OTA Market

Abstract:OTA Markets is an online trading platform that provides access to a wide range of financial markets, including forex, Metal, Oil and Indices. OTA Markets provides a user-friendly trading environment, very low investment threshold and Safe and convenient funds to help traders make informed decisions and navigate the financial markets effectively. Additionally, OTA Markets prioritizes the safety of client funds by following industry standards to safeguard customer funds by depositing them in separate bank accounts from company funds.

| OTA Market Review Summary | |

| Registered Country/Region | United States |

| Regulation | Unauthorized NFA Lisence |

| Market Instruments | Forex, Metal, Oil, Indices |

| Demo Account | Not Mentioned |

| Leverage | 1:100 |

| Spread | Not Mentioned |

| Trading Platforms | META TRADER 5, Tradingweb |

| Minimum Deposit | Not Mentioned |

| Company Address | 30 Hudson St, Jersey City, NJ 07302 USA |

| Customer Support | 24/5 Tel: +678 29666; Email: support@otamarketsltd.com; Live Chat |

What's OTA Market?

OTA Markets is an online trading platform that provides access to a wide range of financial markets, including forex, Metal, Oil and Indices. OTA Markets provides a user-friendly trading environment, very low investment threshold and Safe and convenient funds to help traders make informed decisions and navigate the financial markets effectively. Additionally, OTA Markets prioritizes the safety of client funds by following industry standards to safeguard customer funds by depositing them in separate bank accounts from company funds.

Pros & Cons

| Pros | Cons |

|

|

|

|

Pros

- Multiple Market Instruments: OTA Markets offers a range of market instrument, including Forex, Metal, Oil, Indices.

- Multiple Customer Support Channels: OTA Market provides several channels for customer support including live chat, telephone, email, and social media. This could make it easier for clients to reach out with their queries or concerns.

Cons

- Unauthorized Regulation: OTA Market operates under the unauthorized regulation of National Futures Association. Be cautious while trading with any brokers without valid regulations.

- Lack of Spread Information: Spread information has not been mentioned on OTA Market's official website. This can be crucial for traders in assessing trading costs and making informed decisions.

Is OTA Market Legit?

- Regulatory Sight: OTA Market is currently under the regulation of National Futures Association (No. 0563424), which is unauthorized. While the regulation adds an element of credibility and trust to OTA Market' s operations, it's essential for traders to be cautious.

- User Feedback: Users should check the reviews and feedback from other clients to gain a more comprehensive sight of the broker, or look for reviews on reputable websites and forums.

- Security Measures: OTA Markets follows industry standards to safeguard customer funds by depositing them in separate bank accounts from company funds. This practice ensures a clear separation of client and company funds for added security. Additionally, OTA Markets strictly adheres to anti-money laundering policies to protect client interests and does not permit deposits or withdrawals from third parties under any circumstances.

Market Instruments

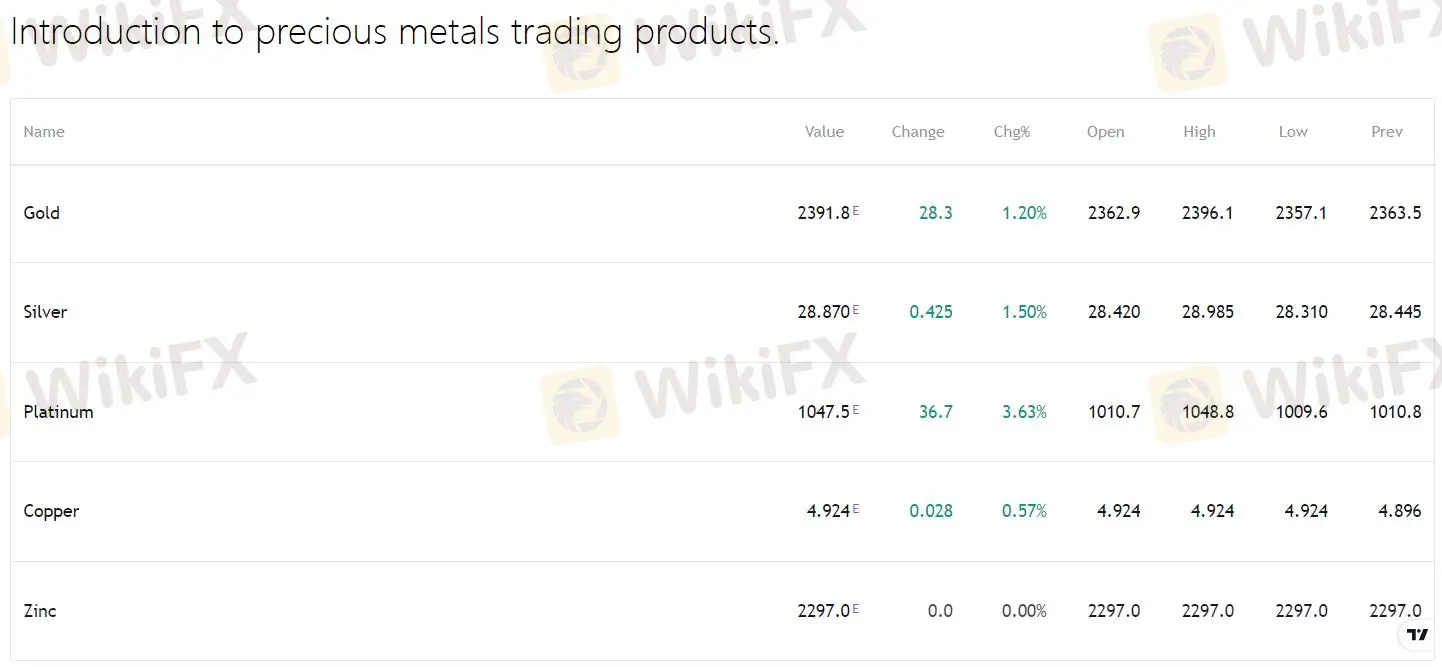

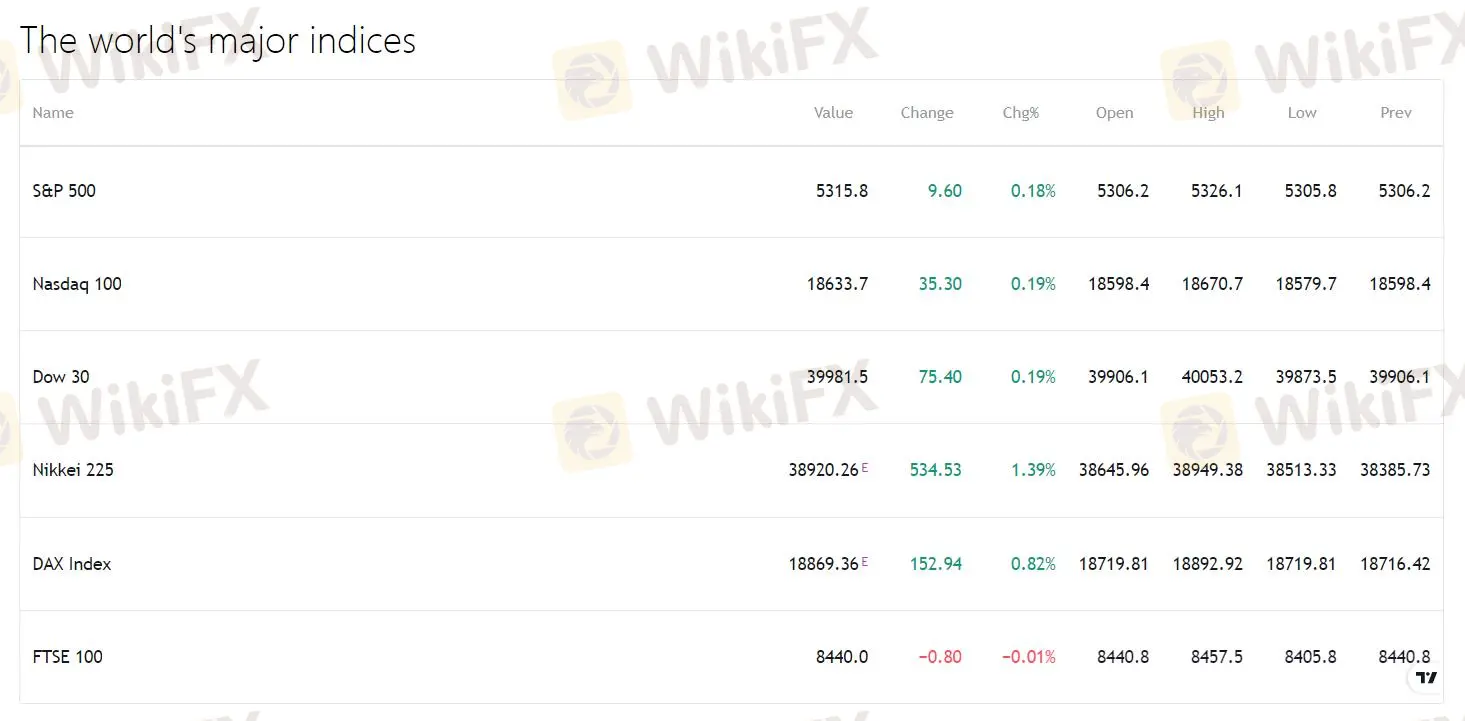

OTA Market provides a diverse range of market instruments for traders, including Forex, Metals, Oil, and Indices. This selection allows traders to access a variety of assets and markets, catering to different trading preferences and strategies.

The availability of Forex pairs enables traders to engage in currency trading and capitalize on exchange rate fluctuations.

Metals like gold and silver offer opportunities for diversification and hedging against market volatility.

Oil trading provides exposure to the energy market, allowing traders to speculate on oil price movements.

Additionally, trading Indices allow traders to invest in a basket of stocks representing a specific market or sector, providing a broader view of market performance.

How to Open an Account?

To open an account, you need to go to OTA Market's official website and click on“Open Real Acocunt”. Then fill in your personal information, including your name, phone number, region, email and so on. Create a password to further secure your account and upload both sides of your ID card to verify your identity. Once your account is verified, you can start utilizing the services offered by OTA Market.

Leverage

OTA Markets offers traders a leverage of 1:100, allowing them to amplify their trading positions. With a leverage ratio of 1:100, traders can control a larger position size with a smaller amount of capital, enabling them to take advantage of market opportunities and diversify their trading strategies.

Trading Platforms

OTA Markets caters to traders with a choice of two platforms: the industry-standard MT5 and Tradingweb. MT5 is available on both PC and Mobile (Apple & Android). It is known for its advanced charting capabilities, technical analysis tools, automated trading features, and customizable interface.

Tradingweb, on the other hand, is a proprietary platform offered by OTA Markets itself, designed to provide a user-friendly interface for beginners and seasoned traders alike, can be available through PC、iOS and Android versions.

Trading Tools

OTA Markets offers traders access to an economic calendar, a valuable tool that provides real-time information on key economic events, announcements, and indicators that can impact the financial markets. By utilizing the economic calendar provided by OTA Markets, traders can stay informed about important economic data releases, such as GDP reports, interest rate decisions, employment figures, and inflation data.

Customer Support

OTA Market offers comprehensive customer support to its clients. This includes being available 24 hours a day, 7 days a week. Clients can reach out to OTA Market through various channels, such as live chat and contact form.

- Telephone: Clients can call their number +678 29666 for any queries.

- Email: The firm offers assistance through email atsupport@otamarketsltd.com.

- Social Media: OTA Market also maintains a strong presence on Facebook, Instagram, LinkedIn and Twitter, providing clients with a more informal method of communication or for staying updated with the firm's latest news.

- Company address: 30 Hudson St, Jersey City, NJ 07302 USA.

Conclusion

In conclusion, OTA Markets offers a range of trading services and tools, including access to the MetaTrader 5 platform and an economic calendar. The leverage of 1:100 provided by OTA Markets can be advantageous for traders looking to maximize their trading positions, but it also poses significant risks. Additionally, the platform's customer support, regulation site and educational resources could be further improved to better assist traders.

Frequently Asked Questions (FAQs)

What market instruments does OTA Market offer?

OTA Market offers Forex, Metal, Oil, Indices.

Is OTA Market regulated?

No. OTA Market's NFA license is unauthorized.

What trading tools does OTA Market offer?

Economic calendar.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors.

Read more

NaFa Markets User Reputation: A Deep Look into Complaints and Scam Claims

Let's answer the important question right away: Is NaFa Markets safe or a scam? After carefully studying all available evidence, NaFa Markets shows all the typical signs of a fake financial company. We strongly recommend not putting any money with this company. You should avoid it completely. Read on for more revelation about the broker.

Core Prime Exposure: Traders Report Illegitimate Account Blocks & Manipulated Trade Executions

Was your Core Prime forex trading account disabled after generating profits through a scalping EA on its trading platform? Have you witnessed losses due to manipulated trades by the broker? Does the broker’s customer support team fail to clear your pending withdrawal queries? Traders label the forex broker as an expert in deceiving its clients. In this Core Prime review article, we have investigated some complaints against the Saint Lucia-based forex broker. Read on!

NaFa Markets Regulation: A Deep Dive Investigation Exposing a Major Scam

WARNING: Do not put any money into NaFa Markets. Our research shows it has all the signs of a clever financial scam. This platform lies about its legal status and uses tricks that are the same as fake investment schemes designed to steal your funds. When people search for information about NaFa Markets regulation, they need to know the truth: it is fake and made up.

Is NaFa Markets Legit? A Complete Investigation

Our research into NaFa Markets gives us a clear and urgent answer. For anyone asking, "Is NaFa Markets legit?", the answer is definitely no. This platform shows all the typical signs of a fake operation created to steal funds from people who don't know better. We strongly recommend that all traders stay completely away from this platform.

WikiFX Broker

Latest News

ECB Minutes: Service Inflation and Wage Spikes Kill Rate Cut Speculation

Trade War Averted: Euro Rallies as US Withdraws Tariff Threats

Yen Volatility Spikes: PM Takaichi Calls Snap Election Amid BoJ 'Hawkish Pause'

Sticky US Inflation Data Dashes Near-Term Fed Rate Cut Hopes

Yen Fragility Persists: Inflation Miss Cements BoJ 'Hold' Expectation

BoJ "Politically Paralyzed" at 0.75% as Takaichi Calls Snap Election

'Bond Vigilantes' Return: JGB Rout Sparks Contagion Fears for US Treasuries

ZarVista User Reputation: Looking at Real User Reviews to Check Is ZarVista Safe or Scam?

Gold Fun Corporation Ltd Review 2025: Is This Forex Broker Safe?

MONAXA Review: Safety, Regulation & Forex Trading Details

Rate Calc