WikiFX Broker Assessment Series | Moomoo: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of Moomoo, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

In this article, we will conduct a comprehensive examination of Moomoo, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Moomoo, established in California in 2018, swiftly became a leading solution for investors' needs, offering professional-grade trading services and data solutions.

In 2022, Moomoo expanded its footprint to Australia, where it introduced intelligent-assisted technology for investment analysis. This innovation earned the platform four prestigious awards from Wemoney. The following year, Moomoo continued its growth by launching its cutting-edge platform in Malaysia and Japan, providing extensive market information, investor education, and interactive community features.

Moreover, Moomoo set its sights on transforming the investment landscape in Canada. The platform aimed to empower Canadian investors with detailed market insights and educational tools, enabling them to navigate the market effectively and capitalize on opportunities.

Moomoo differentiates itself by offering commission-free trading on stocks and ETFs in the United States, Singapore, Hong Kong (SAR), and China. This can be a major advantage for active traders who place a high volume of trades. In addition, Moomoo allows traders to invest in fractional shares of stocks. This can be a good way to invest in expensive stocks or to dollar-cost average into your investments. Although traders on Moomoo do not have direct access to Forex, commodities, or bonds, they can invest in over 3,000 ETFs that encompass these asset classes.

Types of Accounts:

There are no account variants listed on Moomoos website. Therefore, it seems that Moomoo simplifies its operations by offering only one type of trading account, which covers the trading of all the assets provided by Moomoo, with the option to add a margin account.

Deposits and Withdrawals:

Moomoo offers a range of payment options, including bank transfers, FAST, credit cards, debit cards, PayNow, Wise, ACH transfer, and additional methods. While Moomoo asserts a policy of not imposing any commission or fees for deposits and withdrawals, it is important to note that any fees levied by third-party providers shall be the responsibility of the trading client.

Trading Platforms:

Moomoo offers a user-friendly trading platform available on both desktop and mobile devices, featuring streaming quotes, Level 2 market data, customizable charts, technical indicators, fundamental analysis tools, and paper trading.

Research and Education:

While there do not seem to be educational resources found on Moomoos official website, the Moomoo investment community resembles a social media platform such as Facebook or Instagram, allowing users to like and comment on posts and follow discussion threads. Moomoo always provides financial news and market highlights from their editorial team around the clock, as well as an economic calendar for free.

Customer Service:

Moomoo provides customer support through phone, email, and live chat. Representatives are available to assist from Monday to Friday, between 8:30 AM and 5:30 PM EST.

Conclusion:

To summarize, here's WikiFX's final verdict:

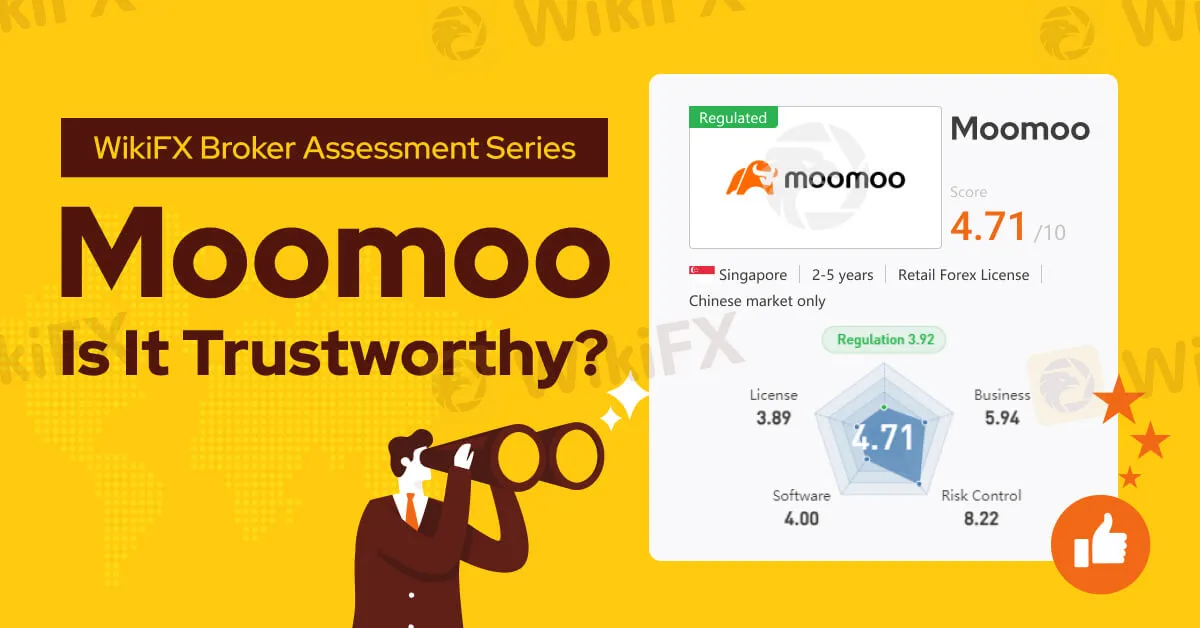

WikiFX, a global forex broker regulatory platform, has assigned Moomoo a WikiScore of 4.71 out of 10.

Upon examining Moomoos licenses, WikiFX found that the broker is regulated by the Monetary Authority of Singapore (MAS) with license number CMS101000.

However, the United States NFA regulation (license number: 0523957) claimed by this broker is suspected to be a clone.

Therefore, WikiFX would urge our users to opt for a broker that has a higher WikiScore for better protection.

Read more

TD Ameritrade Review 2025: Is TD Ameritrade Good or a Scam?

TD Ameritrade is a forex broker with trading experience of 2-5 years. We explore the basic details and trading information about TD Ameritrade in this TD Ameritrade review. We take a closer look at the broker registered in China to assess whether it is a reliable trading platform or a potential risk.

Simulated Trading Competition Experience Sharing

Champion Strategy Revealed: Get a Head Start on Winning

Crystal Ball Markets Exposed: Complaints, Scandals & Trader Concerns

Not getting approval for withdrawal access by Crystal Ball Markets despite multiple attempts? Finding it hard to trade with so many issues in its trading platform? Have you had a bad customer service experience? Many traders have complained about this broker on the review platform. In this article, we have shared some complaints.

Tradier Exposed: Withdrawal Denials, High Commission Charges & Poor Trading Platform

Does Tradier constantly reject your fund withdrawal applications? Do you have to deal with high commission charges & transfer fees at Tradier? Have you faced sudden account closure without any explanation by the broker? Facing trading platform downtime-related issues constantly? You are not alone! Numerous complaints have been filed by traders on several broker review platforms. In this article, we will share some of the complaints. Take a look!

WikiFX Broker

Latest News

FCA Charges UK Finfluencers Over High-Risk CFD Ads

Valutrades Reports Rising Revenue—But Is the Broker Reliable?

SkyLine Review —— XM: Building Lasting Trust Through a Superior Trading Experience

Q3 Trading Results Analysis: Season's End, Shared Growth

The Fed Models Were Wrong About The US Economy

Simulated Trading Competition Experience Sharing

What Are Forex Signals? Expert Insights Review

Tradier Exposed: Withdrawal Denials, High Commission Charges & Poor Trading Platform

Forex Market Liquidity Explained: Definition, Importance & Key Insights

Judd Trump Stars at Exclusive EC Markets Dubai Event

Rate Calc