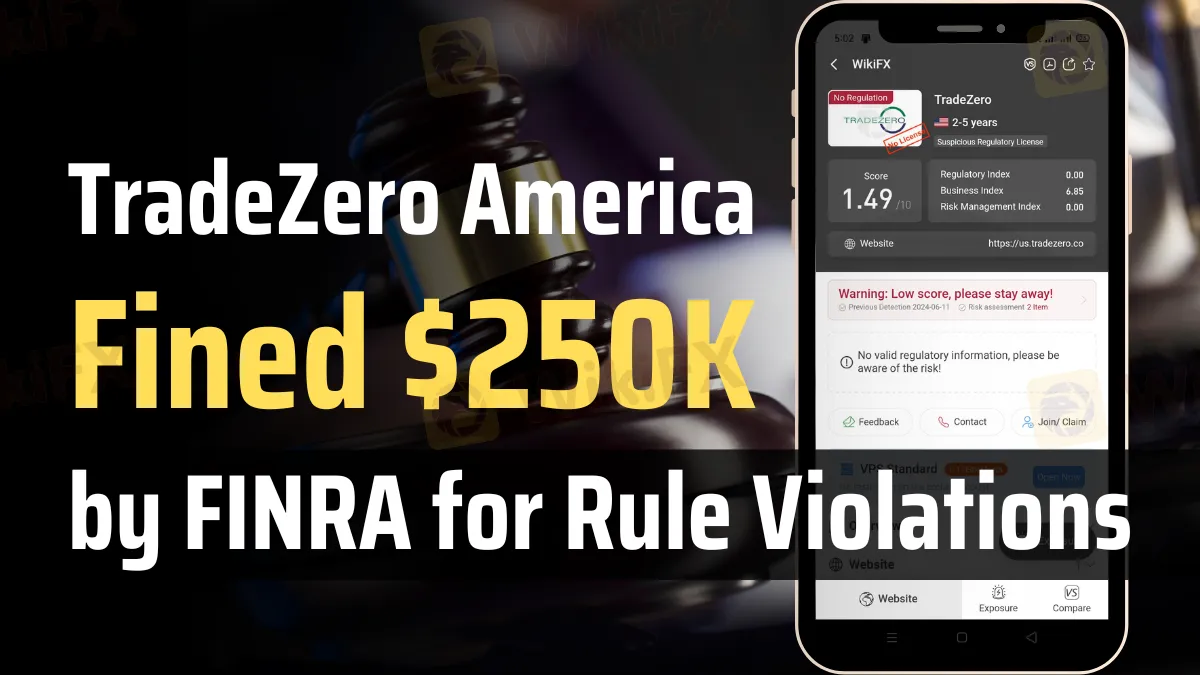

TradeZero America Fined $250K by FINRA for Rule Violations

Abstract:TradeZero America faces a $250K fine from FINRA for improper social media promotions, inadequate supervision, and misleading privacy notices.

The Financial Industry Regulatory Authority (FINRA) fined TradeZero America, Inc. $250,000 for many regulatory violations. Infractions involving the company's use of social media influencers to market its services occurred between July 2020 and October 2022.

At the time, TradeZero America was paying popular people on social media to promote their business. Nevertheless, these advertisements often included inflated claims and lacked objectivity. Not following FINRA Rules 2210(d)(1) and 2010 brought attention to major supervision issues at the company.

Worse still, neither did TradeZero America evaluate nor save the influencers' films prior to their online release, and neither did it keep tabs on nor save any posts made in participatory online forums. This oversight violated the firm's responsibilities as outlined in Section 17(a) of the Securities Exchange Act of 1934, Exchange Act Rule 17a-4(b)(4), and many FINRA rules, such as 2210(b), 4511, 3110, and 2010.

In addition, tradeZero America sent out misleading privacy alerts to clients in 2020 and 2022 about the use of nonpublic personal information. The Securities Exchange Act of 1934's Regulation S-P, Rule 4 (17 CFR § 248.4) and FINRA Rule 2010 were also violated by this misstatement.

These infractions occurred because the company failed to properly design and enforce supervisory procedures for retail communications. These compliance failures were so serious that FINRA censured the company and fined them $250,000.

Without accepting or rejecting the conclusions, TradeZero America has agreed to the censure and penalties as components of the settlement. This resolution highlights the significance of strict regulation and compliance in the financial services industry, especially with regard to contemporary advertising platforms such as social media.

The regulatory body's decision to take action against TradeZero America should serve as a strong warning to other companies about the significance of following the laws in order to keep public communications fair and open.

About FINRA

A non-governmental agency known as the Financial Industry Regulatory Authority (FINRA) is responsible for overseeing broker-dealers in the United States. Under the auspices of the SEC, FINRA has been in operation since 2007 with the goals of safeguarding investors and maintaining honest markets. Registration and education of industry participants, compliance examinations of businesses, enforcement of rules and securities laws, and monitoring of trading activity are FINRA's primary tasks. The goal of FINRA's rule enforcement and transparency initiatives is to increase public confidence in the financial markets. Investors and brokers may take use of the organization's arbitration and mediation services to settle issues.

You may also access the latest news in the financial market here.

Read more

IVY MARKETS Exposure: Traders Allege Illegitimate Fees, Blocked Withdrawal Orders & No Refunds

Did IVY Markets deduct unfair fees from your deposit amount? Has your forex trading account been deleted by the broker on your withdrawal request? Failed to withdraw your funds after accepting the IVY Markets deposit bonus? Did the broker fail to address your trading queries, whether via email or phone? Such issues have been affecting many traders, who have expressed their displeasure about these on broker review platforms. In this IVY Markets review article, we have investigated some complaints. Keep reading to know the same.

Zenstox Review: Do Traders Face Withdrawal Blocks & Fund Scams?

Does Zenstox give you good trading experience initially and later scam you with seemingly illicit contracts? Were you asked to pay an illegitimate clearance fee to access fund withdrawals? Drowned financially with a plethora of open trades and manipulated execution? Did you have to open trades when requesting Zenstox fund withdrawals? You have allegedly been scammed, like many other traders by the Seychelles-based forex broker. In this Zenstox review article, we have investigated multiple complaints against the broker. Have a look!

Smart Trader Exposure: Login Glitches, Withdrawal Delays & Scam Allegations

Did your Smart Trader forex trading account grow substantially from your initial deposit? But did the forex broker not respond to your withdrawal request? Failed to open the Smart Trader MT4 trading platform due to constant login issues? Does the list of Smart Trader Tools not include the vital ones that help determine whether the reward is worth the risk involved? Have you witnessed illegitimate fee deduction by the broker? These issues have become too common for traders, with many of them criticizing the broker online. In this article, we have highlighted different complaints against the forex broker. Take a look!

Investing24.com Review – Can Traders Trust the App Data for Trading?

Does trading on Investing24.com data cause you losses? Do you frequently encounter interface-related issues on the Investing24.com app? Did you witness an annual subscription charge at one point and see it non-existent upon checking your forex trading account? Did the app mislead you by charging fees for strong buy ratings and causing you losses? You are not alone! Traders frequently oppose Investing24.com for these and more issues. In this Investing24.com review article, we have examined many such complaints against the forex broker. Have a look!

WikiFX Broker

Latest News

Silver Volatility Explodes: Tariff Reprieve and Demand Destruction Fears

Castle Market Forex Broker Review: Regulation, Risks & Verdict – Is It Safe or Scam?

Oil Rout: Crude Plunges 3% as Geopolitical Risk Premium Evaporates

Geopolitical Risk: Trump Pauses Iran Strike, Markets Weigh "Tactical Delay" vs. De-escalation

USD/CAD Breaches 1.3900 as Loonie Succumbs to Oil Collapse and King Dollar

US Inflation Stickiness and Geopolitical Rift Keep Dollar Firm; Gold Volatile

Gold Price Surges Above $4,600 as Fed Rate-Hold Bets Offset Fading Safe-Haven Demand

Gold Holds Record Highs as Geopolitical Fractures Widen from Arctic to Middle East

Goldman Sachs 2026 Outlook: Dollar Overvalued by 15%, Tech 'Exceptionalism' is Key Risk

Trump tells Hassett he wants to keep him where he is; Warsh Fed Chair odds jump

Rate Calc