7,000 USD lost! Is VOCO CAPITAL MARKET a scam?

Abstract:Investors are constantly seeking opportunities to grow their wealth. Unfortunately, not every venture turns out to be as lucrative as expected. One such case has recently surfaced involving VOCO CAPITAL MARKET, where a victim named Sanjeev claims to have lost a staggering 7,000 USD. In this article, we delve into Sanjeev's unfortunate experience and explore whether VOCO CAPITAL MARKET is a legitimate platform or a potential scam.

Investors are constantly seeking opportunities to grow their wealth. Unfortunately, not every venture turns out to be as lucrative as expected. One such case has recently surfaced involving VOCO CAPITAL MARKET, where a victim named Sanjeev claims to have lost a staggering 7,000 USD. In this article, we delve into Sanjeev's unfortunate experience and explore whether VOCO CAPITAL MARKET is a legitimate platform or a potential scam.

About VOCO CAPITAL MARKET

VOCO MARKETS is a young broker registered in Comoros. This broker does not hold a legitimate license, which means this broker is unregulated. WikiFX has given this broker a low score of 1.07/10.

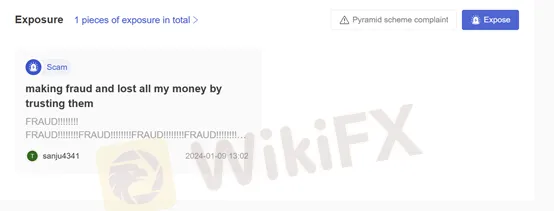

Complaints

Case in Detail

Sanjeev, a 30-year-old individual from the UAE, shares his disheartening story of falling victim to what he believes is a scam orchestrated by VOCO CAPITAL MARKET. According to him, his friend Harshika persuaded him to open an account with the broker. Upon Harshika's recommendation, Sanjeev registered with VOCO CAPITAL MARKET and proceeded to deposit 7,000 USD into his trading account.

Sanjeev states that he engaged in trading activities based on the advice provided by VOCO CAPITAL MARKET's financial advisor Ali. Following Ali's recommendations, Sanjeev executed trades that unfortunately resulted in the complete loss of his 7,000 USD investment. Distressed and frustrated, Sanjeev is now seeking assistance for the refund of his entire investment.

Conclusion

To determine the legitimacy of Sanjeev's claims, it is essential to conduct a thorough investigation into VOCO CAPITAL MARKET. Various factors need to be considered, including the broker's regulatory status, customer reviews, and any history of regulatory actions or warnings.

Investors should exercise caution and conduct due diligence before engaging with any online trading platform to protect themselves from potential scams.

Read more

Traders Say NO to FxPlayer Due to Deposit & Withdrawal Scams: Check Their Complaints

Do you constantly face login issues with your FxPlayer trading account? Does the Marshall Islands-based forex broker prevent you from accessing fund withdrawals? Did your deposit vanish at FxPlayer? You are not alone! Many traders have complained about these suspicious transactions. Take a look!

Degiro Exposed: Unfair Prices, Account Opening Hassles & Poor Customer Service

Do you constantly face exorbitant prices and sudden price changes when trading via Degiro? Don’t find it seamless while trading through this platform? Is the account opening experience full of chaos? Does its customer service team fail to answer your queries? You have added to the growing list of traders with multiple trading issues. Some traders have criticized the forex broker on review platforms. In this article, we have shared Degiro reviews. Keep reading!

CopyFX RoboForex Review: 5 Truths You Must Know About CopyFX Account, App & MT5 Platform

CopyFX, often referred to as CopyFX by RoboForex, is the copy trading platform connected to the RoboForex brokerage. It’s designed to serve both experienced traders, known as "Leaders," and investors, also called "Copiers." The two platforms RoboForex and CopyFX are fully integrated, working seamlessly together.

Mitrade Secures FSCA License in South Africa

Mitrade gains FSCA approval in South Africa, expanding its global CFD trading platform and reinforcing trust in regulated online trading.

WikiFX Broker

Latest News

FXONET Exposed: Traders Report Scam Allegations & Major Capital Losses

RM66 Million Lost in Ponzi Scheme Allegedly Tied to Datuk Businessman

Traders Expose Major Flaws in Moomoo’s Operations: Payout Issues, Poor Support & More

AssetsFX Review 2025: Is This Broker Safe or a Red Flag?

Webull UK announces its new offer

ScoreCM Faces Traders’ Wrath: Unprofessional Behavior & Withdrawal Delays Spoil Investment Mood

Spot Forex Trading Explained: Definition, How It Works and Key Factors to Know

【WikiEXPO Global Expert Interviews】Sergei Grechkin:AI, Risk, and the Future of Forex

How to Spot and Avoid Financial Scams

Germany's Industrial Collapse: No Turnaround In Sight

Rate Calc