StarX Capital Markets

Abstract:StarX Capital Markets, established in 2014 and headquartered in Singapore, specializes in providing comprehensive commercial foreign exchange (FX) services tailored to the needs of institutions and corporates. Utilizing the FX@PAR trading platform, StarX offers many services and products. For customer support inquiries, clients can reach out to StarX Capital Markets via phone at (65) 6230 8588 or email at clientservices@starxcm.com.

| StarX Capital Markets Review Summary | |

| Founded | 2014 |

| Registered Country/Region | Singapore |

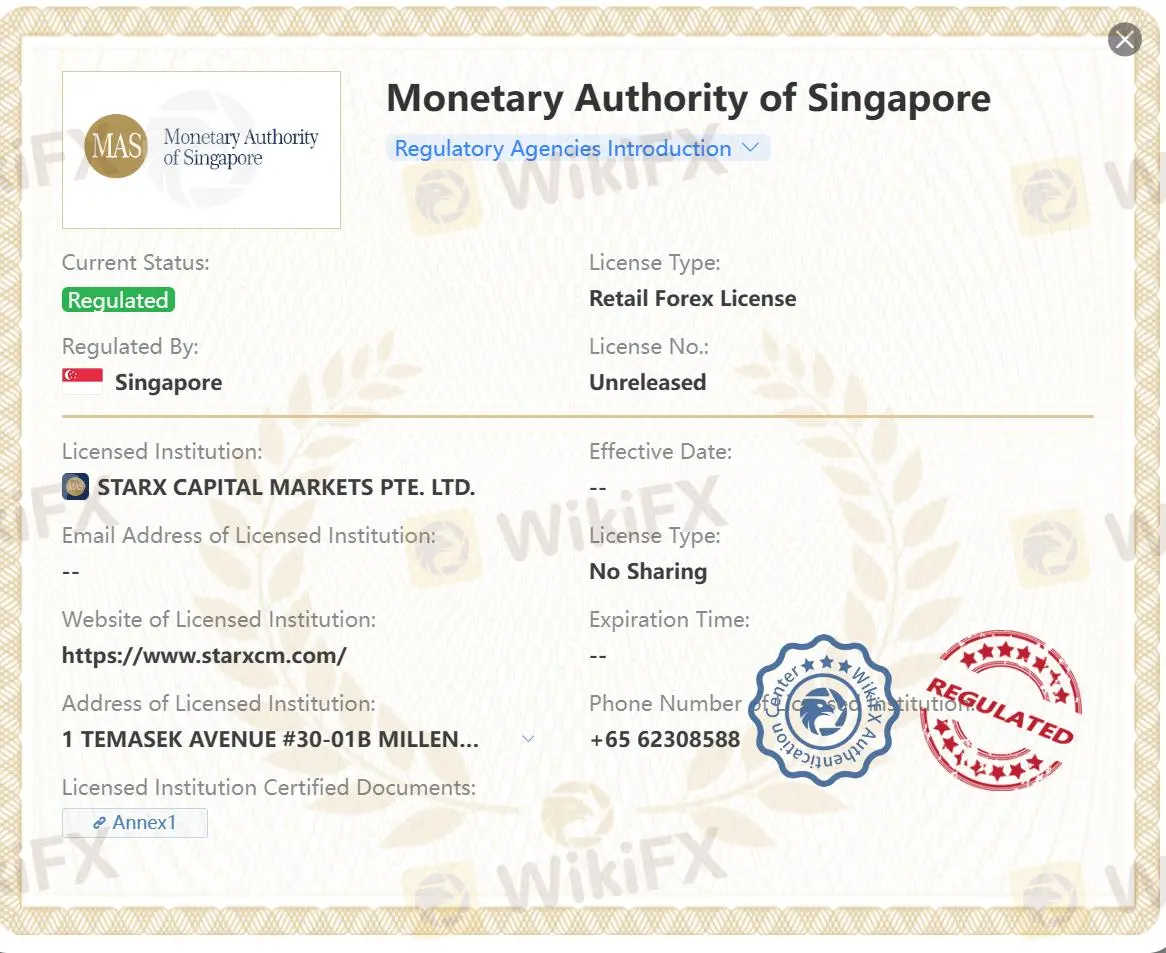

| Regulation | MAS (Regulated) |

| Market Instruments | Currency pairs, FX spot, FX forward (NDF included), FX option, and FX swap |

| Demo Account | Unavailable |

| Trading Platforms | FX@PAR trading platform |

| Minimum Deposit | N/A |

| Customer Support | Phone and email |

What is StarX Capital Markets?

StarX Capital Markets, established in 2014 and headquartered in Singapore, specializes in providing comprehensive commercial foreign exchange (FX) services tailored to the needs of institutions and corporates. Utilizing the FX@PAR trading platform, StarX offers many services and products. For customer support inquiries, clients can reach out to StarX Capital Markets via phone at (65) 6230 8588 or email at clientservices@starxcm.com.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

| Regulatory Compliance | Limited Demo Account Availability |

| Specialization in Commercial FX Services | Single Trading Platform |

| Comprehensive FX Offerings | |

| Advanced Trading Platform |

Pros:

- Regulatory Compliance: Being regulated by the Monetary Authority of Singapore (MAS) lends credibility to StarX Capital Markets. This regulatory oversight ensures that the company adheres to strict standards, providing clients with a sense of security and trust.

- Specialization in Commercial FX Services: StarXs specialization in providing commercial foreign exchange (FX) services tailored to institutions and corporates indicates a depth of expertise in this niche market segment. Clients benefit from tailored solutions that meet their specific needs.

- Comprehensive FX Offerings: The range of FX instruments offered by StarX, including FX spot, forward, options, and risk management solutions, provides clients with a diverse set of tools to manage their FX exposure effectively.

- Advanced Trading Platform: The FX@PAR trading platform offers clients a user-friendly interface and advanced features, enhancing their trading experience and enabling efficient execution of trades.

Cons:

- Limited Demo Account Availability: The absence of a demo account may pose a challenge for prospective clients who prefer to test the platform and services before committing to live trading. A demo account can be instrumental in familiarizing clients with the platforms features and assessing its suitability for their needs.

- Single Trading Platform: While the FX@PAR trading platform may be robust and feature-rich, some clients may prefer a choice of multiple trading platforms to cater to diverse preferences and trading styles.

Is StarX Capital Markets Legit or a Scam?

StarX Capital Markets operates under the regulatory oversight of the Monetary Authority of Singapore (MAS), an institution tasked with not only regulating financial entities like StarX but also with the broader mandate of fostering monetary stability within Singapore's economy. This regulatory framework encompasses a multifaceted approach aimed at ensuring the smooth functioning of financial markets, maintaining price stability, and promoting sustainable economic growth.

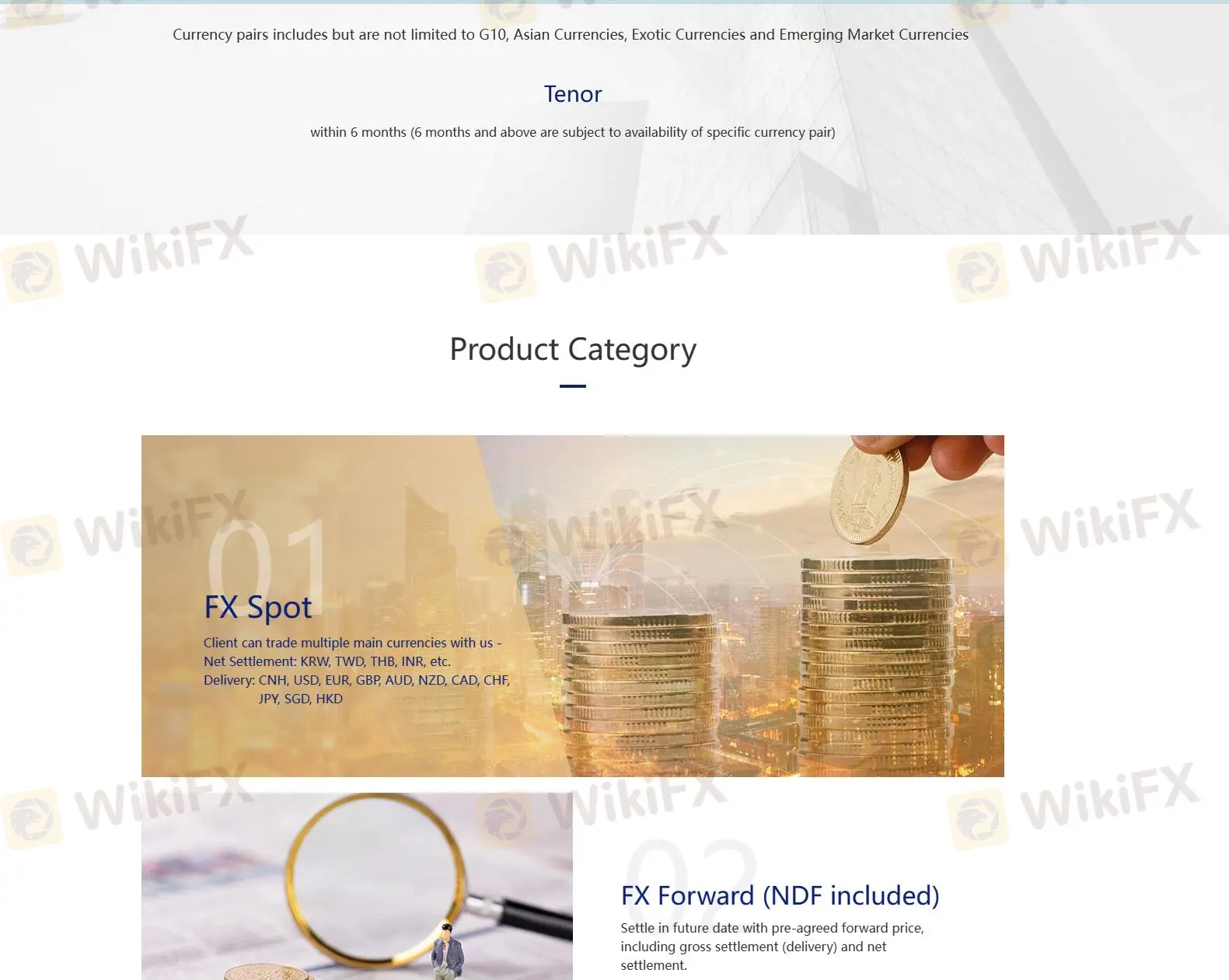

Market Instruments

StarX Capital Markets offers currency pairs (G10, Asian Currencies, Exotic Currencies and Emerging Market Currencies), FX spot, FX forward (NDF included), FX option, and FX swap.

- Currency Pairs: StarX provides access to a wide range of currency pairs, including G10 currencies (major currencies like USD, EUR, GBP, JPY, etc.), Asian currencies (such as CNY, KRW, SGD, etc.), Exotic currencies (less commonly traded pairs like TRY/JPY, ZAR/USD, etc.), and Emerging Market currencies (currencies from developing economies like MXN, INR, BRL, etc.).

- FX Spot: FX spot trading involves the immediate exchange of one currency for another at the current market price. Its the most common type of forex trading and offers traders the ability to speculate on short-term price movements in currency pairs.

- FX Forward (NDF included): FX forward contracts allow traders to exchange currencies at a predetermined future date and price. Non-Deliverable Forwards (NDFs) are a type of forward contract where the physical delivery of the currencies involved doesnt occur. They are commonly used for currencies that have foreign exchange restrictions or are not freely tradable.

- FX Option: FX options provide traders with the right, but not the obligation, to buy or sell a currency pair at a predetermined price (strike price) on or before the expiration date. FX options offer flexibility and can be used for hedging or speculative purposes.

- FX Swap: FX swaps involve the simultaneous purchase and sale of a currency pair at two different dates, with an agreement to reverse the transaction at a later date. FX swaps are commonly used by traders and institutions to hedge against currency risk or to take advantage of interest rate differentials between currencies.

How to Open an Account?

To open an account with StarX Capital Markets, please follow these steps:

| Step 1 | Ensure that you meet the criteria to be considered an Accredited Investor or Institutional Investor as prescribed by the regulations of the Monetary Authority of Singapore. |

| For individuals, this includes meeting one of the following criteria: having an income in the preceding twelve months of not less than S$300,000 (or its equivalent in a foreign currency), possessing financial assets exceeding S$1 million (or its equivalent in a foreign currency), having net personal assets exceeding S$2 million (or its equivalent in a foreign currency), or holding a joint account with an Accredited Investor. | |

| For entities, criteria include having net assets exceeding S$10 million (or its equivalent in a foreign currency) or having the entire share capital owned by one or more persons, each of whom is an Accredited Investor. | |

| Step 2 | Confirm your eligibility and readiness to proceed with the account opening process. |

| Step 3 | Prepare the necessary supporting documents for account opening. These documents will be outlined in a document checklist provided by StarX Capital Markets. |

| Step 4 | If you require any clarification or assistance during the process, reach out to your Relationship Manager or contact StarX Capital Markets directly via phone at (65) 6230 8588 or email at clientservices@starxcm.com. |

| Step 6 | Submit the completed supporting documents and any additional information as requested by StarX Capital Markets. |

| Step 7 | Await confirmation from StarX Capital Markets regarding the approval of your account opening request. (Background checks and account opening can be opened within 2 weeks of receiving the full set of required documents.) |

Trading Platforms

StarX Capital Markets offers the FX@PAR trading platform, a system designed for enterprise and financial institution clients to trade OTC (over-the-counter) foreign exchange. This platform is built on the latest system architecture of the foreign exchange market and was developed by a team with extensive global foreign exchange trading experience.

One of the key features of the FX@PAR trading platform is its comprehensive functionality, which enables users to perform a wide range of trading activities. This includes bidding, ordering, trading, monitoring, and more, all from a single interface. This streamlined approach makes it easier for users to manage their foreign exchange trading operations efficiently.

The platform is deeply rooted in the European interbank market, providing users with access to approximately 200 liquidity providers and financial institutions worldwide. Additionally, it is recognized in the China interbank market and is deployed by many of the largest banks in China. This global recognition and connectivity ensure that users of the FX@PAR trading platform have access to a robust and reliable trading environment.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +65 62308588

Email: clientservices@starxcm.com

Address: 1 Temasek Avenue #30-01B, Millenia Tower, Singapore

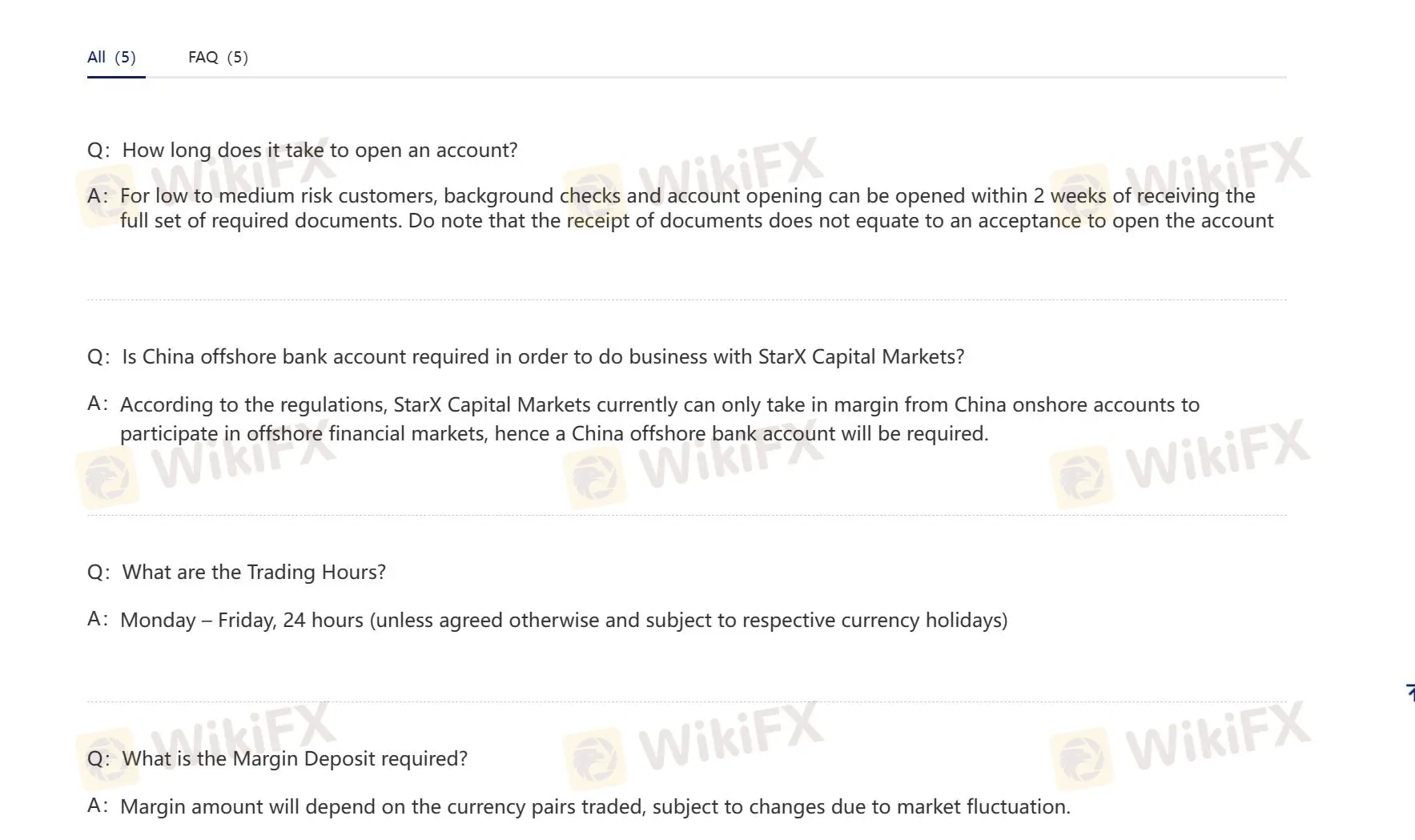

Whats more, StarX Capital Markets provides a Frequently Asked Questions (FAQ) section on their website to assist their clients with commonly asked questions and provide relevant information. The FAQ section aims to address common queries and concerns that investors may have regarding the company's services, processes, and investment opportunities.

Conclusion

In conclusion, StarX Capital Markets presents itself as an institution specializing in commercial foreign exchange services, catering specifically to institutions and corporates. Its regulatory compliance, comprehensive FX offerings, advanced trading platform, and dedicated customer support underscore its commitment to delivering quality service and meeting the needs of its clientele.

However, there are areas for improvement, such as the limited availability of demo accounts and reliance on a single trading platform. Despite these considerations, StarX Capital Markets remains a viable option for those seeking reliable FX services within the Singapore region.

Frequently Asked Questions (FAQs)

| Question 1: | Is StarX Capital Markets regulated by any financial authority? |

| Answer 1: | Yes. It is regulated by MAS. |

| Question 2: | How can I contact the customer support team at StarX Capital Markets? |

| Answer 2: | You can contact via telephone: +65 62308588 and email: clientservices@starxcm.com. |

| Question 3: | Does StarX Capital Markets offer demo accounts? |

| Answer 3: | No. |

| Question 4: | What platform does StarX Capital Markets offer? |

| Answer 4: | It offers FX@PAR trading platform. |

| Question 5: | What services and products StarX Capital Markets provides? |

| Answer 5: | It provides currency pairs (G10, Asian Currencies, Exotic Currencies and Emerging Market Currencies), FX spot, FX forward (NDF included), FX option, and FX swap. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

WikiFX Broker

Latest News

Mitrade Arabic Platform Targets MENA Gold Trading Boom

Israeli Arrested in Rome Over €50M Forex Scam

New FCA Consumer Alert 2025: Important Warning for All Consumers

EmiraX Markets Withdrawal Issues Exposed

Consob Targets Political Deepfake “Clone Sites” and Unlicensed Platforms in Latest Enforcement Round

WikiEXPO Global Expert Interviews: Gustavo Antonio Montero: ESG in Finance

Scam Alert: GINKGO-my.com is Draining Millions from Malaysians!

The Debt-Reduction Playbook: Can Today's Governments Learn From The Past?

Polymarket Onboards First US Users Since 2022 Shutdown: Beta Relaunch Signals Major Comeback

US Seizes US15 Billion in Bitcoin as Prince Group Rejects Crypto Scam Allegations

Rate Calc