ACY SECURITIES rejected the Pakistan Trader’s Withdrawal Request.

Abstract:One trader from Pakistan named Usman recently has come forward with allegations against ACY SECURITIES, claiming that the broker rejected his withdrawal request after he made substantial profits. Usman, a young individual from a financially challenged background, deposited $1800 in November and managed to generate a profit of $5700. However, his hopes were shattered when his withdrawal request of $200 was denied by ACY SECURITIES.

Introduction

One trader from Pakistan named Usman recently has come forward with allegations against ACY SECURITIES, claiming that the broker rejected his withdrawal request after he made substantial profits. Usman, a young individual from a financially challenged background, deposited $1800 in November and managed to generate a profit of $5700. However, his hopes were shattered when his withdrawal request of $200 was denied by ACY SECURITIES.

About ACY SECURITIES

ACY Securities, a trading name of ACY Securities Pty Ltd, is a multi-financial broker with a full license from the Australian Securities and Investments Commission (ASIC, License No. 403863). Since 2011, the company has relied on its keen insight into the market, effective demand management, client-oriented & advanced technology, and perfect educational resources to help more institutional participants and retail traders integrate into the ever-changing financial derivatives industry. ACY Securities offers a wide range of instruments for trading and flexible account options with low minimum deposits. However, there have been reports of issues with withdrawals and slippage. In just three months, we have received more than 100 complaints against this broker. ACY Securities may have a decent score before, but if the number of complaints continues to rise, the score of this broker will be lower.

However, there have been reports of issues with withdrawals and slippage.

The Victim's Account

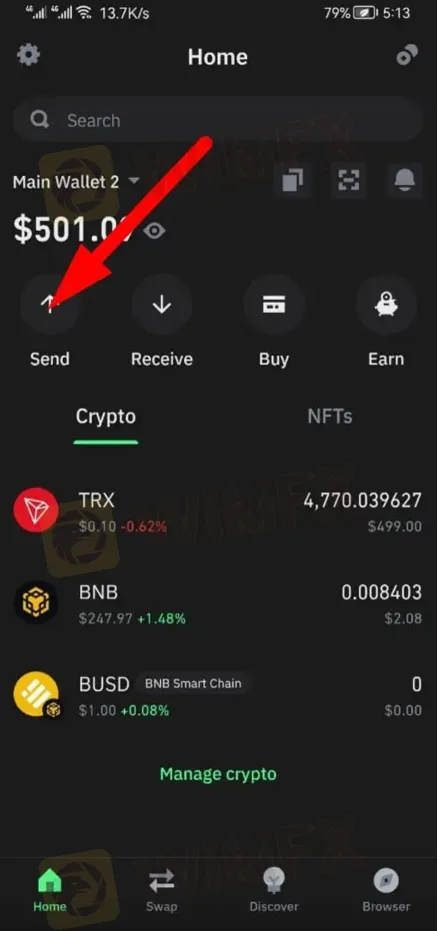

The victim recounts his experience with ACY SECURITIES, stating that after making a full deposit and earning profits, he decided to withdraw a portion of his funds. However, the withdrawal request was rejected by the broker. Even worse, the customer service at ACY SECURITIES allegedly informed him that he needed to deposit more money for his withdrawal to be approved, citing abnormal account fund activity.

This turn of events left the victim in a state of distress and depression. With loans taken from various sources for his trading activities, he faced immense pressure to return the borrowed money. Desperate and with limited options, the victim even expressed contemplating extreme measures, such as selling a kidney, to meet his financial obligations.

WikiFX's Role

As a platform dedicated to exposing unscrupulous activities in the trading industry, WikiFX has taken up this case and brought it to the public's attention. The platform emphasizes the importance of vigilance when choosing a broker and encourages all traders to exercise caution. In a public statement, WikiFX has assured that it is actively engaging with the victim and other affected traders to gather more evidence that could help resolve the issue.

Conclusion

The troubling situation faced by Usman serves as a stark reminder of the potential risks associated with trading and the importance of thorough research when selecting a broker. Traders are urged to remain vigilant, verify the credibility of brokers, and exercise caution to protect their investments.

WikiFX exposed this case to the public to remind all traders of the potential risks. All traders should be vigilant when investing in a broker.

WikiFX is actively reaching out to the victim and other traders hoping to find more evidence to help him resolve the problem. Please stay tuned for more information.

WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFXs official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html) to evaluate the safety and reliability of this broker!

Read more

Enticing or Alarming? Behind CG Fintech’s 20% Deposit Bonus

What’s behind CG Fintech’s generous $5,000 bonus? Is it genuine value or something traders should worry about?

Red Flags Uncovered: IFC Markets Accused of Blocking Withdrawals

Recent complaints logged by users of WikiFX, a global broker regulatory query platform, have brought IFC Markets into the spotlight for all the wrong reasons. Multiple traders have reported serious difficulties withdrawing their funds, raising red flags about the broker’s trustworthiness and operational integrity.

Switch Markets Broker Review: License Revoked, Trust Undermined

The broker once operated under an Australian license—but after the license was revoked, it continued accepting clients. What happens when regulatory protection disappears?

LQH Markets Broker Review: Lack of Regulation Raises Red Flags

Account wiped, funds gone—one trader shares their experience after suddenly losing access to all assets. Without effective regulatory protection, such outcomes may offer no path to recovery.

WikiFX Broker

Latest News

Close Up with WikiFX: TMGM's Presence in Thailand

Swissquote Enhances Trading with Full TradingView Integration

Unauthorized Online Platforms Exposed by BaFin in Latest Report

How Does CFI Academy Empower Traders of All Levels?

FBS Earns a High 8.78 Rating in 2025: What Traders Need to Know

OneRoyal Teams Up with Global Icon Diego Forlán and Unveils Powerful Forex VPS Hosting

Exness Launches Bold New Campaign Celebrating Traders Success

Crypto Never Sleeps with Hantec Markets' 24/7 Trading

Is Saxo Broker the Right Choice for Serious Traders in 2025?

Cloned Layouts, Fake Reviews: A Closer Look at Two Scam Network Cases

Rate Calc