Inveslo

Abstract:Inveslo is an online trading platform based in Kazakhstan, offering multiple account types, with a minimum deposit of $100 and leverage up to 1:2000. Spreads vary by account type, and it utilizes MetaTrader 4 (MT4) for trading. Traders can access Forex, Copy Trading, Spot Metals, Spot Energies, CFD Indices, and Cryptocurrencies. Account options include Standard, ECN Commission-Free, ECN, Premium, and a Demo account with $20,000 virtual funds. Customer support is available 24/7 through various channels, and payment methods include cryptocurrencies, Virtual Pay, Visa, Mastercard, Local Transfer, and Bank Transfer. Inveslo offers educational resources in its “Learn Forex” section.

| Aspect | Information |

| Registered Countra | Kazakhstan |

| Company Name | Inveslo |

| Regulation | AFSA in Kazakhstan |

| Minimum Deposit | $30 |

| Maximum Leverage | Up to 1:2000 |

| Spreads | Starting from 0.1 pips |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex, Copy Trading, Spot Metals, Spot Energies, CFD Indices, Cryptocurrencies |

| Account Types | Standard, ECN Commission-Free, ECN, Premium, Demo |

| Demo Account | Available with unlimited virtual funds |

| Customer Support | 24/7 support via email, phone, and various contact options |

| Payment Methods | Cryptocurrencies, Virtual Pay, Visa, Mastercard, Local Transfer, Bank Transfer |

| Educational Tools | “Learn Forex” section with webinars, guides, video tutorials, and more |

Inveslo Information

Inveslo is an online trading platform based in Kazakhstan, offering multiple account types, with a minimum deposit of $100 and leverage up to 1:2000. Spreads vary by account type, and it utilizes MetaTrader 4 (MT4) for trading.

Traders can access Forex, Copy Trading, Spot Metals, Spot Energies, CFD Indices, and Cryptocurrencies. Account options include Standard, ECN Commission-Free, ECN, Premium, and a Demo account with unlimited virtual funds.

Customer support is available 24/7 through various channels, and payment methods include cryptocurrencies, Virtual Pay, Visa, Mastercard, Local Transfer, and Bank Transfer. Inveslo offers educational resources in its “Learn Forex” section.

Regulation

Inveslo, is regulated in Kazakhstan, and holds a license of Bussiness Registration authorized by the The Astana Financial Services Authority (AFSA) under license no. 210540039066.

Pros and Cons

Inveslo offers a wide range of trading instruments, including copy trading, precious metals, energies, cryptocurrencies, and more, providing traders with diverse investment opportunities. The platform also offers various account types to cater to different trader preferences and experience levels, as well as high leverage for potential profit amplification. Inveslo utilizes the user-friendly MetaTrader 4 platform and provides comprehensive customer support and educational resources.

| Pros | Cons |

|

|

|

|

| |

| |

| |

| |

| |

| |

|

Market Instruments

Inveslo offers a diverse range of trading instruments to cater to various investment preferences and strategies:

- Forex Trading: Inveslo provides access to the foreign exchange market, allowing traders to engage in the trading of major, minor, and exotic currency pairs. This offers opportunities to capitalize on fluctuations in global currencies.

- Copy Trading: With Inveslo's copy trading feature, investors can replicate the trading strategies of experienced traders, amplifying their profits with minimal effort and expertise.

- Spot Metals: Inveslo enables investors to invest in precious metals like gold, silver, and others, offering a secure and potentially lucrative option for those looking to diversify their portfolios.

- Spot Energies: Investors can safeguard their financial future against inflation by trading spot energies like oil and gas, allowing them to benefit from the dynamics of the energy market.

- CFD Indices: Inveslo provides opportunities for traders to speculate on the performance of various indices, potentially making profits by forecasting market trends and movements in stock indices.

- Cryptocurrencies: Inveslo allows traders to expand their investment portfolios with major cryptocurrencies. This includes trading popular digital currencies like Bitcoin, Ethereum, and others, providing exposure to the evolving and dynamic world of digital assets.

Account Types

Inveslo offers a variety of trading accounts to cater to the diverse needs and experience levels of traders. Here's a table of the different account types they provide:

| Feature | Standard | ECN Commission-Free | ECN | Premium |

| Minimum Deposit | $30 | $250 | $500 | $20,000 |

| Maximum Leverage | 1:2000 | 1:2000 | 1:2000 | 1:200 |

| Trading Platform | MetaTrader 4 | MetaTrader 4 | MetaTrader 4 | MetaTrader 4 |

| Account Currency | USD/EUR | USD/EUR | USD/EUR | USD/EUR |

| Spreads | Competitive | From 1.9 pips | From 0.1 pips | From 0.1 pips |

| Commission | No | No | From $3 per lot | No |

| Market Execution | Yes | Yes | Yes | Yes |

| Hedging Allowed | Yes | Yes | Yes | Yes |

| Scalping Allowed | Yes | Yes | Yes | Yes |

| SWAP-free Option | Yes | Yes | Yes | Yes |

| Trading Instruments | Majors, Minors, Exotics, Metals, Indices, Energies | Majors, Minors, Exotics, Metals, Indices, Energies | Majors, Minors, Exotics, Metals, Indices, Energies, Cryptos | Majors, Minors, Exotics, Metals, Indices, Energies |

| Max. Order Volume (Lots) | 30 | 100 | 100 | 250 |

| Max. Orders | 100 | Unlimited | Unlimited | Unlimited |

| Max. Pending Orders | 100 | 300 | 300 | 300 |

| Real Money Required | Yes | Yes | Yes | Yes |

| Additional Features | None | None | None | Ultra-fast execution, Fixed leverage, No last-look pricing |

All accounts offer MetaTrader 4 platform, USD/EUR account currency, SWAP-free option, and trading of Majors, Minors, Exotics, Metals, Indices, and Energies. Key differences include minimum deposit, spreads, commissions, maximum order volume, and additional features.

Leverage

Inveslo offers a maximum trading leverage of up to 1:2000. Leverage in trading allows traders to control a larger position size with a relatively smaller amount of capital. With a 1:2000 leverage, for every $1 in your trading account, you can control a trading position worth up to $2000 in the market.

Spreads and Commissions

Costs vary by account type. Standard & Premium accounts have competitive spreads with no commission. ECN Commission-Free offers competitive spreads (from 1.9 pips) with no commission. ECN accounts have the tightest spreads (from 0.1 pips) but add a commission fee (from $3 per lot).

Deposit & Withdrawal

Inveslo offers a variety of deposit methods with no associated commissions.

- Cryptocurrencies: Deposits in USD are processed instantly.

- Virtual Pay: Deposits in USD are processed based on blockchain speeds.

- Visa and Mastercard: Deposits in USD are processed instantly.

- Local and Bank Transfers: Deposits in USD are processed instantly.

Inveslo supports multiple withdrawal methods, including Cryptocurrencies, Virtual Pay, Visa, Mastercard, Local, and Bank Transfers with no fees. Withdrawals in USD can take up to 24 hours to process.

Trading Platforms

Inveslo offers the widely acclaimed MetaTrader 4 (MT4) trading platform to its users. MT4 is renowned for its user-friendly interface, advanced charting tools, technical analysis capabilities, and customizable features, making it an ideal choice for traders of all experience levels. With real-time market quotes, quick execution, and support for multiple trading instruments, including Forex, commodities, indices, and more, MT4 empowers traders to make informed decisions and execute trades efficiently. Additionally, its compatibility with expert advisors (EAs) enables automated trading strategies, enhancing the trading experience for those seeking algorithmic trading solutions.

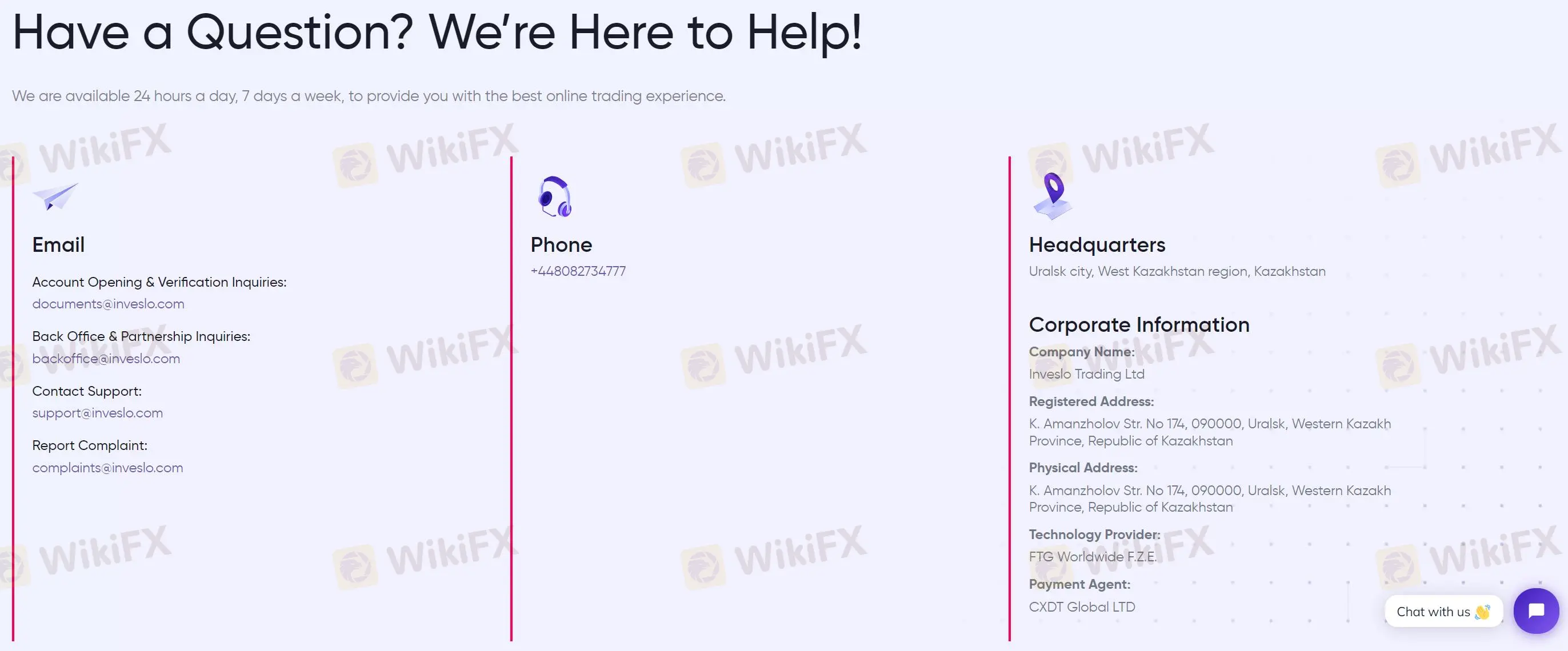

Customer Support

Inveslo offers 24/7 multilingual customer support for investors, especially the live chat on their website. What's more, here are other ways you can reach them:

- Email:

- For account opening and verification inquiries: documents@inveslo.com

- For back office and partnership inquiries: backoffice@inveslo.com

- For general customer support: support@inveslo.com

- To report a complaint: complaints@inveslo.com

- Phone: +448082734777 (international number)

Inveslo is headquartered in Uralsk city, West Kazakhstan region, Kazakhstan.

Educational Resources

Inveslo places a strong emphasis on trader education with its “Learn Forex” section, providing a comprehensive range of resources to enhance trading knowledge and skills.

Traders can access informative webinars to stay updated with market trends and strategies, while the “Guide to Forex” and “Forex Basics” sections offer foundational insights into the intricacies of the foreign exchange market. Understanding core concepts is made easy through the “Forex Trading Concepts” segment, and traders can learn valuable risk management techniques in “How to Protect Your Money.” The platform also offers guidance on planning trades effectively, a blog for further market insights, and downloadable eBooks to expand knowledge.

Summary

Inveslo is an online trading platform that offers various trading instruments, including Forex, copy trading, spot metals, spot energies, CFD indices, and cryptocurrencies. Traders can choose from different account types, each tailored to specific trading needs and experience levels, and access a maximum leverage of up to 1:2000. The platform provides a user-friendly MetaTrader 4 (MT4) trading platform, robust customer support services, and a strong focus on trader education.

FAQs

What trading instruments are available on Inveslo?

Inveslo offers a diverse range of instruments, including Forex, copy trading, spot metals, spot energies, CFD indices, and cryptocurrencies.

What is the maximum leverage offered by Inveslo?

Inveslo provides a maximum trading leverage of up to 1:2000.

Are there educational resources available on Inveslo?

Yes, Inveslo offers a comprehensive “Learn Forex” section with webinars, guides, video tutorials, and more to enhance traders' knowledge and skills.

How can I contact Inveslo's customer support?

You can reach Inveslo's customer support team 24/7 through email, phone, and various contact options listed on their website.

Read more

Scandinavian Capital Markets Exposed: Traders Cry Foul Play Over Trade Manipulation & Fund Scams

Does Scandinavian Capital Markets stipulate heavy margin requirements to keep you out of positions? Have you been deceived by their price manipulation tactic? Have you lost all your investments as the broker did not have risk management in place? Were you persuaded to bet on too risky and scam-ridden instruments by the broker officials? These are some burning issues traders face here. In this Scandinavian Capital Markets review guide, we have discussed these issues. Read on to explore them.

Deriv Withdrawal Issues: Real Client Cases Exposed

Deriv exposed via client cases of withdrawal issues, 13‑month refund delays, severe slippage, and disabled accounts despite multiple “regulated” licenses.

Uniglobe Markets Deposits and Withdrawals Explained: A Data-Driven Analysis for Traders

For any experienced trader, the integrity of a broker isn't just measured in pips and spreads; it's fundamentally defined by the reliability and transparency of its financial operations. The ability to deposit and, more importantly, withdraw capital seamlessly is the bedrock of trust between a trader and their brokerage. When this process is fraught with delays, ambiguity, or outright failure, it undermines the entire trading relationship. This in-depth analysis focuses on Uniglobe Markets, a broker that has been operational for 5-10 years and presents itself as a world-class trading partner. We will move beyond the marketing claims to scrutinize the realities of its funding mechanisms. By examining available data on Uniglobe Markets deposits and withdrawals, we aim to provide a clear, evidence-based picture for traders evaluating this broker for long-term engagement. Our investigation will be anchored primarily in verified records and user exposure reports to explain the Uniglobe Mar

In-Depth Review of Uniglobe Markets Trading Conditions and Account Types – An Analysis for Traders

For experienced traders, selecting a broker is a meticulous process that extends far beyond headline spreads and bonus offers. It involves a deep dive into the fundamental structure of a broker's offering: its regulatory standing, the integrity of its trading conditions, and the flexibility of its account types. Uniglobe Markets, a broker with an operational history spanning over five years, presents a complex case study. It offers seemingly attractive conditions, including high leverage and a diverse account structure, yet operates within a regulatory framework that demands intense scrutiny. This in-depth analysis will dissect the Uniglobe Markets trading conditions and account types, using data primarily sourced from the global broker inquiry platform, WikiFX. We will explore the Uniglobe Markets minimum deposit, leverage, and account types to provide a clear, data-driven perspective for traders evaluating this broker as a potential long-term partner.

WikiFX Broker

Latest News

Gratitude Beyond Borders: WikiFX Thank You This Thanksgiving

MH Markets Commission Fees and Spreads Analysis: A Data-Driven Breakdown for Traders

Alpha FX Allegations: Traders Claim Account Blocks, Withdrawal Denials and Security Breaches

How to Become a Profitable Forex Trader in Pakistan in 2025

CFTC Polymarket Approval Signals U.S. Relaunch 2025

Zipphy Exposed: No Valid Regulation, Risk Warning

KEY TO MARKETS Review: Are Traders Facing Withdrawal Delays, Deposit Issues & Trade Manipulation?

FCA Consumer Warning – FCA Warning List 2025

Australia’s Fraud-Intel Network Exposes $60M in Scams

Voices of the Golden Insight Award Jury | Kazuaki Takabatake, CCO of Titan FX

Rate Calc