AI2 Trade

Abstract:AI2 Trade, founded in 2023 and based in the United Kingdom, offers over 2,100 trading assets including Forex, Metals, Indices, Energy, Futures, Shares, and Cryptocurrencies. The platform operates without disclosed regulatory oversight. It supports popular trading platforms like MT4, MT5, and cTrader, providing market execution with competitive spreads and no financial fees. AI2 Trade accommodates both retail and professional traders with a maximum leverage of 1:200 and options for micro-lot trading. However, detailed information on customer support and educational resources is limited, which can impact user experience and support availability.

| Aspect | Details |

| Company Name | AI2 Trade |

| Registered Country/Area | United Kingdom |

| Founded year | 2023 |

| Regulation | Unregulated |

| Market Instruments | Forex, Metals, Indices, Energy, Futures, Shares, Cryptocurrencies |

| Account Types | AI Account, Premium AI Account |

| Minimum Deposit | Premium AI Account: €39,000+ |

| Maximum Leverage | 1:200 |

| Trading Platforms | MT4, MT5, cTrader |

| Customer Support | N/A |

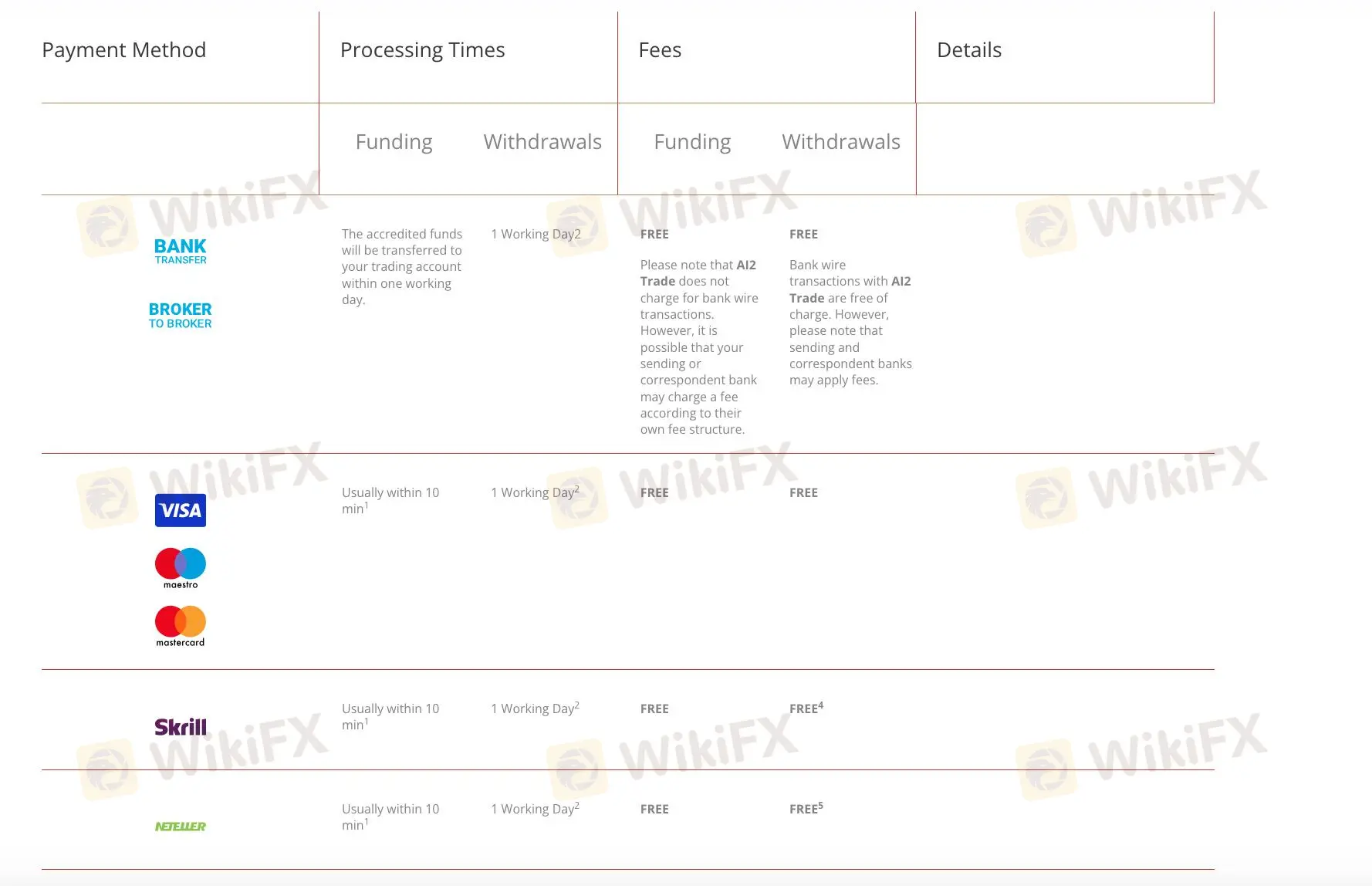

| Deposit & Withdrawal | Bank wire transfers, Credit/Debit cards, Skrill, Neteller |

Overview of AI2 Trade

AI2 Trade, founded in 2023 and based in the United Kingdom, offers over 2,100 trading assets including Forex, Metals, Indices, Energy, Futures, Shares, and Cryptocurrencies.

The platform operates without disclosed regulatory oversight. It supports popular trading platforms like MT4, MT5, and cTrader, providing market execution with competitive spreads and no financial fees. AI2 Trade accommodates both retail and professional traders with a maximum leverage of 1:200 and options for micro-lot trading.

However, detailed information on customer support and educational resources is limited, which can impact user experience and support availability.

Regulatory Status

AI2 Trade operates without regulatory oversight. This means there's no external authority ensuring compliance with financial rules and customer protection standards.

Without regulation, there's a lack of guarantee on fair practices and handling of funds, potentially exposing traders to higher risks of fraud or malpractice.

Pros and Cons

| Pros | Cons |

| Various platforms including MT4/MT5/ctrader | Unregulated |

| Zero financial fees | Minimum deposit for VIP account can be high (€39,000) |

| Over 2,100 trading instruments | No educational resources |

| High maximum leverage (1:200) | No options for customer support channels |

| Market execution with VWAP |

Pros:

- Various platforms including MT4/MT5/ctrader: AI2 Trade offers access to multiple trading platforms like MT4, MT5, and cTrader, providing flexibility for traders to choose the platform that best suits their trading preferences and strategies.

- Zero financial fees: The platform does not charge financial fees on trades, which can significantly reduce trading costs for users, particularly for high-frequency traders or those managing larger volumes of trades.

- Wide range of trading instruments: AI2 Trade supports a wide array of trading instruments including Forex, Metals, Indices, Energy, Futures, Shares, and Cryptocurrencies. This variety allows traders to diversify their portfolios and capitalize on different market opportunities.

- High maximum leverage (1:200): Traders on AI2 Trade can utilize a maximum leverage of 1:200, enabling them to amplify their trading positions and potentially enhance their returns. This high leverage ratio appeals to traders looking to maximize their trading capital efficiency.

- Market execution with VWAP: Orders on AI2 Trade are executed using market execution with volume-weighted average price (VWAP), ensuring transparency and fair pricing for traders. This execution method helps in achieving efficient trade execution, crucial for both short-term and long-term trading strategies.

Cons:

- Unregulated: AI2 Trade operates without a disclosed regulatory framework, which can raise risks among traders regarding investor protection and oversight. The lack of regulation means there can be limited recourse in case of disputes or issues with the platform.

- Minimum deposit for VIP account can be high: To qualify for a VIP account with AI2 Trade, traders are required to deposit a substantial amount of €39,000 or equivalent currency. This high minimum deposit can deter smaller traders or those with limited capital from accessing premium account features.

- No educational resources: The platform does not provide comprehensive educational resources or materials to support trader education and skill development. This absence of educational tools can pose challenges for novice traders seeking to improve their trading knowledge and skills.

- No options for customer support channels: AI2 Trade lacks detailed information on customer support options, which can be critical for traders needing timely assistance or resolution of issues. The absence of multiple support channels can impact user experience, especially during critical trading periods or technical difficulties.

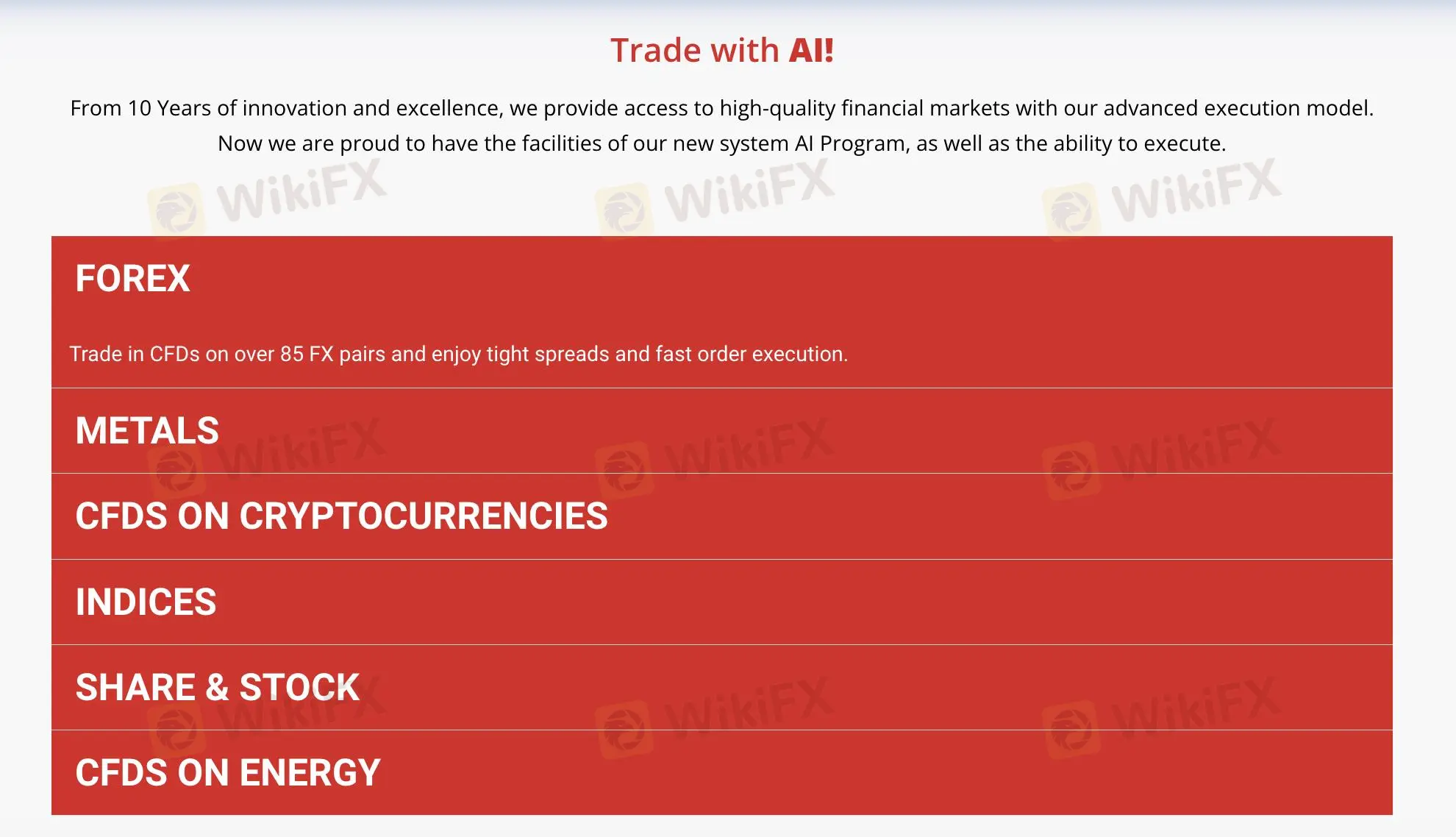

Market Instruments

AI2 Trade offers a variety of trading assets across different categories:

- FOREX: Trade CFDs on over 85 FX pairs with tight spreads and fast order execution.

- METALS: Explore trading opportunities with CFDs on spot metals.

- CFDS ON CRYPTOCURRENCIES: Enjoy trading cryptocurrencies with competitive spreads and quick order execution.

- INDICES: Trade CFDs on popular European indices.

- SHARE & STOCK: Access CFDs on thousands of global stocks, including major US, UK, and EU corporations, with fast order processing and competitive trading conditions.

- CFDS ON ENERGY: Diversify portfolios with CFDs on energy commodities like Brent oil, WTI, and natural gas.

Account Types

AI2 Trade offers two distinct account types tailored to different trader profiles: the AI Account and the Premium AI Account.

The AI Account is suitable for traders seeking a robust trading environment with access to over 2,100 instruments, including forex pairs, commodities, indices, and cryptocurrencies. This account type supports trading on micro lots, accommodating traders who prefer smaller trade sizes for risk management purposes. This account offers up to 30% reduced market spreads, ensuring cost-effective trading. It includes access to a Virtual Private Server (VPS) for managing Expert Advisors (EAs) and trading cBots, enhancing automation capabilities.

In contrast, the Premium AI Account is specifically crafted for professional traders and high-net-worth individuals looking for advanced trading features and personalized services. To qualify for a Premium AI Account, traders are required to deposit €39,000 or equivalent currency into their portfolio. Premium AI Account holders benefit from personalized technical support, market evaluations, and daily insights from expert strategists, enabling them to navigate complex market conditions effectively.

Leverage

AI2 Trade offers a maximum leverage of 1:200, allowing traders to amplify their positions up to 200 times their initial investment.

Spreads & Commissions

AI2 Trade boasts competitive spreads and fees in its pricing structure.

The platform offers 0% financial fees, meaning there are no commissions charged on trades. Spreads vary depending on the instrument traded, with market spreads being up to 30% lower for VIP account holders. Traders benefit from the ability to trade micro lots starting from 0.01, which can suit both cautious traders managing smaller positions and those seeking higher leverage.

Comparatively, AI2 Trade's fee structure can appeal more to experienced traders and institutions who manage larger volumes and require flexibility in trading strategies without the burden of financial fees.

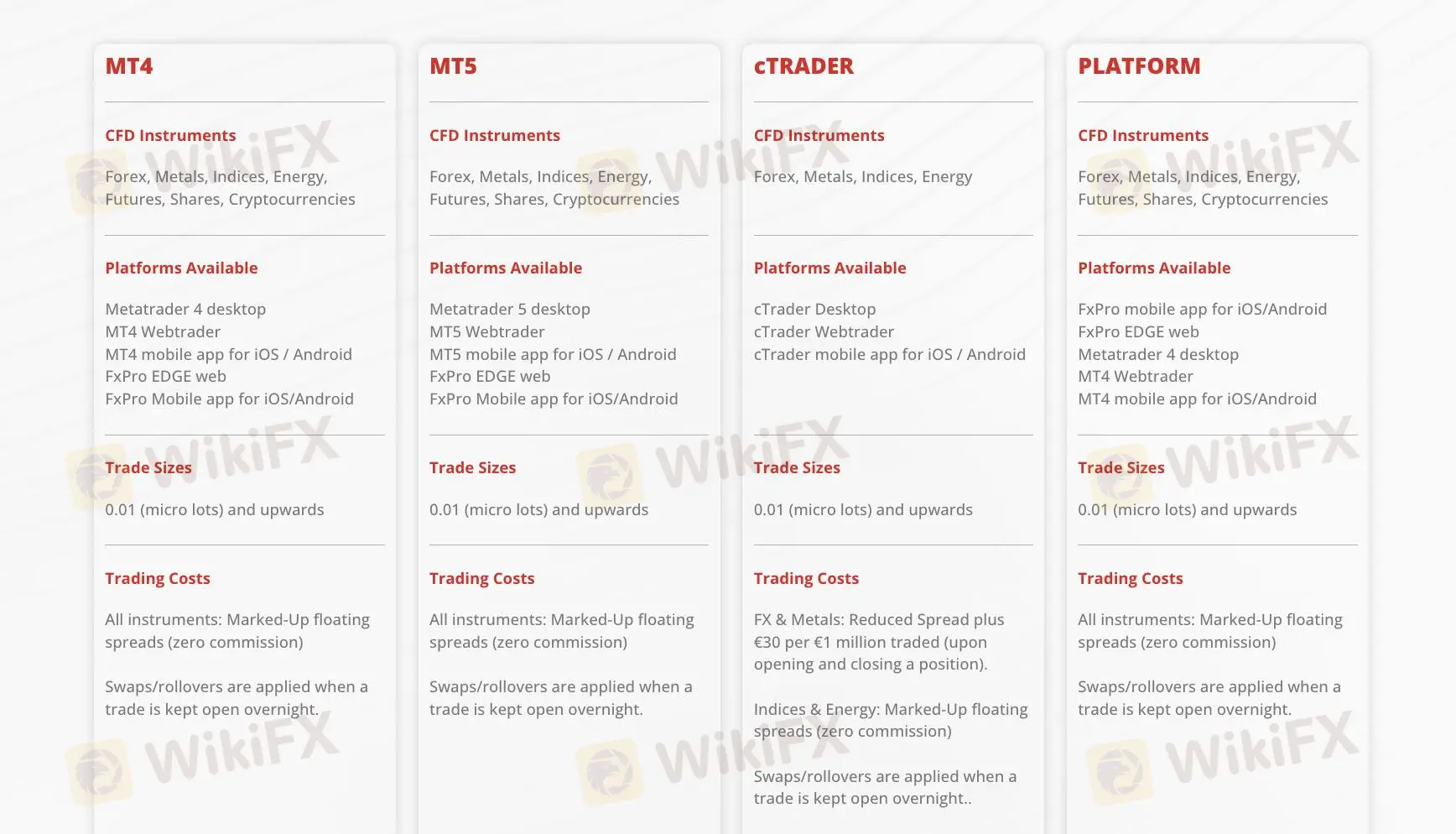

Trading Platform

AI2 Trade offers several well-known trading platforms for different trading preferences:

- MetaTrader 4: Known for its reliability and widespread use, MetaTrader 4 (MT4) is a classic choice among traders. It offers a range of tools for technical analysis, customizable charts, and automated trading capabilities through Expert Advisors (EAs).

- MetaTrader 5: Positioned as an advancement over MT4, MetaTrader 5 (MT5) introduces additional features designed to enhance trading skills. It includes more advanced charting tools, more timeframes, and supports more types of orders compared to its predecessor.

- cTrader: Known for its feature-rich environment, cTrader provides traders with advanced trading capabilities. It offers a user-friendly interface, in-depth charting tools, and access to a wide range of assets. cTrader is favored by traders looking for a competitive trading experience.

Each platform has its strengths depending on the trader's specific needs, such as technical analysis tools, order types, and overall user experience. Traders often choose based on their familiarity with the interface and the specific features that best align with their trading strategies.

Deposit & Withdrawal

AI2 Trade offers a variety of payment methods for both funding and withdrawals. Deposits can be made via bank wire transfers, credit/debit cards (Visa, Mastercard, Maestro), and e-wallets like Skrill and Neteller. Bank wire transfers typically take around 1 working day to process, with no fees charged by AI2 Trade. However, banks involved in the transaction can apply their own fees.

Credit/debit card deposits are processed instantly with no fees, while e-wallet deposits (Skrill and Neteller) are also fee-free and processed within 1 working day. Withdrawals follow a similar process and timeline, ensuring efficient access to funds for traders using these methods.

Conclusion

In conclusion, AI2 Trade is a dynamic trading platform for a wide array of financial instruments with competitive market spreads and no financial fees.

It offers traders access to popular platforms like MT4, MT5, and cTrader. However, its unregulated status can be a consideration for traders seeking regulatory oversight. The platform's high maximum leverage and support for micro-lot trading appeal to both retail and professional traders, though the lack of detailed customer support information and educational resources could impact user satisfaction and support responsiveness.

FAQ

What trading platforms does AI2 Trade offer?

AI2 Trade provides access to popular platforms such as MT4, MT5, and cTrader.

How competitive are AI2 Trade's spreads?

AI2 Trade offers competitive market spreads across a wide range of financial instruments.

Is AI2 Trade regulated?

No, AI2 Trade operates without disclosed regulatory oversight.

Does AI2 Trade charge fees for trading?

AI2 Trade does not charge financial fees on trades, offering zero-commission trading.

What types of assets can be traded on AI2 Trade?

AI2 Trade supports trading in Forex, Metals, Indices, Energy, Futures, Shares, and Cryptocurrencies.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

WikiFX Broker

Latest News

Telegram Investment Scam Wiped Out RM91,000 in Days

SPEC TRADING Review 2026: Is this Forex Broker Legit or a Scam?

Gold Smashes $5,100 Barrier: Dalio Warns of 'Capital Wars'

Fiscal Policy Monitor: Authorities Tighten Tax Compliance Framework

AMBER MARKETS Review 2026 — Is AMBER MARKETS Broker Safe for Forex Trading?

Who are the “Police” Watching Your Forex Broker? (FCA, ASIC, NFA Explained)

Dollar Index Hits Four-Year Low as 'Fed Whisperer' Signals Rate Pause

PayPal Re-enters Inbound Nigerian Market via Paga Partnership

German Capital Flows Heavy into China, Defying Trade War Risks

FIBOGROUP Review: Safety, Regulation & Forex Trading Details

Rate Calc