CNMV Issues Warning on StoneX and IG Group Clones

Abstract:The Spanish CNMV warns against clones of StoneX and IG Group, adding ten entities to its warning list, including eight operating without proper licenses.

Despite ongoing attempts by financial industry authorities, unregulated investment businesses continue to defy their determination. The Spanish CNMV (Comisión Nacional del Mercado de Valores) has lately revealed many fresh cases of fraudsters mimicking well-known retail trade businesses. Their most recent warning list includes various firms operating in Spain without the proper permissions.

CNMV Issues Alerts Against StoneX and IG Group Clones

In a recent update, the Spanish financial markets regulator, CNMV, added 10 new firms to its warning list. Notably, “Finance IG,” which operates under the domains finance-ig.com and financeig.com, has been discovered as a clone of the famous, publicly listed London-based corporation IG Group. IG Group is well-known across Europe and throughout the world.

Furthermore, the list contains a clone of the US-based corporation StoneX, which provides services via the website stonexly.com/es. This is not the first case of trademark impersonation; CNMV issued a warning a few months ago about a company posing as the prominent social trading site eToro.

According to surveys, retail traders see broker and signal provider clones as the most serious danger to the business. Discussions with representatives of often copied businesses demonstrate that the practice is so widespread that successfully combatting it remains a major difficulty.

Eight Unlicensed Entities and Clones

In addition to the two clones, the CNMV's report named eight firms operating without sufficient licenses in the Spanish market. These companies include Fusionlots, TD Markets, Rumlenomic, AMI Solutions, Aduent Capital, TCM Globals, and Trader Experts.

“According to CNMV records, these institutions are not registered in the corresponding registry of this Commission and, therefore, are not authorized to provide investment services or other activities subject to the CNMV's supervision,” the regulator noted.

This update comes after a series of warnings from the Spanish authority over the last month. In June, the CNMV investigated eight unlicensed FX/CFD brokers. CNMV recently highlighted Linq Capital, a company that provides trading leverage of up to 1000:1. Linq Capital purports to be based in a non-existent UK city, and its questionable actions have drawn the notice of Germany's BaFin.

Related broker

Read more

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

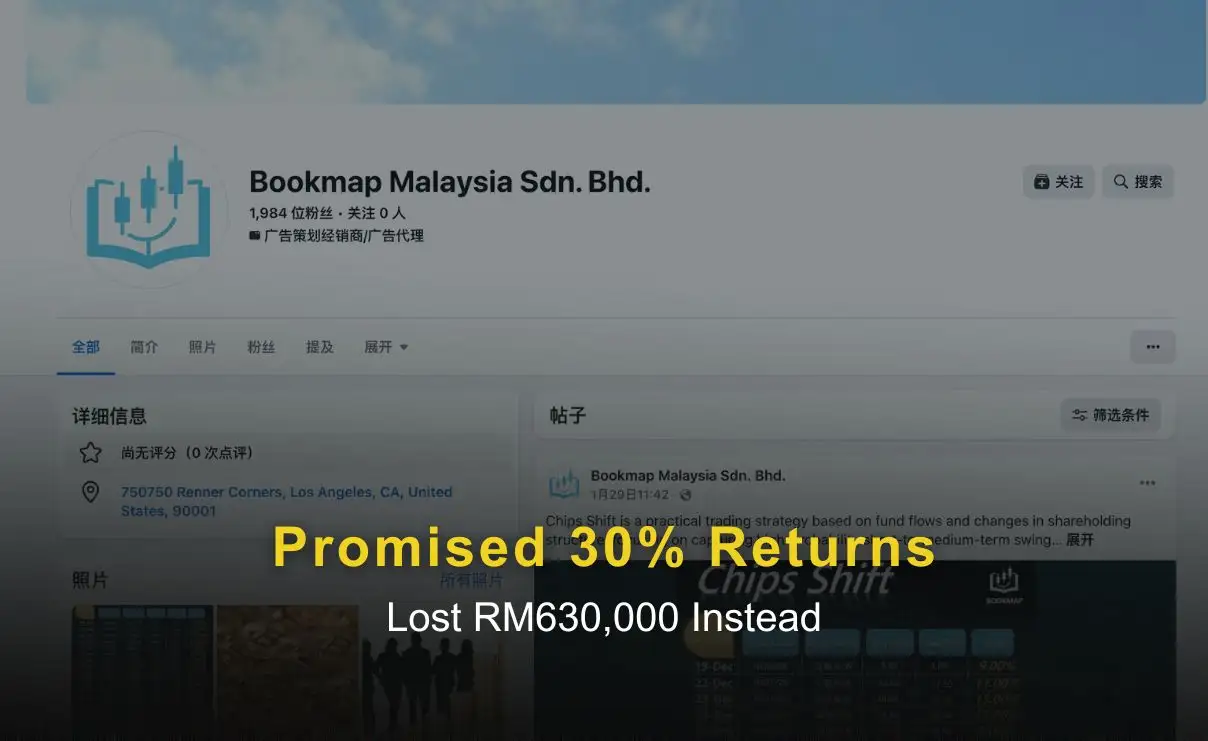

Promised 30% Returns, Lost RM630,000 Instead

A 57-year-old man in Kuantan lost over RM630,000 after being lured by a Facebook investment advertisement and directed to a fake trading app that displayed fabricated profits. The scam unraveled when withdrawal attempts triggered excuses and demands for additional fees, highlighting the risks of high-return promises and unverified platforms.

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

An in-depth look at a scalable fraud method in the forex sector, built on reusing the same website structure under different brand names.

Fidelity Exposure: Examining the Latest User Reviews on Withdrawal Denials & Trade Manipulation

Fidelity Investments has been grabbing attention of late for negative reasons. These include complaints concerning withdrawals, account closure without notice, technical glitches in trade order processing, and inept customer support service. As the complaints continue to grow, we prepared a Fidelity review article showcasing some of them. Read on as we share details.

WikiFX Broker

Latest News

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

MultiBank Group Analysis Report

NEWTON GLOBAL Legitimacy Check (Addressing fears: Is This a Fake or a Legitimate Trading Partner?)

SPREADEX Review: Reliable Broker Check

U.S. trade deficit totaled $901 billion in 2025, barely budging despite Trump's tariffs

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Rate Calc