One Ozo

Abstract:One Ozo is a brokerage based in the United Kingdom and operates without regulation, offering trading services through desktop, mobile, and web platforms. With a minimum deposit requirement of $100, traders can access a variety of assets including forex, CFDs, indices, stocks, and cryptocurrencies across different account types such as Ozo Start, Ozo Gold, Ozo Prime, and Ozo Power. However, the absence of a demo account and limited transparency regarding fees for payment methods may pose challenges for traders. Nonetheless, One Ozo provides multiple customer support channels including phone, email, live chat, and social media, along with educational resources like trading guides, articles, webinars, and video tutorials to assist traders in their journey.

| Aspect | Information |

| Registered Country | United Kingdom |

| Company Name | One Ozo |

| Regulation | Unregulated |

| Tradable Assets | Forex, CFDs, Indices, Stocks, Cryptocurrencies |

| Minimum Deposit | $25 |

| Trading Platforms | Desktop, Mobile, Web Browser |

| Account Types | Ozo Start, Ozo Gold, Ozo Prime, Ozo Power |

| Demo Account | No |

| Payment Methods | Credit/debit card, Bank transfer |

| Customer Support | Phone, Email, Live Chat, Social Media |

| Educational Tools | Trading guides, articles, webinars, video tutorials |

Overview of One Ozo

One Ozo is a brokerage based in the United Kingdom and operates without regulation, offering trading services through desktop, mobile, and web platforms. With a minimum deposit requirement of $100, traders can access a variety of assets including forex, CFDs, indices, stocks, and cryptocurrencies across different account types such as Ozo Start, Ozo Gold, Ozo Prime, and Ozo Power. However, the absence of a demo account and limited transparency regarding fees for payment methods may pose challenges for traders.

Is One Ozo legit or a scam?

Since Ozo broker is unregulated, there isn't a specific regulatory framework governing its operations.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

Market Intruments

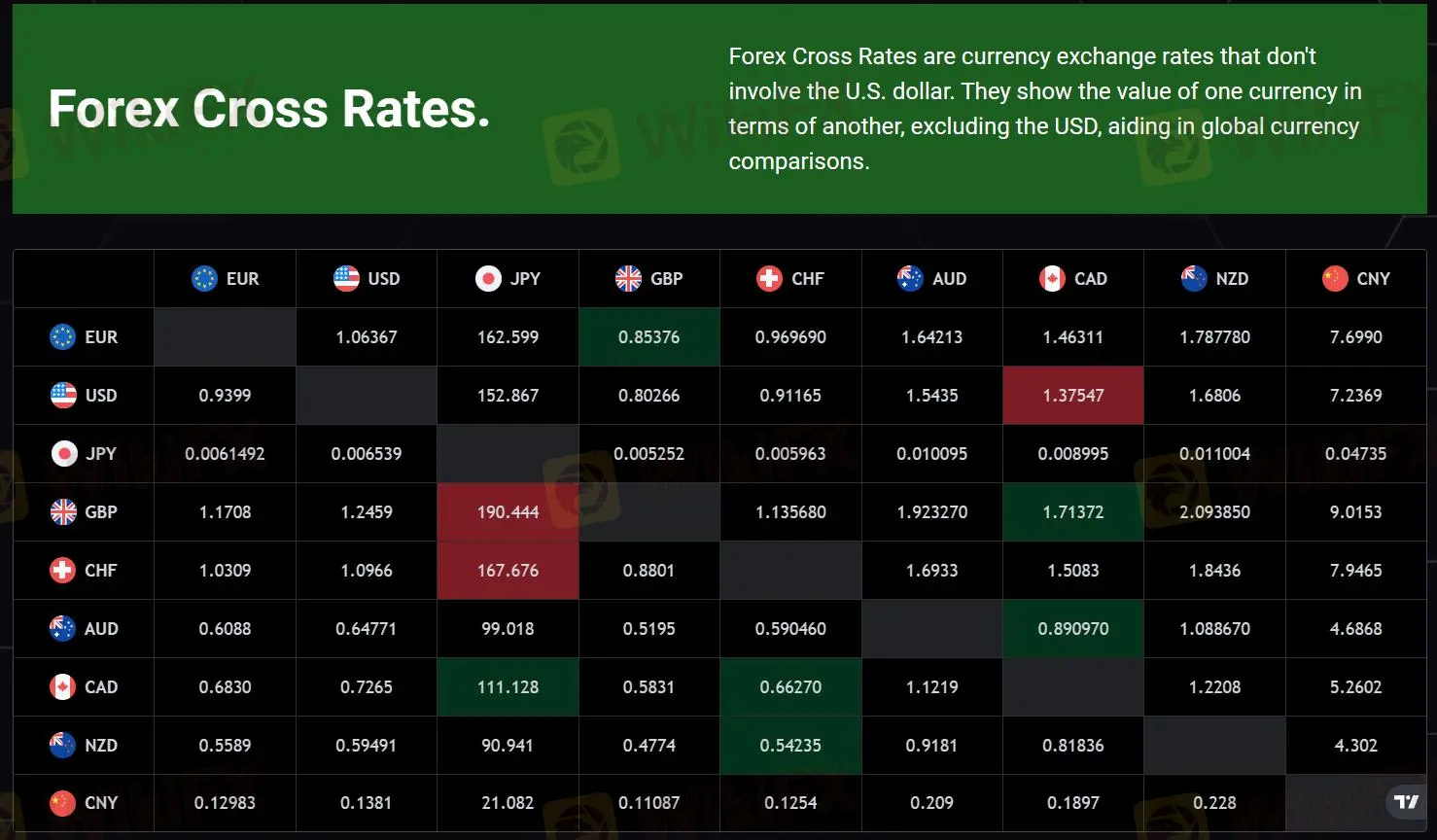

Ozo broker still offer trading instruments such as stocks, forex, commodities, and cryptocurrencies to its clients. These instruments allow investors to speculate on the price movements of various assets.

In terms of stocks, Ozo broker offers trading in a variety of equities from different global markets, allowing investors to buy and sell shares in publicly traded companies.

For forex trading, Ozo broker may provide access to the foreign exchange market, enabling investors to trade currency pairs and speculate on the exchange rate fluctuations between different currencies.

Commodities trading through Ozo broker could involve trading in assets such as gold, silver, oil, agricultural products, and other raw materials. Investors can take positions on the price movements of these commodities in the global markets.

Additionally, Ozo brokers offer trading in cryptocurrencies, allowing investors to buy and sell digital assets like Bitcoin, Ethereum, and others.

Account Types

These accounts offer varying levels of returns, durations, and bonuses, allowing investors to choose the option that aligns with their investment preferences and risk tolerance. Additionally, the referral bonus provides an incentive for investors to introduce others to the platform.

| Account Type | Initial Investment | ROI (Daily) | Total Returns | Duration | Binary Bonus | Capping Limit | Principal Returns | Referral |

| OZO START | $25 - $4,999 | 1.30% | 260% | 200 days | 10% | $1,000 | 100% | 5% - 1.5% |

| OZO GOLD | $5,000 | 2% | 200% | 100 days | 10% | $3,000 | 100% | 10% |

| OZO PRIME | $10,000 | 2.25% | 225% | 100 days | 10% | $6,000 | 100% | 10% |

| OZO POWER | $25,000 | 2.50% | 250% | 100 days | 10% | $12,500 | 100% | 10% |

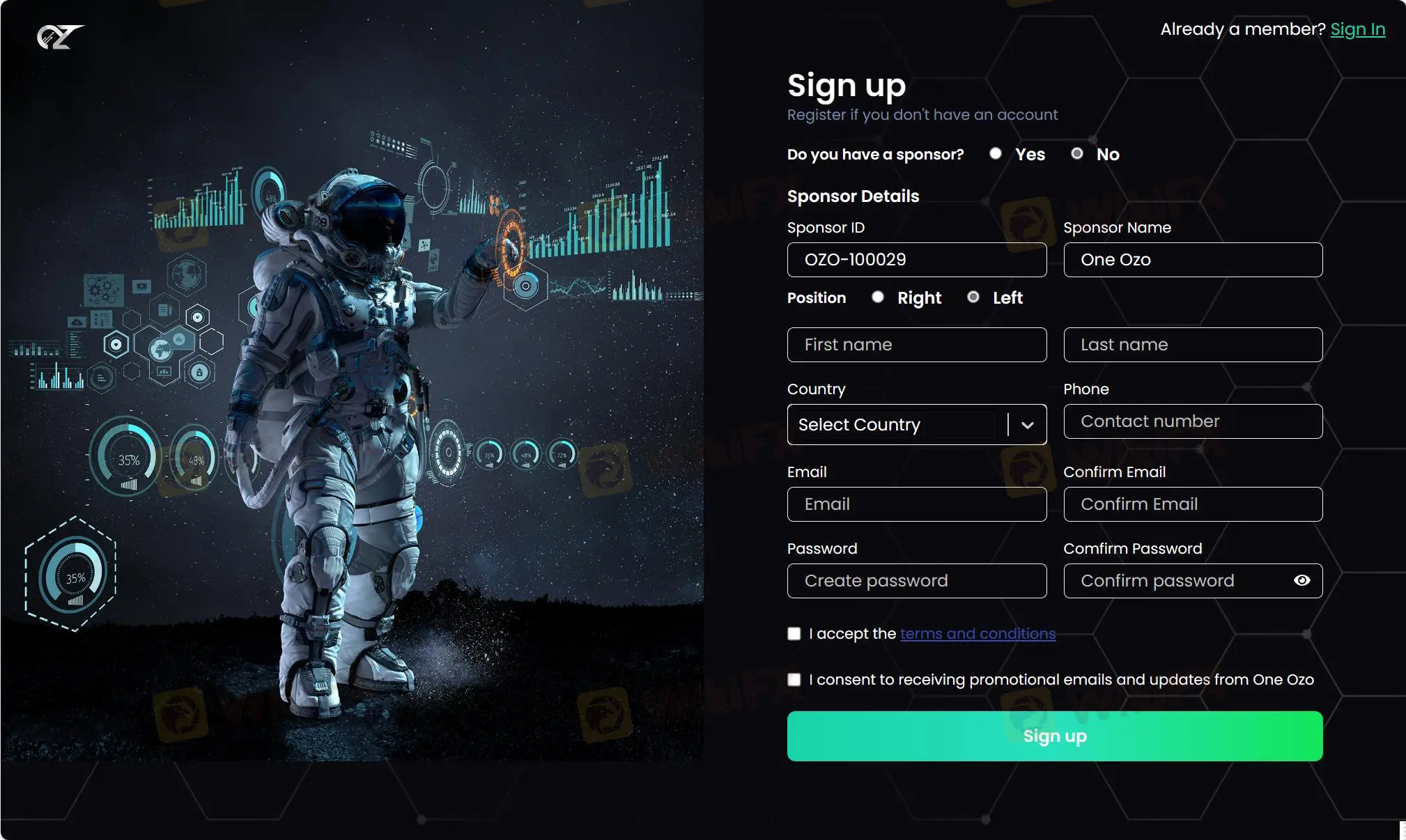

How to open an account?

Based on the available information, the specific steps for opening an One Ozo account are not explicitly provided. However, here's a general outline of the likely process:

- Visit the One Ozo Website:Navigate to the One Ozo website (https://www.onezo.us/).

- Locate the Registration Page:Look for the “Sign Up” or “Register” button or link. It might be located in the top right corner or on a dedicated registration page.

- Complete the Registration Form:Provide accurate and complete personal information, including your name, email address, phone number, and country of residence. Set a strong password and confirm it. Then agree to the Terms of Use and Privacy Policy.

- Verify Your Email Address:A verification link will be sent to your registered email address. Click on the link to confirm your email address and complete the registration process.

- Fund Your Account:Select the desired investment tier (Ozo Start, Ozo Gold, Ozo Prime, or Ozo Power). Choose a payment method (e.g., credit card, bank transfer, cryptocurrency). Deposit the minimum required amount for your chosen tier.

- Complete the Investment Agreement:Review and agree to the investment agreement, which outlines the terms and conditions specific to your chosen tier.

- Start Investing:Once your account is funded and the agreement is accepted, you can start investing and earning returns according to your chosen tier.

Trading Fees

One Ozo might offer trading options alongside their fixed-term investment packages. In this respect, spreads and commissions would apply.

Non-Trading Fees

Account Management Fee: Ozo Broker charges a monthly account management fee of $5.

Deposit/Withdrawal Fees: Ozo Broker charges a fee of 2.5% for deposits made via credit card and debit card, and a fee of $10 for deposits made via wire transfer. For withdrawals made via credit card and debit card, a fee of 3% is charged, while a fee of $25 is charged for withdrawals via wire transfer.

Inactive Account Fee: If your account remains inactive for 6 consecutive months, Ozo Broker will charge a monthly inactive account fee of $10.

Conversion Fee: Ozo Broker charges a fee of 0.5% for currency conversion.

Margin Interest: Ozo Broker charges an annual interest of 5% for margin trading.

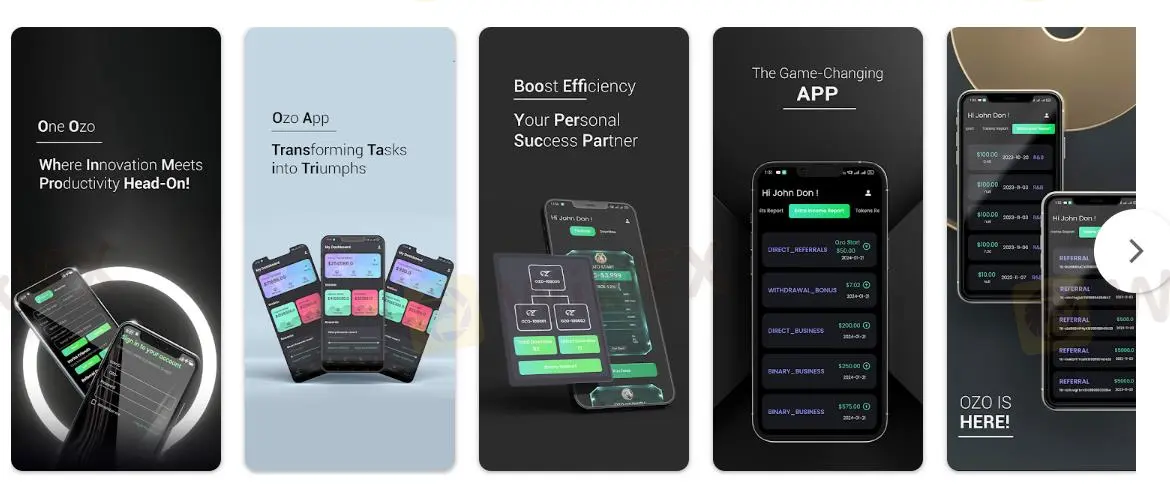

Trading Platform

Ozo Broker is an online trading platform that allows traders to trade forex, CFDs, indices, stocks, and cryptocurrencies. The platform is available for desktop, mobile, and web browsers. The platform offers several advantages, including a wide variety of trading instruments, comprehensive analysis tools, real-time data and news, and 24/7 customer support. However, it also has some drawbacks, such as being limited to online trading, lacking a demo account, requiring a minimum deposit of $100, and charging trading and additional fees.

Deposit & Withdrawal

Deposits:

Minimum deposit: $25

Deposit methods: Ozo Broker might offer various deposit methods, but information readily available online is limited. Here are some common methods generally offered by brokers:

- Credit/debit card: Deposits are usually instant but might come with fees (be sure to check Ozo's fee schedule).

- Bank transfer: This can take 1-3 business days to reflect in your account.

Withdrawals:

Withdrawal processing time: Generally, withdrawals can take 3-7 business days depending on the chosen method.

Withdrawal methods: Similar to deposits, withdrawal methods might vary. Here's a breakdown of common methods and their potential drawbacks:

- Credit/debit card: Withdrawals might take longer than deposits due to additional verification steps. Fees might also apply.

- Bank transfer: This is a secure method but can be slow.

Customer Support

Ozo Broker offers comprehensive customer support to assist its clients with any inquiries or issues they may encounter. Here are some common channels through which customers can reach Ozo Broker's support team:

- Phone Support: Customers can contact Ozo Broker's support team via phone:+44 7452118915 for immediate assistance. The phone number is typically provided on the broker's website or through account documentation.

- Email Support: Clients can also reach out to Ozo Broker's support team via email:Info@oneozo.com. This allows for non-urgent inquiries or issues to be addressed in a timely manner. The email address for support is usually listed on the broker's website.

- Live Chat: They offer a live chat feature on their website :https://api.whatsapp.com/send?phone=447452118915, allowing customers to chat with a support representative in real-time. This can be convenient for quick questions or technical assistance.

- FAQs and Knowledge Base: Ozo Broker may have a comprehensive FAQ section or knowledge base on its website, providing answers to commonly asked questions and troubleshooting guides for common issues.

- Social Media: Ozo Broker maintain active social media profiles where customers can reach out for support or updates. This can include platforms like Twitter, Facebook, or LinkedIn.

Educational Resources

Ozo Broker offers various educational resources to help traders improve their skills, including:

- Trading Guides and Articles: Covering topics like fundamental and technical analysis, risk management, and strategies.

- Webinars and Seminars: Live sessions with experts, ranging from beginner to advanced topics.

- Video Tutorials: Step-by-step guides on using the platform and analyzing markets.

- Educational Courses: Structured courses on forex, stocks, and options trading.

- Market Analysis and Research: Regular reports offering insights into market trends and trading opportunities.

Conclusion

Ozo Broker presents a situation with some potential benefits but overshadowed by significant drawbacks. On the positive side, Ozo offers a vast selection of instruments for trading, from forex to cryptocurrencies. They also boast 24/7 customer support and a user-friendly platform accessible on various devices.

However, these advantages become less appealing when considering the critical issue of regulation. Ozo Broker lacks oversight from major financial authorities, which exposes you to greater risk. This means your funds might not be protected in case of unforeseen circumstances. Furthermore, readily available information regarding Ozo Broker is limited. Details on deposit/withdrawal methods, fees, and the effectiveness of customer support are unclear. This lack of transparency makes it difficult to assess the true cost and reliability of using their platform.

In conclusion, while Ozo Broker might seem like a convenient option with a wide range of instruments, the lack of regulation and limited information online raise significant red flags.

Read more

Apex Markets Review: Traders Outraged Over Withdrawal Denials & Other Trading Issues

Struggling to access fund withdrawals from Apex Markets for months? Does the broker remain silent on fund withdrawal issues? Does the Saint Vincent and the Grenadines-based forex broker reject your winning trades? Have you failed to get a refund into the card used for deposits? Did the broker deduct from your trading account instead? Traders have been imposing these scam allegations while sharing the Apex Markets Review online. We read the reviews and shared some of them below. Take a look!

tastyfx Exposed: Fund Losses, Trade Manipulation & Account Related Hassles Hurt Traders

Are fund losses normal for you at tastyfx? Does the US-based forex broker constantly manipulate prices to hit your trading experience? Do you fail to receive a reply from the broker on your fund withdrawal requests? Do you constantly face trading account issues with tastyfx? It’s time to read the tastyfx review shared by traders online.

Aron Groups Review: Fund Losses, High Commission & Trade Manipulation Keep Traders on Tenterhooks

Have you lost your hard-earned capital while trading via Aron Groups Broker? Has the high commission charged by the broker substantially reduced your trading profits? Does the Marshall Islands-based forex broker constantly manipulate spreads to widen your capital losses? Have you been lured into trading courtesy of Aron Groups No Deposit Bonus, only to find that you had to deposit capital to get a bonus? All these and many more trading issues have become synonymous with the experience of Aron Groups’ traders. Consequently, many traders have shared negative Aron Groups reviews online. In this article, we have shared some of their reviews.

Uniglobe Markets Bonus Review: Understanding the Offers and Uncovering the Risks

Many traders start looking for a new broker by searching for special deals and bonuses. The phrase "Uniglobe Markets no deposit bonus" is something people often search for. Let's address this question clearly and directly. Based on all the information we have, Uniglobe Markets does not currently offer a no-deposit bonus. Instead, this broker focuses on bonuses that require you to deposit your own money first. To get any bonus credits, traders must put in their own capital. Read on to learn how this entire bonus works out for traders.

WikiFX Broker

Latest News

Angel one 2025 Review & Complaints

Latest FCA Daily Alerts and Consumer Warnings for 2025

Webull Widens Crypto Futures with Coinbase Derivatives

Is Nash Markets Regulated or Risk? Truth About Nash Markets’ License & Withdrawal Issues

CySEC Blocks Certification Access to Combat Advisor Impersonation

Exclusive Markets Under the Scanner: Traders Report High Swap Charges, Deposit Discrepancies & More

The United States Outgrows All Its Major Peers

PINAKINE Broker India Review 2025: A Complete Guide to Safety and Services

Pinched By Penny Shortage, US Retailers Beg Congress To Step In

PINAKINE Broker Review: A Complete Look at Its Services and Risks

Rate Calc