ICM Trader

Abstract: ICM Trader was registered in Saint Vincent and the Grenadines and offfers trading services in forex, commodities, indices, stocks and cryptocurrencies to investors. It offers the industry-leading MetaTrader 4 platforms to enhance customer trading experience.

| ICM Trader Review Summary | |

| Founded | 2011 |

| Registered Country/Region | Saint Vincent and the Grenadines |

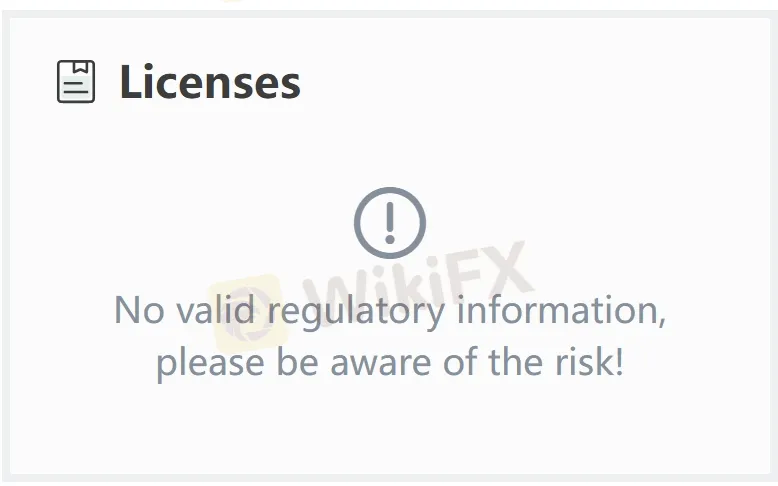

| Regulation | No regulation |

| Market Instruments | Forex, Commodities, Stocks, Indices, Cryptocurrencies |

| Demo Account | ❌ |

| Leverage | Up to 200x |

| Spread | From 0 pips |

| Trading Platform | MT4 |

| Minimum Deposit | / |

| Customer Support | Contact form |

| Tel: +44 203 885 0898 | |

| Email: support@icmtrader.com | |

| Social media: LinkedIn, YouTube, Instagram, Facebook, Twitter | |

| Registered address: Beachmont Business Centre, Suite 294, Kingstown, Saint Vincent and the Grenadines | |

| Restricted Regions | Saint Vincent and the Grenadines, USA and the sanctioned regions |

ICM Trader Information

ICM Trader was registered in Saint Vincent and the Grenadines and offfers trading services in forex, commodities, indices, stocks and cryptocurrencies to investors. It offers the industry-leading MetaTrader 4 platforms to enhance customer trading experience.

There are three live accounts to choose from for different client groups with varying experience levels. What's more, the broker implements segregated accounts to ensure protection of customer funds.

In addition, educational resources like trading tools, market analysis and webinars are provided to equip investors with necessary knowledge and skills for successful trading.

However, a critical consideration when choosing to trade with this broker is that it currently operates without oversight from any regulatory authority, which increases risks to client protection and fund security.

Pros and Cons

| Pros | Cons |

| Rich educational resources | No regulation |

| MT4 platform | No demo accounts |

| Segregated accounts | |

| Various trading instruments |

Is ICM Trader Legit?

The most important factor in measuring the safety of a brokerage platform is whether it is formally regulated. ICM Trader is an unregulated broker, which means that the safety of users' funds and trading activities are not effectively protected. Investors should choose ICM Trader with caution.

What Can I Trade on ICM Trader?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

Unlike many other brokers, ICM Trader does not provide demo accounts for practicing, which is one of its shortcomings since demo account is quiting necessary for clients to simulate real trading before being ready.

While for live accounts, there are three to choose from: namely ICM DIRECT (ECN), ICM ZERO and ICM CENT.

| Account Type | Spread | Commission |

| ICM DIRECT (ECN) | From 0 pips | ❌ |

| ICM ZERO | $7/round lot | |

| ICM CENT | ❌ |

Leverage

While the broker offers leverage up to 200x, which means you can enlarge your position 200 times of your initial deposit at most. However, traders should always use leverage cautiously since leverage not only amplify profits, but also losses at the same time.

Trading Platform

ICM Trader claims to use the world renowned MetaTrader 4 platform, which are well-recognized by its advanced charting tools and robust functionalities.

You can reach the platform on web, or download app from Windows, mobiles phones and Mac.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web, mobile, Windows, Mac | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

ICM Trader accepts deposits and withdrawals via ICM Cashier, which includes Visa and Mastercard (credit/debit), Skrill, Neteller, Ecommpay and others, and third-party payment is not accepted. Deposits may take up to 1 business day while withdrawals may take up to 3-5 business days.

Read more

Tauro Markets Review: Tons of Withdrawal Rejections & Trading Account Terminations

Did Tauro Markets intentionally withhold your capital when seeking withdrawals? Does the support team fail to respond to your several withdrawal requests? Is the Tauro Markets withdrawal approval process too long? Have you received an email from Tauro Markets about your trading account termination? These are some massive forex trading complaints against the broker. In this Tauro Markets review article, we have explained some poor trading experiences. Take a look!

NSFX Forex Broker Review and Regulation Updates

NSFX Forex broker review covering regulation, licenses, and compliance. Learn about NSFX broker's Malta license and revoked FCA authorization.

Is Adam Capitals Safe? A Complete Look at Risks, Rules, and User Worries

This article gives you a detailed Adam Capitals safety review to answer one important question: Can you trust this broker? To be honest, our research shows that Adam Capitals has a high risk level. The main reason for this judgment is that it's an unregulated broker working from an offshore location, specifically Saint Lucia. This one fact is more important than all other parts of its service. This lack of government oversight is a serious problem that puts client money in danger. Industry ratings show this reality, giving the broker poor scores consistently. Throughout this report, we will carefully break down the proof supporting this conclusion. We will look at its regulatory status (or lack of it), study how it operates, and include real-world user worries to give you a complete understanding of the risks involved when trading through Adam Capitals.

Adam Capitals Regulation: A Complete Guide to Its Licensing and Safety Claims

When choosing a broker, every trader needs to ask one key question: Is my capital safe, and is this company legitimate? The question of Adam Capitals regulation is at the heart of this safety check. Based on public records from 2025, the clear answer is that Adam Capitals does not have a valid financial license from any major, trusted regulatory authority. The company, called AdamFxCapitals Ltd, is registered as an International Business Company (IBC) in Saint Vincent and the Grenadines (SVG). However, this registration is not equivalent to financial regulation. As a result, the broker is classified as "High potential risk" and receives low trust scores from industry verification services. This guide will break down the broker's regulatory claims, look at how it operates and what platform it uses, and explain the risks for potential investors. The goal is to give you clear, fact-based information to help you decide if your capital would be safe with them.

WikiFX Broker

Latest News

Scam Alert: 8,500 People Duped with Fake 8% Monthly Return Promises from Forex and Stock Investments

FTMO Completes Acquisition of Global CFDs Broker OANDA, Marking a Major Milestone

Plus500 Allegations Exposed in Real Trader Cases

US Industrial Production Sees Biggest Annual Gain In 3 Years Despite Slowing Capacity Utilization

November private payrolls unexpectedly fell by 32,000, led by steep small business job cuts, ADP reports

Adam Capitals Review 2025: A Detailed Look at an Unregulated Broker

The "Balance Correction" Trap: Uncovering the Disappearing Funds at Vittaverse

HEADWAY: The Fast Track to Financial Dead-Ends?

NordFX.com Review Reveals its Hidden Negative Side- Must-Read Before You Trade

RM460,000 Gone: TikTok Scam Wipes Out Ex-Accountant’s Savings

Rate Calc