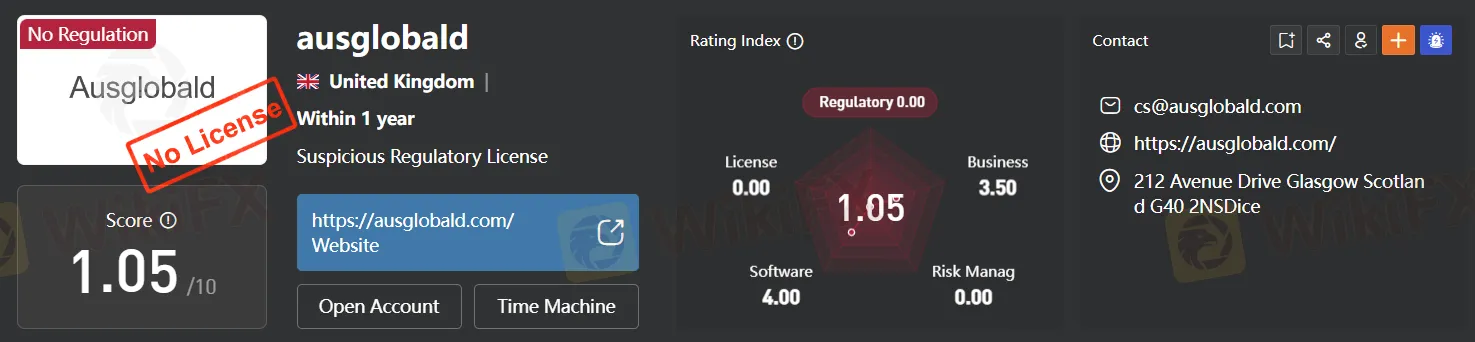

ausglobald

Abstract:Ausglobald, founded in 2023 and headquartered in the United Kingdom, operates as an unregulated brokerage firm. Offering a maximum leverage of up to 200:1 and trading through the MetaTrader 5 (MT5) platform, Ausglobald provides access to a variety of tradable assets including forex, precious metals, cryptocurrencies, and stock indices. With account options ranging from Standard to Specialized, traders can choose the account type that best suits their experience level and trading preferences. While the company's spreads vary based on market conditions, customers can rely on email support for assistance via cs@ausglobald.com.

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded year | 2023 |

| Company Name | Ausglobald |

| Regulation | Not regulated |

| Maximum Leverage | Up to 200:1 |

| Spreads or Fees | Spreads depend on the market |

| Trading Platforms | MetaTrader 5 (MT5) |

| Tradable Assets | Forex, Precious Metals, Cryptocurrencies, Stock Indices |

| Account Types | Standard, Specialized |

| Customer Support | Email support available at cs@ausglobald.com |

Overview

Ausglobald, founded in 2023 and headquartered in the United Kingdom, operates as an unregulated brokerage firm. Offering a maximum leverage of up to 200:1 and trading through the MetaTrader 5 (MT5) platform, Ausglobald provides access to a variety of tradable assets including forex, precious metals, cryptocurrencies, and stock indices. With account options ranging from Standard to Specialized, traders can choose the account type that best suits their experience level and trading preferences. While the company's spreads vary based on market conditions, customers can rely on email support for assistance via cs@ausglobald.com.

Regulation

Ausglobald operates as a broker but is not regulated by any financial authority. This lack of regulation means that the company may not adhere to industry standards or consumer protection measures. Investors should exercise caution and thoroughly research Ausglobald's background and practices before engaging with its services.

Pros and Cons

Ausglobald offers a range of advantages and disadvantages for traders to consider. While its diverse selection of trading products, competitive leverage, and user-friendly account opening process are notable strengths, the lack of regulation and potential risks associated with high leverage warrant caution. Traders should carefully weigh these factors before engaging with Ausglobald's services.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

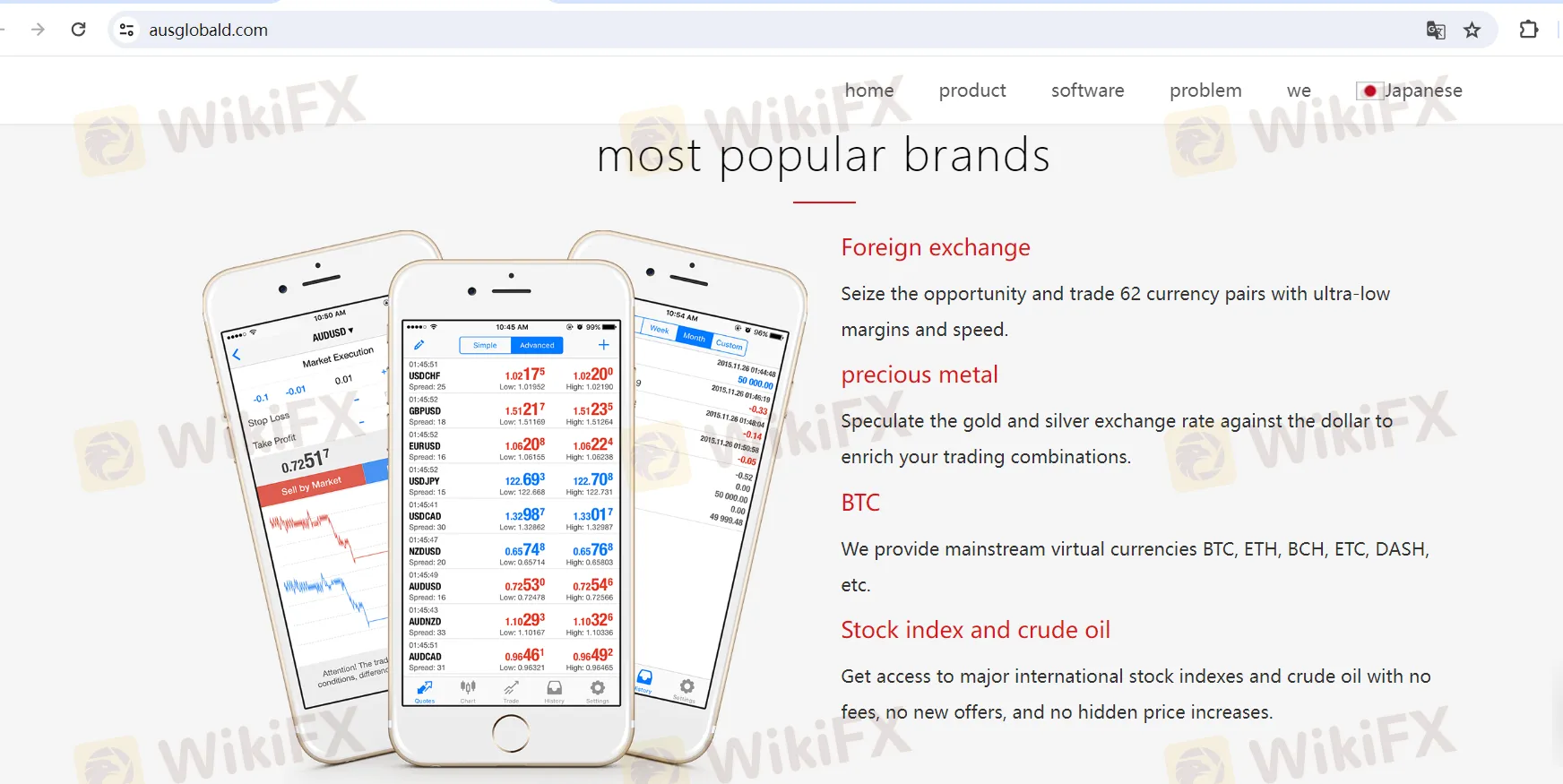

Market Instruments

Ausglobald provides a comprehensive selection of trading products, including:

Foreign Exchange (Forex):

Trade 62 currency pairs with ultra-low margins and high-speed execution.

Precious Metals:

Speculate on the exchange rates of gold and silver against the dollar to diversify trading combinations.

Virtual Currencies:

Access mainstream virtual currencies such as BTC (Bitcoin), ETH (Ethereum), BCH (Bitcoin Cash), ETC (Ethereum Classic), DASH, and more for cryptocurrency trading.

Stock Index and Crude Oil:

Trade major international stock indexes and crude oil without fees, new offers, or hidden price increases, providing access to diversified investment opportunities.

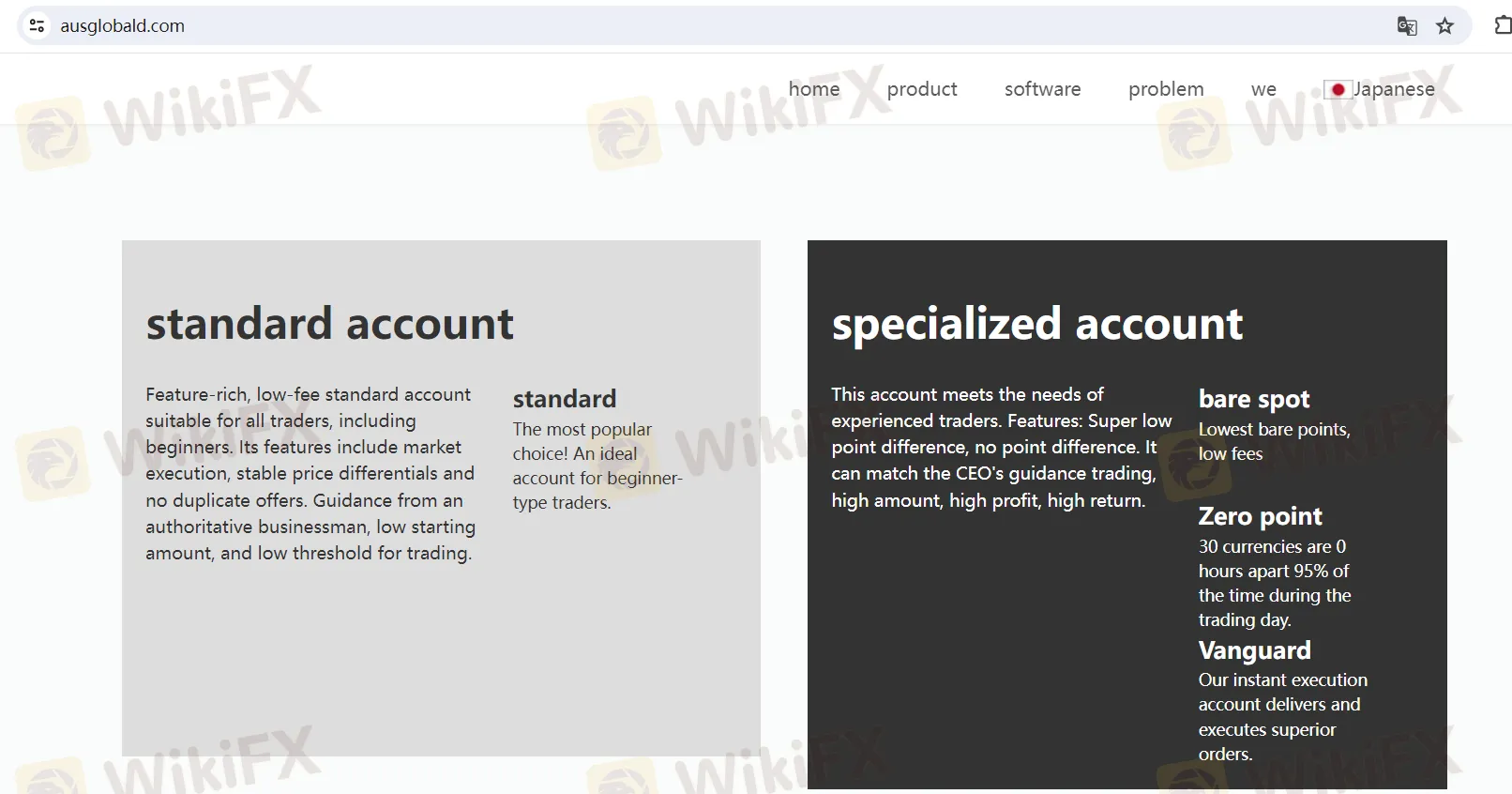

Account Types

Ausglobald offers two main types of accounts:

Standard Account:

Provides guidance from authoritative experts, with a low starting amount and threshold for trading.

Features market execution, stable price differentials, and no duplicate offers.

Designed for traders of all levels, including beginners.

Specialized Account:

Allows for matching CEO guidance trading, with higher initial deposits for potentially higher profits and returns.

Offers super low point differentials or no point differentials.

Tailored to meet the needs of experienced traders.

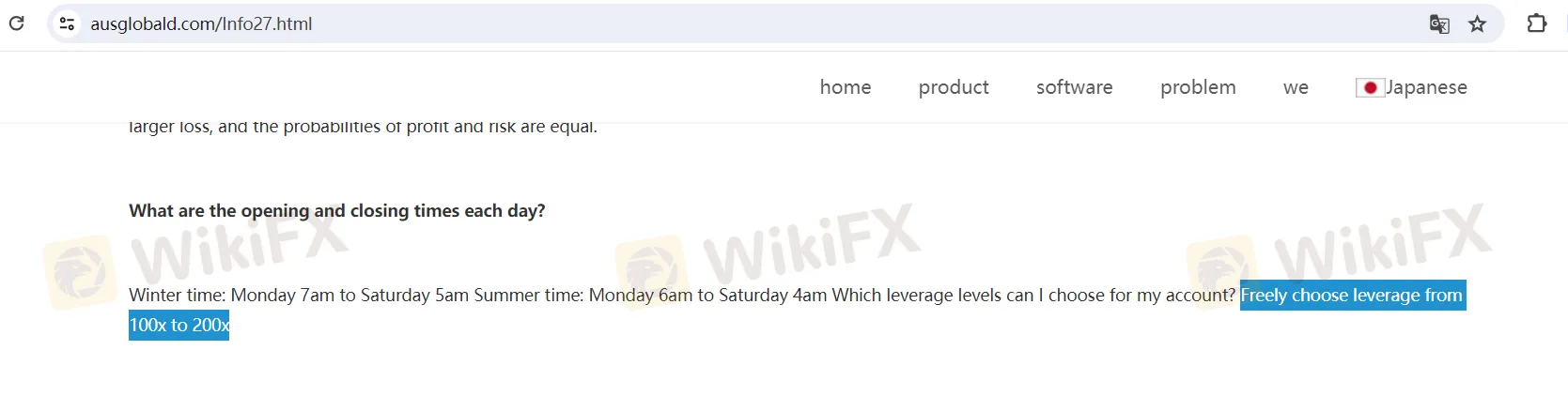

Leverage

The leverage offered by this broker is up to 200:1. This means that for every $1 in the trader's account, they can control up to $200 worth of assets in their trades. This level of leverage allows traders to amplify their potential profits, but it also increases the risk of significant losses, making it essential for traders to exercise caution and employ risk management strategies.

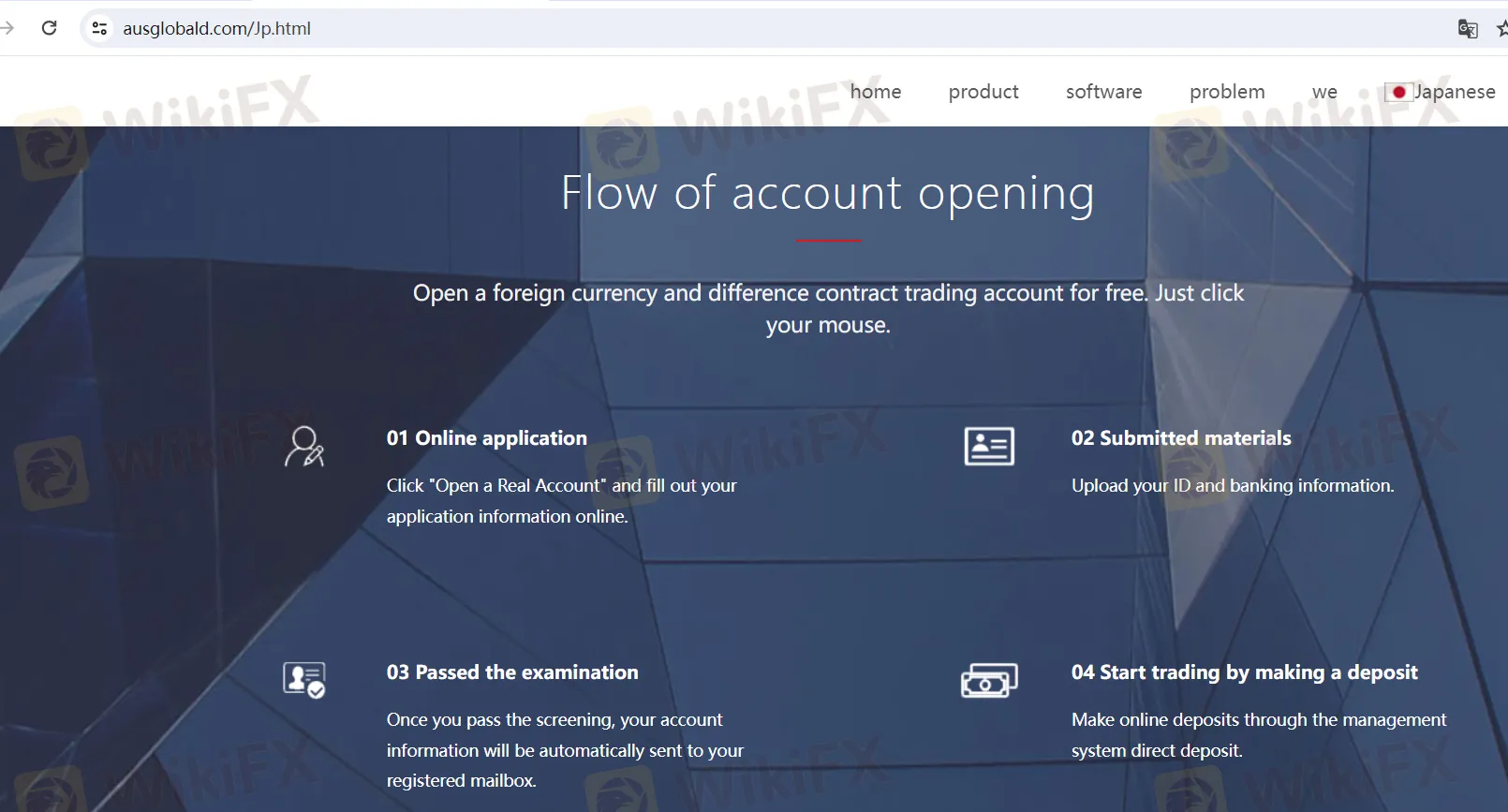

How to open an account?

To open an account with this broker, follow these steps:

Online Application:

Click on “Open a Real Account” on the broker's website and complete the application form with your personal information.

Submitted Materials:

Upload scanned copies of your identification documents and banking information as required by the broker.

Examination:

Your application will undergo screening by the broker. Once approved, your account information will be automatically sent to the email address you provided during registration.

Start Trading by Making a Deposit:

Log in to your account through the broker's management system and proceed to make an online deposit using the provided deposit methods.

By following these steps, you can open a foreign currency and difference contract trading account with the broker quickly and easily.

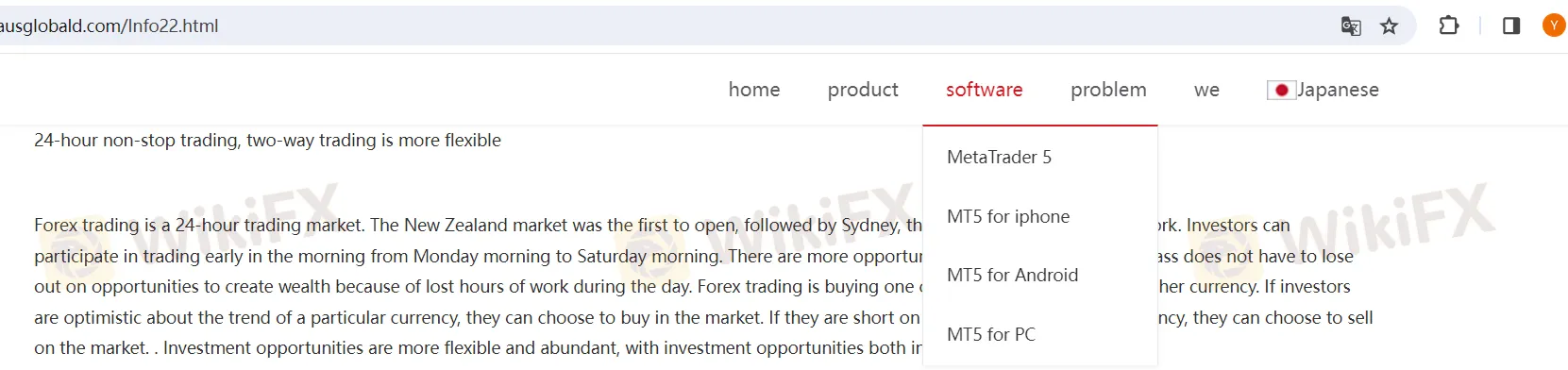

Trading Platforms

This broker offers the popular MetaTrader 5 (MT5) platform, providing traders with a robust and versatile trading environment. With MT5, traders gain access to advanced charting tools, technical indicators, and analytical resources to facilitate informed decision-making. The platform supports a wide range of assets, including forex, commodities, stocks, and cryptocurrencies, allowing traders to diversify their portfolios seamlessly. Additionally, MT5 offers automated trading capabilities through expert advisors (EAs), enabling traders to implement algorithmic trading strategies and execute trades automatically based on pre-defined parameters. With its intuitive interface and powerful features, MT5 serves as a comprehensive trading solution for both novice and experienced traders alike, empowering them to navigate the financial markets with confidence and efficiency.

Customer Support

Ausglobald's customer support can be reached via email at cs@ausglobald.com. Their customer support team is dedicated to assisting clients with any inquiries or issues they may encounter while trading. Whether it's questions about account setup, platform functionality, trading strategies, or technical assistance, traders can expect timely and helpful responses from the support team. Additionally, Ausglobald may offer other channels of support such as live chat or phone support to ensure accessibility and convenience for their clients. With a commitment to providing excellent customer service, Ausglobald strives to address the needs and concerns of their traders promptly and effectively, fostering a positive trading experience for all.

Conclusion

In conclusion, Ausglobald presents a diverse range of trading opportunities across forex, precious metals, cryptocurrencies, and stock indices, coupled with competitive leverage options. While the absence of regulation warrants caution, the broker's accessible account opening process and comprehensive customer support aim to facilitate a positive trading experience for both novice and experienced traders. Coupled with the robust MetaTrader 5 platform, Ausglobald endeavors to empower traders with the tools and resources necessary to navigate the financial markets with confidence. However, traders should remain vigilant and adhere to risk management strategies to mitigate potential losses.

FAQs

Q1: Is Ausglobald regulated by any financial authority?

A1: No, Ausglobald operates as a broker without regulation.

Q2: What trading products does Ausglobald offer?

A2: Ausglobald provides trading opportunities in forex, precious metals, cryptocurrencies, and stock indices.

Q3: What leverage does Ausglobald offer?

A3: Ausglobald offers leverage of up to 200:1 for trading.

Q4: How can I contact Ausglobald's customer support?

A4: You can reach Ausglobald's customer support via email at cs@ausglobald.com.

Q5: What trading platform does Ausglobald offer?

A5: Ausglobald offers the MetaTrader 5 (MT5) platform for traders, providing advanced tools and resources for trading.

Risk Warning

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.

Read more

AssetsFX Review – What Traders Are Saying & Red Flags to Watch

Has AssetsFX stolen your deposits when seeking withdrawals from the trading platform? Did the broker fail to give any reason for initiating this? Did you notice fake trades in your forex trading account? Does the Mauritius-based forex broker deny you withdrawals by claiming trading abuse on your part? Did you also receive assistance from the AssetsFX customer support team? Firstly, these are not unusual here. Many traders have shared negative AssetsFX reviews online. In this article, we have highlighted such reviews so that you can make the right investment call. Take a look!

ROCK-WEST Complete Review: A Simple Guide to Its Trading Platforms, Costs, and Dangers

Traders looking for unbiased information about ROCK-WEST often find mixed messages. The broker offers some appealing features: you can start with just $50, use the popular MetaTrader 5 trading platform, and get very high leverage. These features are meant to attract both new and experienced traders who want easy access to potentially profitable trading. However, as you look deeper, there are serious problems. The good features are overshadowed by the broker's weak regulation and many serious complaints from users, especially about not being able to withdraw their capital. This complete 2025 ROCK-WEST Review will examine every important aspect of how it works—from regulation and trading rules to real user experiences—to give traders clear, fact-based information for making smart decisions.

LTI Review 2026: Safe Broker or a High-Risk Scam? User Complaints Analyzed

When you search for terms like "Is LTI Safe or Scam," you are asking the most important question any investor can ask. Picking a broker is not just about fees or trading platforms; it is about trust. You are giving the broker your hard-earned capital, expecting it to handle it honestly and professionally. The internet is full of mixed user reviews, promotional content, and confusing claims, making it hard to find a clear answer. This article is designed to cut through that confusion.

LTI Regulatory Status: Understanding Its Licenses and Company Registration Details

When choosing a forex broker, the most important question is always about regulation. For traders looking into the London Trading Index (LTI), the issue of LTI Regulation is not simple. In fact, there are conflicting claims, official warnings, and major red flags. According to data from global regulatory tracking platforms, LTI operates without proper regulation from any top-level financial authority. The main problem comes from the difference between what the broker claims and what can actually be verified. While LTI presents itself as a professional company based on London's financial standards, independent research shows a different story. This article will examine the claims about the LTI License, look closely at the broker's company structure, and analyze the warnings issued by financial watchdogs. Read on!

WikiFX Broker

Latest News

Is ICM Brokers Legit? Checking Its Legitimacy and Scam Risks

Trade Nation Rebrands TD365 in Global Integration Move

NaFa Markets Review: An Important Warning & Analysis of Fraud Claims

TenTrade Review: Safety, Regulation & Forex Trading Details

USD Crisis: Capital Flight Accelerates as Europe Pivots Away from 'Political Risk'

Gold Breaches $5,110: 'Fear Trade' Dominates as Dollar Wavers

Italian Regulator Moves to Block Multiple Unauthorised Investment Platforms

Yen Awakening: Intervention Risks and Real Rates Signal Structural Turn

HERO Review: Massive Withdrawal Crisis and Platform Blackouts Exposed

PRCBroker Review: Where Profitable Accounts Go to Die

Rate Calc