four account types with varying minimum deposits. The Basic account has the lowest entry point at $250, followed by the Intermediate at $5000, Advanced at $25000, and Expert at $100000. This tiered structure allows traders to choose an account type that aligns with their investment capital and trading experience.

| Account Type | Basic | Intermediate | Advanced | Expert |

| Minimum Deposit | $250 | $5000 | $25000 | $100000 |

Leverage

ARROW FORTUNE provides different leverage options across its account types. The Basic and Intermediate accounts offer a maximum leverage of 1:100. The Advanced account increases this to 1:200, while the Expert account provides the highest leverage at 1:300. These options allow traders to select a leverage level that suits their risk tolerance and trading strategy.

| Account Type | Basic | Intermediate | Advanced | Expert |

| Maximum Leverage | 1:100 | 1:100 | 1:200 | 1:300 |

Customer Support

For customer support, ARROW FORTUNE provides both a telephone number (+1 2046900625) and an email address (info@arrowfortune.com). These contact options allow clients to reach out for assistance with their trading accounts or general inquiries about the platform's services.

Conclusion

In conclusion, ARROW FORTUNE offers a range of account types with varying deposit requirements and leverage options. While it provides multi-user support and claims transparency, the lack of regulation warrants careful consideration by potential traders.

FAQs

- What account types does ARROW FORTUNE offer?

ARROW FORTUNE offers Basic, Intermediate, Advanced, and Expert account types.

- Is ARROW FORTUNE regulated?

No, ARROW FORTUNE is not currently regulated by any financial authority.

- How can I contact ARROW FORTUNE's customer support?

You can reach ARROW FORTUNE's customer support via phone at +1 2046900625 or by email at info@arrowfortune.com.

Review

ARROW FORTUNE seems to be aiming for a broad audience with its four-tier account system. They're covering the spectrum from newbies to high rollers, with minimum deposits ranging from a modest $250 to a hefty $100,000. The leverage options are pretty interesting too, ramping up as you climb the account ladder. The multi-user support could be a nice touch for those who like to trade as a team. They're talking a big game about transparency, which is always good to hear. But here's the kicker - they're flying solo without any regulatory backup. It's a mixed bag, really. It could be exciting for some, but you'd want to keep your wits about you.

Risk Warning

Trading online carries inherent risks, including the potential loss of your entire investment. It's essential to recognize that online trading may not be suitable for everyone, and individuals should carefully consider their risk tolerance before participating. Additionally, please be aware that the details provided in this review are subject to change as companies update their services and policies. Therefore, it's advisable to verify the most up-to-date information directly with the company before making any trading decisions. Ultimately, the responsibility for utilizing the information in this review lies solely with the reader.

Read more

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

NEWTON GLOBAL Deposit and Withdrawal Methods: A Complete 2026 Review

When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker. One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from "How can I withdraw?" to "Is it safe to invest here?" This background information is essential for protecting your capital.

Is NEWTON GLOBAL Safe or a Scam? A Deep Look at User Reviews & NEWTON GLOBAL Complaints

When you look up information about a financial broker, you have one main worry: Is my capital safe? For NEWTON GLOBAL, the facts point to a clear answer. After looking at its regulatory status, user feedback and how transparent it is, NEWTON GLOBAL presents a very high risk to all traders. This conclusion isn't based on opinion, but on real data collected by platforms designed to protect investors. The main problems—no valid regulation and a pattern of serious user complaints—show major warning signs that can't be ignored. A broker's reputation depends on two things: regulatory oversight and positive user experiences. As we will show, NEWTON GLOBAL fails badly on both. We encourage traders to always check information on independent platforms. You can see the full data we are analyzing on the official WikiFX page for NEWTON GLOBAL. This article will break down its regulatory standing, look at real user complaints, and give you a clear verdict to help you make an informed decision.

WikiFX Broker

Latest News

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Promised 30% Returns, Lost RM630,000 Instead

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Effective Stop Loss Trading Strategies

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Hits Q4 Growth

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Slams Growth

Kudotrade Review 2026: Is this Forex Broker Legit or a Scam?

Rate Calc